The Value of Using a Block Desk for ETF Trades

Discover the benefits of using an institutional block desk when you have an ETF trade.

Think your trade is not big enough to bother a block desk? Think again. The block desk is one of your best resources to attain best execution on an ETF trade—whatever the size.

"It never hurts to get the block desk’s opinion on an ETF trade. The traders have years of experience in high-pressure situations, insight on the depth of interest in an ETF and strong networks of relationships to share with advisors."

Matt Lewis, Head of ETF Implementation and Capital Markets

Of course on large trades, traders on the desk can source shares in both the secondary and primary market. It can also trade in increments to manage the effect the trade could have on prices or obtain a quote to execute the entire trade.

On smaller orders and lower volume ETFs, the block desk may find that it’s a better trading strategy for the advisor to go through the desk rather than directly into the market.

There’s More to ETF Trading Than Its ADV

The first move advisors usually make with a new trade is to look at the average daily volume (ADV) on a ticker. However, the on-screen or secondary market liquidity is only one source of liquidity for an ETF.

What you see on the screen, including the highest bid and lowest ask, reflects only the trading activity of buyers and sellers that has already occurred on the exchange.

In other words, the ADV shows only what has been traded, not what could have been traded.

The block desk’s order book contains additional shares it’s ready to trade. What’s more, its relationships with market makers let it tap the primary market not accessible to advisors. This is possible through a distinctive feature of ETFs—their multiple layers of liquidity.

The ultimate source of ETF liquidity comes from its open-ended structure. Unlike stocks that have a set number of shares, authorized participants can create new ETF shares and redeem existing shares based on investor demand.

The creation and redemption process ensures there is sufficient inventory to fill investors’ orders. Additionally, it allows large buy or sell trades to be executed in the ETF with little or no impact to the market.

To help better understand the depth of the market, the graphic below highlights ETFs’ three levels of liquidity and the depth of the market.

ETF Liquidity: More Than Meets the Eye

ETF Block Trade Examples

Below are a few examples of actual trade scenarios where the on-screen liquidity didn’t meet the trade requirements, and a block desk accessed the market depth not seen by the average investor.

These trades cover a variety of asset classes. In each case, the trades were executed efficiently, with minimal to no impact on the bid/ask spread.

Learn how to use trading orders to your advantage.

