What Role Should Core Bonds Play in Retirement Plans?

As bond yields have normalized, core fixed-income strategies have strengthened their potential value to retirement investors.

Key Takeaways

In our view, with most bond yields near multiyear highs, retirement plan investors can pursue attractive income potential with higher-quality bonds.

Core fixed income’s traditional role in a retirement plan menu is to provide long-term diversification and a high-quality source of income potential.

We believe retirement plans should scrutinize their existing fixed-income offerings to ensure their investors have a true core fixed-income option.

Following the financial crisis, bond yields hovered at historical lows. This created challenges for diversified investors seeking attractive income, prompting many to venture into lower-quality (core plus) strategies in search of higher yields.

Investors face different circumstances today. In the post-pandemic period, surging inflation helped catapult investment-grade bond yields higher and restore more typical asset-class correlations. Fixed-income investors no longer must sacrifice their quality objectives to pursue attractive income potential.

This yield backdrop helped reinstate core bonds' traditional role of helping diversified retirement investments temper volatility in their portfolios. In general, bonds experience less price volatility than stocks, which helps smooth out the effects of regular gyrations in equity markets.

Additionally, the historically low correlation between stock and bond performance highlights the complementary nature of these asset classes.

Comparing Core and Core Plus Bonds in Retirement Plans

Significant philosophical differences exist between portfolios within Morningstar’s intermediate core bond category. The group includes genuine, high-quality, core fixed-income funds and others that take on higher risk and behave more like core plus strategies.

Now that yields have normalized, including in the high-quality space, we believe retirement plans can pursue long-term diversification and compelling income generation with core bonds.

Furthermore, we think the potential advantages of a true core bond fund should persist in today’s environment of structurally higher inflation and higher yields. Near-term economic concerns only increase the urgency of evaluating the core fixed-income alternatives you offer to plan participants.

Why Searching for Yield Is a Bygone Strategy

Stretching into riskier core bond portfolios in retirement plan menus was a sensible approach when yields lingered at historical lows. In the 12 years between the financial crisis and the pandemic, bond yields remained unusually low, which triggered a widespread search for yield. However, in today’s structurally higher rate environment, we believe participants don’t have to seek creative ways to boost yield and returns.

Instead, we believe high-quality bonds offer attractive opportunities for retirement investors. In general, bond yields are attractive across high-quality sectors and maturities. Today’s economic backdrop and historical bond market performance patterns further support this view.

