Need to Max Out? 2025 IRA Contribution Deadline Is April 15

The countdown is on to get your taxes in order, including taking advantage of potential deductions and tax benefits. One way is to make or max out your IRA contributions for the previous year.

Key Takeaways

You can still make traditional and Roth IRA contributions for the 2025 tax year up until the tax filing deadline on April 15, 2026.

Contributing the maximum each year will help you grow your retirement savings and benefit from potential tax advantages.

Traditional and Roth IRAs have different tax advantages and eligibility rules, so choosing the right one for your situation is important.

Why Contribute to an IRA Now? 2025 Tax Benefits!

Traditional and Roth IRAs offer different options for tax savings. For traditional IRAs, some or all contributions may be tax-deductible and could potentially lower your taxes. By contributing to a traditional IRA before April 15, 2026, you can take advantage of these benefits for your 2025 tax bill.

While Roth IRA contributions aren’t tax-deductible, you’re still allowed to make prior-year contributions. Doing so will help boost your retirement savings and allow you to enjoy the benefits of qualified tax-free Roth IRA withdrawals in the future. (Read on to compare traditional and Roth tax benefits.)

Note: Unlike extensions for regular tax filings, the IRS does not allow extra time for IRA contributions. Once the April deadline has passed, you’ll miss the opportunity for the previous tax year.

Check irs.gov or your state's tax website for updates on current extensions or in case of other potential events.

Log in to your account to see how much you’ve contributed to your IRA for last year. You can also get a head start on contributions for 2026.

What Is the Maximum IRA Contribution?

IRAs are often an essential part of retirement planning because of their tax benefits. The more you contribute now, the greater the potential for your money to grow and provide tax advantages.

The IRS sets specific contribution limits for each tax year, with extra “catch-up” contributions available to those age 50 and older:

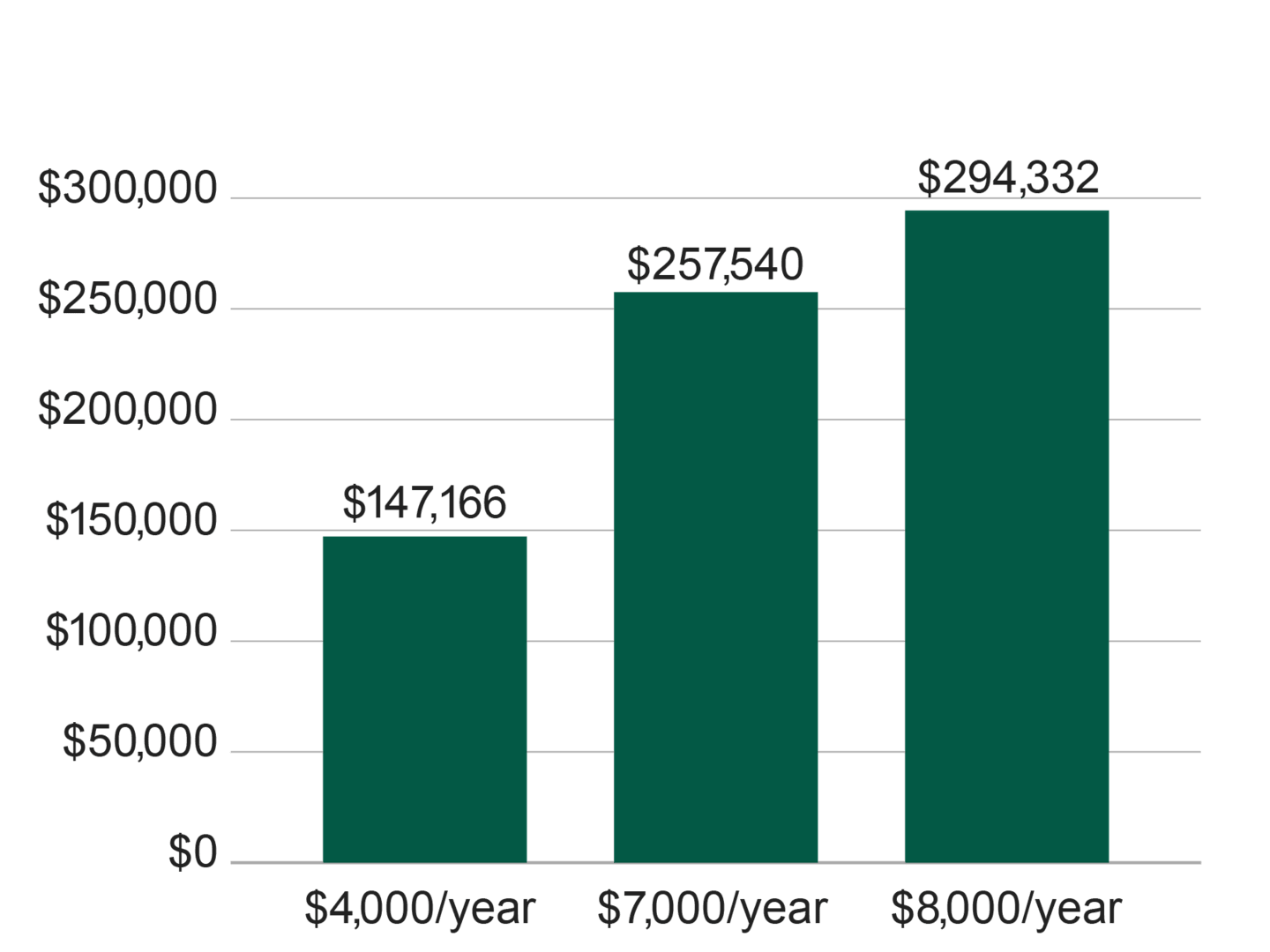

But will contributing the maximum to an IRA make a difference? Below is a hypothetical example of how $7,000 or $8,000 a year for 20 years could add up, compared to the average $4,000 Americans save in an IRA each year.1

Saving the Average vs. Maxing Out

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. The calculations represent an annual investment in an IRA for $4,000, $7,000 and $8,000 over 20 years with a 6% return rate with a total of 20 annual deposits. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Source: American Century Investments, Future Value Calculator, Financial Calculators from dinkytown.net, February 2026. ©1998-2026 KJE Computer Solutions, LLC.