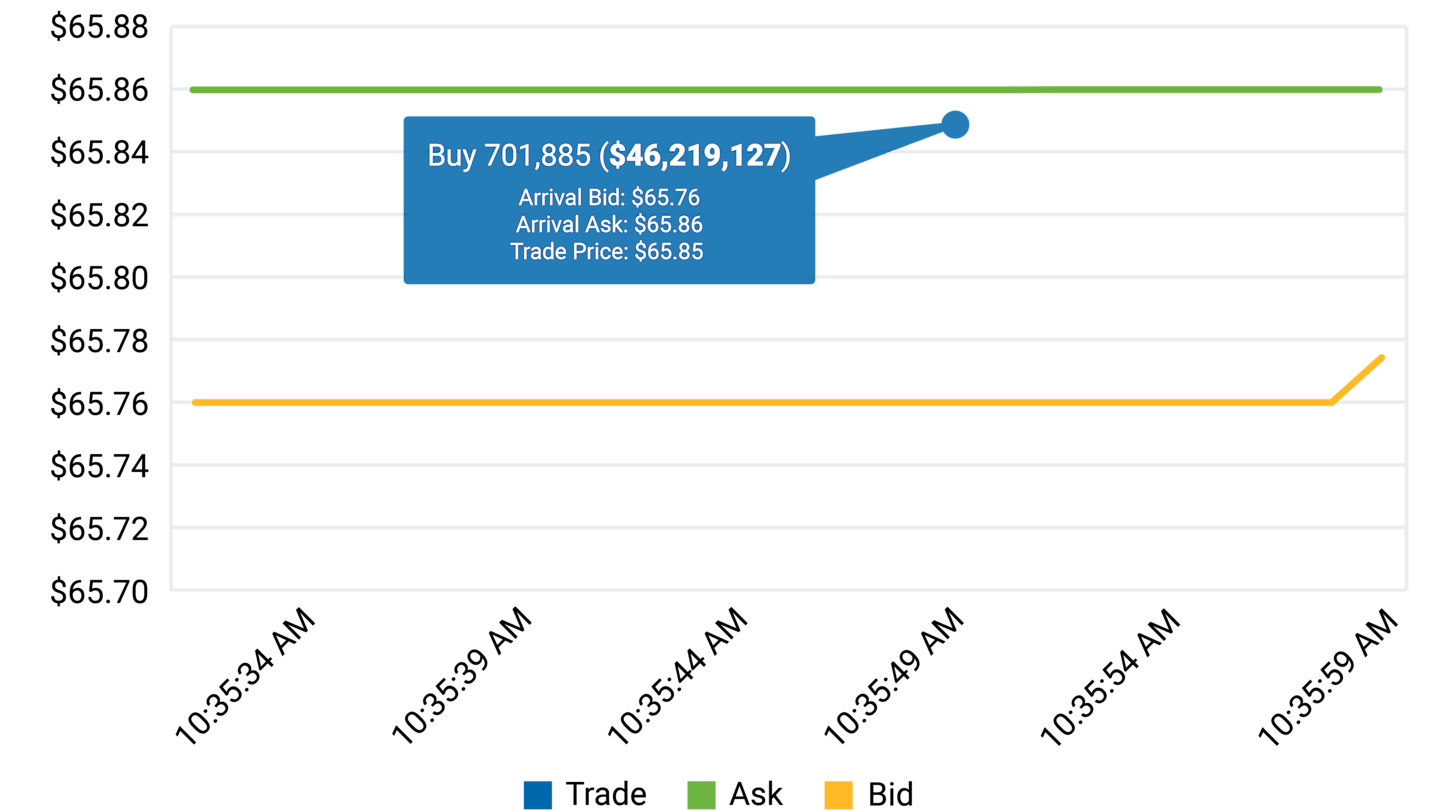

Real-World Example 1: American Century Large Cap Equity ETF (ACLC)

Desired Trade: 701,885 shares at $65.86 per share

On-screen liquidity (Level 1) at the time of the trade: 30-day ADV of 27,818 shares.

Through the block desk, the buyer was able to capitalize on the other layers of ETF liquidity (Levels 2 and 3) that were not visible in the on-screen volume.

The trade was executed at $65.85 per share, just a little below the ask price, for a total value of $46,219,127.

This fund is different from traditional ETFs.

Traditional ETFs tell the public what assets they hold each day. This fund will not. This may create additional risks for your investment. For example:

You may have to pay more money to trade the fund's shares. This fund will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy fund shares on an exchange may not match the value of the fund's portfolio. The same is true when you sell shares. These price differences may be greater for this fund compared to other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The ETF will publish on its website each day a "Proxy Portfolio" designed to help trading in shares of the ETF. While the Proxy Portfolio includes some of the ETF's holdings, it is not the ETF's actual portfolio.

The differences between this fund and other ETFs may also have advantages. By keeping certain information about the fund secret, this fund may face less risk that other traders can predict or copy its investment strategy. This may improve the fund's performance. If other traders are able to copy or predict the fund's investment strategy, however, this may hurt the fund's performance.

For additional information regarding the unique attributes and risks of this ETF, see the additional risk discussion at the end of this material.

