How Would a Fed Rate Cut Lift Return Potential for Bond Investors?

Market Minute | A simple equation reveals attractive opportunities, particularly for investors with cash-equivalent accounts.

Key Takeaways

With the Federal Reserve (Fed) likely to reduce short-term interest rates, we think yields on popular cash-equivalent accounts may follow suit.

Lower interest rates have tended to boost return potential for bond investors, as duration, yield to maturity (YTM) and a simple equation reveal.

Short-duration bonds — popular vehicles for many investors repositioning their cash holdings — may offer attractive performance potential when rates fall.

Download Market Minute: How Would a Fed Rate Cut Lift Return Potential for Bond Investors? as a PDF

Economic Signals Point to Easing

Market expectations for the Fed to cut interest rates have risen recently. Here’s why:

The labor market has shown signs of weakening.

Overall economic growth is likely to slow down amid tariff uncertainties and a softer jobs market.

As growth decelerates, consumer demand may ease, causing inflation to moderate.

Fed officials have characterized the current interest rate environment as still modestly restrictive.

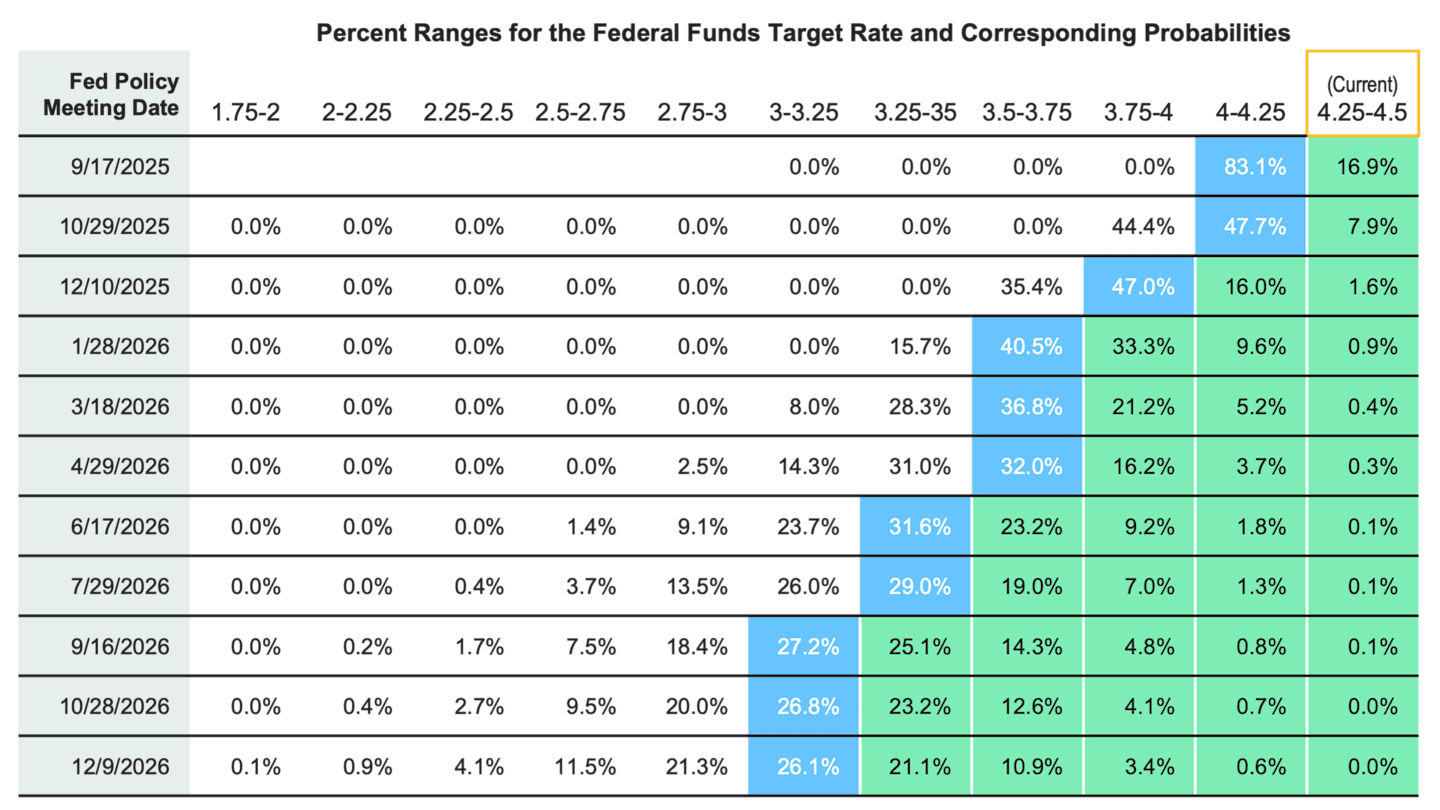

Figure 1 | Markets Expect Several Fed Rate Cuts in the Months Ahead

Data as of 8/19/25, when the federal funds rate was 4.25% – 4.5%. Source: CME FedWatch Tool. The percentages represent the market probabilities of the federal funds rate landing in a specific range after upcoming Fed meetings. For example, investors indicated a 47% probability of the rate dropping to 3.75% – 4% at the Fed’s December meeting, reflecting two 25 basis point rate cuts by year-end.

How Rate Cuts Impact Cash Equivalents

While Fed easing may mean lower rates for auto, home equity and other loans, it also drives down other yields:

Yields on Treasury bills, CDs and other cash equivalents typically move in tandem with the federal funds rate.

So, when the Fed cuts rates, yields on these popular savings vehicles generally follow suit, and reinvestment risk rises. This means you may not be able to reinvest your cash flows at the same yield you’ve been earning.

The bottom line: You’ll likely earn less monthly income from your cash holdings.

