How Will You Navigate the Transition to Retirement?

Explore strategies for a smoother retirement transition and be prepared for the financial and lifestyle changes ahead.

Key Takeaways

Making the transition from working to retirement is a significant step that requires planning for your money needs after the last paycheck.

Planning how you will spend your time and how to take care of your health are also important considerations before you stop working.

Our financial consultants give tips—for both your money and your mind—to help make your retirement transition smoother.

Retirement is rarely a single point in time. It’s often a process as you transition from one life stage to another. From planning years in advance to saving as much as you can before your last workday to living the dream, your idea of retirement may likely shift over time. But it’s not just about the money you’ll need—planning for retirement is also preparing for how life will change.

Financial consultants Kory Klossner and Kyle Ray discuss ways to make your transition to retirement as smooth as possible, both for the well-being of your money and your mind.

The Retirement Transition Is About More Than Money

While many people consider retirement primarily a financial change, it’s so much more than that. Your lifestyle—even your identity—will transition as you adjust to new circumstances.

“Clients typically ask two questions when they think about retirement: ‘When can I retire?’ and ‘When will I run out of money?’” says Kory. “And most of the time, they concentrate only on the money aspect, not how they will live their life in retirement.”

Preparing for the financial aspect of retirement is more than a numbers game—it takes planning. Learn what to consider as you approach your final working years.

Moving from one season in life to another can be an abrupt change for some. Explore some aspects to think about as you determine what you want your future to look like.

Having a plan for all parts of retirement can help you better understand what retirement will look like—both for your money situation and how you will spend your time. And both are equally important.

“Planning for how you spend your time will help you fill the days you were otherwise at work," says Kyle. "Planning the financial aspect will help you know if you have the money to pay for it.”

A financial professional can help you create a plan for both your money and your mind. Choosing an advisor who has experience with both may be a good place to start.

Transitioning Your Finances for Retirement

As you move closer to retirement, your budget, the mix of your investments and where you get income will evolve with your changing circumstances. Here are some things to consider as you prepare for retirement.

The Budget Transition

During your working years, a budget is key to ensuring you’ll have enough money for day-to-day expenses and for the future. That means looking at your current expenses and setting enough savings aside to invest in retirement.

Many experts recommend saving a greater percentage of your salary as you approach retirement. Not sure how much to save? Get checkpoints to gauge your progress with retirement savings goals by age.

In retirement, the strategies you use for income are also important for your retirement budget. See how the bucket strategy may help you manage short- and long-term expenses and help turn your investments into the income you'll need to cover your budget items.

