Track Your Money Goals With the Future Value Calculator

Are you making the right moves? Estimate how your investment contributions and returns will grow.

Key Takeaways

Gauging your progress toward your investment goals is an important part of the financial planning process.

Calculating various contribution and return scenarios will help you see whether you're on track or need to catch up.

You'll also see how investing early and the power of compounding can affect your investments over time.

Whether saving for a home, retirement or a dream vacation, setting money goals is the first step toward achieving the life and financial security you want. But how do you know that your contributions—10% of your paycheck to your 401(k) or $100 a month to your kids’ college savings—will get you where you financially want to be in the future?

The Future Value of Investment Calculator is an easy-to-use tool to help answer the question, “Will I hit my money goal?” And the calculator is not meant to be a one-and-done tool. Use it to check your progress or make adjustments when life happens.

The Importance of Compounding

Your aim is to grow your invested money by earning a positive return. Ideally, your original investment will earn interest, plus your interest will earn interest over time. This is compounding. Understanding how your investments can grow—or compound—over time is essential.

Connecting your current efforts with your expected outcomes helps give you direction and motivation to keep working toward your desired lifestyle and future.

Investors use future value to estimate how much their investment today will be worth at a future date based on an assumed growth rate.

Future Value = Investment amount x (1 + rate of return)# of time periods

Future value can also reveal if you risk missing your investment goal, so you can make changes before it’s too late. For example, if a younger investor moves all of their investments from equity to bonds in an effort to avoid the risk of losing money, calculating the future values will show a lower nest egg at retirement, which could jeopardize the investor’s ability to retire.

The Future Value of Investment Calculator

Whether you’re saving for a house, retirement or that dream vacation, check whether you’re on track to meet your money goal with our Future Value of Investment Calculator.

Input your current investment balance, contributions (savings or spending), expected investment return and when you need your money (end of your goal). The calculator will then provide an estimate of the future value of your investments based on these factors.

Future value calculators work best with lump sum (a single current balance) and equal periodic cash flow investments. And to make the calculator easy to use, assumptions have been made. Therefore, calculations are estimates, so you should use them as a guide.

Let’s run a hypothetical money goal through the calculator.