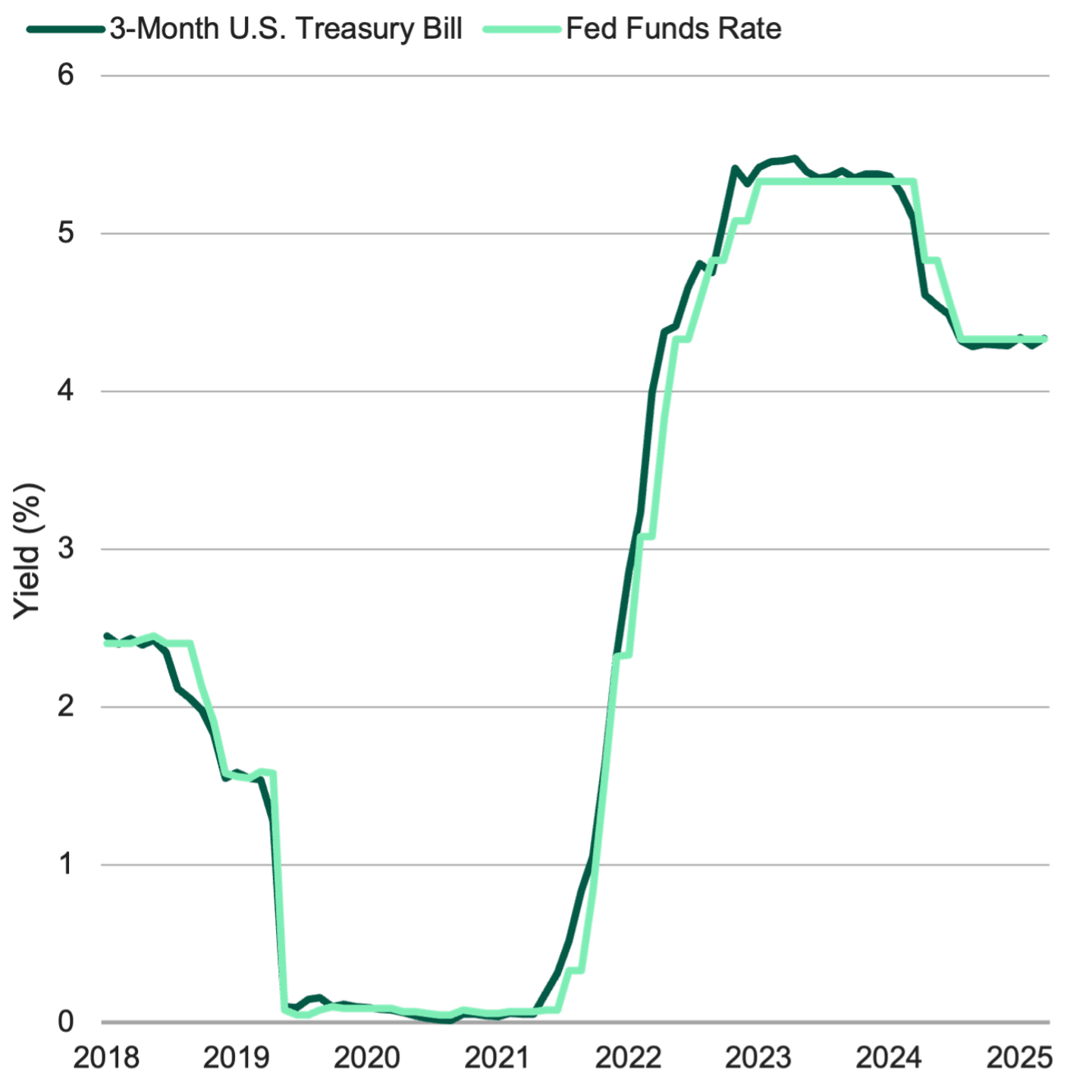

Since the Fed’s 50 basis point (bp) rate cut in September 2024, the yield on the three-month Treasury bill has dropped 64 bps.1

The Fed subsequently cut rates by another 50 bps before the end of 2024.

Figure 2 | Treasury Bill Yields Have Tracked Fed Rate Cuts

Data from 12/31/2018 – 7/31/2025. Source: FactSet. Past performance is no guarantee of future results.

While cash-equivalent accounts typically pay lower yields after Fed rate cuts, most bond funds offer greater return potential.