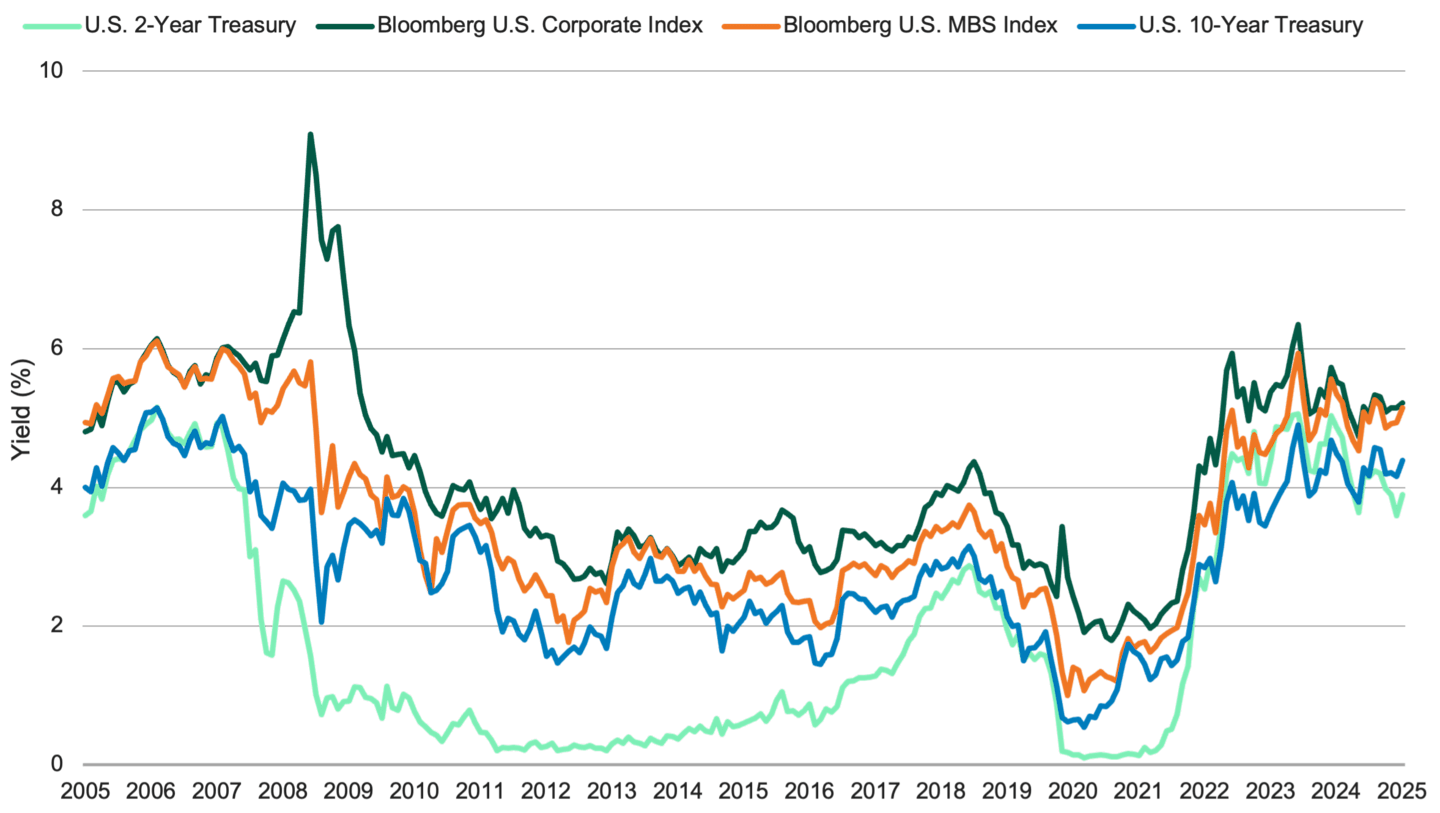

The Return of Bond Yields and What It Means

Following the financial crisis, most bond yields lingered at or near record lows for an extended period due to the combination of easy monetary policy and low inflation.

But that changed in the pandemic's wake, as inflation soared, the Federal Reserve (Fed) aggressively raised interest rates, and bond yields climbed to multiyear highs. Several years later, bond yields and income potential remain at or near multiyear highs, as Figure 1 demonstrates.

Figure 1 | Bond Yields Have Normalized

Data from 5/31/2005 - 5/30/2025. Source: FactSet.

Slowing Economy Favors High-Quality Bonds

Although inflation has moderated, we believe it’s likely to remain above the Fed’s 2% target due to deglobalization, tariffs and other factors. Therefore, we expect interest rates and yields to remain above pre-pandemic levels.

Additionally, the Fed's still-restrictive monetary policy and ongoing consumer pricing pressures may pressure economic growth. Against this backdrop, we think yields on high-quality bonds, including longer-maturity Treasuries, may drop. This should lead to additional positive return potential, beyond the yield, for high-quality bond portfolios with at least modest duration exposure.

Today’s higher-yield environment also helps restore the diversification benefits of high-quality bonds in an economic slowdown. Bonds are now viable substitutes for part of an equity allocation, where investors selling risk assets may consider high-quality bonds with meaningful yields as replacements. This inverse demand should help bring correlations between stocks and high-quality bonds back to their historically low levels.

Now’s the Time to Ensure Participants Can Access True Core

We believe most retirement investors could benefit from a core bond allocation. In our view, bond funds that remain “true” core strategies can help investors diversify and/or generate income in today’s market climate.

Over the long run, well-rounded and high-quality bond funds, such as American Century Investments’ Diversified Bond Fund, offer income potential to asset allocation strategies. They may also reduce risk for an investor’s well-diversified portfolio.

