Investing for Longevity: Will Your Retirement Savings Last?

No one wants to outlive their savings. It can happen if you don’t save enough, spend too much in retirement or earn too little from your investments. Learn more about this risk and ways you can seek to reduce it.

Key Takeaways

Failing to plan for the chance that you live for years beyond the average increases the risk of running out of money in retirement—known as longevity risk.

Investing to beat longevity risk involves balancing multiple types of risk, including market, interest rate and inflation risks.

Delaying Social Security benefits and having a sensible withdrawal strategy may help preserve savings while providing you with the lifestyle you want in retirement.

What’s your greatest fear about retiring? Most people say running out of money. The possibility that you will run out of money in retirement is known as longevity risk.

50% of retirement savers said outliving their savings and investments was one of their top worries.¹

55% of employers who offer retirement plans worry their employees will not have enough money in retirement.¹

Estimating how long your retirement savings need to last is a fundamental input in financial planning. It affects your quality of life, your health care options and how much you can leave behind for loved ones. But you can’t predict how long you'll live with 100% accuracy.

Fortunately, you can reduce the risk of outliving your savings through careful planning and smart choices. Here are a few tips that may help.

What We Can Get Wrong About Longevity

Longevity—how long you might live—is often confused with life expectancy, which is how long, on average, an individual of your age, gender and health is anticipated to live, according to the Society of Actuaries. Longevity is a complex calculation of probabilities that change over time.

