Tariff Turbulence: Embracing Long-Term Strategies in Uncertain Times

In a landscape marked by shifting trade policies, volatility can create opportunities for resilient investors.

Key Takeaways

Amid fluctuating tariff and trade policies, we believe that you should prioritize your long-term financial plan rather than react to every news headline.

Market volatility can be uncomfortable, but it offers patient, long-term investors opportunities.

Just as we seek good companies at attractive prices amid volatility, you can sell high and buy low by rebalancing your diversified portfolio.

The most common question we receive from our clients is: What are you doing to address the uncertainty and volatility caused by President Trump’s tariff policies?

We understand your anxiety because we’ve been riding the market rollercoaster with you. We invest in our portfolios right alongside you, and our success is tied to the performance of our portfolios.

This article discusses how we approach tariffs in our portfolios and how similar principles apply to your investments.

What Peak Trade Policy Uncertainty Means for Investors

First, we urge you not to overreact. Instead of making decisions based on a constantly changing policy environment, we prefer to concentrate on areas where we possess more reliable insights and expertise. For us, this means focusing more than ever on our investment process.

For you, that might mean revisiting your financial plan to ensure your portfolio is still suited to your goals and risk tolerance. Or you might be due to rebalance your portfolio to predetermined target weights, which may now be out of whack due to market conditions.

Trade policy is in flux. We’ve seen tariffs change from the morning to the afternoon, and from one day or week to the next. As I write this, we’re partway through the Trump administration’s initial 90-day pause on most of the “liberation day” tariffs. We’ve also just started a new 90-day period of lower (but still elevated) tariffs on China. It’s unclear what will happen at the end of these 90-day pauses.

We don’t know if these policies represent permanent change or something much shorter-term. Policy isn’t an input to our investment process, and we don’t advocate overhauling your portfolio in response to unpredictable policy pronouncements.

How Tariffs Impact Different Industries

In our portfolios, we prefer to let the company management teams sort out tariff implications rather than react to every announcement or tweet. Of course, tariffs won’t affect every industry or company equally. However, these companies are experts in their markets and best positioned to understand and navigate the consequences for their businesses.

Consider electric vehicle manufacturer Tesla, which has made significant efforts in recent years to localize its manufacturing and supply chains. Vehicles sold in the U.S. are produced mainly in U.S. Tesla factories from U.S.-sourced parts. Similarly, the Model 3 and Model Y sold in China are made in China. As a result, the company is less exposed to tariffs than other automakers.

This is a good example of the steps and decisions companies can make in a less globalized world with more trade friction. Ultimately, some companies will better manage their supply chains and take advantage of pricing power.

How Market Volatility Offers Potential Opportunities

Although short-term volatility can be unsettling, it also presents opportunities. This is where diversification and rebalancing become important for your portfolio. As noted earlier, your diversified portfolio may be out of balance due to recent market performance.

For example, you might be overweight in the large technology stocks that drove market returns in 2023 and 2024. Or you could be underweight non-U.S. stocks, which have lagged in recent years.

You can think of rebalancing as selling high on outperforming asset classes while buying low on underperformers. When you rebalance, you’re not only getting your portfolio back in line with your long-term risk tolerance but also increasing your exposure to areas of the market that have suffered the most. This might include good businesses unduly punished along with their weaker counterparts in this environment.

We maintain a long-term investment perspective for the companies in our portfolios, often looking at them over many years. Our evaluation process spans the entire corporate life cycle rather than focusing solely on quarterly performance. Therefore, when there’s significant short-term volatility, we can identify companies trading at appealing prices compared to our long-term estimates of their fair values.

We want our portfolio companies to lean in during times like these. We want them to take advantage of the opportunities uncertainty and flux provide them, rather than always playing defense. Companies with pricing power and a focus on global supply chain management are likely better competitively positioned in this environment.

We continuously seek opportunities to enhance our portfolios by visiting businesses and making calls to identify potential prospects at the company level. We believe that this effort, combined with current market challenges, can create significant shareholder value in the future. This is particularly true if we can identify strong companies that may have been temporarily impacted by overall market weakness.