Inside the High-Quality Bond Universe

Diversified Bond’s management team seeks the best values among high-quality bonds, including U.S. Treasury, corporate and securitized securities. This broad range of investments exposes the fund to various sources of income and total return within the higher-quality universe. It also allows the team to pursue attractive active returns in all market environments.

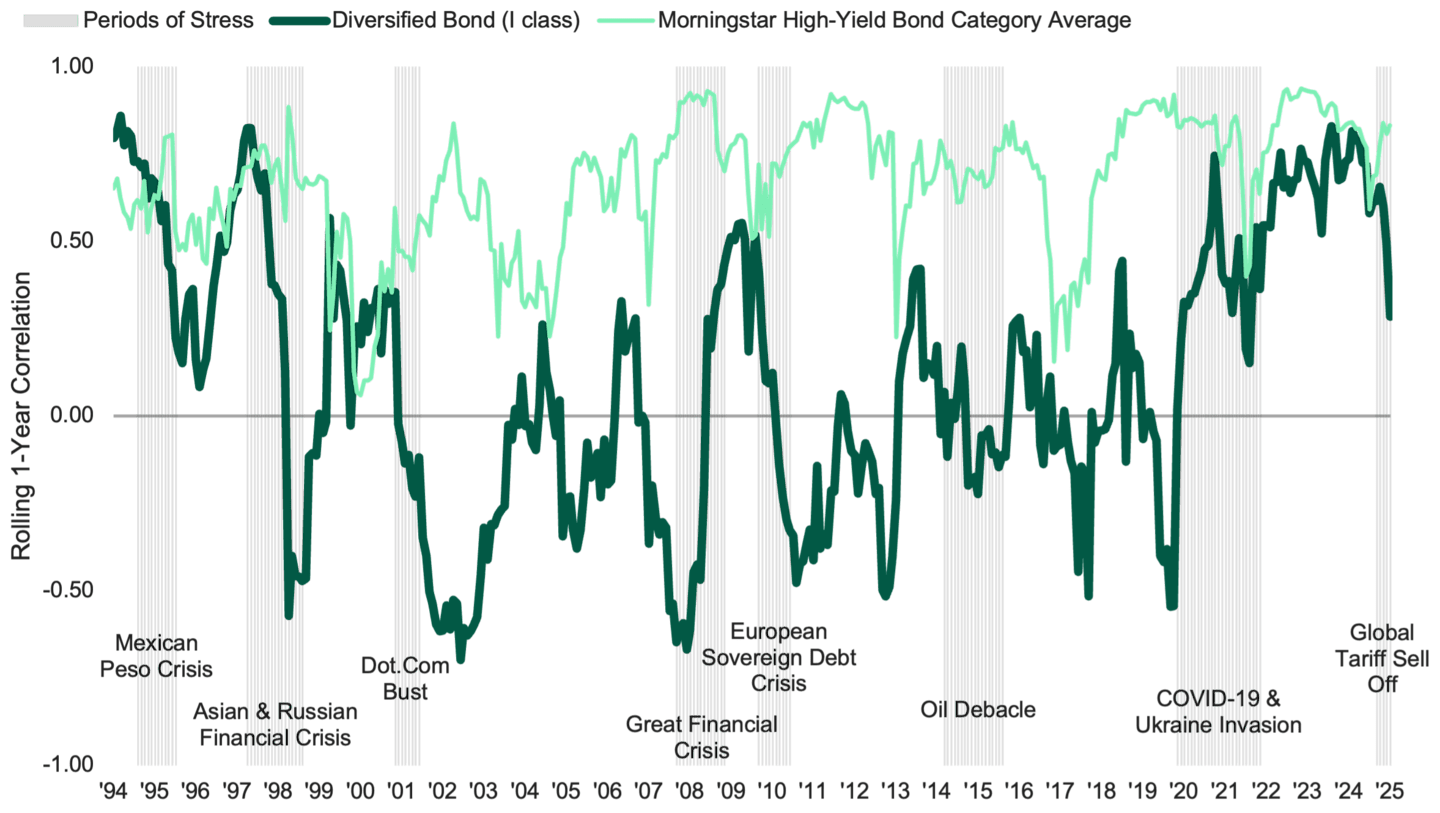

Can Core Bonds Help Reduce Portfolio Volatility?

