Get a Personal Risk Assessment

What kind of risk taker are you? Knowing your risk tolerance can help you make investment decisions.

What Is Risk Tolerance?

Risk tolerance refers to how much risk you are willing to take with your investments. All investments have risks, so knowing your comfort level can help you pick investments that are well-suited for your financial goals. Investments that have more risk, such as stocks, can come with potentially more gains, but also more losses.

An important element for your risk comfort level is how much time until you’ll need the money. Generally, the longer you have to invest, the more risk you can take because you have time to recover from losses.

A risk assessment can help you get a good idea about how much risk you should have in your portfolio. It starts with understanding what kind of risk taker you are—from very conservative to very aggressive—and how your time frame affects your decisions.

Start Your Assessment

Answer a set of questions and receive a risk level and investment options that correspond to your risk tolerance during various investment scenarios.

What Risk Levels Look Like for You and Your Portfolio

The assessment can also help you choose different investment types and how much of each to allocate in your portfolio (your asset allocation). Here are samples of very conservative, conservative, moderate, aggressive and very aggressive portfolios to compare. These are for illustrative purposes only and are not personalized for your situation.

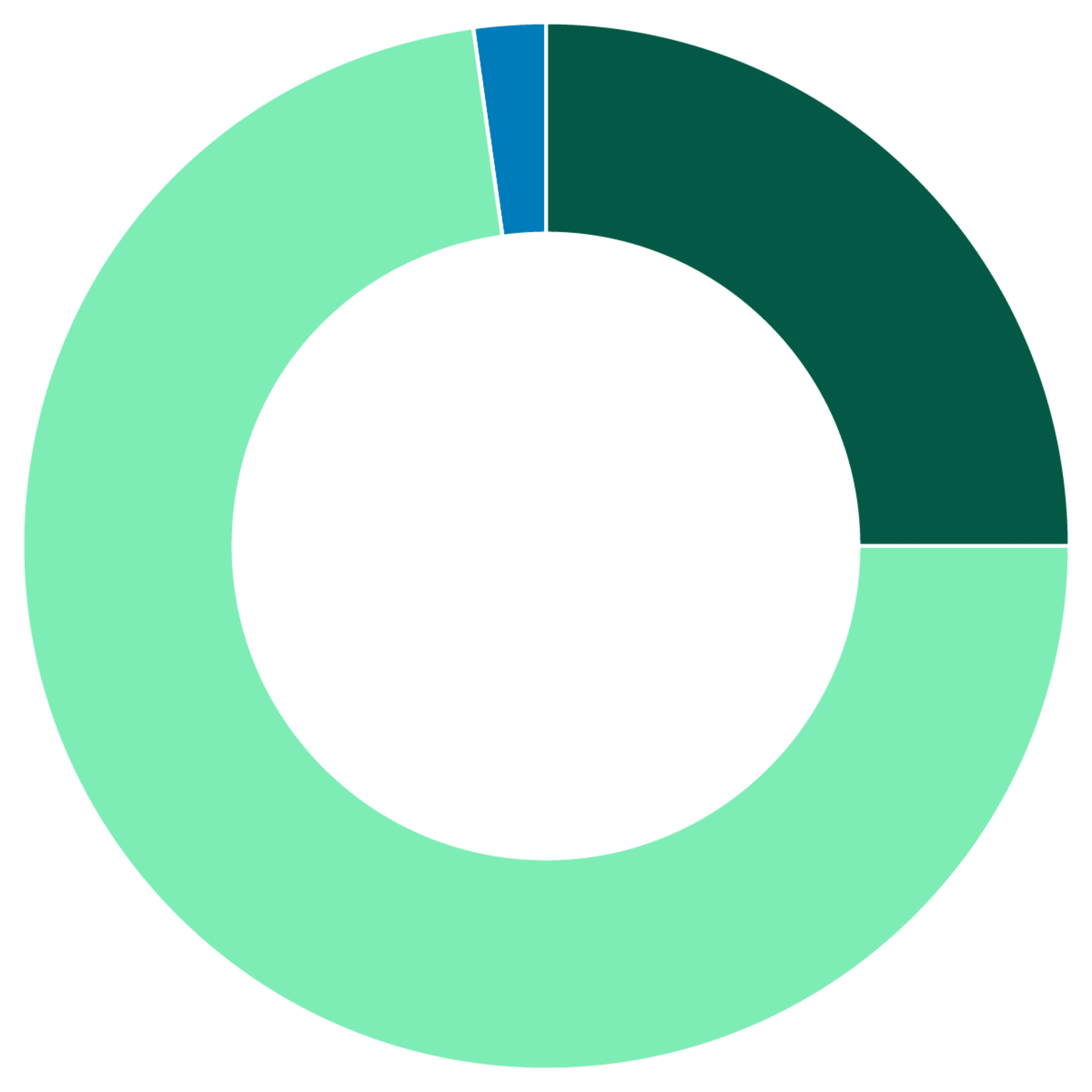

Portfolio Example

Stocks = 25%

Bonds = 73%

Short Term = 2%

Very Conservative

If you have a very conservative risk tolerance, you may have a high aversion to losing money and prioritize preserving your capital. You might be more comfortable with fixed-income and short-term investments, such as bonds, government securities and cash equivalents. A small allocation to equities is possible, but you are likely more willing to accept lower returns in exchange for lower risk.

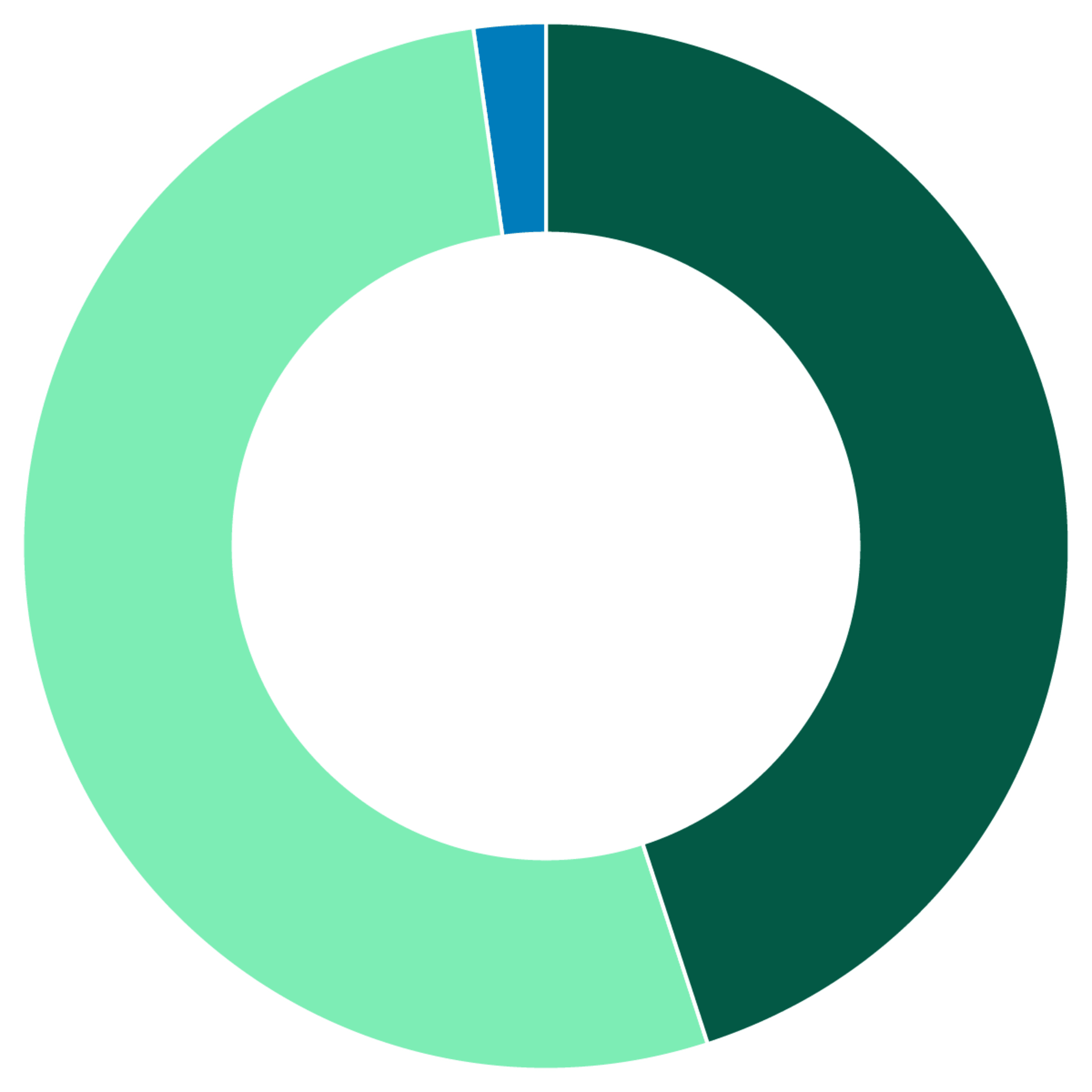

Portfolio Example

Stocks = 45%

Bonds= 53%

Short-Term = 2%

Conservative

Are you conservative but not that conservative? You may want to consider balancing risk and return with a higher allocation to stocks—but combined with a significant amount of bonds, government securities and cash equivalents. Steady returns may be your goal, but you also want to maintain a lower level of risk.

