Zero Coupon Funds Reverse Share Split

Find out how reverse share splits work

Why Do a Reverse Share Split?

Keep in mind, the amount of a distribution can increase when the dividend payments or profits increase. A fund's capital gain distribution, however, is not necessarily a reflection of its overall performance.

How Does the Reverse Share Split Work?

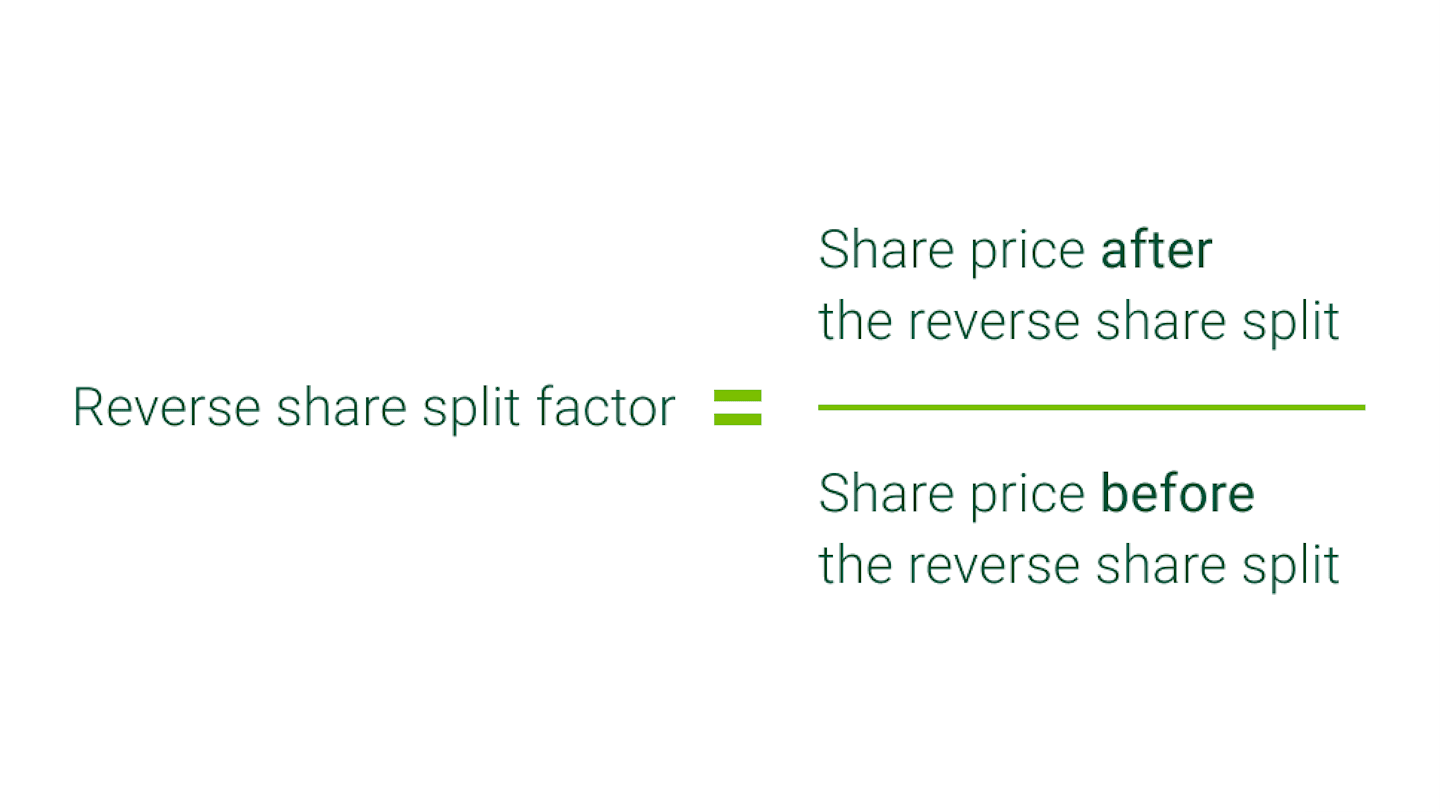

On the day the dividends and capital gains are distributed, the share price of each Zero Coupon fund drops by the amount of the distribution. Immediately following the distribution, the reverse share split is performed. Each fund's share price is raised to the same level as before the distribution, while the share balance of each account in the fund is reduced proportionally. To accomplish this, each fund calculates a "reverse share split factor" as follows:

A Reverse Share Split Hypothetical Example

Bob and Sue each own 100 shares in a Zero Coupon fund. Bob has his distribution paid to him in cash, while Sue reinvests her distribution.