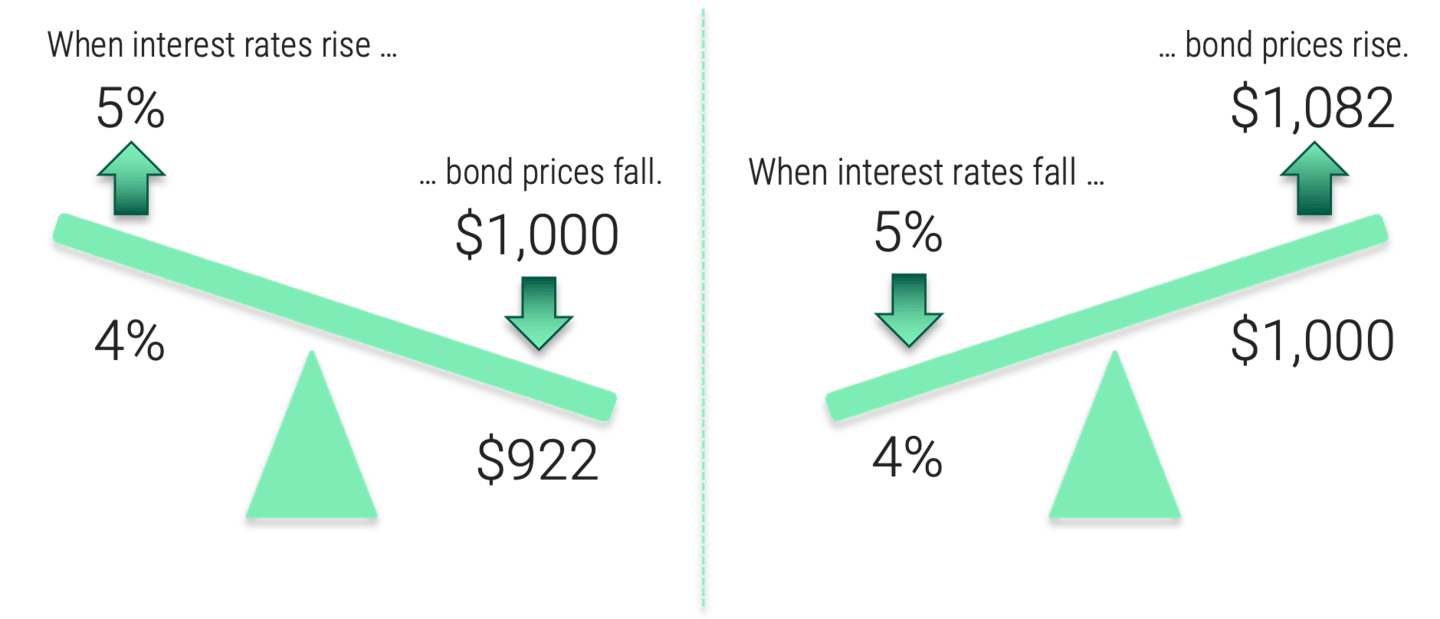

When the Fed cuts interest rates, yields on newly issued bonds generally fall. However, lower interest rates usually trigger higher return potential for existing bonds.

That’s because existing bonds — with their higher yields and income streams — become more valuable to investors in the lower-rate environment.

So, prices on previously issued bonds typically rise when interest rates decline, boosting their total return potential.

Figure 3 | Interest Rates and Bond Prices: An Inverse Relationship

For illustrative purposes only. Assumes a bond paying 4% with a fixed semiannual coupon and a 10-year maturity.

The Math Behind Bond Prices

Two key bond fund metrics can help you measure the potential performance effects of a Fed rate cut:

Yield to maturity (YTM): Expressed as an annual rate, yield to maturity shows a bond fund’s estimated total return if you hold the fund to maturity.

Duration: Expressed in years, duration measures a bond fund’s price sensitivity to interest rate changes.

In general, bond funds with longer durations are more sensitive to changes in interest rates. When the Fed cuts rates, longer-duration funds tend to experience greater price appreciation.

But they’re also more likely to drop in value when the Fed raises rates. As such, longer-duration bond funds may offer higher interest rate risk than many investors seek when considering a shift out of cash equivalents.

Meanwhile, short-duration funds may provide a compelling alternative.

In today’s yield environment, shorter-duration bond funds may offer attractive performance potential if the Fed cuts rates. Consider the characteristics of the average fund in Morningstar’s short-term bond category:*

Yield to maturity: 4.7%

Duration: 2.34 years

Assume the Fed reduces its short-term interest rate target 50 bps by year-end. The average short-term bond fund could see its total return potential increase more than 100 bps.