Why Does the IRS Allow IRA Catch-Up Contributions?

Because investors may have missed out on IRAs’ tax advantages in the past, the IRS accepts catch-up contributions for those 50 and older. This allows investors to contribute additional money each year to help make up any shortfalls in previous savings.

For 2025, the catch-up amount is $1,000, bringing the contribution maximum to $8,000. For 2026, the catch-up amount includes a cost-of-living adjustment and is now $1,100, for a contribution maximum of $8,600.

A lack of extra money may be a barrier to investing the maximum every year, but you might be able to find the funds elsewhere. For example, we've seen clients with large taxable accounts and no IRAs. One strategy is to automatically transfer money to the IRA each month for long-term tax benefits.

No IRA Yet? Compare the Benefits of Traditional and Roth IRAs

If you don’t have an IRA or want a different type, comparing traditional and Roth IRAs can help you determine the best choice for you. And just like contributing to a current IRA can be done until Tax Day, you can also open a new IRA until then and not miss out on the 2025 contribution year.

Two key questions are whether you’ll be in a lower or higher tax bracket in retirement. Also, consider your time frame until you begin withdrawing the money.

Same tax bracket: If you expect to remain in the same tax bracket when you make contributions and withdraw the full balance (or if you have a long time frame), a Roth IRA generally may be the best option.

Lower tax bracket: A traditional IRA may be a better choice if you'll be in a lower tax bracket when you begin withdrawals (or have a shorter time frame).

Most people expect their income, and therefore their tax bracket, to be lower in retirement. However, this is not always the case. Most sources of income for retirees, such as Social Security income, pension income and traditional IRA/401(k) withdrawals are all generally taxable forms of income.

Another consideration is whether or not you believe tax rates will change by the time you retire. If the government raises tax rates in the future, it’s possible you may pay a higher tax rate in retirement, even if your income is lower.

Roth vs. Traditional IRAs

Roth IRA

Income Requirements

You must have earned income within annual limits to be eligible for full or partial contributions.

Taxes on Contributions and Earnings

Contributions are not tax-deductible but can be withdrawn tax-free and penalty-free at any time. 2

Earnings can also be tax-free if the account is at least five years old and you are at least age 59½.

Withdrawal Considerations

At age 59½, you can make penalty-free, qualified withdrawals.

You are not required to withdraw money at any age, and you can contribute as long as you have earned income.

Traditional IRA

Income Requirements

You must have earned income to make contributions to a traditional IRA.

Taxes on Contributions and Earnings

Some or all contributions may be tax-deductible depending on your income, tax-filing status and any employer plan participation.3

Income tax on investment earnings is deferred until you withdraw them.4

Withdrawal Considerations

At age 59½, you can make penalty-free withdrawals.

The year you turn 73 (or 75, for those born after 1959), you must take annual required minimum distributions (RMDs) to avoid a 50% penalty on the required withdrawal.

Did you know you can open an IRA for a child’s future? The child must have earned income, just like a regular IRA, and the account can be used for retirement or other IRS-specified purposes.

Make Too Much for a Roth IRA? Consider a Roth Conversion

If your income exceeds the IRS limits and you don’t qualify, you can still consider a Roth IRA conversion. You can convert all or part of your traditional IRA to a Roth IRA without being subject to the 10% early withdrawal penalty.5

In the year you convert, you will owe taxes on your previous contributions and earnings, which were not taxed while in the traditional IRA.

Want to know what effect a conversion may have? Try our Roth IRA Conversion Calculator.

What Is a “Backdoor” Roth Conversion?

If your income is too high for Roth contributions, the so-called backdoor conversion may be an option. Instead of converting an existing traditional IRA to a Roth IRA, this strategy requires you to make a nondeductible contribution to a traditional IRA and then convert it to a Roth.

There are several important nuances to this strategy, which can make it challenging to implement. Consult with an accountant or tax expert before determining if this option is right for you.

Other Tax Tips and Reminders

Investing in an IRA annually can give the tax and retirement benefits we’ve already covered. However, there are other tax tips and strategies to consider at tax time and throughout the year.

You can also visit our Tax Center to find additional information, such as fund-specific exemptions, help understanding cost basis, and other tools, resources and tips.

Authors

Financial Consultant

Make Tax Time Your Time to Save

For your future and on taxes, this could be your time to save more. Log in or register to contribute or open a new IRA.

Contributions to Individual Retirement Accounts (IRAs): Fact Sheet, congress.gov, December 3, 2025. The average annual contribution amount is $4,510 for traditional IRAs and $3,482 for Roth IRAs.

State and local taxes may apply.

Some or all contributions may be tax deductible, depending on your modified adjusted gross income, tax-filing status and if you or your spouse participated in a workplace plan.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

If you choose to withhold taxes as part of a Roth conversion, the amount withheld is generally subject to the 10% early withdrawal penalty. Please consult your tax advisor as needed.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.