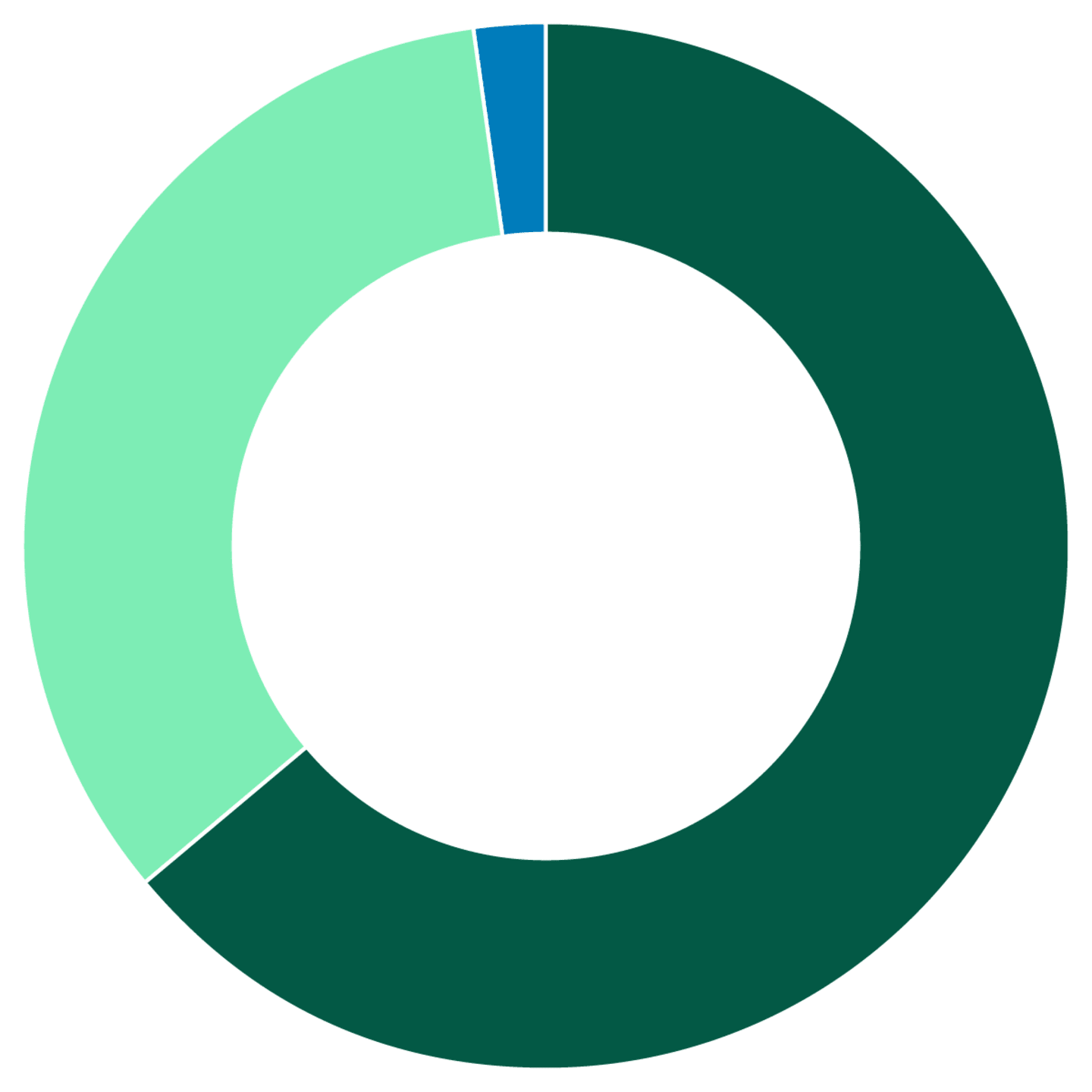

Portfolio Example

Stocks = 64%

Bonds = 34%

Short-Term = 2%

Moderate

If you have a moderate risk tolerance, balancing risk and return in your portfolio is likely important to you. An emphasis on stocks, combined with a significant allocation to bonds, government securities and cash equivalents, may help you achieve the balance between taking risks and growing your portfolio.

Portfolio Example

Stocks = 82%

Bonds = 16%

Short-Term = 2%

Aggressive

With this level of risk, you may be more willing to take on higher risks for potentially higher returns. Your primary focus may want to be on stocks, including non-U.S. companies, to potentially achieve growth, with a smaller allocation to bonds and government securities.

