2025 Retirement Survey Highlights

How are plan sponsors reacting to the downward trend in confidence? Their more positive survey responses indicate that their views may be lagging current participant attitudes and experiences.

1. Fewer Participants Are Very Accepting of Market Risk

According to survey data, participants are more wary of market risk than in previous years. However, sponsors believe participants are more comfortable with market risk and investment loss than they actually are.

Disconnect

Participants are less willing to accept large losses in their retirement account than sponsors think is reasonable.

Next Step: Address Suitability

Take a closer look at your participant base. Risk preferences can vary widely by age, gender, and asset level—and preferences may evolve over time. Call us to discuss factors in determining retirement plan suitability.

2. Participants' Retirement Confidence Is Slipping

While both plan sponsors and participants say inflation and interest rate risks are top of mind, sponsors may be overlooking participant concerns about running out of money and navigating the transition to retirement.

Disconnect

Participants wish they had saved more earlier, and plan sponsors may not realize how much participants worry about achieving a successful retirement.

Next Step: Support Savings Goals

Emphasize the importance of early and consistent saving to help employees get the most out of their retirement plan. We can help you support participants as they consider longevity risk and the transition to retirement.

3. Participants Are Looking for Growth and Protection

Participants reported wanting the opportunity to grow their savings and protect it from market volatility. Unfortunately, they may not know how to align their risk tolerance and income needs with available investment options. Plan sponsors reported more confidence in participant understanding and risk tolerance than the participants themselves.

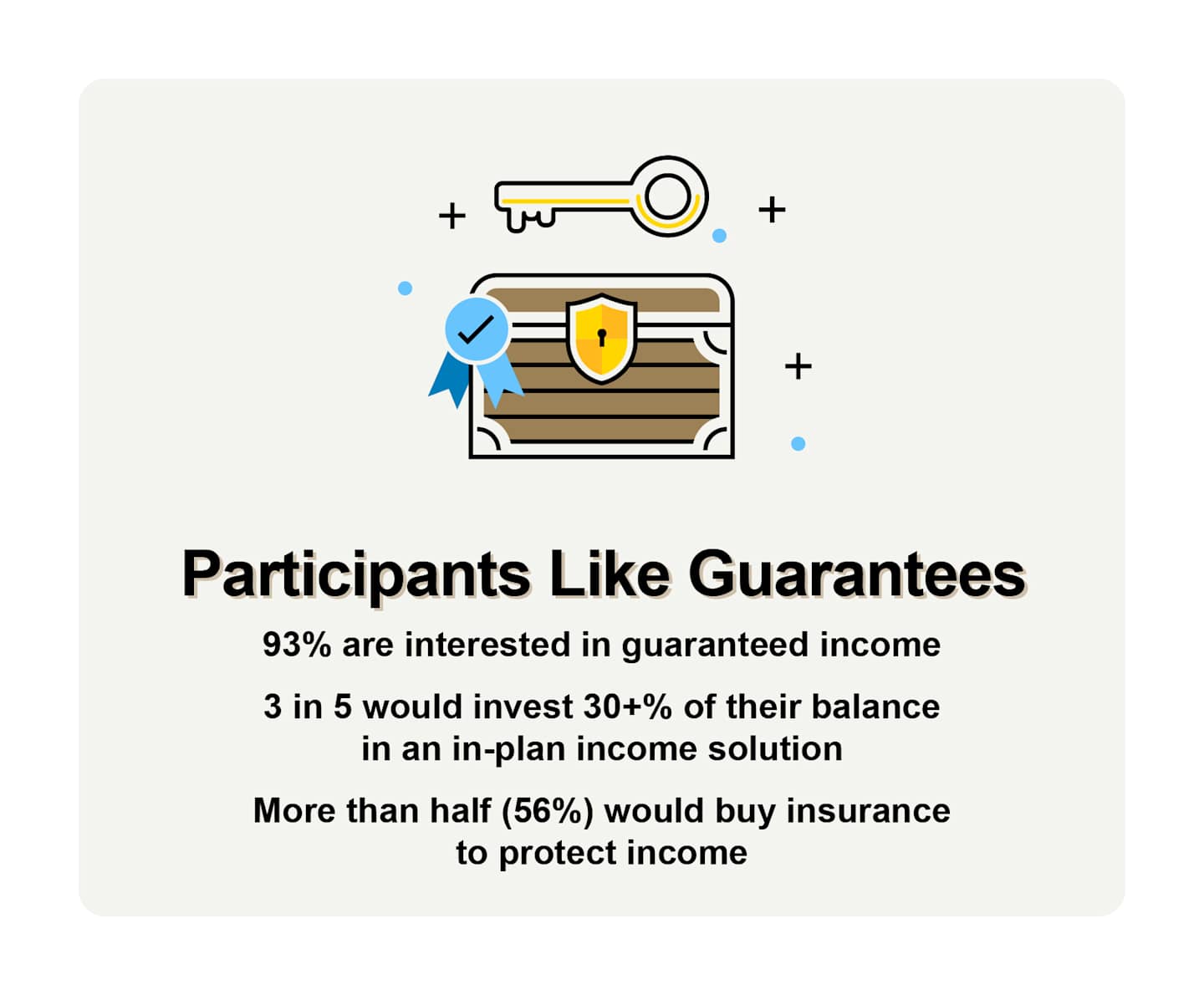

Additionally, while sponsors and participants both value flexibility, participants show strong interest in guaranteed income solutions that offer security and simplicity.

Target-Date Funds (TDFs) Disconnect

Plan sponsors tend to overestimate participant understanding of target-date funds and may not realize the extent of confusion or lack of access among participants.

Next Step: Bridge the Gap with Education

Despite being the most common QDIA in retirement plans, TDFs remain misunderstood by many participants: 62% believe TDFs provide income, and 35% say TDFs won't lose money. This highlights the need to demystify how the products work and educate participants on how glide paths can align with long-term retirement goals.

Guaranteed Income Disconnect

Sponsors believe their education is effective, but participants still feel unprepared and want more support to turn savings into income.

Next Step: Support Income Needs

Participants want a simple way to generate predictable income in retirement. Our Income Blueprint analysis can help you compare the features and benefits of in-plan guaranteed income products. Call to learn more about Income Blueprint.

Full Retirement Survey Findings

2025 Participant Survey

2025 Plan Sponsor Survey

Retirement Advisor Tools

Target-Date Blueprint

Narrow the TDF universe to focus on only funds with investment profiles that align with a plan’s demographics, risk profile and preferences.

Income Blueprint

Compare and contrast features and benefits of in-plan guaranteed income products.

Let’s Connect

Call your American Century Investments Wholesaler to discuss in-plan options and for help identifying the right solutions for clients.

Methodology: The participant survey was conducted between June 3, 2025, and June 23, 2025. The survey included 1,500 full-time workers between the ages of 25 and 70 saving through their employer’s retirement plan. The data were weighted to reflect key demographics (gender, income, and education) among all American private sector participants between 25 and 70.

The sponsor survey was conducted between May 20, 2025, and June 16, 2025. Survey included 500 plan sponsor representatives holding a job title of Director or higher and having considerable influence when it comes to making decisions about their company’s retirement plan (either 401(k), 403(b), or 457 plans). The data were weighted to reflect the makeup of the total defined contribution population by plan asset size.

Percentages in the tables and charts may not total 100 due to rounding and/or missing categories.

Greenwald Research of Washington, D.C., completed data collection and analysis.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.