Health Care Stocks on the Mend: Signs of a Promising Turnaround

Despite the challenges posed by policy uncertainty and new regulations in 2025, we still see signs of life in the health care sector.

Key Takeaways

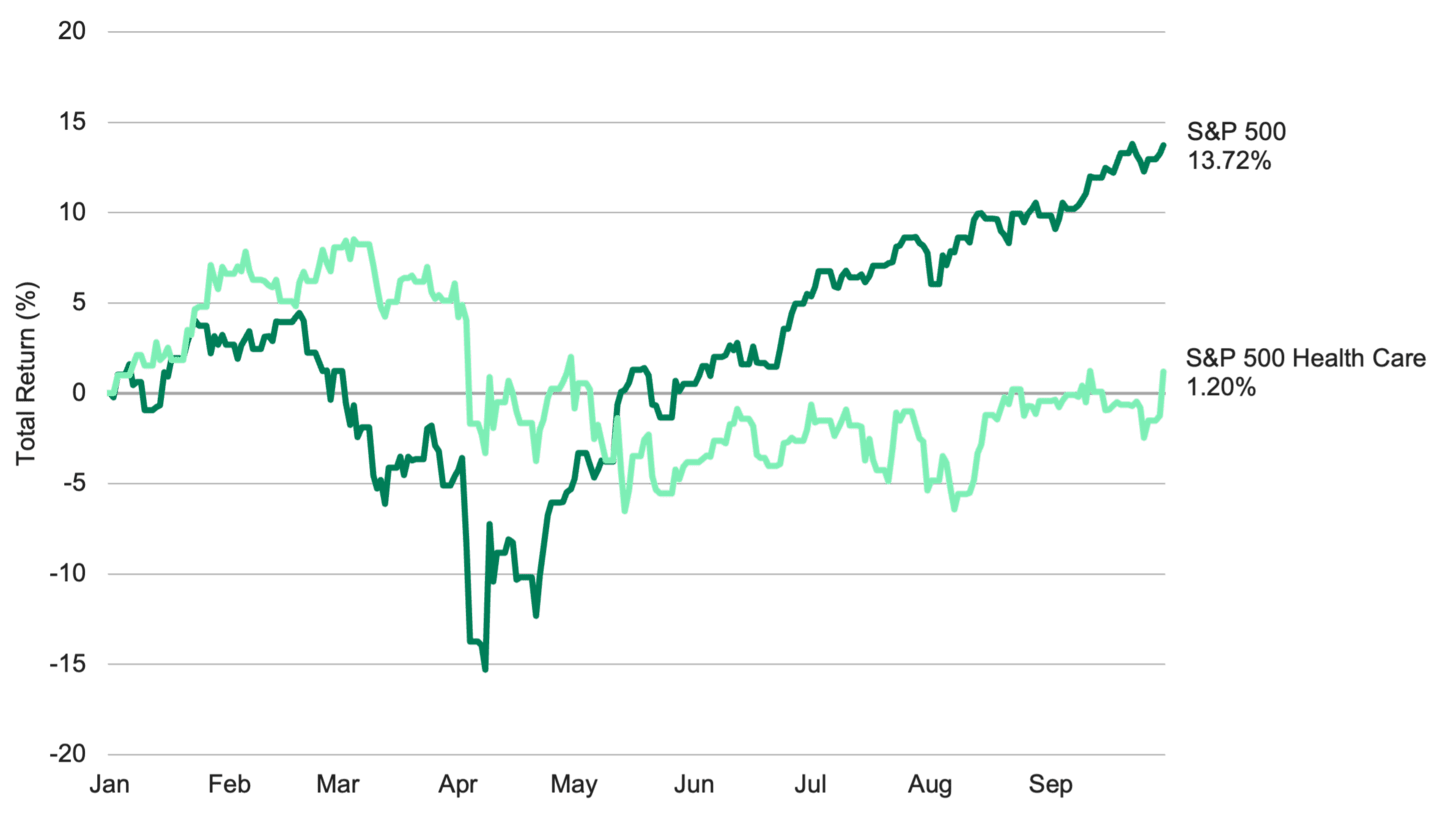

While health care stocks have lagged the broad market in 2025, they began recovering in early August.

We think challenges affecting some health care companies are temporary. Certain industries are already rebounding.

Low valuations add to the appeal of health care stocks, in our view.