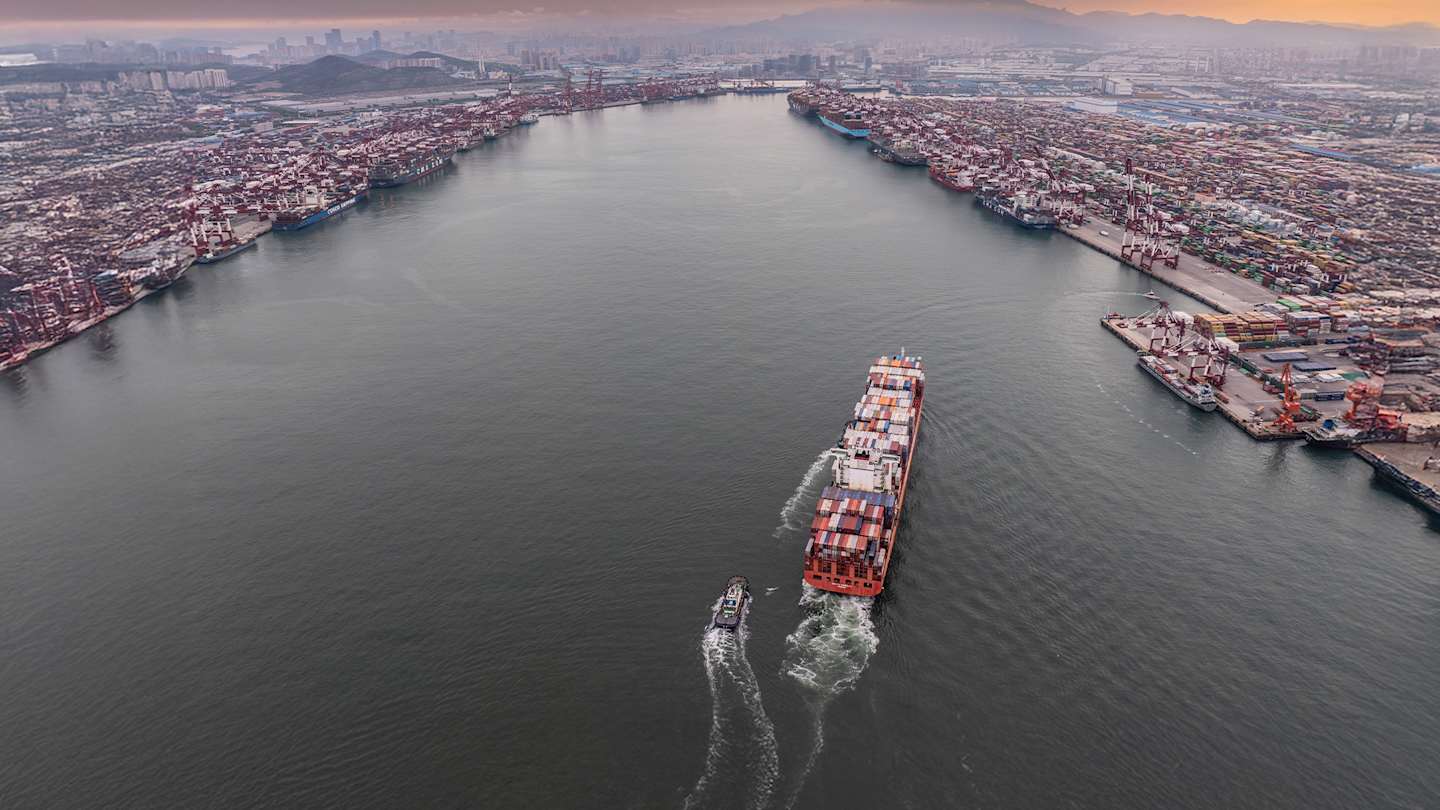

Tariffs and Their Economic Ripple Effects

In the short term, tariffs tax the U.S. consumer because companies will likely pass on the increased cost of goods. For example, Walmart, Best Buy and Procter & Gamble have already said their customers can expect price hikes. Higher prices equate to higher inflation, mainly since trade partners will likely impose reciprocal tariffs in response, leading to even higher inflation.

From a monetary policy perspective, raising interest rates to help manage inflation would be the logical response.

Meanwhile, the Trump administration has urged the Federal Reserve (Fed) to lower interest rates. That’s because tariffs can contribute to slowing down the economy by increasing costs for consumers and businesses. The president is arguing that the Fed should lower interest rates to manage the tariff burden on the U.S. economy and help stimulate the consumption of U.S. goods.

One significant concern about increased reliance on domestically produced products is whether comparable U.S. goods are available at similar post-tariff prices and quality. A larger issue, particularly in the short term, is whether U.S. companies have sufficiently moved their manufacturing back onshore.

Higher input costs from tariffs will negatively impact U.S. companies that rely on overseas manufacturing. In this scenario, tariffs can be counterproductive, especially if no lower-cost domestic alternatives are available. However, tariffs could also have a positive effect by initiating a series of negotiations with trade partners.

Could Tariffs Lead to Positive Trade Negotiations?

The best-case scenario is that Trump's trade tariffs encourage international partners to negotiate, resulting in balanced trade and reduced negative impact on economic growth. Ideally, the administration’s Department of Government Efficiency (DOGE) would reduce government spending and waste, lowering the budget deficit and reducing the need to raise taxes.

Furthermore, reduced government spending would alleviate the crowding-out effect caused by government debt issuance. With less debt, a reduced interest burden, a more balanced trade situation, increased private investment and enhanced productivity, these factors could collectively contribute to higher and more sustainable economic growth in the United States.

This would be the ideal outcome in our view.

Stay the Course Amid Market Volatility

We encourage you to stay calm; likewise, we’ll refrain from overreacting or making drastic changes to our portfolios in this environment.

We will conduct fundamental research to understand how our portfolio companies are navigating current conditions and communicate with management teams to assess their positioning for uncertainty.

When it comes to your portfolio, this thoughtful approach may involve regularly reviewing your financial plan. It's essential to ensure that your portfolio is diversified across various asset classes and that your target allocations align with your risk tolerance and investment time horizon.

Authors

Learn more about the funds Keith manages through turbulent times.

Consider any tax consequences associated with selling investments in a non-retirement account prior to rebalancing. Discuss your situation with a financial or tax professional as needed.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations.

Diversification does not assure a profit nor does it protect against loss of principal.

Rebalancing allows you to keep your asset allocation in line with your goals. It does not guarantee investment returns and does not eliminate risk.