Growing a Portfolio With Stocks

Opportunities, Risks and Portfolio Positioning

Stocks Add Growth Potential

Investing in stocks lets you participate in the growth of individual companies and the economy in general. While that gives you higher return potential over time than bonds and cash equivalents, like money markets, it also exposes you to a greater risk of loss.

Why Invest in Stock Mutual Funds?

Stock mutual funds pool money to purchase a portfolio of individual stocks that meet specific objectives, like growth or income. By investing in stock mutual funds, you benefit from professional portfolio management and eliminate the process of choosing individual stocks.

Investing in mutual funds may also lower the risk that a decline in any one stock will have a significant impact on your overall portfolio value.

Exchange-traded funds (ETFs), like mutual funds, are pooled investment vehicles and invest in a portfolio of stocks (or bonds or other securities). But unlike mutual funds, ETFs trade like stocks on stock exchanges and are bought or sold throughout the trading day at fluctuating prices.

The Role of Stock Funds in Your Portfolio

Different stocks can play specific roles in a diversified portfolio. Stocks are generally known for their growth potential, but they can also provide dividend income and act as a hedge against inflation.

Higher Return Potential

Benefits

Stocks are generally the primary driver of growth in a portfolio because their return potential is higher than many other asset types. That makes them a key portfolio consideration for investors who need long-term growth, as well as retirees who need continued growth as they seek to avoid running out of money.

Cautions

Stocks can be volatile, which means they can increase or decrease in value relatively quickly. The volatility can be caused by a company’s internal factors, economic conditions or headlines, so it’s important to understand how various risks can affect your investments.

Portfolio Diversification

Benefits

Asset classes often respond differently to market changes, so investing money across asset types (diversification) can help spread out risk and lower overall volatility in your portfolio. Stocks can be split into subcategories that provide opportunities in different areas of the stock market.

Cautions

Even a properly diversified portfolio will need adjustments. Your needs may change over time, and you may want to increase or decrease your allocations to stocks. Changes in market value could cause your stock portion to increase (or decrease) and expose you to more (or less) risk than you’d planned for.

Dividend Income

Benefits

Investors generally seek income from bonds, but dividend-paying stocks are another way to incorporate a potential income stream into a portfolio. Reinvesting dividend payments can also boost returns over time due to compounding.

Cautions

Companies can cut dividends at any time due to internal challenges or during economic downturns. Additionally, investors who focus on income from dividends may miss out on opportunities for higher growth.

Inflation Hedge

Benefits

Even low inflation has the power to erode purchasing power over time. Stocks have the potential to grow a portfolio at a rate higher than the rate of inflation.

Cautions

Stocks do have the potential to increase in value over time, but economic and market events and company performance can cause the value of your investments to drop at any time.

Understanding Stock Characteristics

You can select stocks and stock funds based on a variety of characteristics.

Market Capitalization

Stocks and stock funds are often categorized by market capitalization (or market cap), which is the value of a company’s outstanding shares of stock. Larger capitalization stocks are generally more established and stable businesses. Smaller capitalizations usually include younger, smaller and faster-growing firms.

Mega-cap: $200+ billion Large-cap: $10 - $200 billion Mid-cap: $2 - $10 billion Small-cap: $250 million - $2 billion Micro-cap: Under $250 million

Investment Style

A mutual fund’s style refers to the type of stocks it holds and the fund’s overall investment objectives.

Growth funds typically invest in fast-growing companies expected to have high growth potential.

Value funds usually invest in companies that may be fundamentally strong but whose stocks are thought to be undervalued.

Core funds invest in both value and growth stocks.

Growth and income funds invest in a mix of stocks that seek capital appreciation and pay dividends.

Index funds invest in companies to track a benchmark index, such as the S&P 500® Index. The indexes are not investment products available for purchase.

Mutual funds can hold a variety of investment types.

- Balanced funds invest in set proportions of stocks and bonds, with a typical mix of 60% stocks and 40% bonds.

- Asset allocation funds invest in a combination of stocks, bonds and cash equivalents, like money markets. Some use a “fund-of-funds” structure and invest in other mutual funds rather than individual securities.

Geography

A mutual fund might invest only in the U.S., only in other countries or in a combination.

International or non-U.S. funds invest primarily in developed markets, such as Europe or Japan.

Global funds invest in the U.S., other developed markets and sometimes emerging markets.

Emerging markets funds generally invest in markets that are still developing, such as China, India, Russia, Mexico or Brazil.

Regional or single-country funds concentrate on a region, such as Latin America, or a specific country.

Specialty

Specialty mutual funds invest in a specific area of the economy.

Sector funds concentrate investments in one specific segment of the economy or industry, like technology and utilities.

Real estate funds generally invest in real estate investment trusts that own or operate income-producing property, such as apartments and shopping centers.

Choosing Stock Funds for Your Portfolio

Stock mutual funds are generally categorized by a combination of their location, market capitalization and investment. Funds could include a U.S. large-cap core fund, a U.S. mid-cap value fund, an emerging markets small-cap fund or a global real estate fund.

Each category will have a specific risk and return profile and can be mixed and matched—your unique allocation should account for your age, risk tolerance and goals for the future. A diversified mix of stock funds (not just large-cap growth funds, for example) may help you weather the ups and downs in any specific category.

Hypothetical Portfolio Mix

Source: American Century Investments®. The hypothetical scenario is for illustrative purposes only and is an example of what a diversified portfolio might look like. Cash includes cash equivalents such as money markets.

