Trading One Investment Risk for Another? Find Balance

All investments have risk, but is there a way to manage it and still get rewards? Our consultants discuss the tradeoffs some investors make to avoid risk and how a balanced portfolio may help.

Key Takeaways

For investing, risk and reward go hand in hand, but that doesn’t mean investors like it. Having a balanced portfolio can help in a variety of market conditions.

Because of risk aversion, some investors seek safety in cash equivalents and other perceived “safer” investments but doing so can come with other risks.

Our financial consultants discuss the risks of playing it too safe with your investments and how you can go about finding your own portfolio balance.

Risk and reward. One implies danger, and the other success, right? Not exactly. With investments, it’s difficult—or even impossible—to have one without the other.

That’s why financial consultants Rachel McLain, Addison Schubert and Don Thomas recommend a diversified mix of investments: a portfolio that’s balanced and broad enough to cover a variety of market conditions and seeks to avoid volatile swings in value. Here’s what else they have to say about having a balanced portfolio—and the pitfalls of trying to avoid risk altogether.

What Is a Balanced Portfolio?

A balanced portfolio means having a diversified mix of investments and the right amount of each so that the risk level matches your needs. Having the appropriate asset allocation—how your portfolio is divided across asset classes such as stocks, bonds and cash equivalent investments—can help you find the appropriate risk amount for your situation.

“I find that investors who consider the right amount of risk can stick to their plan better,” says Don. “They’ve already done the work and made investment decisions that match their goals and timeframe.”

Not having that appropriate mix might lead to knee-jerk reactions when markets perform poorly or tempt you to try to time the market when they are performing well. So, how do you know what the appropriate mix of investments is for you?

“There are online tools and questionnaires that can help you determine what risk level is right for you,” says Addison. “And those may be more helpful if your goals are far away or you’re looking for ballpark guidance. However, if you’re nearing retirement or some other important goal, you may want to consider talking or confirming your results with a professional.”

Rachel agrees, “It may be beneficial to talk through those risk questions with an advisor to make sure you understand what they mean and what the results might mean. And if you are getting close to a goal, the risk conversations are even more critical.”

When it comes to risk, all the consultants agree that you might not want to “wing it.” But if you are going to improvise, Addison says, “It might be better to stick with the investment you choose and don’t try to go in and out of the markets when they are volatile. That may end up hurting you more in the end.”

Don says, “We will hear from investors who tried to wing it when it doesn’t work out. Although we believe having the plan is a better strategy, it’s never too late to get the plan in place and start following it.”

