Pay Off Debt or Save for Retirement? Why It’s Not an Either/Or Choice

Get tips on how to juggle what you owe with saving for your future—and how to set your financial priorities.

Key Takeaways

You don’t have to choose between paying off debt and saving for retirement. Doing both is possible with the right strategy.

It’s best to prioritize eliminating high-interest debt, then compare the interest rate on low-interest debt to the potential return on an investment.

Time is your greatest asset when saving for retirement. Even small, consistent contributions early on can grow significantly over time.

If you’re wondering whether to pay off debt or save for retirement first, you’re not alone. Many Americans face this dilemma, and the advice often sounds like: “Pay off all your debt, then start saving.”

But that’s not always the best approach.

Why? Because money you invest has the potential to grow exponentially over time.

Put Time to Work for You

The earlier you start saving, the more your money can potentially grow by benefiting from compound growth. Of course, while compounding can lead to exponential growth with positive returns, negative returns can erode capital.

Example: The Difference Time Can Make

Save $100 per month, which earns a 6% rate of return compounded annually:

Source: American Century Investments; Compound Savings Calculator, Dinkytown, Inc., March 2025. The calculation assumes a 6% rate of return compounded annually until age 65. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Financial Calculators from Dinkytown.net. Financial Calculators ©1998–2025 KJE Computer Solutions, LLC.

Waiting just 10 years to start saving cut the total saved by more than half.

That shortfall matters because it’s unlikely that Social Security payments alone will cover all living expenses in retirement. Here’s what the Center on Budget and Policy Priorities says:

The average Social Security benefit in 2024 was just $1,862 per month ($22,344 per year).

The Social Security Administration offers a variety of online calculators to help with your planning.

So how can you build savings to supplement Social Security while still paying down debt? By looking at the mix of your debt and developing a plan of attack.

Understand the Different Types of Debt

Most of us don’t have the cash to make large purchases, and some debt is inevitable for many. That’s why some people make a distinction between good debt versus bad debt.

What Is ‘Good’ Debt?

Good debt typically has low interest rates and can help build your net worth or improve your quality of life:

Student loans are tied to higher earnings potential and generally low interest rates.

Mortgages build equity and may offer tax deductions.

Automobile loans assist with daily life and getting to and from work, although cars depreciate.

Even good debt becomes bad if it’s unaffordable or excessive.

What Is ‘Bad’ Debt?

Bad debt usually has high and/or variable interest rates and is associated with depreciating assets and/or unnecessary spending:

Credit cards have annual percentage rates (total cost of borrowing) that can exceed 20%, making it easy for account balances to grow.

Personal loans may charge high interest rates and fees as well as penalties if you pay off the loan early.

Payday loans are notorious for charging extremely high interest rates and fees that can send account balances spiraling out of control.

What Debt Should You Pay Off First?

Credit cards are typically one of the most expensive forms of borrowing and, therefore, should be at the top of the list. Two popular ways for paying it down are the avalanche and snowball methods:

Pay off the highest interest rate debt first.

- Saves the most money long term.

Pay off the smallest balance first and then add that payment amount to the next debt’s payment.

- Builds momentum and motivation.

