What Bigger Defense Budgets Mean for Emerging Markets

Military budgets have expanded, supporting demand for EM-based companies in shipbuilding, aeronautics and other fields.

Key Takeaways

Armed conflicts and U.S. pressure on its allies are spurring countries to boost military spending.

Defense companies in emerging markets have become competitive suppliers in various technologies.

Investors in this space should identify firms positioned to capture lasting growth while meeting challenges unique to their markets and businesses.

As geopolitical tensions lead more nations to build up their military capabilities, many are turning to defense firms in emerging markets (EM) for critical weaponry and equipment.

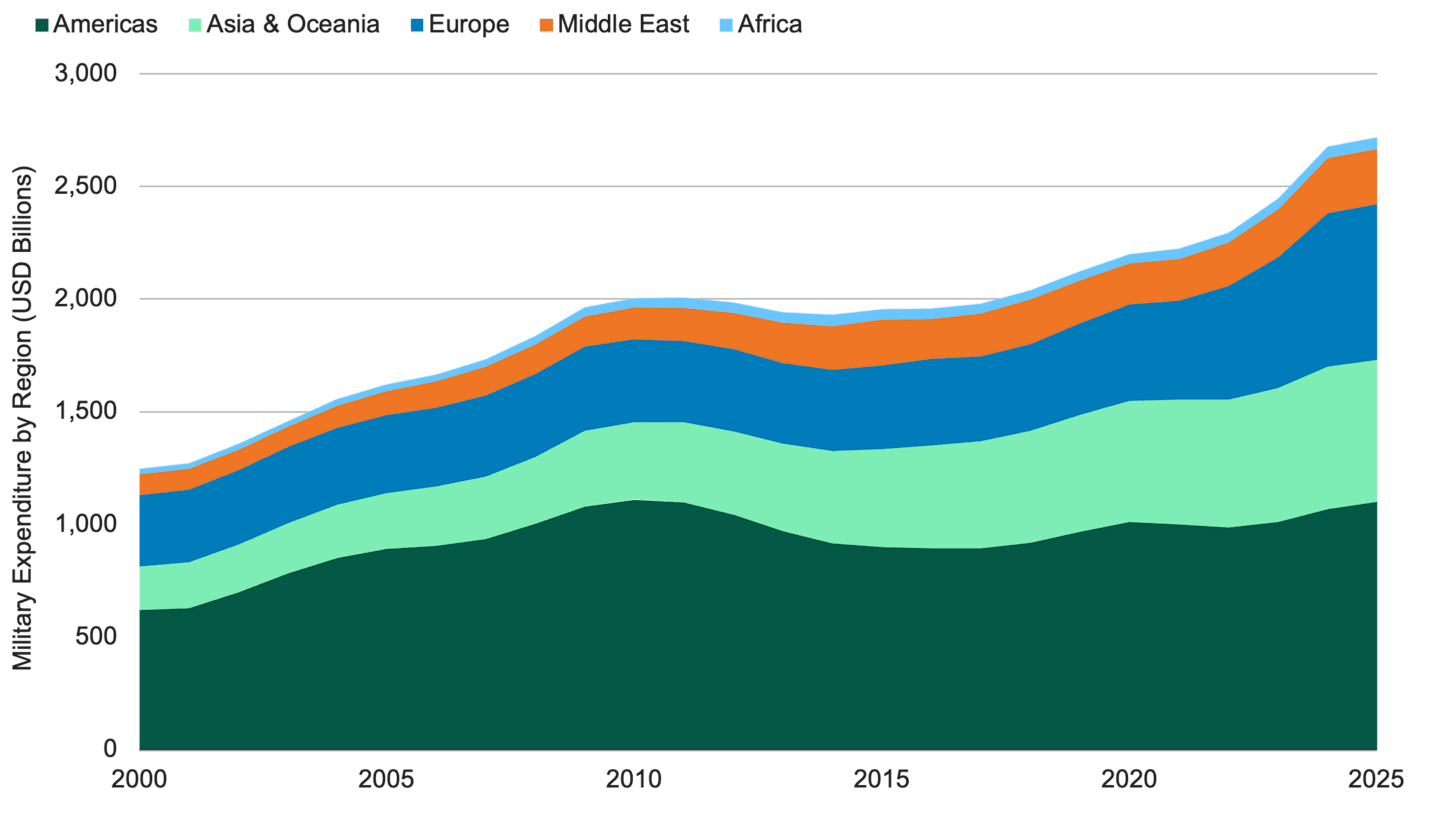

Globally, military spending rose 9.4% in 2024, the largest annual increase since the end of the Cold War in 1991.1 While spending has ticked upward for decades, demand has spiked in recent years amid conflicts in Ukraine and the Middle East. See Figure 1.

Figure 1 | Military Spending Continues to Rise Globally

Data from 1/1/2000 – 6/30/2025. Source: SIPRI Military Expenditure Database 2025, HSBC.

For EM defense firms, this increasing long-term demand represents a broadening customer base and may support further expansion for capable firms.

Although developed markets dominate the defense industry, emerging markets are increasingly home to competitive companies. China (No. 4) and South Korea (No. 10) both ranked among the top 10 weapons exporters from 2020–2024.2 Turkey was No. 11.

EM firms are also positioned to benefit from multi-year commitments to higher spending. Members of NATO, for example, have pledged to increase their defense and security-related outlays from 2% of gross domestic product (GDP) to 5% by 2035.3

Given these trends, our team views defense as an important area for EM investors.

What Are the Reasons for the Rise in Defense Spending?

Geopolitical Conflicts and Tensions Remain High in Many Regions

The Russia-Ukraine conflict has heightened focus on military preparedness.

