3 Tips to Help Temper Taxes

Consider three key financial planning strategies investors may use to manage taxes on investment gains and dividends in an effort to improve overall outcome and allows investors to keep more of the returns post taxes.

Key Takeaways

Focusing on tax-friendly investments—and implementing strategies and tactics designed to reduce the portfolio’s tax liability—helps keep tax efficiency at the forefront all year long.

Managing capital gains and dividend distributions, from holding periods to ex-dividend dates, can potentially help enhance a portfolio’s tax efficiency.

In some cases, you may be able to turn investment losses into potential strategic wins for your clients. Using losses to offset gains may result in a lower tax bill.

As most investors know, investment returns alone don’t mean much. Rather, we believe it’s after-tax investment returns that matter. Investing with an eye on taxes should be a yearlong effort. Waiting until tax season may mean missed opportunities to take advantage of important strategies throughout the year. Adhering to three ongoing efforts—strategically implement an asset allocation, manage the portfolio income tax efficiently and harvest tax losses—may improve the overall tax efficiency in your clients’ portfolios.

1. Invest Your Portfolio Strategically

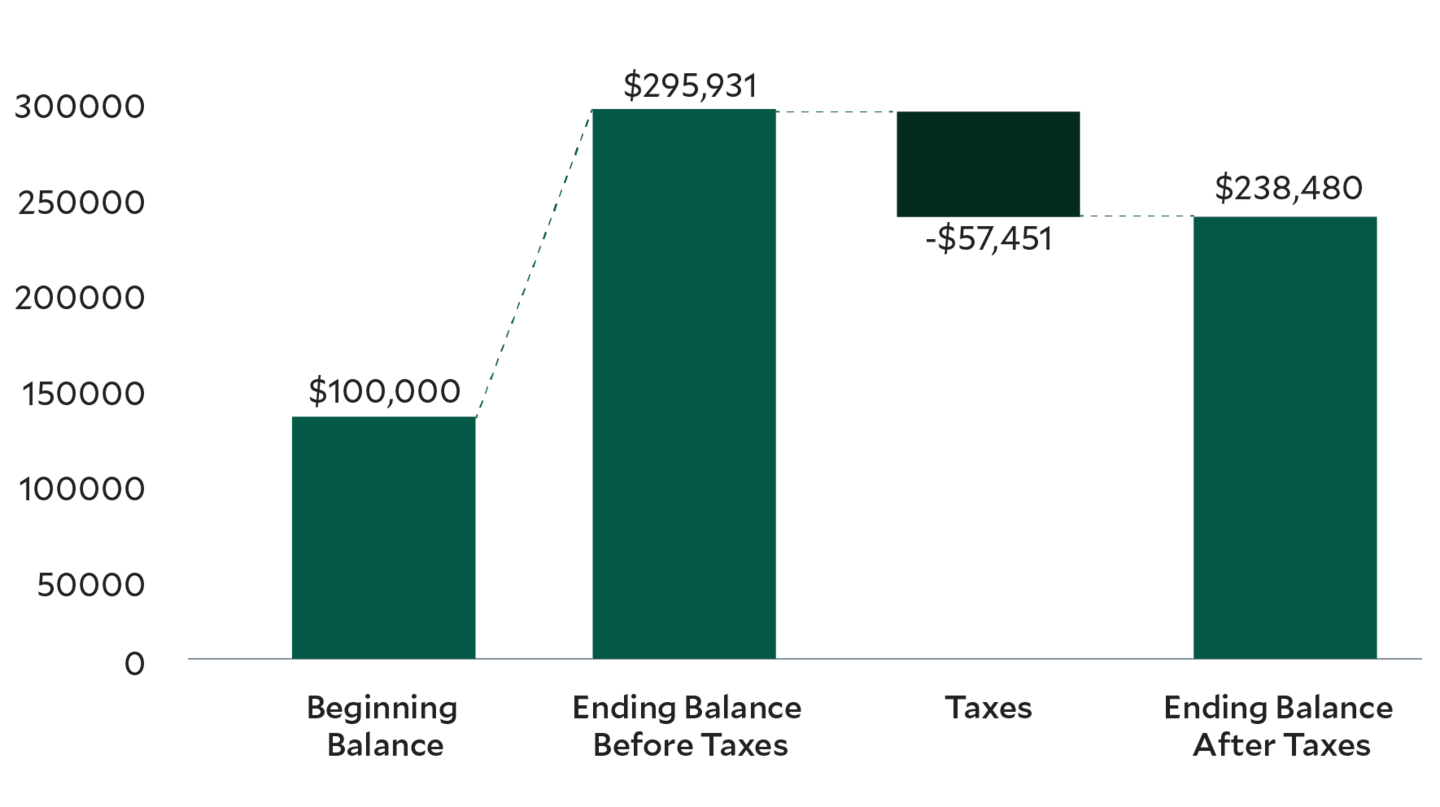

Over time, the effect of capital gains distributions can add up, cutting into your clients’ long-term profits. Consider these figures for a hypothetical $100,000 investment in the average U.S. large-cap stock mutual fund, according to Morningstar. For the period 2014 through 2024:

Assuming an average annual return of over 11%, the portfolio’s pretax value at the end of the 10-year period was nearly $295,931.1

The average annual tax cost for the period was 1.90%, or $5,622—with almost double the average expense ratio of 0.91%.2

The total tax bill for the 10-year holding period was approximately $57,451, cutting the after-tax portfolio value to $238,480.1

Limiting the effect of taxes on a portfolio’s long-term performance requires ongoing attention to the portfolio’s holdings. It is important to start by implementing an appropriate asset allocation for the portfolio. Perhaps most importantly, consider tax-efficient investments, such as ETFs. Compared with actively managed mutual funds, many ETFs experience lower turnover—and therefore, fewer taxable events. In addition, the ETF structure is generally more tax friendly than most mutual funds. When mutual fund investors redeem shares, the fund may have to sell securities to meet the redemptions. And those sales may trigger capital gains for the fund and all its shareholders. But when ETF investors sell shares, they sell those shares to other investors, resulting in no taxable gains for the ETF.

Figure 1 | The Effect of Capital Gains Distributions

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There are no assurances similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