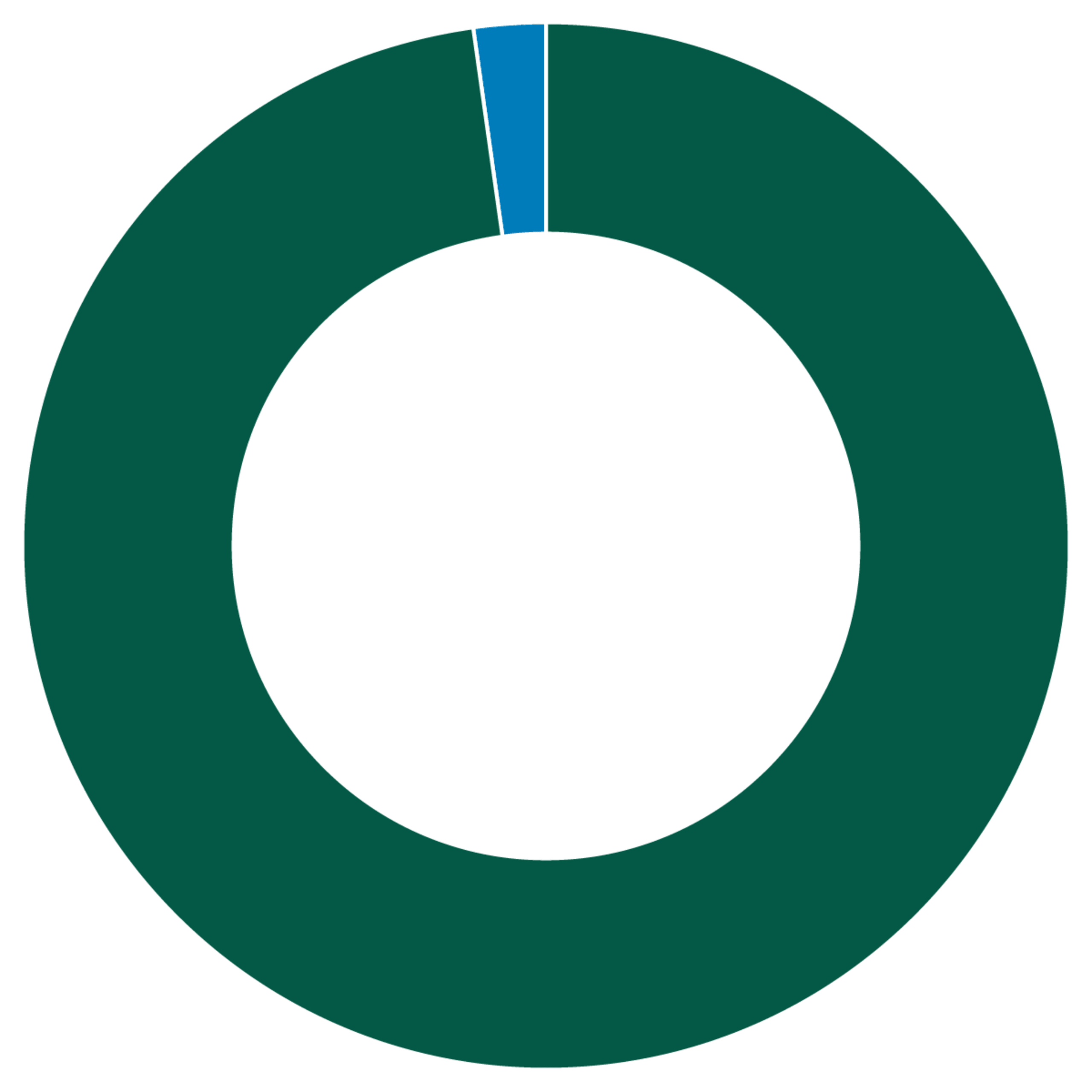

Portfolio Example

Stocks = 98%

Bonds = 0%

Short-Term = 2%

Very Aggressive

If you have a very high risk tolerance, you may want to seek maximum growth potential from your portfolio. You can consider a strong emphasis on stocks, including non-U.S. companies, while maintaining a much smaller portion of bonds and government securities. Because of the additional risk you're taking, you'll want to carefully balance your need for growth with your time frame and goals.

Ready to Get Started?

Know how much investment risk you want to take by answering a few key questions about your comfort level and timeline. Based on your answers, you’ll receive a risk analysis that can help you choose your investments.

Want a more in-depth approach? Learn more about our advice options—from a one-time appointment to ongoing planning.

Get a Personal Risk Assessment

Knowing what you can tolerate will help you make the best investment decisions for your situation.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.