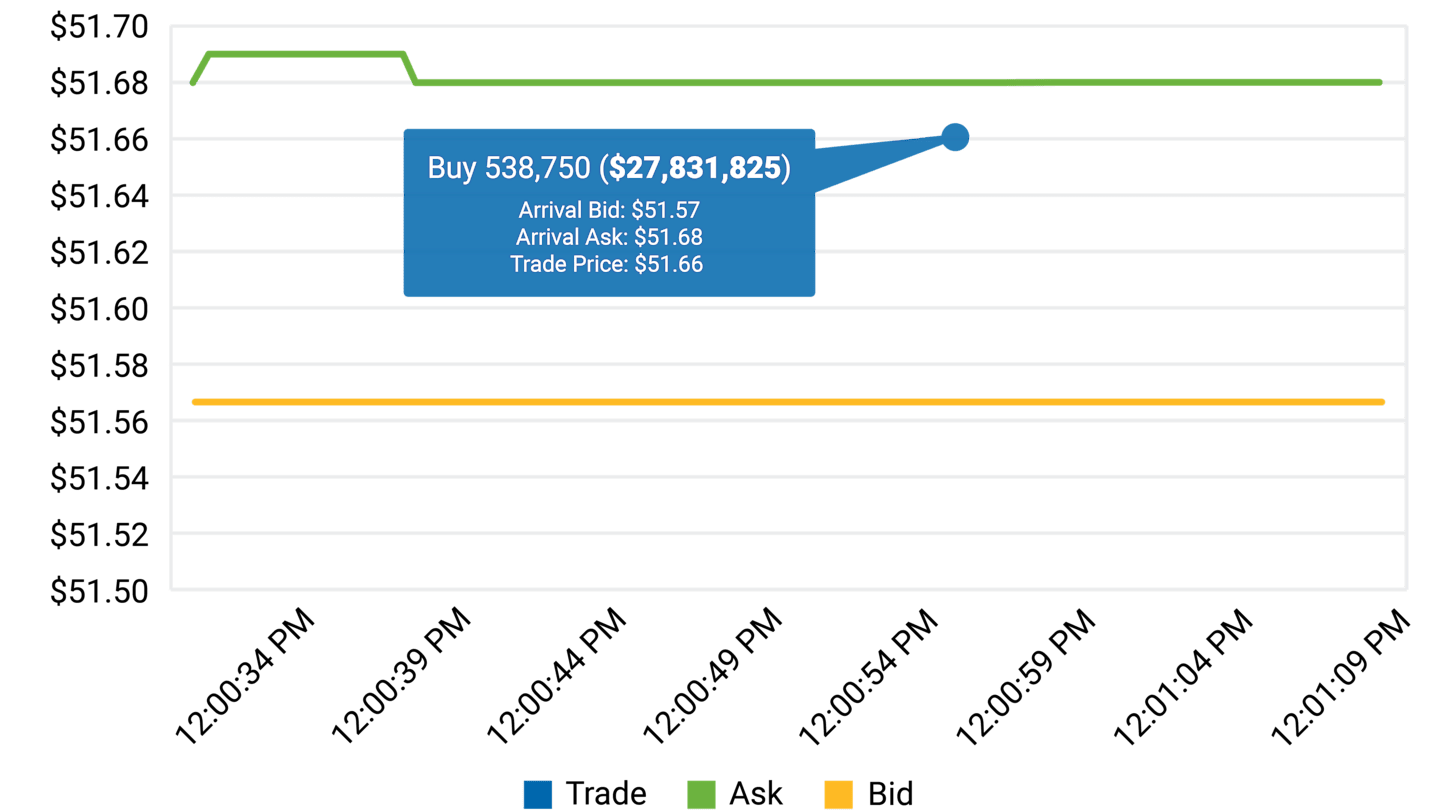

Real-World Example 2: American Century Quality Diversified International ETF (QINT)

Desired Trade: 538,750 shares at $51.68

On-screen liquidity (Level 1) at the time of the trade: 30-day ADV of 92,876 shares.

Through the block desk, the buyer was able to capitalize on the other layers of ETF liquidity (Levels 2 and 3) that were not visible in the on-screen volume.

The trade was executed at $51.66 per share, just a little below the ask price, for a total value of $27,831,825.

