What Causes Volatility in the Stock Market?

Stock market volatility is a natural part of investing. Understanding its causes can help you navigate uncertainty and stay focused on the long term.

Key Takeaways

Stock market volatility is a normal part of investing and can cause uncertainty for investors.

Understanding the factors behind market swings can help you stay focused on your long-term financial goals.

Rather than reacting emotionally, take measured steps to prepare for market volatility.

The stock market moves up and down all the time, and you may see a lot of movement during the day. Like supply and demand for a product, if there are more buyers than sellers, prices will generally move higher; if there are more sellers than buyers, prices will generally move lower.

The S&P 500 is often used to represent stock market performance, and it’s considered a bellwether (or leading indicator) for the direction of the U.S. economy. Price swings in the S&P have tended to accurately reflect turbulent periods in the U.S. economy.¹

A turbulent—or volatile—market can be concerning as an investor, especially if your investments lose value. You may wonder what to do. Should you cash out of retirement plans or other accounts? Move your money to something more conservative? Do nothing?

Here's what to know about a stock market volatility, the causes and the potential ways to combat it.

What Are the Main Causes of Stock Market Volatility?

Different events and factors can cause the markets to move up and down. Unexpected global events, economic uncertainty and changes in investor sentiment can all cause market fluctuations. Larger drops occur occasionally, but historically, markets have bounced back from declines.

Understanding the potential causes of stock market volatility can help you make decisions about risk in your investment plan. It may also help you stick with it through the ups and downs. Here are some causes beyond the "normal" ebbs and flows of the market.

Global Events and Market Uncertainty

Wars, terrorism and tensions between countries can significantly affect global economies and businesses. They also bring uncertainty. And where there's uncertainty, there is usually stock market volatility.

Global events can spur volatility because their effects are more widespread, and the uncertainty is more significant. Examples include an economic crisis in a leading world financial center with the potential to ripple into other countries. Or, as we saw in 2020, a pandemic that impacts health and disrupts economic activity.

Geopolitical and Election Risks

Politics can cause uncertainty and spur market volatility, especially before an election. As the rhetoric heats up, it can add to increased nervousness. In the U.S., that can be true in both presidential and midterm election years. However, stock market volatility has historically tended to smooth out following elections—regardless of which party is in power.

A significant leadership change in any country can cause uncertainty, as government policy can significantly shape the business environment. Major policy changes can impact a business's financial standing, creating both winners and losers. The larger the country’s economy, the greater the potential ripple effect around the world.

Natural Disasters

Earthquakes, hurricanes and wildfires are examples of natural disasters that can impact global markets. How widespread the event is and how quickly governments and companies can respond to a catastrophe (or not) affects how investors view these events. The high cost of recovery can contribute to negative investor sentiment impacting financial markets.

The financial impact of natural disasters to governments, companies and individuals has grown significantly. In 2024, more than 25 weather and climate disasters in the U.S. caused losses exceeding $1 billion each.²

Economic Developments

Investors can become jittery as government agencies release reports about the economy's health. Job numbers, gross domestic product (GDP), consumer prices and manufacturing activity can indicate if an economy is growing. The stock market often reacts when economic indicators are higher or lower than expected.

For example, markets may react if GDP numbers decline. GDP measures the goods and services a country produces, and it is considered a comprehensive measure of economic growth. GDP affects the market because stock prices typically reflect expectations about the future.

Inflation and rising prices on goods and services can affect market activity, too, especially when it involves a resource that impacts all economic segments—like oil. Investor sentiment about the economy and the stock market can rise and fall with changing fuel costs.

Central Bank Policies

When a country's central bank, like the U.S. Federal Reserve, announces a monetary policy change, it can prompt volatility. We may also experience volatility when investors react to economic data they believe will cause a change in central bank policy.

Stock market volatility may depend on the purpose of the monetary change—to expand the economy or to restrict it. Expansionary measures, such as lowering interest rates, tend to positively impact the stock market, while tightening has had the opposite effect.

