Why Should Muni Investors Consider Active Strategies?

We believe municipal bond market dynamics favor active managers who have the flexibility to explore all opportunities.

Key Takeaways

The municipal bond (muni) market is a large, diverse market that we believe is well-suited for active investment management strategies.

We believe combining top-down economic analysis with bottom-up research identifies the most attractive sectors, issuers, securities and risk exposure.

Along with generating tax-exempt income for investors, munis may enhance return potential and help temper risk in diversified portfolios.

Municipal bonds are tax-advantaged securities that state and local governments issue to fund roads, bridges and other public projects. For investors, they generate income exempt from federal taxes and, in some cases, state and local taxes.1 The muni market is vast and diverse, which is why we believe active management can capture the broad opportunities available in the marketplace.

Unlocking Value with an Active Approach to Muni Investing

We view the muni asset class as a dynamic market of individual and distinct bonds rather than a collection of homogenous securities. We believe investing in this varied market requires an active strategy powered by fundamental credit research. Through our research, we seek to expand the investment opportunities available to investors and enhance performance potential.

Our active approach gives investors access to municipal bonds across a broad range of sectors, issuers and quality buckets. Conversely, most passive strategies rigidly track a market index, limiting investors’ exposure to a small set of sectors and the largest muni issuers.

Our approach also gives us the flexibility to adjust portfolios ahead of shifting economic influences, tax policies and sector- and issuer-specific factors. Index-constrained funds don’t have this freedom.

Building Muni Portfolios Designed to Capture Diversified Sources of Return

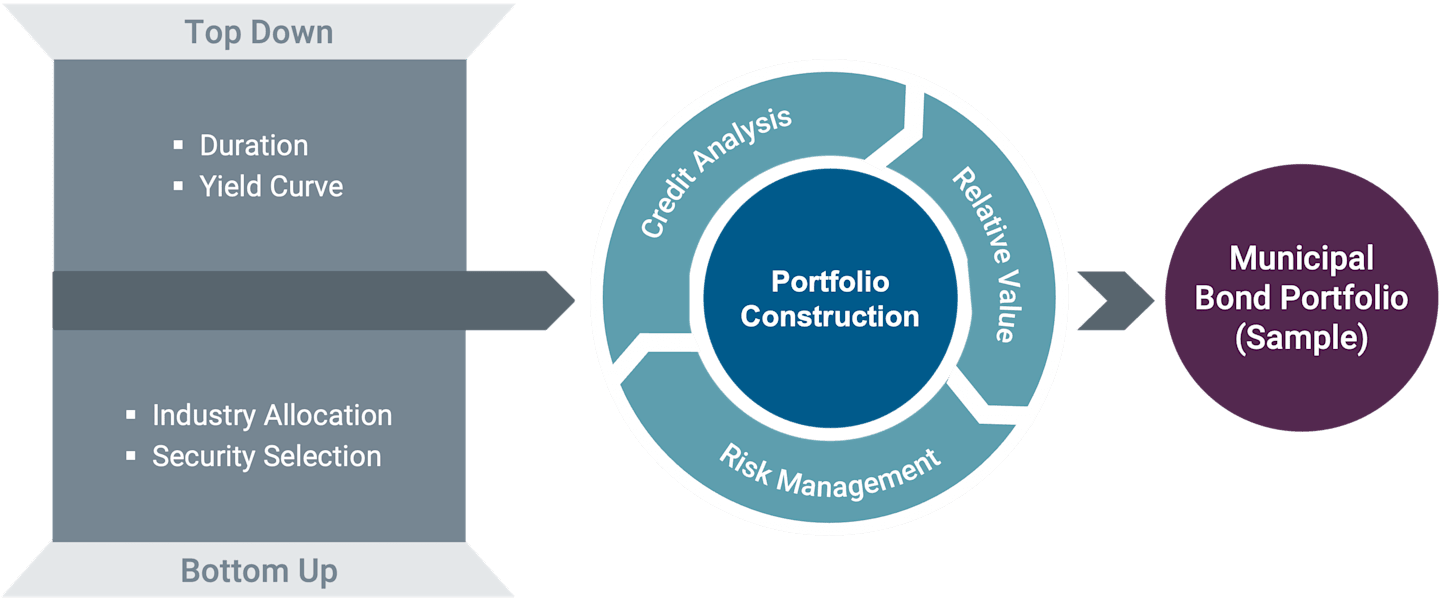

We build our portfolios by combining a top-down overview with bottom-up analysis, as Figure 1 outlines. From a top-down perspective, we examine broad market influences such as fiscal, monetary and tax policy. This informs our views on duration, yield curve positioning and allocations to high-yield municipal bond sectors.