Imagine the stock market as a waiting room. In one chair sits artificial intelligence stocks — like a robust, energetic patient who’s eager to get moving but needs to avoid burnout. In the next chair are health care stocks — like a patient recovering from an illness, regaining strength and showing promising signs of a strong recovery with the right support.

Throughout much of 2025, health care stocks experienced limited growth due to regulatory uncertainty, tariffs and other factors. However, we believe that many of the challenges facing health care in 2025 are exaggerated, unlikely to materialize or have already been reflected in current stock prices.

Indeed, health care stocks began to show signs of improvement in early August, as shown in Figure 1. We also think certain pockets of the health care sector have strong fundamentals that could offer the benefit of diversification if the market starts to broaden.

Figure 1 | Health Care Has Lagged the Market During Most of 2025

Data from 1/1/2025 - 9/30/2025. Source: Morningstar. ©2025 Standard & Poor’s Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase. show less The S&P 500® Health Care comprises those companies included in the S&P 500 that are classified as members of the GICS® health care sector. Past performance is no guarantee of future results.

Understanding the Challenges Facing Health Care Stocks

A key reason health care stocks have struggled in 2025 is the market environment, which has benefited higher-risk and expensive sectors like technology and challenged the less volatile nature of many health care stocks. However, we believe this environment may be shifting, opening doors for health care to regain its footing.

Challenges faced by specific sectors, along with the risk of tariffs, have negatively impacted the performance of some health care stocks. Investors should also keep in mind that policy developments and regulatory changes are often temporary; while they may influence short-term sentiment, they rarely affect the long-term fundamentals of companies.

Managed care companies, which administer private health insurance plans and government programs like Medicare and Medicaid, have posted terrible earnings, dragging down the broader health care sector. Much of this stems from a cycle of mispricing their premiums. Still, as these companies adjust, we expect improved pricing strategies to help restore their profitability.

Pharmaceutical companies have been under pressure from various sources. Early in the year, Robert F. Kennedy Jr.’s appointment as the secretary of the Department of Health and Human Services affected their stocks. Kennedy has openly expressed his desire to lower drug prices and his concerns that some pharmaceutical products may be harmful.

Tariff announcements, one as high as 250%, have also pressured pharmaceutical stocks. Like Trump’s other proposed tariffs, the one targeting pharmaceuticals was fluid. Under the U.S. framework trade agreement with the EU, tariff rates on pharmaceuticals were capped at 15%, significantly lower than the original proposal.

Along similar lines, investors believed that tariffs would significantly impact medical device companies.

Becton Dickinson, which makes various medical devices, saw shares fall on the initial U.S. tariff announcement in April. But the company’s stock price has improved, thanks to improving volumes, rerouted supply chains and subsequently lower tariff rates, which have mitigated the anticipated effect of Trump’s trade policies.

Similarly, medical device maker Zimmer Biomet has absorbed tariffs with various mitigation strategies and benefited from steady performance in its end markets. These examples highlight the sector’s ability to adapt, with companies leveraging innovation and operational adjustments to weather challenges and position for growth.

Strong Corners of the Health Care Sector

Other health care industries have persisted through what’s been an otherwise tough year for the sector. Their resilience demonstrates the diversity within health care, and we think select opportunities remain compelling for forward-looking investors.

Contract research organizations (CROs), which manage data and clinical trials for drugmakers, have seen improvement after a rough first half of 2025.

CROs have reported an uptick in activity from biopharma and smaller biotechnology companies that delayed projects earlier in the year. Iqvia Holdings started to rebound after seeing growth from small biotechnology companies. Tariff uncertainty remains a concern for companies like Iqvia, but the second half of 2025 is expected to be better than the first half.

Similarly, clinical laboratories have seen gains in demand and volumes. For example, Quest Diagnostics, has grown organic volumes and reported stronger utilization trends.

Dental products companies, which have faced hurdles with utilization trends and interest rates, are also seeing a bounce. Envista Holdings, a holding company of several dental brands, raised its earnings guidance by 10% in July after reporting strong demand in various end markets.

The continued progress in these subsectors underlines how adaptability and focused execution can help companies overcome adversity, making them potentially well-positioned for further gains as sector headwinds abate.