In a Balanced Portfolio, Each Investment Plays a Role

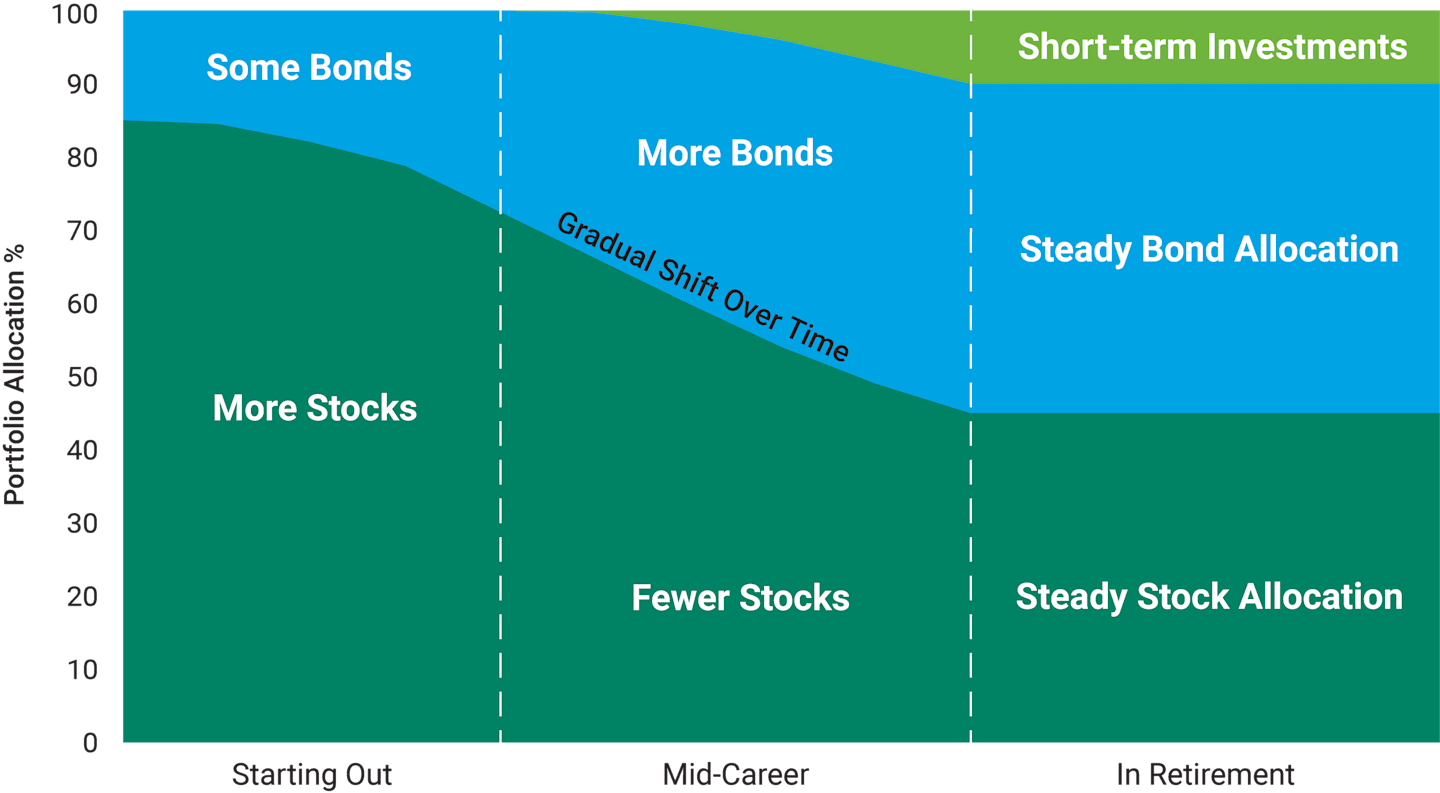

Let’s look at an example of what a balanced portfolio might look like over time—from just starting out through retirement. One thing you’ll notice is that the investments aren’t static. The percentage of each type—stocks, bonds and short-term investments (short-term bonds, money markets, cash equivalents, etc.)—gradually changes over time.

“That gradual shift is important,” says Rachel. “Younger investors have more time before retirement to make up for any losses from market declines and can tolerate the risk inherent to stocks.” However, those nearing retirement or already retired may need more conservative choices to defend against sudden drops.

“But even those close to or already retired may want to consider some growth (via stock exposure) in the portfolios to help carry them through a full life in retirement,” says Don.

Consider An Already Balanced Portfolio

Choosing the right amount of stocks, bonds and cash that matches your preferred risk level can feel hard. You may consider an already diversified portfolio based on your risk level or time frame.

Our managed portfolios that come with our in-depth advice service are also balanced based on risk. Request a call to find out more.

Balancing Risk: Portfolio Makeup Over Time

Source: American Century Investments, September 2024.

The Risk of Avoiding Investment Risk

Why don’t investors have a balanced portfolio? It may be because they are risk averse. “I’ve heard investors say they don’t want any risk at all, but it’s not possible,” says Addison. “There’s no investment that doesn’t have risk, including being in a cash equivalent, like a money market.” Keeping your money in cash comes with its own risks.

“Investors who don’t want risk may be reacting to personal experiences,” says Rachel. “They may have watched their parents lose money, for example, in 2008, and decided they don’t want to take that chance with their own money.” The biggest risk that could open you up is inflation risk, which is discussed in detail later in this article.

Another risk is that you could miss out on the growth you need to reach your goals. In retirement, longevity risk—or outliving your money—is a chance no one wants to take. To overcome both risks, you’ll likely need to invest in something that carries more risk than a money market investment.

Investing in Cash—The Risk of Missing Ingredients

Many investors consider selling their stocks and even bonds during volatile markets. But what does that do to your overall portfolio mix? “Relying too much on more conservative investments, such as money markets, could mean you miss out on future stock and bond market gains,” says Addison.

“If you’re tempted to move to cash or shift to less volatile investments, consider the risks you face with that decision,” says Rachel.

However, that doesn’t negate that there are valid reasons to invest in a money market or other cash investment, and it’s important to understand them. “You also need to know how much to keep in cash based on your needs,” she says.

Generally, you may invest in stocks for growth potential and bonds for income. Investments like money markets, on the other hand, are used for their relative safety: They can help preserve capital, provide liquidity if you need the money quickly, and, along with bonds, can provide a hedge against major stock market swings.