We seek to generate most of our performance from the bottom-up portion of the process, which includes sector and security selections. We begin with proprietary credit research to identify sector outlooks and trends that drive our sector allocation decisions. Our analysis of issuers and the specific characteristics of their bonds (coupons, call features, etc.) helps us highlight promising individual securities within these sectors.

Fundamental research and assessments of valuation and risk drive our buy-and-sell decisions. Accordingly, we continuously conduct:

Credit analysis, which includes using proprietary rating criteria to assign internal ratings to all credits, surveilling credit events and holding regular credit committee meetings.

Relative value assessments that focus on munis we believe offer the best combination of risk premium, structure and total return potential.

Risk management and monitoring, which ensures portfolio risks align with our investment teams’ convictions.

Figure 1 | An Active, Multifaceted Investment Process

For illustrative purposes only.

Proprietary Credit Analysis Reveals Opportunities

We believe fundamental credit analysis expands investment opportunities compared with passive portfolios tracking broad market indices. Due to the way they’re constructed, many market indices are underrepresented in sectors such as health care, tobacco settlement, charter schools and land secured.

Meanwhile, our fundamental research enlarges the investment universe to include considerations among:

Higher-yielding securities.

Lower-rated or non-rated municipal bonds.

Market segments that other investment managers may not follow or that passive benchmarks may not hold.

Of course, investing in riskier or underfollowed market segments requires asset class insights and in-depth research and analysis. This combination helps uncover promising opportunities and aids in the ongoing monitoring of each security. Equally as vital, the research process helps eliminate the riskiest securities from consideration.

Lower-rated municipal bonds may exhibit greater volatility and credit risk than investment-grade securities. However, they may also help mitigate other risks, including sensitivity to interest rate changes. The higher level of tax-advantaged income from high-yield munis compounded over time can generate attractive total return potential for long-term investors.

Managing Through Market Cycles

We apply our researched-focused strategy in all market climates. In our view, this consistent approach enables us to respond quickly and opportunistically to changing and challenging market conditions.

From the top-down, this means understanding how the macro environment influences municipal credit, market risk and ultimately total returns.

From the bottom-up, this means selecting durable securities with structures we believe may withstand economic volatility.