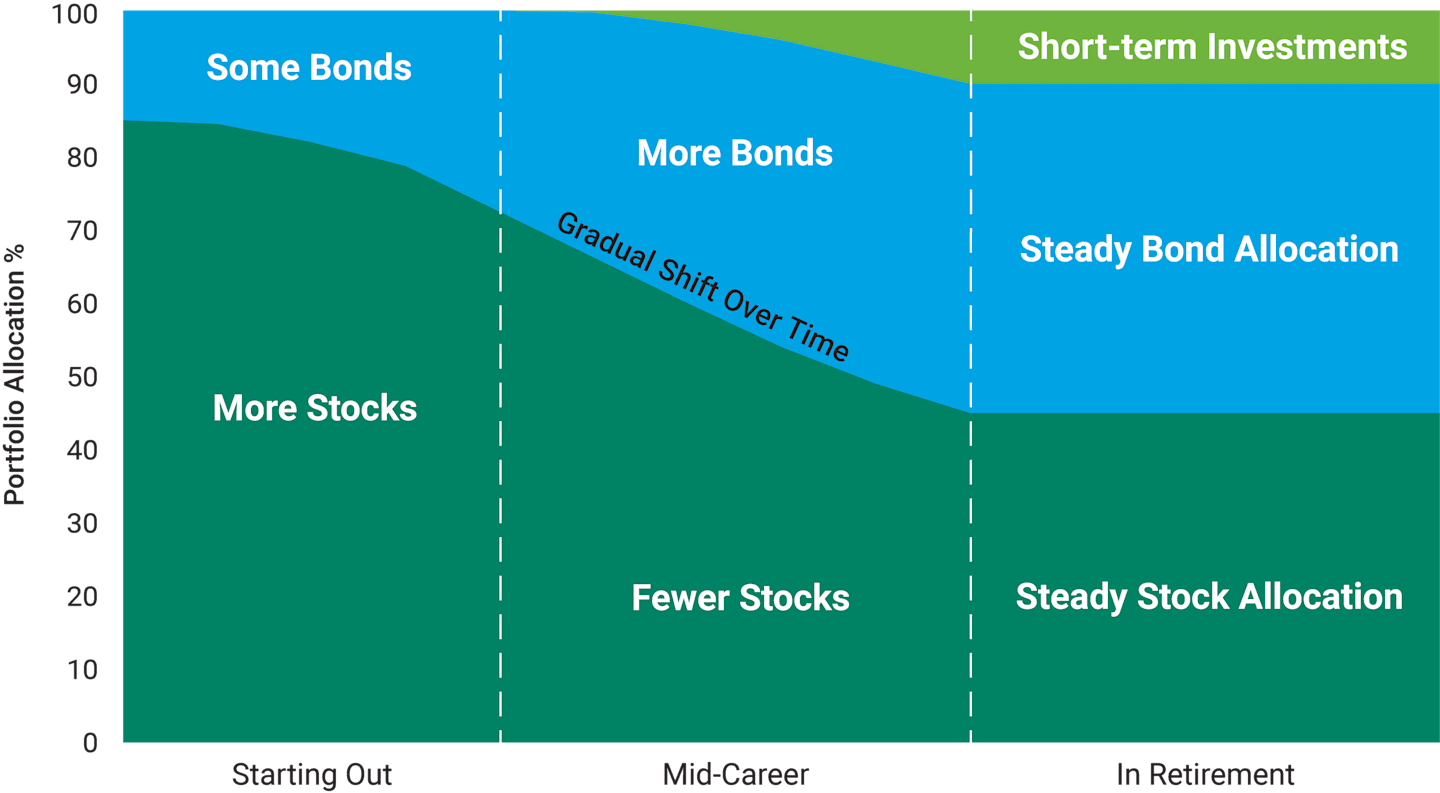

The Portfolio Transition

Your portfolio will also likely need to change as you approach retirement and while you’re living in it. Kory says, “You generally want your retirement portfolio to be more conservative, but not completely so. You want enough conservative investments to potentially buffer against market declines but still have enough risk to provide growth potential to see you through a long retirement.”

What could that look like?

Risk-Appropriate Considerations Now and For the Future

Source: American Century Investments.

Your specific percentages of stocks, bonds and money market investments will vary depending on your own goals, time frame and risk tolerance, but this may give you a place to start as you evaluate your current and future investment plans.

The Income Transition

Retirement may seem uncertain when you go from getting a regular paycheck to relying on your savings and being exposed to the fluctuations of the investment markets. But it doesn’t have to be that way.

Instead of hoping you’ll have enough, plan for it. Use income from your final working years to help pad your nest egg, and then work out various income scenarios. Some of the scenarios may include:

Consider your current and future budget and possible spending ranges.

Calculate various withdrawal rates to ensure you won’t be taking out too much (or too little and sacrificing your lifestyle plans).

Factor in potential income from other sources (inheritance, part-time work, rental income, etc.).

Consider your portfolio’s asset allocation and potential swings in the value of your investments.

Retirement Income—Shape Your Own Reality

Give Yourself Permission to Spend

A topic you might not consider as you are planning your finances for retirement is allowing yourself the freedom to spend the money you’ve worked hard to invest and save.

Kyle says that on the flip side of people needing to live within their means during retirement are those who are afraid to spend money at all. “I see this when retired clients start seeing a cash reserve dwindle. They almost go into starvation mode and cut back on everything, even though they have plenty of investments to rely on.”

“It seems to happen with clients who’ve been the most diligent about saving,” agrees Kory. “Planning can help them see what retirement could look like and also give them the confidence they need to enjoy the spending.”

Considerations as You Plan the Financial Transition to Retirement

- Is your job or income changing as you approach retirement? Will you remain fully employed, cut back hours, transition to a new job, etc.?

- How much have you been saving as you approach retirement? Can you increase that amount?

- How may your spending needs change in retirement? What will be less? What will be more?

- Have you calculated premiums and out-of-pocket costs for medical care?

- What annual percentage withdrawal plan are you considering for when you’re in retirement?

