Digital Advice

Live in the moment. Invest for your dreams. Do both with help from our digital financial advisor.

Investing Made Easier

When you have to do it all, money doesn’t have to be the thing that falls off your list. Sign up for digital advice and get a recommended portfolio that matches your goals. In minutes! No maintenance required—our super-smart investment professionals take care of that.

Available with a minimum investment of $10,000.

How It Works

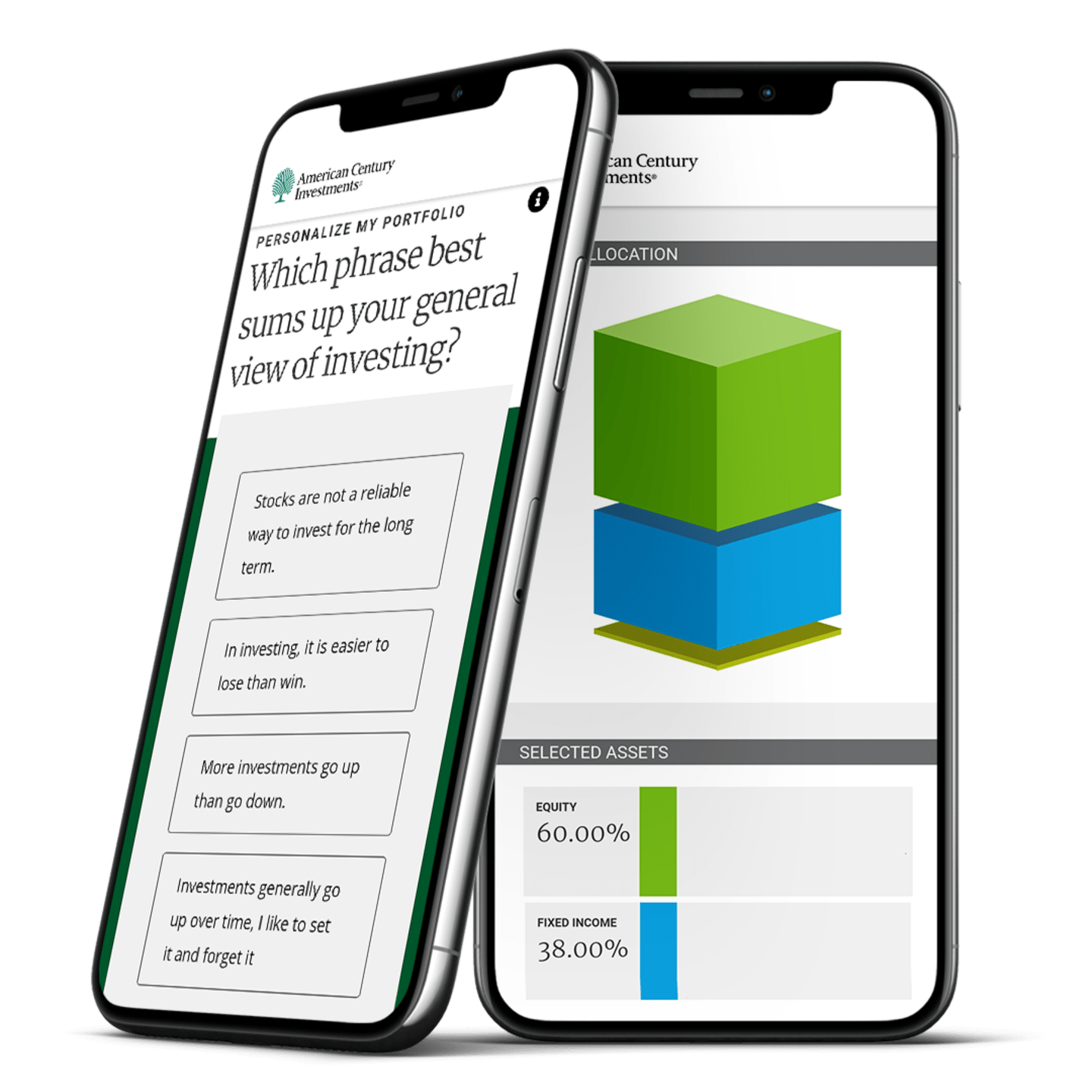

Answer questions about you.

Get a portfolio of tax-friendly investments recommended for your risk level.

Move money to your new portfolio.

And Now, the Details

What’s It Going to Cost Me?

You get all our investment know-how in a pre-built managed portfolio for one low management fee, generally 0.25% to 0.40%. The account minimum is $10,000 and the advice is free. Already invest with us? It’s easy to transfer existing money to a Digital Advice account.

What’s in the Portfolio?

We’re glad you asked. (This is where we nerd out.) Your portfolio will have a variety of investments: equities, fixed income, money markets, ETFs. Check! Each one is handpicked by a team of professionals. They watch. They anticipate. And make tactical moves. The goal? To provide you with a smoother journey toward your future.

You don’t need to worry about today’s complex markets. Or jargon like diversification, risk management or portfolio rebalancing. That’s our job. Everything we do is focused on helping you invest for All. The. Things.

Can I Call a Real Person?

Anytime! Well, during regular business hours. Need help figuring out if Digital Advice or another option is right for you? We can walk you through it. The conversation is free. Request a call now.

For illustrative purposes only.

Take Your Finances to the Next Level

Request a Personal Consult

Connect with a certified financial planner in a one-time session or more for a financial plan. The consultation can complement Digital Advice.

Explore In-Depth Advice

When your finances feel complex or you want ongoing advice, join our Private Client Group. It’s our highest level of service for your journey.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

Digital Advice is provided by American Century Investments Private Client Group, Inc., a registered investment advisor, for clients with a minimum $10,000 investment. Digital Advice provides discretionary investment management. American Century does not charge an advisory fee for this discretionary advice. The Journey Portfolios offered through Digital Advice all contain American Century exchange traded funds (ETFs) and mutual funds, which charge investors investment management fees, underlying fund fees, and other administrative and servicing fees. Depending on the different weightings or allocation of such ETFs and mutual funds, your fees for investing in a Journey Portfolio will vary, but generally range from 0.25% to 0.40% per year. American Century Investments' financial consultants do not receive a portion, or a range of the advisory fee paid by clients. Client-oriented trades outside of our recommendations, personal consultations by phone or in-person with our financial consultants, and other activities like wire transfer fees are offered for an additional fee.

All investing involves risk.

Private Client Group advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. This service is generally for clients with a minimum $50,000 investment. Call us to determine the level of service that is appropriate for you. The advisory service provides discretionary investment management for a fee. All investing involves risk.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.