Plan to Live Longer Than You Think

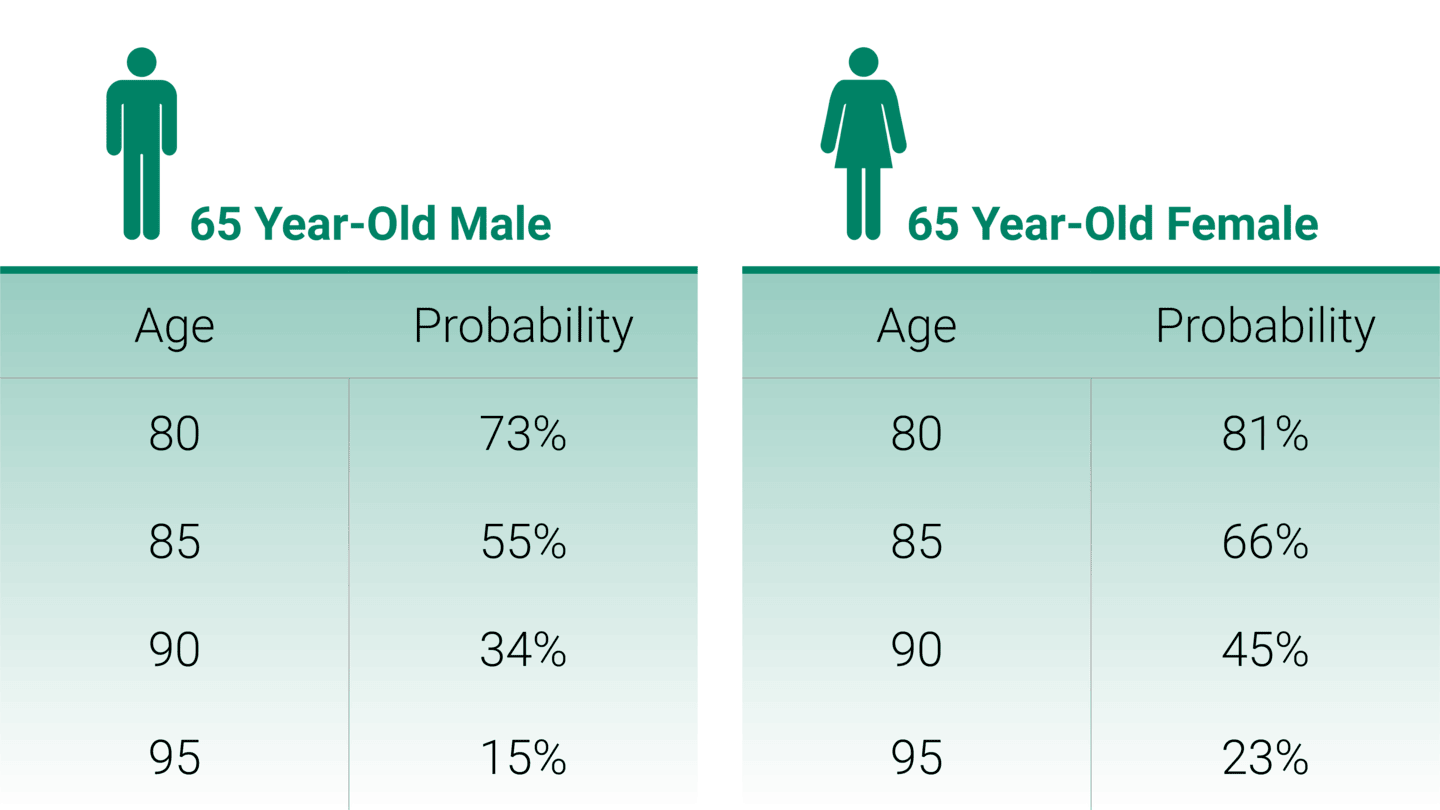

Probability of Today's 65-Year-Old Living to Various Ages

Source: Actuaries Longevity Illustrator, 2024 Society of Actuaries and American Academy of Actuaries. All calculations are based on the information provided and the 2019 Social Security Administration mortality table, with future mortality improvement projected using the Society of Actuaries’ MP-2021 scale.

How long you have already lived changes the calculation.

If you live to age 65, there’s a higher likelihood that you’ll make it to age 85.

And if you make it to 85, there’s a higher likelihood that you’ll make it to age 90.

The Actuaries Longevity Illustrator can help you forecast how long you might live based on your age, health and gender. Having a realistic understanding of how long your retirement could last can help you more effectively combat longevity risk.

Managing Longevity Risk: Balancing Interlinked Risks

How do you minimize the chance of outliving your retirement savings? The simple answer would seem to be to aim for the highest returns with your investments—that is, take on more market risk. However, doing that can increase other risks that could lead to losses you may not be able to recover from.

For example, increasing stock allocations generally offers higher growth potential, but it also increases your exposure to downside risk: Market declines occur more often than you may think. Over the past 90 years, the stock market has declined 20% or more every eight years.²

What if a big decline occurs when you’re close to or in retirement? That’s known as sequence risk, the timing or sequence of your portfolio’s performance.

A market drop of 20%

- Will have more of an effect on investors who need their money right now for retirement.

- May not matter as much for those who won’t need their money for decades and thus have time to potentially recover from a loss.

Other types of risk come into and out of play as you move toward retirement. For instance, interest rate risk becomes more important when fixed-income investments increase the closer you get to your retirement date.

Inflation risk also rises as retirement nears because the loss of purchasing power can mean you need to withdraw more money than planned to cover the higher cost of living.

Learn more about the many types of investment risk.

Investing for retirement should involve balancing the many risks investors face, according to our Multi-Asset Strategies team. The team developed a proprietary balance-of-risks framework for managing our target-date asset allocation funds.

Our professionals actively manage multiple risks as they change in relative importance over time and through various market environments. Here are some of the key risks our team monitors:

4 Components to Longevity Risk

Growth risk: The possibility that your investments don’t gain enough to see you through retirement.

Market risk: The risk that a market downturn will significantly harm your chances of having a fully funded retirement.

Macro environment risks: The chance that unexpected changes in the economy, like a recession or high inflation, will hurt investment performance.

Behavioral risks: The risk that investor decisions will hurt retirement readiness, such as abandoning a retirement plan during a market downturn.