In addition to using tax-efficient investments to create a solid foundation in the portfolio, other tactics to consider also may help limit the annual tax bill:

Consider the asset location which strategically locates assets between different accounts (ie, taxable, tax-deferred, and tax-free accounts). For example, actively managed funds generating large capital gains and fixed income funds ought to be in tax-deferred accounts, whereas, ETFs, and passively managed funds can be placed in taxable accounts.

Pursue a buy-and-hold strategy to reduce turnover within the portfolio.

Limit exposure to investments that pay taxable distributions several times a year.

Minimize long-term gains when rebalancing the portfolio, or liquidating holdings for cash flow purposes.

Avoid taking short-term capital gains, which are typically taxed at a higher rate.

Invest regularly, rather than trying to time the market.

2. Manage Capital Gains and Dividends

Monitoring distribution timelines and investment holding periods and determining if or when to buy or sell specific assets are important components of a comprehensive investment strategy. These planning efforts can make a big difference in the portfolio’s yearly tax bill.

Regarding capital gains, the holding period is crucial. How long your client owns an investment before selling it at a profit will determine the potential tax liability. Selling an investment owned for less than one year or less triggers a short-term capital gain, while exiting an asset owned for more than a year causes a long-term capital gain.

In general, long-term capital gains receive more favorable tax treatment than short-term gains, which are taxed as ordinary income at marginal rates as high as 37%. In addition, the net investment income tax (NIIT), or the Medicare Surtax of 3.8% applies to portfolio income including capital gains. The maximum tax rate for long-term capital gains is 20% (see Figure 2).

Figure 2 | Long-Term Gains Get Favorable Tax Treatment

Source: IRS as of March 1, 2025

Similarly, dividends receive different tax treatment depending on their classification. Qualified dividends, in general, are taxed at the same rates as long-term capital gains. Nonqualified dividends are treated as ordinary income for tax purpose to be a “qualified,” dividend:

Must be paid by a U.S. corporation or qualified foreign entity.

Cannot consist of premiums or insurance kickbacks, annual distributions from a credit union or dividends from co-ops or tax-exempt organizations.

Must meet holding period requirements.

There are other important dates and timelines to consider regarding capital gains and dividend distributions (see Figure 3). This concept is commonly known as “buying the dividend or the distribution", and involves the potential tax liability associated with this income. In most cases, given a two-day settlement period:

If you buy a security before the ex-dividend date, you will receive the dividend (or capital gains distribution).

