Welcome to American Century Investments®

So Glad You're Here!

Keep Saving Today to Avoid Future Regret

Choosing Investments Doesn't Have to Be Hard

Understand Target Date Funds

Do you need to change investments?

Your savings are in a money market fund, but it's smart to diversify your investments. That can help manage risks and may give you a better chance of reaching your goal. A convenient way to diversify is with a target-date fund.

Need guidance? Call 1-800-345-2021.

Diversification does not assure a profit nor does it protect against loss of principal.

What's Next?

After activating your IRA, options to keep your money growing—and retirement on track—are wide open! Here are a few ideas.

Stay Invested

Tempted to spend your savings today?

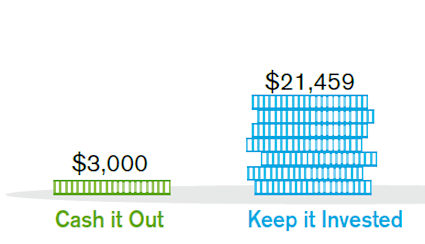

Cashing Out Can Cost You

Save More

Invest a regular, set amount to save more.

Saving More Can Pay Off

Consolidate Retirement

Tackle retirement head on by consolidating other accounts.

One View to Manage Easier

Get a more accurate view of your investments.

Make better decisions when you see it in one place.

Save time tracking and qualify for potentially lower costs.

These hypothetical situations are for educational purposes only, and do not represent any American Century Investments' Fund. Cashing out calculation assumes a marginal federal tax rate of 25% and does not include state or local taxes and a withdraw with taxes and penalties. Staying invested assumes a non-money market fund with 6 percent returns for 25 years. Saving more assumes a non-money market fund, adding $100 a year with 6 percent returns for 25 years.

New Account FAQs

Why was my money moved?

Employers can transfer money out of their retirement plans when they don't receive instructions from former employees about what to do with the money. That account is moved into either a Rollover IRA or a Roth IRA, depending on what kind of contributions you made to the plan.

Is it easy to transfer other accounts here?

It's so easy. Take the first step by calling a Rollover Specialist at 1-800-345-2021, and they'll help with the rest—from assisting you with the paperwork to monitoring the rollover until it's complete.

What investment options do I have?

You have over 80 investment choices here at American Century Investments, including already-diversified portfolios that are specifically designed to give people a better chance of having enough in retirement. Find out why these diversified portfolios may be good for retirement.

Who is American Century Investments?

For over 60 years, we've been helping individuals with their financial goals by delivering investment results and building long-term relationships. At the same time, we support research that can improve health and save lives. Learn more about who we are.

Why would I want to consolidate retirement accounts?

Having all your retirement money in one place can give you a better view of how your money is working and see if you’re on track. It can also be easier to manage.

What if I just want to take my money?

It's tempting to want to spend the money on something you want or need right now. But your future is worth keeping that money working for retirement. Plus, if you aren't 59½, there are early withdrawal penalties and taxes to consider.

What do I get with free guidance?

Once you activate your account, use our Retirement Planner tool to understand the kind of portfolio that may be right for you. Or, if you need help now choosing a new fund, request a one-on-one consultation with an experienced Investment Consultant. Both are free.

*Adding to your rollover IRA may make it ineligible to move to another employer-sponsored retirement plan in the future, depending on the plan's contribution rules. IRAs have annual contributions limits; the recent rollover money is NOT included in those limits.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision. Our representatives can help you evaluate all of your distribution options.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.