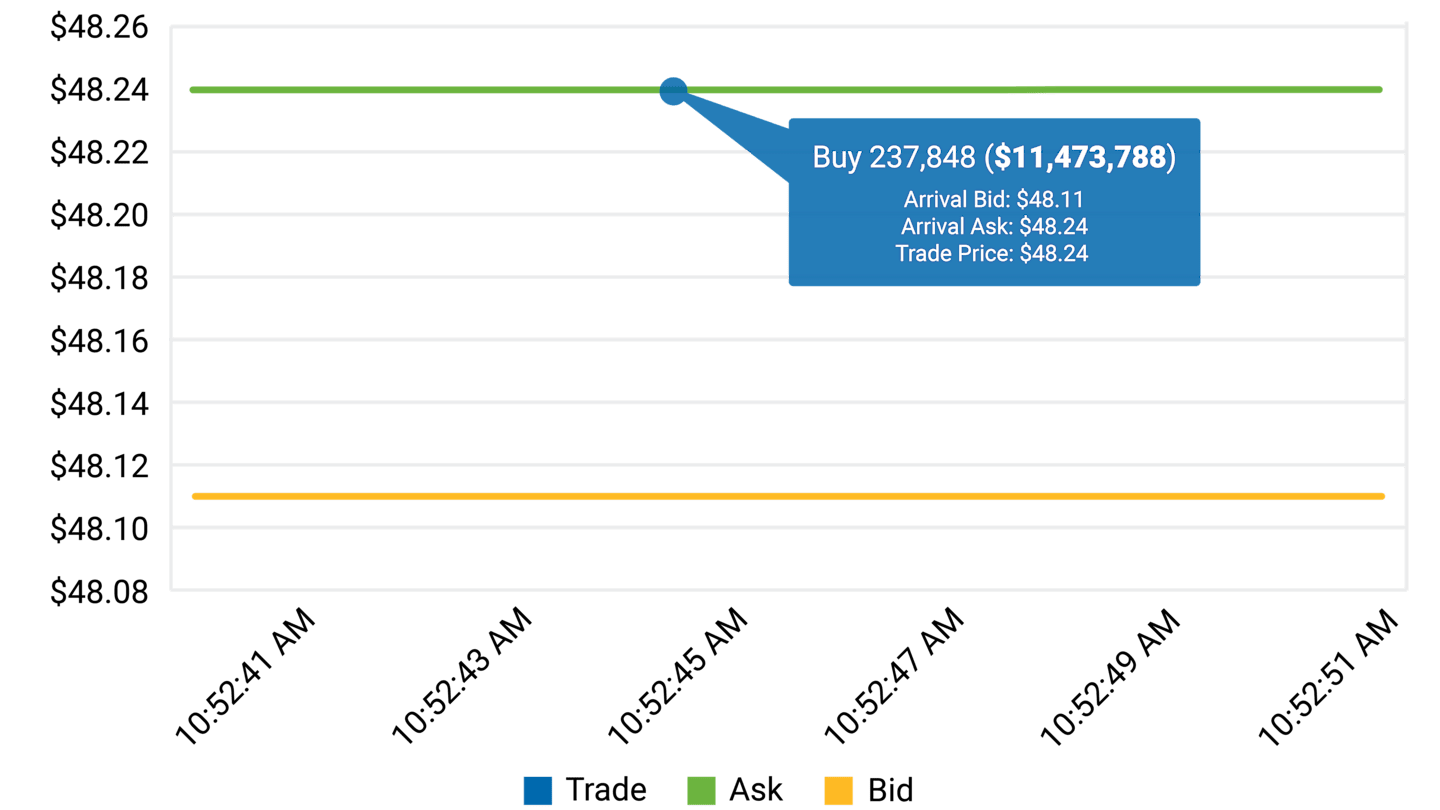

Real-World Example 3: American Century California Municipal Bond ETF (CATF)

Desired Trade: 237,848 shares at $48.24 per share

On-screen liquidity (Level 1) at the time of the trade: 30-day ADV of 849 shares.

Through the block desk, the buyer was able to capitalize on the other layers of ETF liquidity (Levels 2 and 3) that were not visible in the on-screen volume.

The trade was executed at $48.24 per share, the ask price, for a total value of $11,473,788.

Contact Experts to Help You Execute ETF Trades

You are not alone when trading ETFs. From large to small trades to navigating market volatility, take advantage of the ETF community of professionals and the resources and tools they can provide. Their jobs are to support advisors in fulfilling their clients’ needs.

Institutional Block Deck

Advisors who are on institutional platforms have access to institutional block desks for ETF orders. These desks provide trade guidance, execution expertise and advice on trading strategies.

The platform’s website or advisory help center will have contact information for the institutional block trading desk.

Broker/Dealer ETF Trade Desk

Advisors or institutional investors who are not on an institutional platform or do not have access to an institutional block desk should contact their broker/dealer ETF trade desk.

Sales representatives at the broker/dealer should be able to direct advisors to the relevant ETF trade desk.

ETF Issuer's Capital Markets Desk

ETF specialists are available to discuss trade execution and provide overall guidance.

If you have questions around trade execution, please refer to the tools provided above or contact the American Century Investments® Capital Markets Desk through your American Century or Avantis Investors® representative.