Our team’s risk management process is focused on reducing the possibility of large losses. The aim is to generate a smoother path of investment returns, which may lead to more investors successfully reaching their retirement goals.

You can gauge a portfolio manager’s ability to manage risks by looking at an investment’s risk-adjusted returns . “Risk adjusted” simply refers to an investment’s gain or loss relative to its risk. So, if two investments have the same absolute return during a given period, the one that got there with lower risk has a better risk-adjusted return.

Take Social Security Strategically So Money Lasts Longer

For many retirees, Social Security is a key income stream in retirement. If you can delay taking benefits, you may be able to minimize the risk associated with increasing longevity because you’ll receive more monthly income from Social Security once you start to take it.

You may be eligible to receive benefits starting at age 62 and that may be the right decision for you depending upon your situation. However, waiting until full retirement age (which varies depending on when you were born) or until age 70 could mean that you get a higher monthly benefit.

Married couples may want to consider their Social Security strategy together. Each spouse’s earnings and anticipated life expectancy help determine how and when it makes sense to take this benefit.

Before you file, run a few different scenarios to see how your benefits would change based on when you collect. You can contact the Social Security Administration up to four months before starting benefits, but you can review your options much earlier. Socialsecurity.gov is a good resource, or you can call for an appointment at 1-800-772-1213.

Seek a Sustainable Withdrawal Rate to Lower Longevity Risk

Of course, the rate at which you withdraw your savings when you’re in retirement also impacts how long it will last. Your withdrawal rate is how much you take from your retirement accounts each year to fund living expenses. A sensible withdrawal strategy can help you make the most of the money you have worked so hard to accumulate.

A withdrawal rate that is too high can deplete your savings sooner rather than later.

A withdrawal rate that is too low means you may unnecessarily miss out on having the lifestyle you really want.