Bad Headlines for Large Companies

Corporate scandals can undermine the financial standing of the affected company, leading to substantial declines in its stock price. Negative headlines may even cause investors to lose confidence in an entire industry or the broader stock market.

Additionally, scandals can lead to new regulations that could impact companies within and outside the industry. While scandals are bad news, they may not have as much impact on the overall stock market in the long run.

The Enron bankruptcy in 2001 is still considered one of the most far-reaching scandals in U.S. history, sparking new regulations and long-lasting consequences in the financial world.³ The company’s collapse, which resulted in dozens of felony convictions, sweeping government reforms and the downfall of a major accounting firm, has become a symbol of corporate fraud. It also contributed to investors losing trust in the stock market.

How Do You Prepare for Volatile Markets?

During volatile times, many investors feel tempted to take action, such as selling declining investments. A better response may be to review your strategy and make decisions based on your plan rather than market whims. Such times are true tests of your risk tolerance and may be an indicator that your investment strategy is not aligned with your willingness to accept risk.

Remember That Investing Is a Long-Term Strategy

Because volatility is normal, you should build a long-term investing plan that accounts for market fluctuations over time. Review your plan and make sure it matches your risk appetite.

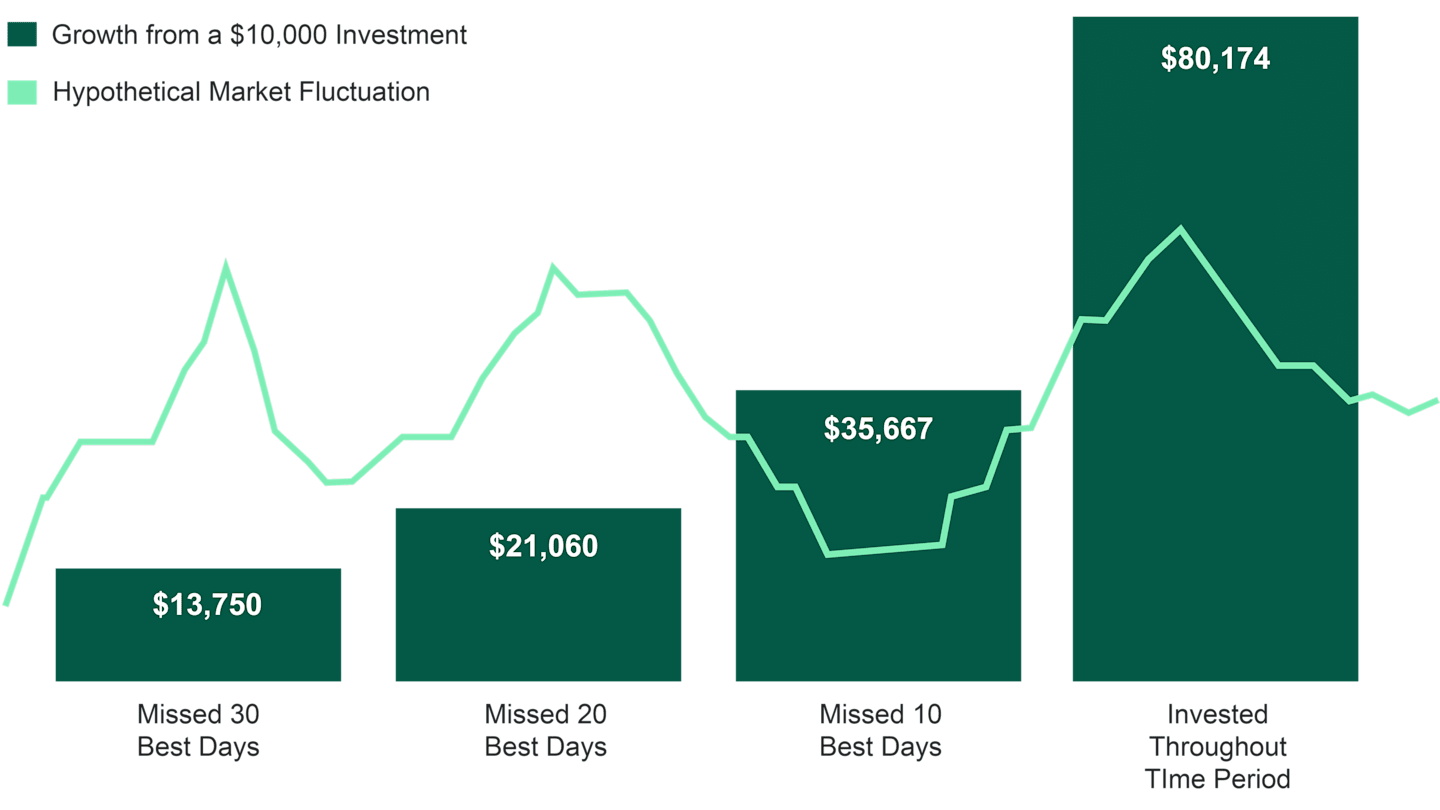

Are you comfortable with big swings in your portfolio value? How big? Ask yourself if you're prepared to handle the stress of higher volatility—and whether you’ll be tempted to sell during market downturns. Here’s how missing just a few of the market's best days over a 20-year period could affect the potential gains.

Jumping In and Out May Cost You

Source: FactSet. Growth of $10,000 in the S&P 500 Index, 20-year data as of September 30, 2025.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

Indices are not investment products available for purchase. Past performance is no guarantee of future results.

Stay in the Mix

Keep a diversified portfolio of stocks, bonds and cash equivalents (like money markets), which may help reduce the overall risk in your portfolio. Look for investments that don't react the same way to market events to help smooth out performance. When one investment type isn't doing well, another may be in favor.