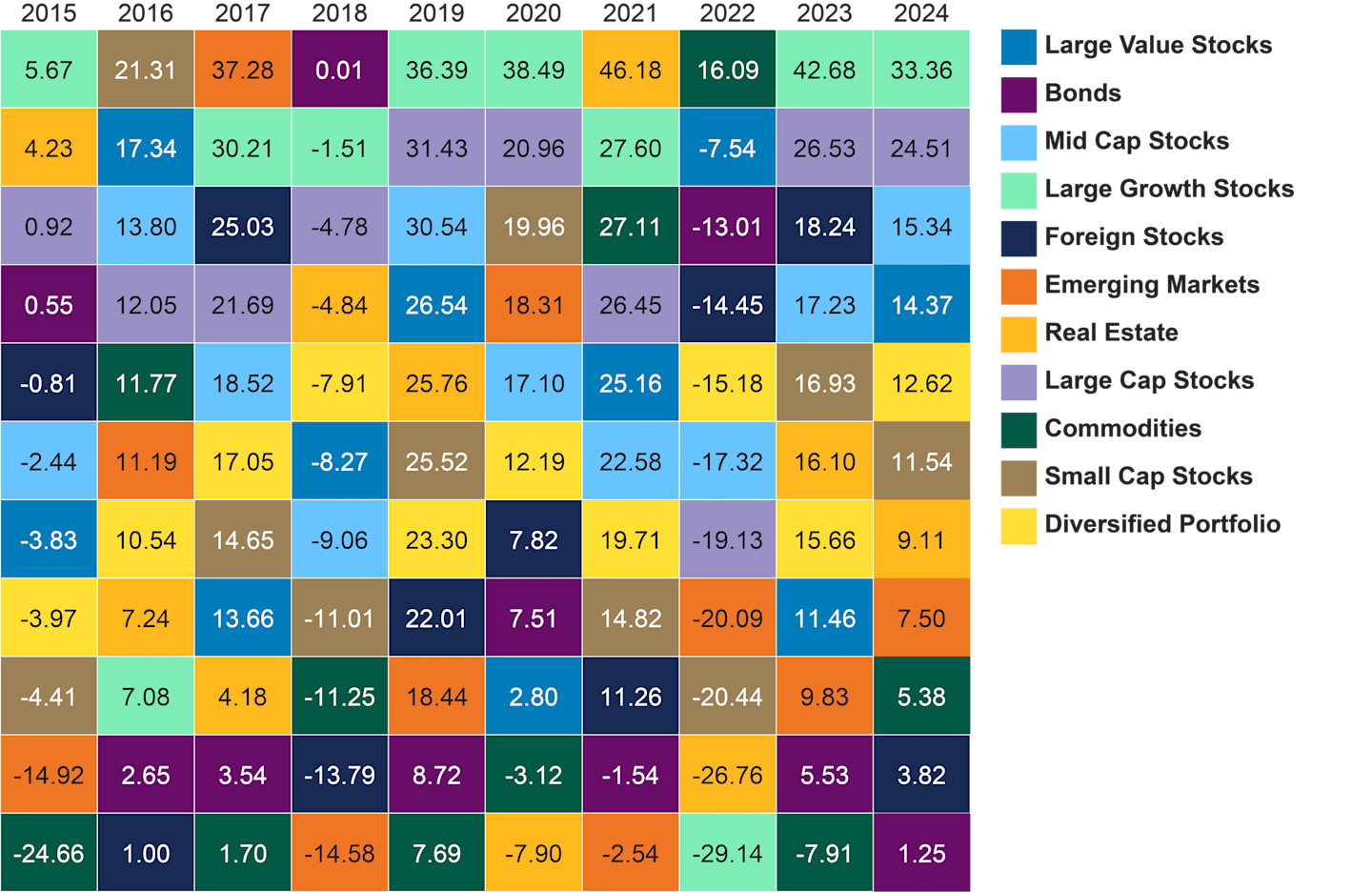

Stocks: The Highs and Lows

Different types of stocks add different features to your portfolio. Some have more or less potential to increase in value, and some have more or less exposure to risk.

Riskier options might get you higher returns one year and negative performance the next. The more conservative options might not be as volatile, but they may not provide the growth you need over time.

Asset Performance Over Time

Past performance is no guarantee of future results.

The diversified portfolio is a hypothetical example of an equal-weighted portfolio of all other represented asset classes (e.g., 1/10th allocation). Returns represent total annual returns and do not reflect fees and expense. Investors cannot invest directly in an index. Diversification does not assure a profit nor does it protect against loss of principal. Asset classes are represented by the following indexes: Large Cap Stocks = Russell 1000 Index, Large Growth Stocks = Russell 1000 Growth Index, Large Value Stocks = Russell 1000 Value Index, Mid Cap Stocks = Russell Midcap Index, Small Cap Stocks = Russell 2000 Index, Foreign Stocks = MSCI EAFE Index (Europe, Australasia and Far East), Emerging Markets = MSCI Emerging Markets Index, Real Estate = Wilshire U.S. REIT Index, Commodities = Bloomberg Commodity Total Return Index, Bonds = Bloomberg U.S. Aggregate Bond Index.

Sources: U.S. Bureau of Labor Statistics, Federal Reserve, Bloomberg, Morningstar and Russell Investments: 12/31/2024.

Find the Right Stock Fit

You need growth for your future. But the path to get there depends on your current situation and what you already own. We offer a variety of mutual funds designed to help fill your growth needs—whether you’re building from scratch or complementing existing investments.

Ready to Get Started?

We provide investments designed to support your needs—and the expertise to help you build a portfolio for the long term.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

As with all investments, there are risks of fluctuating prices, uncertainty of dividends, rates of return and yields. Current and future holdings are subject to market risk and will fluctuate in value.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

International investing involves special risks, such as political instability and currency fluctuations.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

©2026 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.