An Example of Future Value

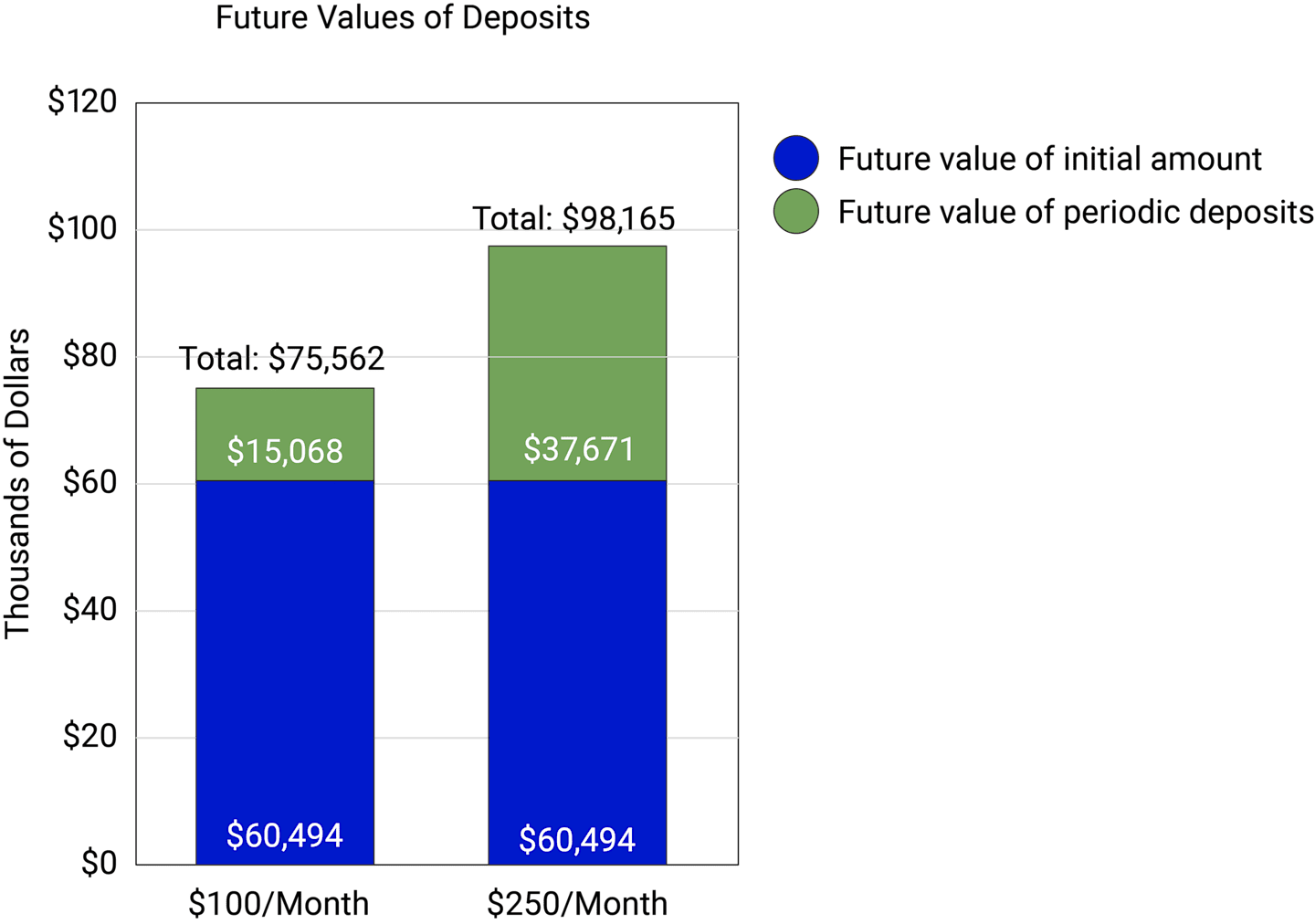

Tom and Martha contribute $100 monthly to a 529 college savings account for their daughter, Caila. The account currently has a balance of $35,000. Given a recent raise, the couple wants to see how they can impact the amount their daughter will have for college by increasing their monthly contributions from $100 to $250.

Caila will enter college in 2032. Tom and Martha assume a 6% average rate of return over the next nine years. They reason that their investments will be more aggressive in the early years and, because they assume there will be market fluctuations, move toward a more conservative mix as they get closer to needing the money.

At their current $100 monthly investment, their daughter is expected to have $75,562 in college funds.

What if they increase their monthly deposit to $250?

These are hypothetical calculations monthly investments of $100 or $250 to a $35,000 existing balance over 9 years with a 6% return rate. Assumes reinvestment of all gains, dividends and interest, and does not include fees, expenses or taxes. If all taxes, fees and expenses were reflected, the reported value would be lower.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Source: American Century Investments Future Value Calculator.

Financial Calculators from Dinkytown.net. ©1998-2023 KJE Computer Solutions, LLC.

Tom and Martha estimate the future value of their daughter’s college savings will be $98,165 if they contribute $250 a month versus $75,562 if they keep contributing $100 a month. These calculations give helpful information to Tom and Martha to see how changes in their current savings behavior may affect the future value of their money goal.

Whether they decide to increase their monthly investment or keep it where it is, they can always return to the calculator, check the math and their assumptions, and see how changes in their current savings and investing can affect their results.

How and When to Use the Calculator

The Future Value of Investment Calculator is versatile. It will estimate whether your current strategy will give you the money you need for your goal. You may also use it to see how changes in the following aspects of your investing will change your results:

End Date

See how much money you will have in 5, 10 or 20 years. When are you expected to hit the amount of money you desire for this goal in the future? The answers can help you determine whether you should adjust your expected time frames.Initial Deposit Amount

If you put more toward your goal now or are considering withdrawing funds, you would change this number by that amount to estimate how this may impact the future value of this money goal. This may help you determine the best use for funds you’ve recently come into or the impact on attaining the goal if you need to pull funds.Rate of Return

See how different rates are expected to affect your future value. What rate do you need to hit your money goal? The results might help inform whether you are on the right track to reach your goal with your mix of investments. Are the returns realistic and appropriate for your risk tolerance?Periodic Deposit (Withdrawal)

See how increasing or decreasing your monthly or yearly savings will affect the future value. At what monthly savings will you hit the future value desired for your goal?

Entering a negative number here turns the periodic deposit into a withdrawal, changing this input from saving to spending. Let’s look at a classic retirement question. Given your accumulated retirement funds (initial deposit) and your expected time in retirement (end date), will your savings last? A positive future value would indicate yes. You may adjust the spending until you get a value close to $0 to see what withdrawals you may expect to make and have your funds last through retirement.

All Inputs

When deciding between two investments, run the expectations of each through the calculator and compare the future values. Estimating outcomes can be insightful.

You can calculate future values of investments when you set up money goals in the investment planning stage and check in on your progress periodically, which can be done during a portfolio checkup. It’s also a good idea to check in with the calculator when you change your current savings rate or investment mix.

A Final Note

Partnering with the Future Value of Investment Calculator can help you stay on track and realize your money goals. If the calculator indicates otherwise and shows that changes are needed to reach an investment goal, make sure changes are appropriate for you and your plan before making any moves.

Have Questions About Your Money Goals?

A Financial Consultant can help you figure out your next steps.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.