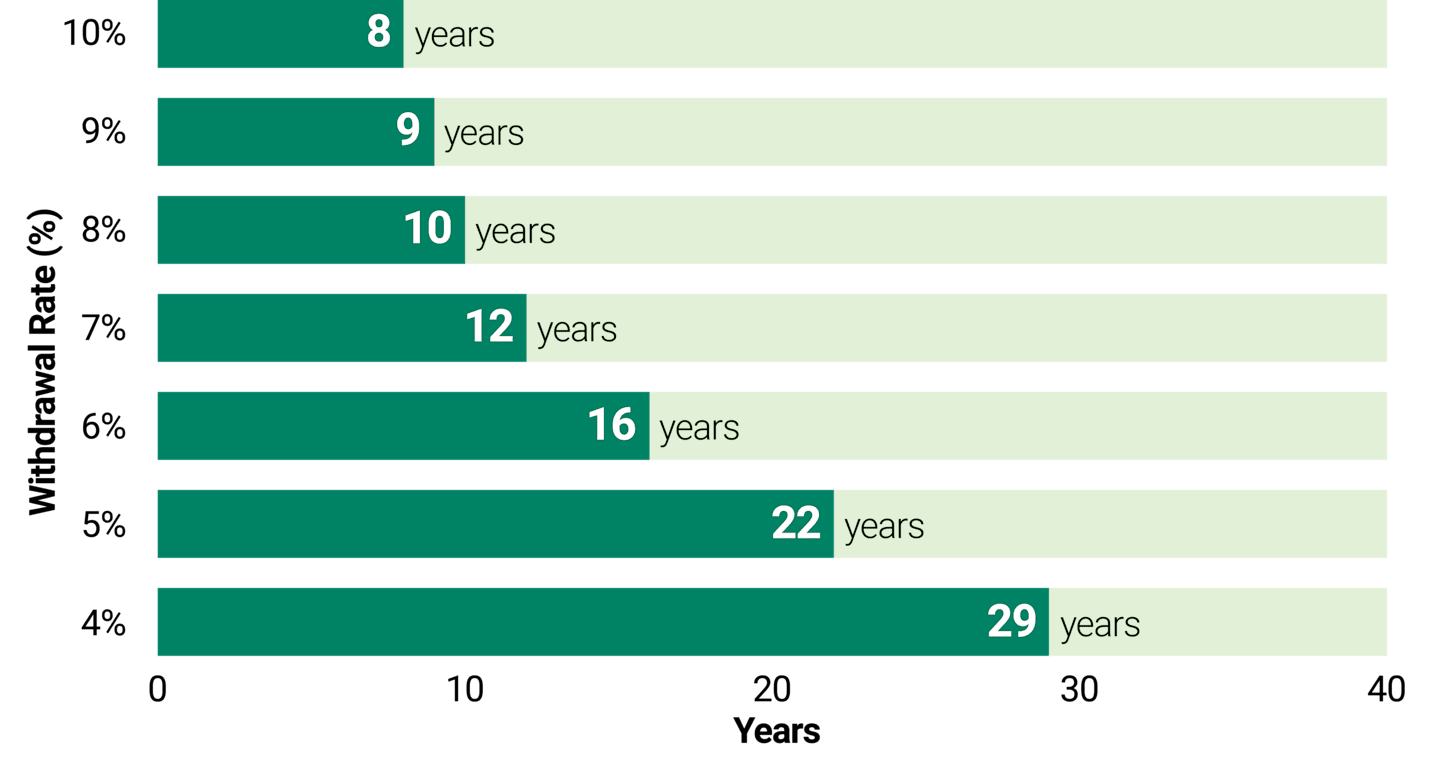

In the examples below, withdrawing 10% each year may result in the money running out after eight years. That’s too short a time horizon for most people retiring now. However, reducing the withdrawal rate to 4% shows the money lasting 29 years.

You often hear about withdrawal rates between 3% and 5% as a guideline, but it depends on your situation.

Impact of Withdrawal Rate on How Long Your Money Lasts

(Hypothetical Examples)

These hypothetical situations contain assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Assumes a portfolio with 50% equity, 45% bond, 5% cash equivalents over 30 years at a 90% confidence level, with the following average monthly capital market returns: stocks 7.9%, 18.90% standard deviation; bonds: 5%, 4.95% standard deviation; cash equivalents: 2.25%, 1% standard deviation. The correlation between stock and bond returns is 0.2. Inflation rate is assumed to be 2% annually and is included in each of the withdrawal rates depicted above.

Standard deviation defines how widely returns vary from the average over a period of time.

Source: American Century Investments, 2024.

Misinformation about benefits, finances and investing can undermine retirement goals. Learn more about some common money mistakes that could derail your retirement plans.

Tackling Longevity Risk Is Smart Contingency Planning

Accounting for longevity risk in your retirement planning involves looking at the probabilities of living to various ages and the financial resources you’ll need in those situations. You can think of it as contingency planning—being prepared for the unexpected.

Consider working with a financial advisor who can help you develop a plan based on your individual circumstances and objectives—and make the most of the time you have left before retiring.

Explore Multi-Asset Solutions

Consider an already diversified portfolio that is designed to manage multiple risks retirement investors face.

Source: American Century Investments. Greenwald Research of Washington, D.C., completed data collection and analysis. The participant survey was conducted between June 3, 2025, and June 23, 2025. The survey included 1,500 full-time workers between the ages of 25 and 70 saving through their employer’s retirement plan. The data were weighted to reflect key demographics (gender, income, and education) among all American private sector participants between 25 and 70. The sponsor survey was conducted between May 20, 2025, and June 16, 2025. Survey included 500 plan sponsor representatives holding a job title of Director or higher and having considerable influence when it comes to making decisions about their company’s retirement plan (either 401(k), 403(b), or 457 plans). The data were weighted to reflect the makeup of the total defined contribution population by plan asset size.

Source: FactSet, S&P 500® Index Returns. Average returns 1/1/1929 - 12/31/2023.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.