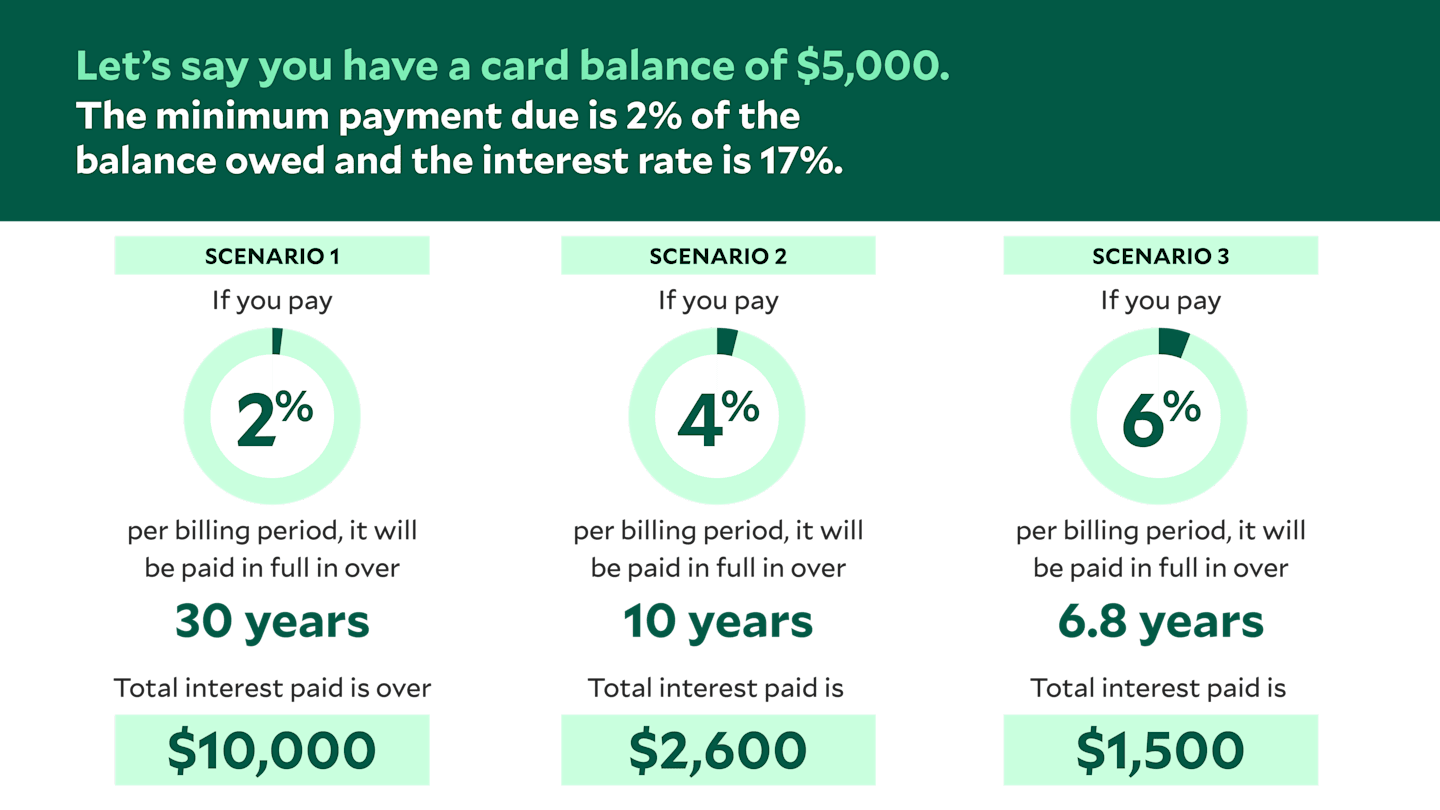

Why You Should Avoid Making Only the Minimum Payments on Bad Debt

Paying only the minimum on your credit cards or loans might seem like a way to stay afloat, but it can cost you thousands in the long run—and keep you in debt for years.

Three reasons why:

Interest keeps accumulating. Minimum payments are typically just 1%–3% of your balance. Most of that goes toward interest, not the principal. That means your balance barely shrinks month to month.

You stay in debt longer. The longer you carry a balance, the more interest you pay. A small debt can balloon into a long-term burden.

It hurts credit scores. High balances relative to your credit limit can lower your credit score, making it harder to qualify for better rates in the future.

Example: Dodge the Minimum Payment Trap

Source: TransUnion LLC.

Even an extra $10–$50 per month can reduce your payoff time and amount of interest paid.

How Do You Pay Off Debt and Save?

