Should You Take Social Security Early?

Does it ever make sense to claim your Social Security benefits early? Learn some possible reasons to consider claiming sooner versus waiting.

Key Takeaways

Delaying Social Security benefits can increase your payments, but there could be reasons you want (or need) to claim earlier.

A change in employment, health issues or a spouse’s benefits may impact the timing of your Social Security strategy.

It's important to consider all of your retirement income options before locking in a lower benefit amount.

If you’re nearing retirement, you may be looking into Social Security benefits. You’ve likely heard the advice that you should wait as long as possible to claim them. But there also may be reasons you may want or need to claim earlier.

Every year you delay claiming those benefits (up to age 70) means potentially bigger monthly checks once you do start. And higher monthly benefits over your lifetime can help cover more of your retirement expenses.

Why Are So Many Retirees Filing for Social Security Earlier?

More than 2.3 million people filed for benefits in the first half of 2025, a 16% jump over the same period in 2024. That’s more than just the increase in the number of people eligible to claim. Possible causes of the early filings: 1,2

Improvement in how the Social Security Administration (SSA) notifies spouses of beneficiaries

Updated SSA policies and customer service changes

Fears that the program is “running out of money”

Taking Social Security at 62 vs. 67 vs. 70

Let's say you were born in 1964. You could start drawing Social Security benefits when you reach age 62 in 2026. But if you do, you lock in monthly payments that are 30% smaller than if wait until your full retirement age (FRA) of 67 in 2031.

And if you delay your benefits until you're 70 in 2034, you could collect 24% more each month than you would have gotten at age 67.

Claiming Early vs. Waiting

Age 62

30% Less

Age 67 (FRA)

100% Benefit

Age 70

24% More

Sources: SSA.gov Benefits Planner: Retirement | Born in 1960 or later, SSA.gov Benefits Planner: Retirement | Delayed Retirement Credits, Accessed December 2025.

That’s a large difference and highlights how important it is to maximize your benefits. Consider the income you need to maintain your lifestyle and achieve the goals you have set.

Reasons to Take Social Security Early

Those higher payments may be a pretty convincing argument for many people. But there are times when it may make sense to claim your benefits before age 70, or even before full retirement age.

Here are four situations in which you might want to consider taking Social Security early.

1. You Retired Early and Need the Funds

We often talk to clients about working as long as possible to build a healthy nest egg. But sometimes that isn’t possible. You might have to retire if you become physically unable to do your job, or you could be laid off in a corporate downsizing, for example.

If you’ve retired before your FRA, taking Social Security early may be a necessity to cover your bills. What’s more, it could also let you avoid dipping into your retirement nest egg sooner than you expected. That may give your investments more time to grow.

Early social security payments also can provide consistent income, giving you the peace of mind needed as you settle into a new chapter of life.

2. You Have Health Issues

Today’s longer life expectancies are one reason it can make sense to delay claiming benefits until FRA.

But it can be wise to think carefully about your own health situation. Consider factors such as your family health history, your lifestyle and any existing medical conditions you have. If there’s a possibility you might not have many years in retirement, waiting might not make financial sense.

3. You’ll Be Eligible to Claim Spousal Benefits

If two spouses can each claim Social Security based on individual earnings, the spouse who earned lower lifetime earnings may qualify for spousal benefits . The lower-earning spouse can claim as early as age 62 based on his or her own earnings, but then may qualify to receive up to 50% of the higher earner’s FRA benefit when the higher earner retires.