You can also invest beyond general asset types for increased diversification. Each of these can be split further into more specialized categories that take advantage of different sections and behaviors of the markets.

Adjust Your Portfolio to Prepare for Volatility

All investments have ups and downs. If you are nearing retirement or saving for college, it's wise to be more careful and take extra measures. If your goals are decades away, you likely can withstand more volatility and hopefully take advantage of market rebounds.

Regardless of your investing timeline, a surprisingly simple way to manage volatility is with a diversified portfolio. A healthy mix of different kinds of investments may help smooth out volatility in your portfolio.

View Market Volatility as an Opportunity

After you’ve aligned your portfolio with your tolerance for market swings, try changing your focus from fears about volatility to the inherent opportunities it can offer. You can add to your portfolio at deep discounts when stock prices are down, one of the potential benefits of a strategy known as dollar-cost averaging.

Note that dollar-cost averaging does not assure a profit or protect against loss in declining markets. To fully take advantage of the strategy, be prepared to continue investing at regular intervals during all market conditions.

Dollar-Cost Averaging During Volatility

Market uncertainty can be worrisome, but a dollar-cost averaging strategy can help you keep investing—and potentially lower your average investment cost.

Staying Calm During Market Volatility

Market volatility is a part of investing. While it can feel unsettling at times, understanding its causes and patterns can help you stay grounded.

Rather than reacting emotionally to short-term ups and downs, focusing on your long-term financial goals and sticking to a well-considered investment plan are effective strategies for weathering market turbulence. Remember, history has shown that markets tend to recover from downturns over time.

Authors

Financial Consultant

Looking for a Balanced Portfolio to Help With Volatility?

We offer diversified solutions to help you weather market fluctuations.

S&P 500 Index: Evolution, Significance, and Economic Impact? Investopedia, November 20, 2025.

U.S. Billion-Dollar Weather and Climate Disasters, NOAA National Centers for Environmental Information, November 2025.

Enron Scandal, United States History, Britannica, November 24, 2025.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.