Learn more about American Century Investments ETFs.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. The fund's prospectus or summary prospectus, which can be obtained by visiting americancentury.com/etfs, contains this and other information about the fund, and should be read carefully before investing. Investments are subject to market risk.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

ACLC:

The fund is an actively managed ETF that does not seek to replicate the performance of a specified index.

Proxy Portfolio Risk: The goal of the Proxy Portfolio is to track closely the daily performance of the Actual Portfolio. The Proxy Portfolio is designed to reflect the economic exposures and the risk characteristics of the Actual Portfolio on any given trading day.

ETFs trading on the basis of a published Proxy Portfolio may exhibit wider premiums and discounts, bid/ask spreads, and tracking error than other ETFs using the same investment strategies that publish their portfolios on a daily basis, especially during periods of market disruption or volatility. Therefore, shares of the fund may cost investors more to trade than shares of a traditional ETF.

Each day the fund calculates the overlap between the holdings of the prior Business Day's Proxy Portfolio compared to the Actual Portfolio (Proxy Overlap) and the difference, in percentage terms, between the Proxy Portfolio per share NAV and that of the Actual Portfolio (Tracking Error).

Although the fund seeks to benefit from keeping its portfolio information secret, market participants may attempt to use the Proxy Portfolio to identify a fund's trading strategy, which if successful, could result in such market participants engaging in certain predatory trading practices that may have the potential to harm the fund and its shareholders.

Premium/Discount Risk: Although the Proxy Portfolio is intended to provide investors with enough information to allow for an effective arbitrage mechanism that will keep the market price of the fund at or close to the underlying net asset value (NAV) per share of the fund, there is a risk (which may increase during periods of market disruption or volatility) that market prices will vary significantly from the underlying NAV of the fund.

Trading Issues Risk: Trading halts may have a greater impact on this fund compared to other ETFs due to the fund's nontransparent structure.

Authorized Participant Concentration Risk: Only an authorized participant may engage in creation or redemption transactions directly with the fund. The fund may have a limited number of institutions that act as authorized participants. The fact that the fund is offering a novel and unique structure may affect the number of entities willing to act as Authorized Participants. During times of market stress, Authorized Participants may be more likely to step away from this type of ETF than a traditional ETF.

QINT:

This fund is not actively managed and the portfolio managers do not attempt to take defensive positions under any market conditions, including declining markets. The portfolio managers also do not generally add or remove a security from the fund until such security is similarly added or removed from the underlying index. Therefore, the fund may hold an underperforming security or not hold an outperforming security until the underlying index reacts. This may result in underperformance compared to the market generally. In addition, there is no assurance that the underlying index will be determined, composed or calculated accurately. While the index provider provides descriptions of what the underlying index is designed to achieve, the index provider does not guarantee the quality, accuracy or completeness of data in respect of its indices, and does not guarantee that the underlying index will be in line with the described index methodology. Gains, losses or costs to the fund caused by errors in the underlying index may therefore be borne by the fund and its shareholders.

Historically, mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

On September 9, 2022, QINT began to track the American Century® Quality Diversified International Equity IndexB. Historical index data prior to September 9, 2022, is for the Alpha Vee American Century® Diversified International Equity IndexC. Spliced index data on and after September 9, 2022, is for the spliced Quality Diversified International Equity IndexB.

CATF:

This fund is an actively managed ETF that does not seek to replicate the performance of a specified index. To determine whether to buy or sell a security, the portfolio managers consider, among other things, various fund requirements and standards, along with economic conditions, alternative investments, interest rates and various credit metrics. If the portfolio manager considerations are inaccurate or misapplied, the fund's performance may suffer.

Because the fund invests primarily in California municipal securities and securities issued by U.S. territories, its yield and share price will be affected by political and economic developments within the state and territories.

There is no guarantee that all of the fund’s income will be exempt from federal, California state or local income taxes. The portfolio managers are permitted to invest the fund’s assets in debt securities with interest payments that are subject to federal income tax, California state tax, local income tax and/or the federal alternative minimum tax. Capital gains are not exempt from state and federal income tax.

The lower rated securities in which the fund invests are subject to greater credit risk, default risk and liquidity risk.

Exchange Traded Funds (ETFs): Foreside Fund Services, LLC - Distributor, not affiliated with American Century Investment Services, Inc.