Using duration, YTM and bond math reveals this potential.

A simple equation calculates the effect interest rate changes may have on a bond fund’s return potential:

Rate Change x Fund’s Duration = Change to YTM

0.5 x 2.34 = 1.17 percentage points

A half-point rate cut would boost the average fund’s YTM by 1.17 percentage points to 5.87% (4.7 + 1.17).

The math works in the other direction, too. A Fed rate increase would reduce the fund’s YTM by 1.17 percentage points.

Even in the unlikely event of a near-term Fed rate hike, we believe short-term bond fund yields should remain attractive versus cash equivalents.

*As of June 30, 2025. There were 132 funds in Morningstar's short-term bond category. Short-term bonds funds invest primarily in corporate and other investment-grade U.S. bonds and have durations of one to 3.5 years. If duration is unavailable, they have average effective maturities of one to four years.

Explore Our Short-Duration Capabilities

With the Fed likely to cut interest rates in the months ahead, we believe reinvestment risk continues to rise for investors with significant cash holdings. And the time frame to effectively confront this risk is shrinking.

In our view, adding modest duration exposure before the Fed makes another move may help investors address this risk:

Bond prices typically climb in declining interest rate environments. So, boosting total return potential by moving into higher-yielding alternatives may cost more once rates drop again.

Unlike cash equivalents, short-duration bonds offer price appreciation potential that can help offset the effects of lower interest rates.

Authors

Check Out More of Our Market Minute Articles

Investment insights for savvy investors.

As of August 13, 2025; reported in The Wall Street Journal. The three-month Treasury bill yield was 4.86% on September 17, 2024, the day before the Fed started cutting rates.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

©2026 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.