According to one analysis, Europe, including Russia, raised military spending by 17% in 2024.4 The EU has called Russia a “persistent threat” to its security for the foreseeable future.5

Meanwhile, Israel and Hamas have agreed to a ceasefire, but that conflict continues to simmer. Middle Eastern nations as a group spent 15% more on defense year over year in 2024.6 Israel’s defense spending alone grew 65%.

Growing Economies Have More Resources for Defense

As China’s economy has grown, so has its military budget. Its defense spending now ranks as the world’s second largest, behind only the U.S. It accounted for 50% of all defense spending in Asia and Oceania in 2024.7

In some cases, developing and emerging countries are spending more on their militaries to modernize aging equipment and weapons. The average age of India’s fighter fleet is about 20 years, according to HSBC Global Investment Research.8

U.S. Is Pressuring Allies to Boost Defense Budgets

Along with advocating for higher spending by NATO members, the Trump administration has encouraged its Asian allies to expand their military budgets.9

Japan already plans to raise its military spending to 2% of GDP by 2027, up from 1% previously.10

South Korea’s latest defense budget includes a 7.5% boost, the biggest hike in several years.11

Why EM Firms Are Becoming More Competitive

Ability to Deliver Orders Faster

In 2022, South Korean companies won a contract worth billions of dollars to supply tanks and howitzers to Poland.12 The first of these shipments arrived a few months later, which was a faster timeline than many developed-market firms typically offer. The nation’s military and defense companies collaborate closely, enabling them to adjust domestic orders to create more room for Poland’s.

Specialization and Expertise

Baykar, a Turkish defense company, has established itself as a leader in drone technology by selling its Bayraktar TB2 to various countries. The TB2 has been used in conflict zones such as Ukraine, demonstrating its ability to operate in real engagements.

Government Support

EM governments are motivated to bolster their domestic defense firms. Their contracts are a crucial business source, and governments can support these firms by helping negotiate deals in other countries.

Larger EM nations like India and Brazil maintain sizeable defense forces. Domestic companies serving these militaries can benefit by operating at a larger scale and gaining valuable practical experience.

How EM Defense Firms Are Expanding Their Global Reach

Land Systems

Hyundai Rotem of South Korea has signed agreements to sell hundreds of its K2 tanks to Poland. The company also recently finalized a deal with Peru, marking a significant entry into the Latin American market.13

Aerospace

Embraer has achieved success with its military transport and light-fighter aircraft, which are regarded as both reliable and economical. The Brazilian company has several NATO clients and is expanding into India.14

Maritime

South Korea’s HD Hyundai Heavy Industries is among the world’s largest shipbuilders. The company’s expertise includes military vessels, container ships and oil tankers.

The firm recently signed a memorandum of understanding with Huntington Ingalls Industries (HII), the largest U.S. shipbuilder, to collaborate on defense and commercial ships.15

Electronic Warfare and Cybersecurity

This category includes command-and-control systems, electronic warfare and cybersecurity tools. For instance, Data Patterns, an Indian company specializing in radar and electronic warfare technology, announced during its recent earnings call that it aims for 20%–25% revenue growth in fiscal year 2026.16

How Can Selectivity Help Navigate EM Exposure?

As global defense spending grows, we believe some EM firms may be well-positioned to benefit from increased demand. However, due to the complexity of the defense industry, individual EM firms could face challenges unique to their specific markets and operations.

To identify the most compelling stock opportunities, our team uses an active, selective approach. This allows us to focus on firms that we believe exhibit accelerating, sustainable growth — key characteristics we prioritize across our strategies.

Authors

Sr. Client Portfolio Manager

Explore Our Emerging Markets Capabilities

Stockholm International Peace Research Institute, “Unprecedented Rise in Global Military Expenditure as European and Middle East Spending Surges,” Press Release, April 28, 2025.

Mathew George, Katarina Djokic, Zain Hussain, Pieter D. Wezeman, and Siemon T. Wezeman, “Trends in International Arms Transfers, 2024,” Fact Sheet, Stockholm International Peace Research Institute, March 2025.

NATO, “The Hague Summit Declaration,” June 25, 2025.

Stockholm International Peace Research Institute, “Unprecedented Rise in Global Military Expenditure as European and Middle East Spending Surges,” Press Release, April 28, 2025.

European Commission, “Joint Communication to the European Parliament, the European Council and the Council: Preserving Peace - Defence Readiness Roadmap 2030,” October 16, 2025.

Stockholm International Peace Research Institute, “Unprecedented Rise in Global Military Expenditure as European and Middle East Spending Surges,” Press Release, April 28, 2025.

Ibid.

Pankaj Agarwala and Alastair Pinder, “EM Defense: A New Megatrend – Q&A,” HSBC Global Investment Research, November 3, 2025.

The White House, “Press Secretary Karoline Leavitt Briefs Members of the Media,” YouTube, June 6, 2025.

Japan Ministry of Defense, Reiwa 6 Defense White Paper, 2024.

Lee Minji and Kim Hyun-soo, “Gov't 2026 Defense Budget to Rise 7.5 Pct as It Seeks to Bolster Three-Axis Deterrence System,” Yonhap News Agency, December 3, 2025.

The Straits Times, “Poland Tie-Up to Help South Korea in Bid to Become Major Arms Supplier,” May 29, 2023, and updated November 21, 2024.

Lee Minji, “S. Korea Bolsters Arms Exports Drive with K2 Tank Deal with Peru,” Yonhap News Agency, December 10, 2025.

FactSet, Embraer Q3 2025 Earnings Call Transcript, November 4, 2025.

HII, “HII and HD Hyundai Heavy Industries Sign Memorandum of Understanding,” April 7, 2025.

FactSet, Data Patterns Investor Presentation – Q2 FY 2026, November 12, 2025.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risk considerations, including economic and political conditions, inflation rates and currency fluctuations.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.