After you address your credit card and other bad debt, look at your lower-interest debt. You might benefit from investing some of your money rather than making a higher debt payment.

The general rule of thumb is that if the expected return on investment is greater than the cost of the debt, consider investing.

For instance, if your debt is a student loan at 4%, and you expect a 7% return from investing, it may make sense to invest while making minimum payments on the loan. Of course, returns can fluctuate, and it is possible to lose money so you want to carefully weigh the potential risks and rewards.

Take Advantage of Workplace Retirement Plans

If you have a workplace retirement plan, such as a 401(k) or 403(b), we suggest taking advantage of it to help you save. You may not see much change in your take-home pay since the contributions you make are pretax, which essentially lowers your income tax.

You can calculate the difference on your paycheck to see for yourself.

Additionally, employers may offer a Roth 403(b) or Roth 401(k) option. These accounts are funded by employees with after-tax dollars. The contributions do not reduce your earned taxable income, but they still provide the potential for long-term benefits.

With many companies now offering employer matches on contributions, a basic guideline is to save enough to get the full employer contribution. It’s not exactly “free money,” but every dollar you receive from your employer is one more dollar you don’t have to save yourself.

Example: Get Your Match

Suppose your employer matches 50 cents for every $1 you contribute, up to 6% of your salary.

If you make $50,000 per year and make contributions from each paycheck that add up to at least $6,000 for the year, your employer could add $3,000 to your account (0.06 x $50,000).

This match is an instant return on your investment, so long as you stay with your employer for the amount of time it takes for those amounts to vest (or become 100% yours).

If $6,000 is too high right now, start with a smaller amount, which will still be matched.

Don’t be afraid of starting small. You can always increase your contribution as your financial situation improves.

Build an Emergency Fund

Before maxing out retirement contributions, make sure you have emergency and rainy-day funds in place. These funds have a role in helping you meet other savings goals.

Pulling out the credit cards is one of the first things many people do when they don’t have enough money in reserve for an unexpected expense.

Use precommitment strategies and automate your savings and debt payments to stay on track.

What if You Still Have Debt in Retirement?

Ideally, you’ll enter retirement debt-free, including mortgage-free. If that’s not the case, we suggest turning your focus to becoming so.

Life is financially riskier with debt when you have a fixed income. It limits the ability to deal with unexpected expenses, increasing health care needs and rising food and other costs from inflation.

Nearly half (47%) of adults age 50 and older who carry credit card debt use credit cards to pay for basic living expenses that they do not have enough money to cover, with 17% of them relying on credit cards to cover basic expenses every month over the last year.*

If you’re near or in retirement, in addition to the tips above, you may want to step up your efforts to pay off debt. Consider:

Working longer to pay off debt before retiring.

Consolidating high-interest debt into lower-rate options.

Downsizing your home to reduce mortgage and living costs.

Taking a 401(k) loan, but be aware of terms and penalties.

Seeing if you qualify for any early 401(k) withdrawal exceptions if your plan allows for early withdrawals. (Generally, withdrawals from retirement accounts before age 59½ are subject to income tax and may be subject to an additional tax.)

If you’re dealing with debt collectors, know your rights. Here are some things to know .

You Can Tackle Debt and Savings at the Same Time

Paying off debt and saving for retirement aren’t mutually exclusive. A smart plan will:

Prioritize eliminating high-interest debt

Build an emergency fund to avoid future debt

Take advantage of employer retirement matches

You may tackle one, then the other goal, or your plan may include working through both. It all depends on where you are in your investor life cycle, how much you’ve already invested for retirement and how much debt you have. Financial professionals can help you create a plan that addresses your current debt payoff needs as well as your future in retirement.

Authors

Financial Consultant

Financial Consultant

Want to Talk Through Your Options?

We offer one-on-one sessions with a certified financial planner.

New AARP Survey Highlights Credit Card Debt Among Older Americans, AARP. March 10, 2025.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.