How Do Municipal Bond Yields Compare to Taxable Bond Yields?

Evaluating bond yields through the lens of taxable-equivalent yield reveals a key tax advantage of municipal bonds for many investors.

Key Takeaways

Calculating the taxable-equivalent yield of a municipal bond helps investors compare the real income potential of municipal bonds with that of taxable bonds.

Taxable-equivalent yield demonstrates that investors in most income tax brackets can potentially benefit from municipal bond income's tax-exempt status.

In addition to their tax appeal, we believe municipal bonds may deliver compelling quality and diversification characteristics to enhance portfolios.

Bond yields have climbed off multiyear lows across the board, boosting investors’ income potential and reinforcing fixed income’s traditional role as a portfolio diversifier. The municipal bond (muni) sector is no exception.

For many income-focused investors, evaluating muni yields may expose potential tax savings. This benefit may represent an attractive companion to the asset class's quality and diversification features.

Among the many investor-friendly features of munis, tax advantages remain at the forefront. Yields on municipal bonds aren’t subject to federal income tax; in some cases, they may also be free from state and local taxes.1 This feature represents a key differentiator versus other fixed-income securities.

In general, the higher your income tax bracket, the greater your tax-savings potential. But munis’ tax benefits aren’t reserved solely for the wealthiest investors. Calculating the taxable-equivalent yield of a municipal bond often reveals potential advantages for investors in most tax brackets.

What Is Taxable-Equivalent Yield?

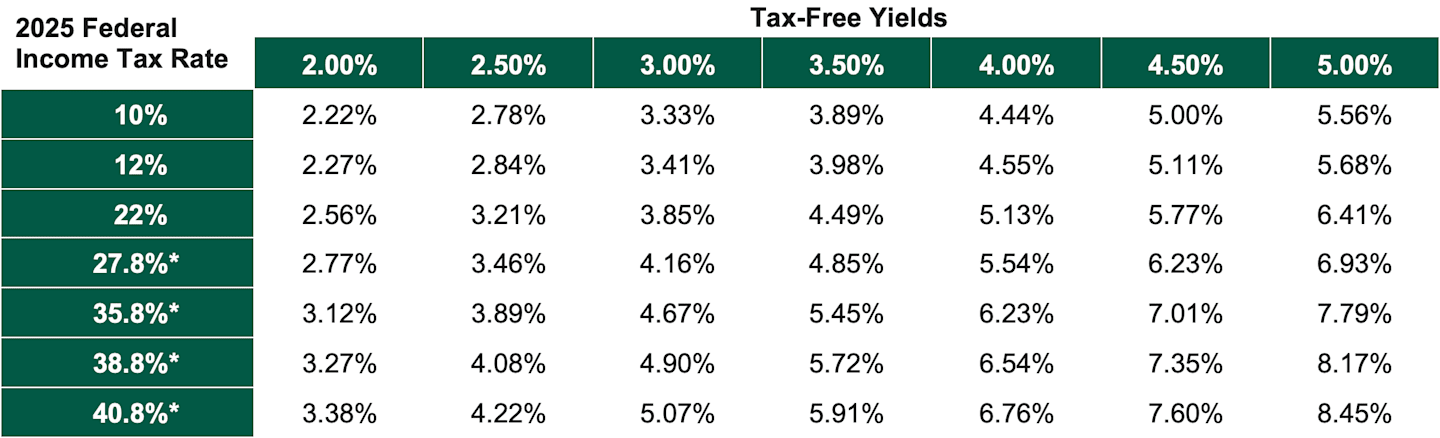

Taxable-equivalent yield is a calculation that puts tax-exempt municipal bond yields and taxable bond yields on an even playing field. It indicates the yield a taxable bond would have to generate to “equal” the tax-free yield of a municipal bond, as Figure 1 demonstrates. This information helps determine whether investing in munis makes sense from an income tax perspective.

Figure 1 also shows how municipal bond yields become increasingly more attractive for investors paying higher tax rates.

Figure 1 | Comparing Yields Reveals the Tax Advantages of Munis

*Includes a 3.8% Net Investment Income Tax.