Because Diversified Bond generally experiences less price fluctuation than stock funds, the fund has historically had low correlation to stocks, as Figure 2 demonstrates.

Figure 2 | Crisis-Era Correlation: Bonds vs. Stocks

Data from 5/31/1994 - 5/31/2025. Source: FactSet. Mexican Peso Crisis: 12/1/1994 - 11/30/1995; Asian & Russian Financial Crises: 8/1/1997 - 12/31/1998; Dot-Com Bust: 4/1/2001 - 10/31/2001; Great Financial Crisis: 1/1/2008 - 3/31/2009, European Sovereign Debt Crisis: 2/1/2010 - 10/31/2011; Oil Debacle: 7/1/2014 - 12/31/2015; COVID-19 & Ukraine Invasion: 3/1/2020 - 3/31/2022; Tariff-related sell-off: 1/31/2025 - present. Past performance is no guarantee of future results.

More important, the correlation of Diversified Bond to equities dipped even lower and into negative territory when investors needed it most — during periods of market stress. This illustrates the fund’s potential to dampen the overall volatility in a plan participant’s portfolio over time.

The Value of Active Management in the Bond Market

Diversified Bond strives to deliver attractive risk-adjusted returns through its active management process. Sector specialists research the investable universe to identify the best relative values within their areas of expertise. Their analysis of the economic and interest rate backdrops, inflation and Fed policy helps inform these decisions.

Equipped with these insights, the team sets the fund’s broad duration, yield curve and sector allocations. Risk management — or seeking to maximize return consistent with Diversified Bond’s high-quality risk level — remains a primary focus throughout the investment process.