Reasons to hold cash:

Here are three reasons you may want to hold cash in your portfolio. We used money market examples as cash investments.

Buffer against volatility. The stock market can fluctuate significantly and may result in a wide range of returns. For example, money market values are more stable because they are designed to keep a set price of $1 per share.

Emergency fund. Experts generally recommend that you save three to six months’ worth of living expenses. A money market’s ability to preserve your capital can help ensure the value of your emergency fund doesn’t vary much.

Short-term goals. You may want to hold a cash investment while you’re working through a large one-time purchase, such as a down payment for a house.

Too Much of a “Safe” Thing Is Also an Investment Risk

But many investors don’t always consider that “playing it safe” isn’t always safer.

“Cashing out stocks or bonds in favor of cash investments may cause you to lock in losses in a market downturn, and then begs the question of when to get back in the markets,” says Don. Rebounds are nearly impossible to predict and can pass you by while you wait on the sidelines.

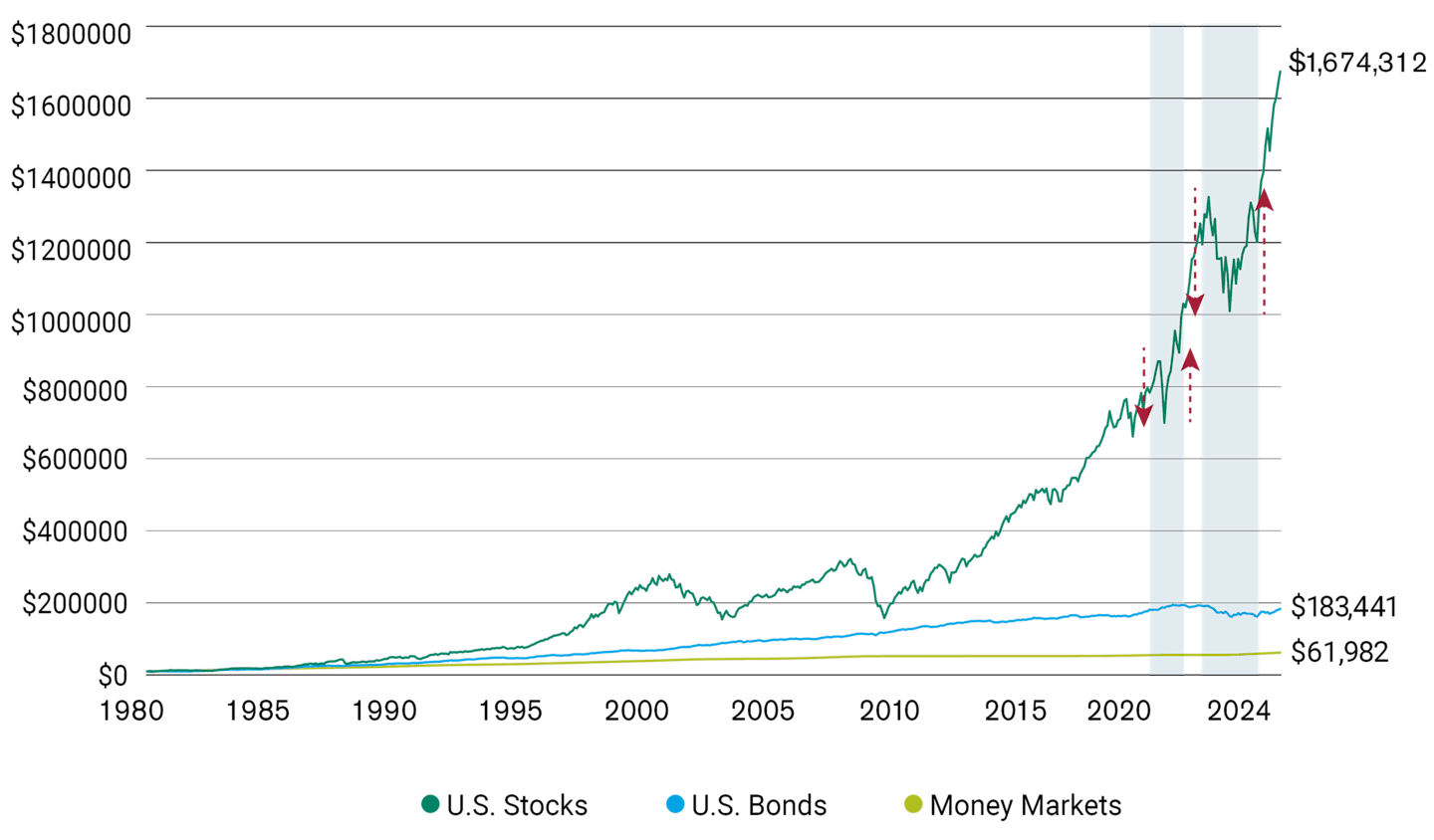

Consider the historical chart below, which uses common indexes as an example. Selling stocks during the 2008 financial crisis may have avoided a further drop in value, hypothetically speaking. But starting in 2009, stocks made up those losses—and then some.

Short-Term Reaction, Long-Term Regret?

Source: American Century Investments, Morningstar Direct. Hypothetical value of $10,000 invested at the beginning of 1980 and ending September 30, 2024. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly into an index. Past performance is not guarantee of future results.

U.S. stocks are represented by the S&P 500® Index. U.S. bonds are represented by the Bloomberg U.S. Aggregate Bond Index. T-Bills are represented by the FTSE 3-Month U.S. T Bill Index, which is often used as a benchmark for money market investments.

In a more recent example, equity markets plunged in early 2020 at the beginning of the COVID-19 pandemic. However, stock prices quickly recovered, and the S&P 500 rose 18% over the entire year.1 Investors who may have panicked and sold stocks early in the year may have missed out on future gains.

Conservative Investments vs. Inflation: Could You Fall Behind?

Historically, inflation has been a major risk when people seek safety. As of September 18, 2024, money market average rates are between 0.01% and 4.25% annual percentage yield,2 depending on your account balance. Higher balances usually earn higher rates. Some of the rates of return on these investments generally don’t keep pace with the rate of inflation, which averaged 2.9% over the past 10 years.3

Also, consider that the higher yields people are seeing with money markets and high-interest savings accounts can change as the Federal Reserve implements its monetary policy. “One of the tools we use estimates what yields may look like this time next year, and those estimates have already started to go down,” says Addison.