Good News for Health Care Stocks: They’re Inexpensive

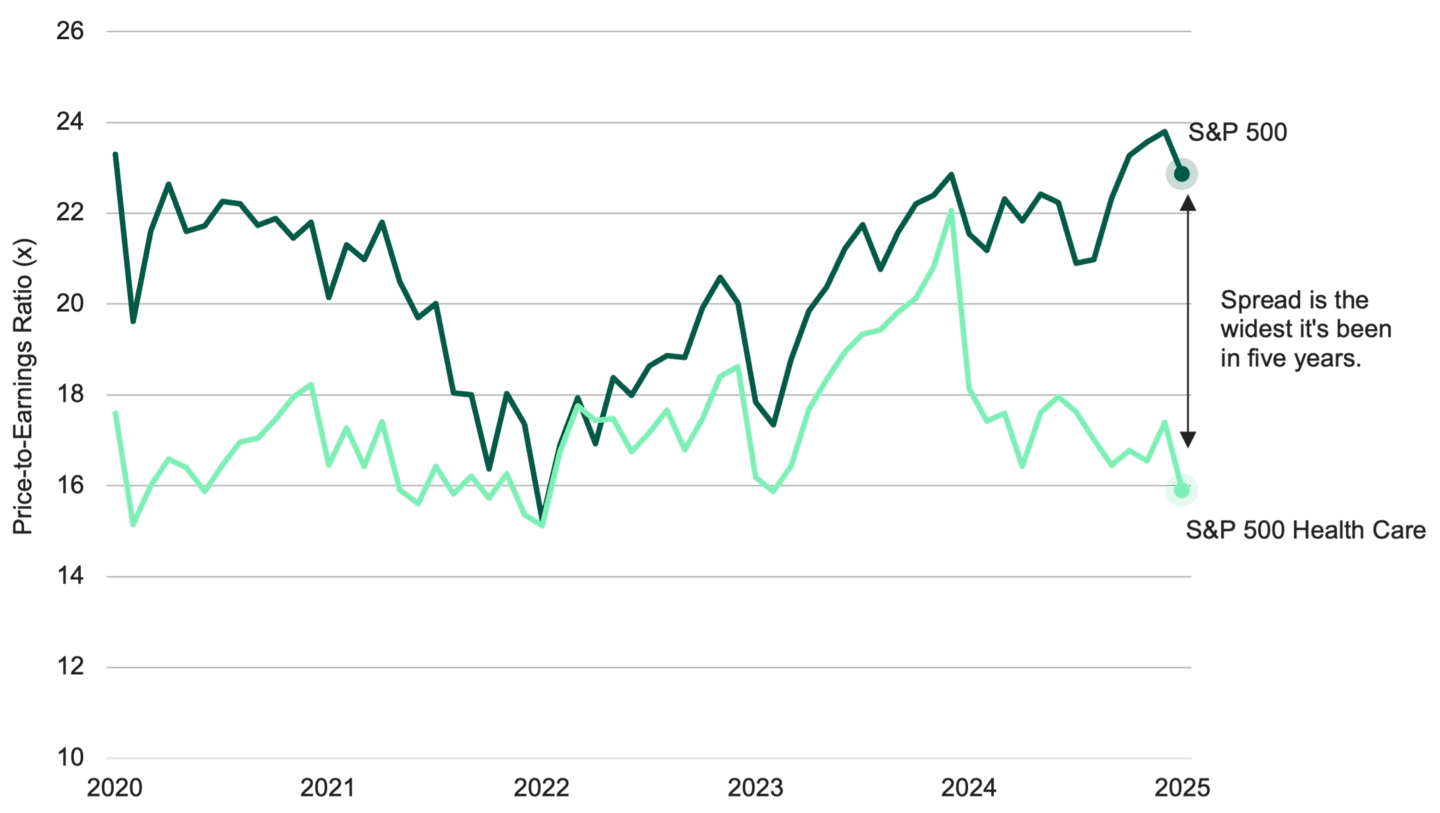

Health care’s challenges have led to low valuations, as many growth investors have exited in favor of the booming fortunes of other sectors like technology. See Figure 2.

Figure 2 | Health Care Stocks Are Cheaper Than the Broad Market

Data from 9/30/2020 - 9/30/2025. Source: Morningstar. The Price-to-Earnings (P/E) Ratio is the price of a stock divided by its annual earnings per share. These earnings can be historical (the most recent 12 months) or forward-looking (an estimate of the next 12 months). A P/E ratio allows analysts to compare stocks on the basis of how much an investor is paying (in terms of price) for a dollar of recent or expected earnings. Past performance is no guarantee of future results.

However, as value investors, we believe health care’s low prices position the sector for a potential turnaround, regardless of whether the bull market continues or dissipates.

Authors

Senior Investment Director

Read More Insights from Portfolio Manager Nathan Rawlins

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

©2026 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.