Before Distribution

On the day before the ex-dividend date (the date the dividends and capital gains are paid), the closing share price for the fund is $50, giving Bob and Sue an account value of $5,000.

Bob

100 shares @ $50/share = $5,000

Sue

100 shares @ $50/share = $5,000

After Distribution

On the ex-dividend date, the fund declares a distribution of $10 per share, causing the share price to drop to $40. Sue's account value remains the same since she reinvests her distribution, while Bob's drops because he receives his distribution in cash. Bob and Sue must each report dividend/capital gain income of $1,000 on their tax returns.

Bob

100 shares @ $40/share = $4,000

($1,000 cash paid)

Sue

125 shares @ $40/share = $5,000

After Reverse Share Split

Then the reverse shared split is performed. The reverse share split factor is 0.8 ($40 / $50).

Bob

80 shares @ $50/share = $4,000

(100 x 0.8) (40 ÷ 0.8)

Sue

100 shares @ $50/share = $5,000

(125 x 0.8) (40 ÷ 0.8)

Consider Cost Basis Adjustments

Each time a reverse share split is performed, you are allowed to adjust your per share cost basis proportionally in order to avoid overpaying on taxes when you sell shares. Essentially you are allowed to perform the reverse share split on your cost basis. For each purchase, including reinvested distributions, reduce the number of shares and increase the share price using the reverse share split factor.

Hypothetical Example

Original Cost Basis

Based on the previous example, suppose Bob and Sue each purchased their 100 shares at $20 per share. Sue also purchased 25 shares at $40 per share when she reinvested her distribution:

Bob

100 shares @ $20/share = $2,000

Sue

100 shares @ $20/share = $2,000

*25 shares @ $40/share = $1,000

* shares purchased with reinvested dividends

Adjusted Cost Basis

Using the reverse share split factor (0.8), they would adjust their respective cost basis as follows:

Bob

80 shares @ $25/share = $2,000

Sue

80 shares @ $25/share = $2,000

(100 x 0.8) (20 ÷ 0.08)

20 shares @ $50/share = $1,000

(25 x 0.08) (40 ÷ 0.08)

Notice that the total purchase amount does not change; it is only the per-share cost basis that is adjusted. Notice also that the total number of shares after the cost basis adjustment equals the total number of shares owned after the reverse share split (80 for Bob, 100 for Sue).

Please consult your tax advisor for more information on reporting cost basis on your account.

Note: If you own shares in an American Century Zero Coupon fund through your retirement plan [i.e. IRA, 401(k) or 403(b)] or Coverdell Education Savings Account, your distributions are automatically reinvested so the reverse share split will not affect you

Additional Tax Implications

Although you do not receive regular interest payments from zero-coupon bonds, the IRS requires you to pay income tax on the accrued interest each year as if it had been paid to you. This type of interest is referred to as "imputed interest." Taking distributions in cash may affect your account value over time and create unique tax considerations.

Reverse Share Split Factors

| ZERO COUPON 2015 FUND | ZERO COUPON 2020 FUND | ZERO COUPON 2025 FUND INVESTOR CLASS |

2024 | -- | -- | .95033 |

2023 | -- | -- | .95962 |

2022 | -- | -- | .96552 |

2021 | -- | -- | .96733 |

2020 | -- | -- | .96152 |

2019 | -- | .95775 | .96116 |

2018 | -- | .9600 | .9467 |

2017 | -- | .9637 | .9573 |

2016 | -- | .9385 | .9659 |

2015 | -- | .9492 | .9706 |

2014 | .9603 | .9378 | .9752 |

Although you can potentially earn a dependable return if you hold your shares to maturity, you should be prepared for dramatic price fluctuations which may result in significant gains or losses if sold prior to maturity

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.