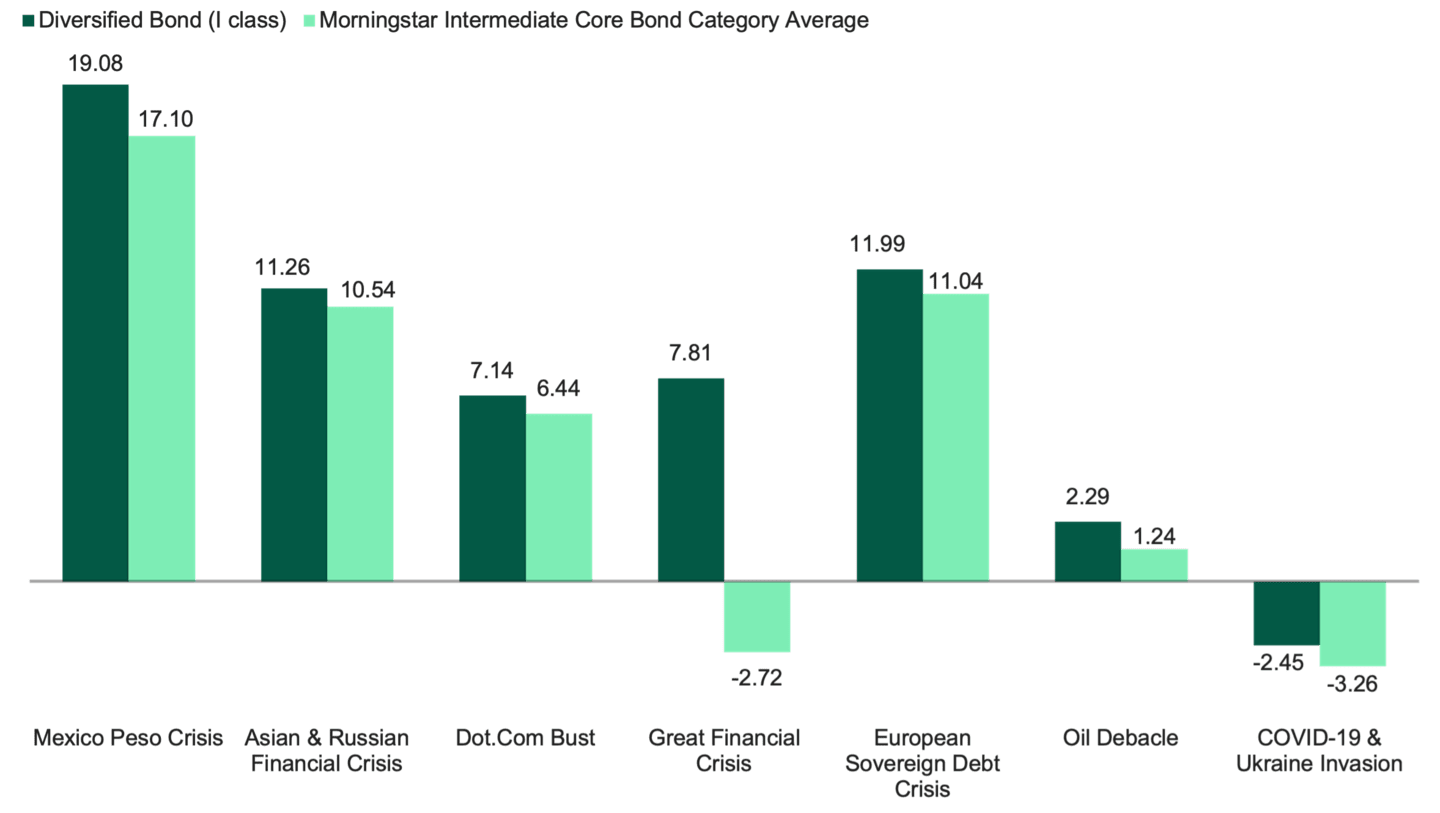

How Diversified Bond Has Performed in Times of Stress

Investors generally expect bonds to offer an element of steadiness during market downturns. Diversified Bond has historically delivered on this expectation by consistently outperforming its peers during these periods. See Figure 3.

Figure 3 | Outperforming During Market Unrest

Data from 12/1/1994 - 5/31/2025. Source: FactSet. Mexican Peso Crisis: 12/1/1994 - 11/30/1995; Asian & Russian Financial Crises: 8/1/1997 - 12/31/1998; Dot-Com Bust: 4/1/2001 - 10/31/2001; Great Financial Crisis: 1/1/2008 - 3/31/2009, European Sovereign Debt Crisis: 2/1/2010 - 10/31/2011; Oil Debacle: 7/1/2014 - 12/31/2015; COVID-19 & Ukraine Invasion: 3/1/2020 - 3/31/2022. Past performance is no guarantee of future results.

Data reflects past performance, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown. Investment return and principal value fluctuates. Redemption value may be more or less than original cost. Returns less than one year are not annualized.

To obtain performance data current to the most recent quarter or month end, click here.

Potential Income Opportunities in Today’s Bond Market

With interest rates at or near multidecade highs, we believe Diversified Bond can potentially deliver an attractive, reliable income stream without taking undue risk.

Investors approaching or already in retirement should consider pairing their income needs with potential downside protection. Most investors in this stage of life can’t afford to take more risks with their principal to pursue their income needs.

In our view, the Diversified Bond Fund offers a potentially attractive alternative, allowing retirement plan participants to pursue their long-term objectives, ranging from diversification to income generation.

Do You Have the Right Fixed-Income Option in Your Retirement Plan?

Investing in lower-quality bonds in pursuit of higher income can add undue risk to your plan participants’ retirement strategies. Fortunately, given today’s yield environment, your retirement plan doesn’t have to aggressively pursue yield on behalf of your participants. That’s why we believe it’s a good time to reassess your core fixed-income option, confirming that a true high-quality core bond fund remains an option for your participants.

As its name implies, Diversified Bond provides broad exposure to the investment-grade bond market. This genuine core bond fund seeks consistent long-term returns and income, making it an attractive portfolio diversifier. We believe its focus on relative value, high-quality bonds, intermediate duration and risk management makes it appropriate for investors pursuing diversification and high-quality retirement income.

Authors

Investing for Income

Explore strategies designed to generate income while tempering risk potential.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

The letter ratings indicate the credit worthiness of the underlying bonds in the portfolio and generally range from AAA (highest) to D (lowest).

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

FOR FINANCIAL PROFESSIONAL USE ONLY/NOT FOR DISTRIBUTION TO THE PUBLIC