Federal income tax rates are based on IRS data published October 22, 2024, and are subject to change. These hypothetical examples do not consider state and local taxes. They are for illustrative purposes only and are not intended as investment, accounting, legal or tax advice. Actual results will vary. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

How to Calculate Taxable-Equivalent Yield

To calculate a muni’s taxable-equivalent yield, you need the yield and your federal income tax bracket:

Suppose an investor paying a marginal federal income tax rate of 38.8% considers a high-quality taxable bond yielding 5% and a high-quality muni bond yielding 4%. Which is the better alternative from a tax perspective?

Following the formula above, here’s the calculation to determine the muni’s taxable-equivalent yield:

.04 / (1 - 0.388) = 6.54%

Why a 4% Muni Yield May Beat a 5% Taxable Yield

The calculation above illustrates that a municipal bond yielding 4% may offer more value than a taxable bond yielding 5% for this hypothetical investor. This is because the yield on the tax-exempt bond equates to a taxable yield of 6.54%.

Stated differently, a taxable yield of 6.54% equals an after-tax yield of 4%. Accordingly, when considering the effects of taxes, this municipal bond offers a 2.5-percentage-point advantage over the taxable bond yielding 5%.

As Figure 1 illustrates, the municipal bond’s taxable-equivalent yield exceeds the taxable bond’s yield for investors in most tax brackets.

However, the advantage is more pronounced for investors paying the highest marginal income tax rates. The value of the tax exemption is also greater for municipal bonds with higher yields.