Don says, “It’s a good conversation to have with a financial professional about what to do with the money you have in more conservative investments and how you will replace those yields if interest rates continue to drop.”

“It’s the same conversation I have with clients who are invested in Certificates of Deposit (CDs), says Rachel. "If they are currently getting 5%, are they willing to renew it at 3%? I think it’s important to look at other options—like investing in the stock market—and why a balanced portfolio can be critical.”

Risks of holding too much in money markets:

Opportunity cost. Money markets don’t provide much opportunity for growth or income. They have historically provided a lower rate of return over time compared to most stocks and bonds.

Lack of diversification. A diverse mix of bonds can also be used to hedge against stock volatility while having higher return potential than money markets.

Inflation risk. Inflation may outpace money market returns, undermining your future purchasing power.

The Fear of Running Out of Time

Many investors may be concerned that they don’t have enough time to make up losses due to volatile markets, particularly if they’re nearing retirement. Cashing out may seem like the best option to preserve a nest egg. Others may take on additional stock risk in an attempt to gain back any losses.“

Investors have more options than just being in “risky” or “safer” investments,” says Addison. “It doesn’t have to be an either/or decision.” There are a variety of options across the investment risk spectrum to choose from.

Finding Your Own Balance

Remember, the percentage of each type of investment in your own portfolio should always depend on your personal situation, comfort with risk and time frame.

If you’re worried about the market impact on your portfolio, we can help. A comprehensive financial plan can help ease your fears and chart a course forward.

Authors

Financial Consultant

Financial Consultant

Financial Consultant

Need Balance?

We can help evaluate your current asset allocation or help you build a portfolio with the right amount of risk. Check out our advice services to see which might best help you.

Source: FactSet. Data as of 9/30/2024.

What Is the Average Money Market Account Rate? Smartasset.com, September 18, 2024.

U.S. Inflation Calculator, Current U.S. Inflation Rates, 2000-2024, September 2024. Note, 2024 rate is based on the previous 12 months.

Annual Percentage Yield (or APY), is the amount of compound interest an account earns in a year. The calculation is based on the account’s interest rate and the number of times interest is paid during the year.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

Private Client Group advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. This service is generally for clients with a minimum $50,000 investment. Call us to determine the level of service that is appropriate for you. The advisory service provides discretionary investment management for a fee. All investing involves risk.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.