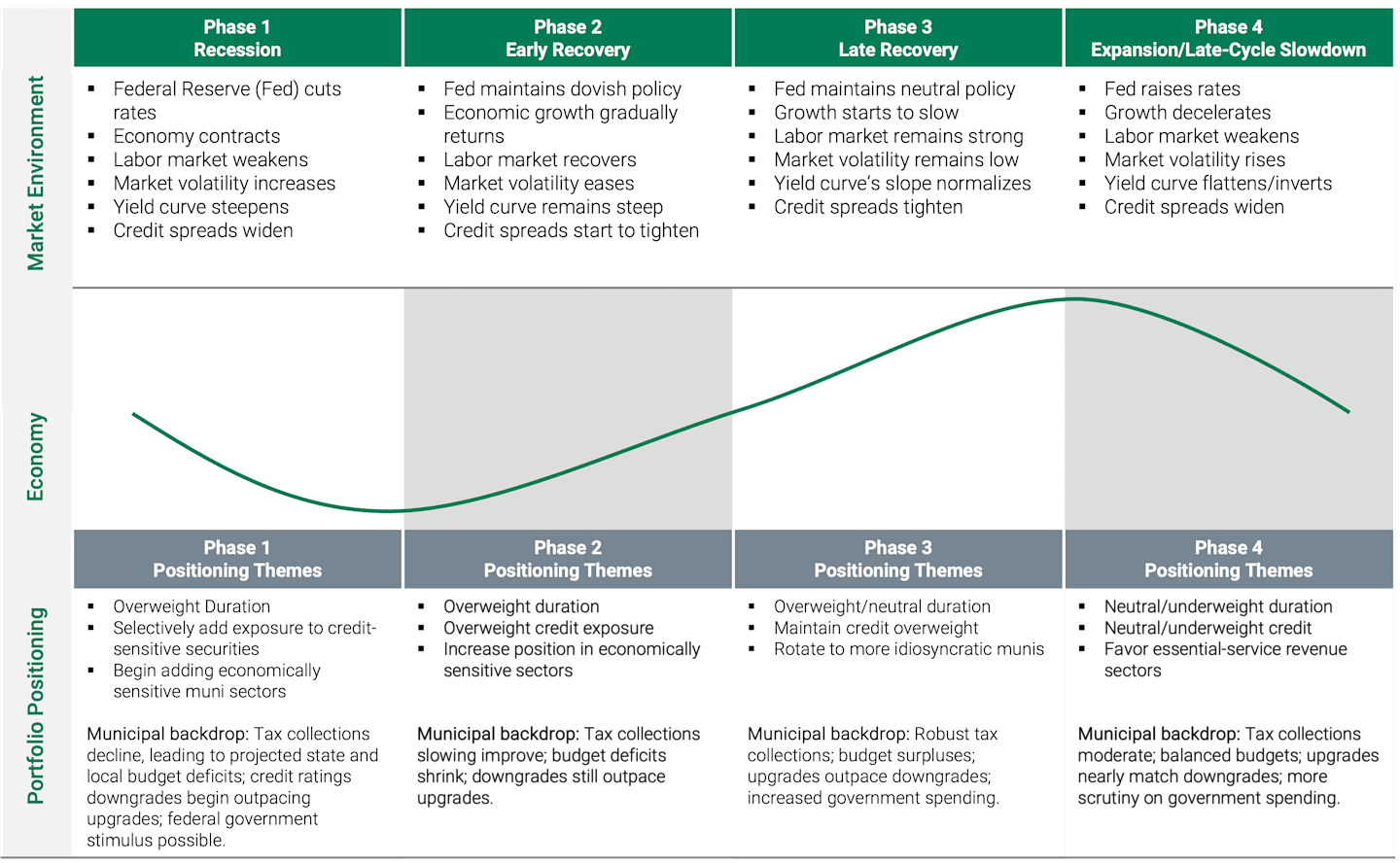

Figure 2 highlights a framework we use to relate phases of economic growth to municipal fundamentals and positioning themes. Though market cycles vary, identifying common characteristics of each stage helps us manage duration, yield curve, sector and credit risk positioning.

Figure 2 | Example of Muni Positioning Throughout an Economic Cycle

Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice. For Illustrative Purposes Only. Green line above represents hypothetical U.S. economic growth. The chart is presented as a guideline only and reflects potential economic, market and investment scenarios. Federal Reserve (Fed) is the U.S. central bank, responsible for monetary policies. Credit spread is the difference between the yield of two different debt instruments with the same maturity but different credit ratings. Spread tightening and widening refers to changes in the relative value of two debt instruments. Credit ratings are issued by a rating agency based on the issuer’s financial strength. A downgrade reflects the rating agency’s view that the issuer’s ability to repay a bond’s principal and interest has declined.

Potential Benefits for Investors of Different Income Levels

Municipal bonds generate income free from federal taxes – and sometimes state and local taxes. While investors in the highest income tax brackets typically benefit most from munis, the tax advantages aren’t limited to the wealthiest investors.

You can see the advantages by comparing tax-exempt yields with their taxable counterparts. A taxable-equivalent yield is the yield a taxable bond would have to pay to equal the tax-advantaged yield of a municipal bond. Figure 3 shows the taxable equivalents for hypothetical tax-exempt securities with different yields.

You can use American Century Investments’ calculator to determine the taxable-equivalent yield for bond investments based on your state and federal tax situation.

Figure 3 | Taxable-Equivalent Yields Highlight Tax-Bracket Advantages

These hypothetical examples do not consider state and local taxes. They are for illustrative purposes only and are not intended as investment, accounting, legal or tax advice. Actual results will vary. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Municipal Bonds: Potential Tax and Diversification Benefits

In addition to their potential tax benefits, we believe munis can enhance diversification in well-rounded portfolios. Municipal bonds tend to react to market and economic influences differently than stocks and taxable bonds. Because of this, munis may help enhance performance potential while managing risk in an investor’s broadly diversified portfolio.

Of course, diversification doesn’t assure a profit or protect against loss of principal. However, we believe diversification may help investors weather the market’s ups and downs.

Authors

Senior Portfolio Manager

Explore Our Municipal Bond Capabilities

Investment income may be subject to certain state and local taxes and, depending on your tax status, the federal alternative minimum tax (AMT). Capital gains are not exempt from state and federal income tax.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

The letter ratings indicate the credit worthiness of the underlying bonds in the portfolio and generally range from AAA (highest) to D (lowest).

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.