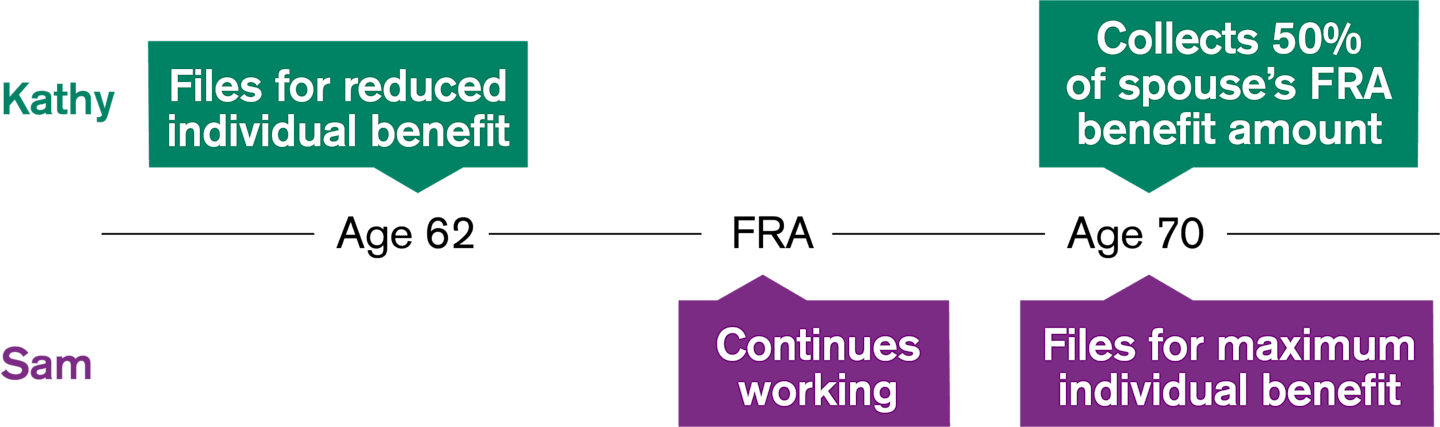

Here’s an example of how a couple could use this strategy to maximize their benefits. Kathy files at age 62 with a lower benefit than she would have received at FRA. Sam waits until age 70 to claim his own maximized benefits. When he claims, Kathy may be able to receive a spousal benefit that is higher than her own.

Kathy's benefit at age 62 is $560 (instead of waiting for her FRA benefit of $800).

Sam's FRA benefit at age 67 is $2,000. His maximized benefit at age 70 is $2,480.

Kathy could switch to spousal benefits when Sam retires at age 70 and begin receiving up to half of his FRA benefit—$1,000 instead of $560. With Kathy’s spousal benefit and Sam’s maximized benefit, the couple would receive a total of $3,480.

Read more about spousal, survivor and ex-spouse Social Security benefits.

4. You’re Working Part Time or Not Earning Much Money

You can still work in retirement and claim benefits before your FRA, as long as your earnings don’t total more than $24,480 (the limit for 2026). If you make more than that, your benefit will be reduced by $1 for every $2 your income exceeds that limit. Claiming early may make sense if you’re still working but not earning much and need the extra funds.

Note that after you reach FRA, there are no earnings limits, even when you’re claiming benefits.

Not sure how to create a Social Security strategy that fits into your investment plan? Schedule a personal consultation with a financial consultant.

Can I Undo My Social Security Claim?

There are two situations in which you can change your mind after starting payments. If you claim early, you’re allowed to undo your decision within one year . Just be aware that you’ll have to pay back whatever benefit money you already received, plus any Medicare premiums or taxes that were withheld.

If you claim benefits at FRA, you can later suspend the payments to earn a higher benefit amount. The Social Security Administration will start the payments again when you turn 70 unless you request to restart your benefits sooner.

Weigh the Pros and Cons of Taking Social Security Benefits Early

Think carefully before starting Social Security benefits earlier than your FRA. There can be reasons to consider starting benefits early, depending on your situation.

But those advantages may be canceled out when you lock in a lower monthly benefit rate for the rest of retirement. Annual cost-of-living adjustments (COLAs) may help, but it’s important to get all the facts so you can be confident in your decision.

Did you know that Social Security benefits may be taxable? Taking a few smart steps can help you reduce the income tax bite.

Start Planning Before You File

The Social Security Administration offers a variety of information and calculators online to help you understand your benefits and project monthly benefit amounts. You can also make an appointment to talk through your situation. Once you decide when to claim benefits, ensure you file four months before you plan to start receiving your benefits.

Remember that Social Security benefits are unique. You can’t always exchange notes with your friends and family because everyone's situation will have many differing factors.

Authors

Financial Consultant

Need Help With Social Security Decisions? Let's Talk

Our financial consultants can help answer questions you have about claiming your benefits and how it may work with your overall retirement plan.

"AARP Exclusive: Why More Americans Are Suddenly Claiming Social Security Early," AARP, August 19, 2025.

"More Americans Are Filing for Retirement Benefits Earlier—Their Long-Term Retirement Security Could Suffer as a Result," Urban Institute, May 23, 2025.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.