Transitioning Your Mindset for Retirement

Your finances often overshadow the “softer” side in the run-up to retirement. Along with a strategic plan for spending your retirement savings, you also need a plan for how you will spend your time. It can be a stark reality for some retirees when they move from a job with a two-week vacation to essentially a 52-week vacation.

From seeing yourself in a new way to how you will interact with people and take care of your health, here are things to consider as you prepare for the lifestyle change that is retirement.

The Identity Transition

How will it feel when you’re no longer a full-time doctor, accountant, insurance agent or [fill in the blank]? Our careers are often entwined with our identities, and it’s important to consider how you’ll react to the void left when this chapter of life is over. Pursuing part-time or “encore” employment or enjoying a new role as a more involved grandparent may help ease the emotional transition.

Additionally, retirement may also change personal dynamics at home. Spouses don’t usually retire at the same time. Suddenly having both spouses at home (or one working spouse and one retired) may result in competing priorities, shifts in household duties and getting accustomed to one another’s daily presence and habits.

“Life will be different,” says Kory. “Communication and preparation—ideally before your last day at work—can help you overcome the friction when navigating a new environment.”

The Social Transition

Work often provides automatic social interaction: You go to work and see the same people in your office or for after-hours get-togethers.

After you retire, you’ll have to decide how you might maintain those relationships and whether you’ll seek out new ones through clubs, hobbies or volunteer/charity work. Depending on your plans, your time spent with family might also increase or decrease.

“Social circles are vital to our health and happiness, particularly in retirement. Family and friends can offer new experiences, someone to spend time with and support in difficult or stressful times. They can also provide or strengthen our sense of belonging,” says Kyle.

The Physical Transition

Retirement may give you the freedom to travel, spend more time with friends and try out new activities. As you think about these opportunities, also consider your current health and fitness and how that might change over time.

Do you need to reconsider your housing situation? Many retirees consider downsizing, moving to retirement communities, changing climates, splitting time between two homes and moving closer to family—either for convenience or to plan for future needs.

“Your assessment can also help you plan to stay physically active during retirement,” says Kyle. Consider your current fitness and decide whether you’ll start a new routine or adjust your existing exercise regimen.

Considerations as You Plan for the Mindset Transition to Retirement

- Are you retiring at the same time as your spouse or friend/social group? How will you keep in touch?

- Do you have specific plans for the first few months of retirement or are you playing it by ear?

- Do you expect to travel or purchase another home? Will you be downsizing?

- Are there groups, charities or other volunteer work you’d like to spend more time on?

- What will your fitness routine look like in retirement?

Another Option: Ease Into the Retirement Transition?

For some, retirement isn’t always the end of employment. Full-time jobs could turn into part-time work, higher-paying careers can be replaced by more meaningful or charitable work, and hobbies can become productive side gigs.

Kyle says, “When I have clients who are planning a part-time retirement, I ask them questions to see if gradually transitioning into retirement may be the right choice for them. If a person can ease into it, it can give them the benefits of work, but on a lesser scale. Plus, it may help them keep more of their retirement savings intact for longer.”

Part-time retirement often gives people a whole new view of their jobs. There's a difference between wanting to be at a job versus having to be there. Many times, people feel happier (and less stressed) when they move to that part-time or reduced-schedule role.

Considerations for a Part-Time Retirement

- Do you like what you do now?

- Do you have the option to work part time, either for your current employer or at a new job?

- Are there any possible health obstacles if you continue working?

- Could you live off the reduced salary if you reduce your work schedule?

- Will your health insurance benefits change if you work less, or can you apply for Medicare?

Get Help Planning Your Transition to a Happy Retirement

After doing the hard work of saving for retirement, it can be an adjustment to shift to spending those savings. But with a realistic outlook on your needs, some support from those you trust and a sensible plan, you can become comfortable tapping your assets to enjoy life and love your retirement.

Additionally, you don’t have to do it alone. A financial professional can help you talk through lifestyle changes you may want to make and figure out the money part with a financial plan to make the transitions smoother. And if you do a little prep work before you meet, it can make the discussion that much easier.

Authors

Financial Consultant

Financial Consultant

Think You’re Ready to Retire?

Take our retirement quiz to determine whether you and your finances are ready to take the retirement plunge.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.