Many retirees count on Social Security checks for financial stability, especially during times of uncertainty. If you haven't retired yet, it's a critical element for planning. In 2021, there are changes you should know about—most of which point to benefit increases. However, it's a mix of bright spots and clouds.

How Important Is Social Security to Me?

While the 1935 Congress may never have intended Social Security to be your ONLY retirement resource, it is an important source of income for many retirees. The 2021 changes aren't over-the-top but will likely be good news for the many Americans who receive benefits.

Source: The Center on Budget and Policy Priorities, “Policy Basics: Top Ten Facts about Social Security,” August 13, 2020.

Source: The Center on Budget and Policy Priorities, “Social Security Lifts More Americans Above Poverty Than Any Other Program,” February 20, 2020.

Social Security is an important part of overall financial planning.

Listen to our podcast series for help understanding and maximizing your benefits.

Social Security Changes for 2021

1. Partly Cloudy: Slight Cost of Living Increase

It's not as big as the 2.8% increase retirees received in 2019, but the 2021 cost-of-living adjustment (COLA) of 1.3% is, at least, something. And it's intended to cover increased Medicare costs. For the average retiree, the increase means about $20 more each month.

2. Sunny: Maximum Benefits Go Up

The maximum wage cap limits the amount of your income that's subject to Social Security taxes. That limit increased in 2021 to $142,800—up from $137,700. The maximum monthly benefits limit, or how much you can collect, also increased to $3,148. This should be good news in retirement for workers who may be at the top of the income scale.

3. Sunny: Make More Money Without Raining on Benefits

If you collect Social Security and work part-time, the amount you can earn without your benefit being reduced has been raised. How much depends on whether you've reached full retirement age (FRA)—the age at which you can receive 100% of your benefits.

What's My Full Retirement Age?

In 2021, it looks like this:

Year Born | FRA |

|---|---|

1958 | 66, 8 months |

1959 | 66, 10 months |

1960 | 67 and later |

Source: SSA.gov, October 2020

Before FRA:

In 2021, your Social Security benefits won't be reduced if you earn $18,960 or less. Make more, and the Social Security Administration will withhold $1 from your check for every $2 you earn.

At FRA and Older:

If you reach FRA in 2021, earn up to $52,520 without getting dinged on your benefits. After that amount, Social Security will withhold $1 for every $3 you earn.

4. Partly Sunny: Full Retirement Age Rising

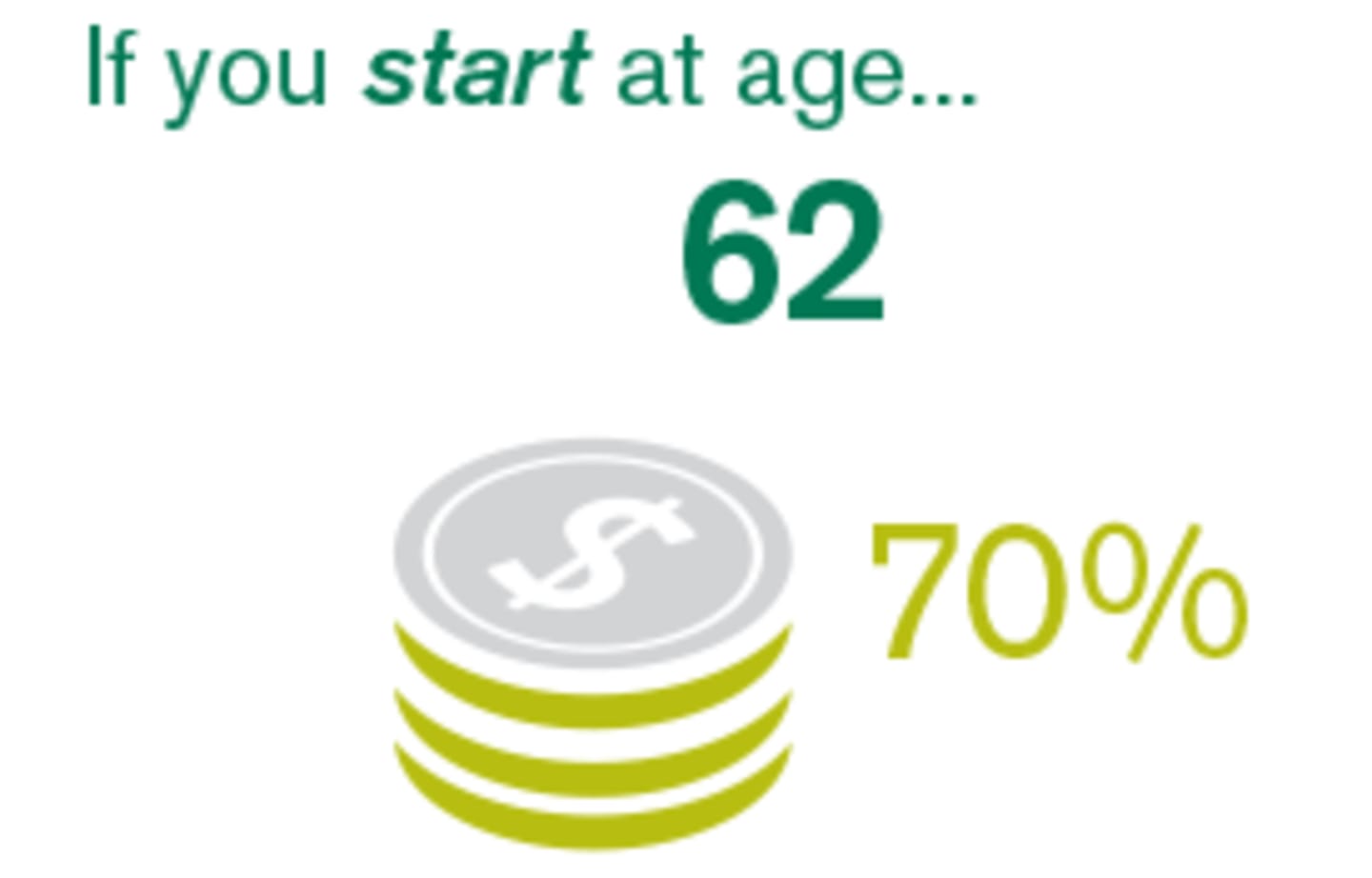

Full retirement age is 67 for those who were born in 1960 and after. For those born earlier, FRA is between 66 and 67 (see the chart). As always, taking your benefits before or after your FRA can affect how much you receive.

As of October 2020. Assumes Full Retirement Age is 67. Increased benefits for delaying Social Security max out at age 70. Source: www.ssa.gov

5. Cloudy: Will Social Security Last?

Social Security benefits are administered from two federal trust funds. Projections show that revenue from the current trust fund could be depleted by the year 2035. This could result in Social Security being able to pay less than 80% of benefits from ongoing payroll taxes. Of course, that can change if Congress acts—and they typically do. They have various options, which include raising taxes or continuing to gradually increase the FRA, among others.

Make Social Security Part of Your Plan

Whether you're taking Social Security now or will in the future, it's important to know how it fits in your plan for after you stop working.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.