State-Specific Muni Bonds May Deliver Additional Tax Advantages

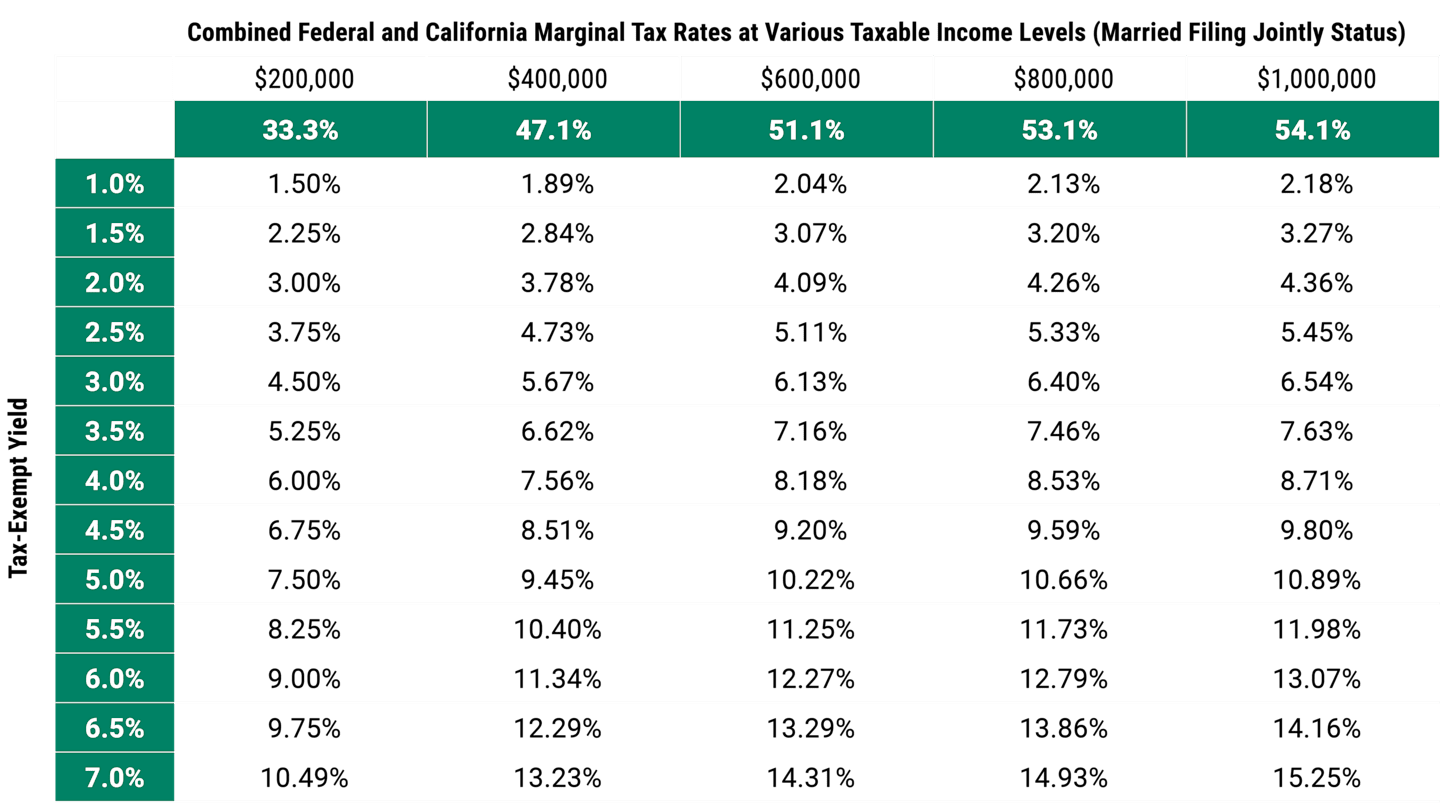

Investors residing in high-tax states can realize even greater tax advantages. State-specific municipal bonds feature income exempt from federal and state income taxes. Again, calculating the taxable-equivalent yield for state-specific munis highlights the expanded benefits.

For example, Californians face the highest income tax rates in the nation, underscoring why many investors strive to minimize the government’s take. With a top state tax rate of 13.3%, California’s combined state and federal tax burden can easily top 50% for high-income investors.

Consider a hypothetical married couple earning $600,000 a year, subject to a combined tax rate of 51.1%. For these investors, the taxable-equivalent yield for a muni yielding 4% is 8.18%, as Figure 2 illustrates.

Figure 2 | Munis Can Help Reduce State Tax Liabilities, Too

Taxable-Equivalent Yields

Data as of 7/31/2025. Source: Tax Foundation, IRS.

The tax benefits of state-specific munis aren’t reserved for the highest-income taxpayers. For example, a married California couple earning $200,000 annually and facing a 33.3% combined tax rate may also find the 4% muni more attractive. In this scenario, the municipal bond’s taxable-equivalent yield is 6%.

The interactive calculator on American Century Investments’ website allows you to review different yield, income and tax-status scenarios.

Credit Quality and Diversification in Muni Bonds

In our view, along with potential tax advantages, credit quality is a key feature of munis. Generally, investment-grade municipal bonds are a higher-quality asset class than credit-sensitive taxable bond sectors. This is partly because the taxing power of state and local governments supports the credit quality rating of many securities.

Often, matching the taxable-equivalent yield of a high-quality muni requires shifting lower on the taxable bond sector’s credit-quality spectrum or longer on its maturity range.

Consider the hypothetical California couple earning $600,000 annually. For them, a muni yielding 4% is equivalent to a taxable yield of more than 8% — a yield often characteristic of lower-quality bonds.

Additionally, we believe munis can potentially enhance diversification in well-rounded portfolios. Municipal bonds tend to react to market and economic influences differently than stocks and taxable bonds. Because of this, we think munis could deliver solid performance potential while helping manage risk in broadly diversified portfolios.

Of course, diversification doesn’t assure a profit or protect against loss of principal. However, we believe diversification could help investors weather the market’s ups and downs.

Authors

Senior Portfolio Manager

Learn about the tax advantages of municipal bonds.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Even though a tax-free bond fund is designed to purchase assets exempt from federal taxes, there is no guarantee that all of the fund’s income will be exempt from federal income tax or the federal alternative minimum tax (AMT). Fund managers may invest assets in debt securities with interest payments that are subject to federal income tax and/or federal AMT. State and local taxes may also apply.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.