If you buy a security on the ex-dividend date, you will not receive the dividend (or capital gains distribution).

If you sell a security prior to the ex-dividend date, you will not receive the dividend (or capital gains distribution).

If you sell a security on the ex-dividend date, you will receive the dividend (or capital gains distribution).

Figure 3 | Know Your Distribution Timeline

Example

3. Harvest Tax Losses

While losses are never the goal, losing money in an investment can sometimes have an upside. With a tax-loss harvesting strategy, investment losses in one or more investments can help offset gains in others,* which may result in a lower overall tax liability. Investors can use their realized losses to offset capital gains or ordinary income, up to $3,000 in a single year for joint filers ($1,500 for single filers), according to the IRS. Investors may be able to carry forward any additional losses indefinitely. The IRS provides guidance on the amount you can carry forward, or consult with a professional tax consultant. Let’s take a look at Figure 4 (on the following page) for a hypothetical example of how tax-loss harvesting can work: When using the tax-loss harvesting strategy, it’s important to keep a few things in mind:

Figure 4 | Hypothetical example: Rebecca and Joe bought two mutual funds years ago for $25,000 each.

Tax-Loss Harvesting

The $10,000 loss from Investment A could offset the $5,000 gain from Investment B, eliminating the taxable gain and reducing the loss to a $5,000 loss.

That means Rebecca and Joe would owe no taxes on the gain and could use the remaining $5,000 loss to offset $3,000 of their ordinary income in the current tax year.

The remaining $2,000 loss can be carried forward to offset capital gains or ordinary income in future tax years.

Potential additional tax savings:

Assuming Rebecca and Joe are in the highest tax bracket of 37%, the potential tax savings on the $5,000 from Investment B that would have been taxed at the current capital gains rate of 23.8% results in $1,190 in tax savings.

In addition, the current tax code allows joint, single and head-of-household filers to apply up to $3,000 a year in remaining capital losses after offsetting gains to reduce ordinary income (including income from dividends or interest).

As a result, Rebecca and Joe (in the 37% marginal tax bracket) can deduct the $3,000 loss from their current-year income and save an additional $1,110 in income taxes.

Be mindful of the IRS’ wash-sale rule. This rule prohibits the purchase of the same or “substantially identical” security within 30 days (before and after) of selling that security at a loss for a total of 60 days.* You also may not sell a security at a loss in a taxable account and purchase that same security for a tax-deferred account within 30 days of the sale. However, you may purchase a similar investment to maintain exposure to that industry or sector.

Know your alternatives. Consider the relative advantages and disadvantages of using ETFs, active mutual funds or indexed mutual funds to replace a security sold at a loss.

Don’t let taxes alone drive the sell decision. Before harvesting tax losses, make sure the sale makes sense for the overall investment strategy and client goals.

The strategy works for taxable accounts only. There’s no benefit to harvesting losses in a tax-deferred account.

Engage with the experts. Consider working with a professional CPA or tax attorney who is most familiar with the complexity of tax rules and regulations

Target Tax Efficiency All Year Long Taxes shouldn’t drive your clients’ investment decisions, but tax consequences should be an ongoing consideration. For example, remain mindful of the potential liability associated with the investments in your clients’ portfolios. Also, think strategically about purchases and sales, ensuring all transactions make sense from a tax perspective. And make tax planning an ongoing effort, so tax season doesn’t result in any tax-bill surprises.

Authors

Head of ETF Product and Strategy

3 Tips to Help Temper Taxes

Long and short term capital gains are taxed at different rates. Long-term capital losses offset long-term capital gains. Likewise, short-term capital losses offset short term capital gains. The net losses from one category offset the net gains from the other category. Additional losses can offset up to $3,000 of ordinary income with the remainder losses carried over to future years to offset future capital gains and ordinary income.

American Century Investments calculations are for illustrative purposes only and are not indicative of the performance of any fund or investment portfolio. The calculations do not include commissions, sales charges or fees.

Source: Morningstar, as of December 31, 2024. The tax rate applies to the oldest share class of all active U.S. large-cap equity open-end mutual funds available in the U.S.

All capital gains tax rates noted reflect IRS rates as of May 31, 2025.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.