Inflation in the U.S and Europe: Different Paths to Moderating Rates

Key Takeaways

Inflation has moderated in the U.S. and Europe over the past year. Reasons for the retreat are as varied as the drivers of the advance.

Central banks reacted differently to the pandemic and the upswing in inflation data and now have different stances as rates level off.

The persistence of U.S. core inflation may be more difficult for investors than Europe’s potentially transitory energy-driven drivers.

Inflation has moderated in the United States and Europe after spiking to four-decade highs in 2022. A closer look reveals that the composition of the underlying data in the two regions differs greatly. Increased demand has driven higher U.S. core inflation, while higher energy costs and supply chain uncertainty from the Russia-Ukraine war have had a bigger influence on European headline inflation.

Differences in headline inflation rates reflect divergent fiscal and financial responses to the pandemic. They also help explain central banks’ varying approaches to combatting the surge in prices.

How each region got to where it is, and the steps needed to resolve this situation have important implications for global equity investors.

Not All Inflation Is Created Equal

Headline inflation in the U.S. and Europe last year approached the highest level since the hyperinflation of the 1970s. A closer look reveals that while overall inflation was similar, the components of U.S. and European inflation, particularly core inflation (less food and energy costs), were quite different.

U.S. Inflation Is Largely Demand-Pull

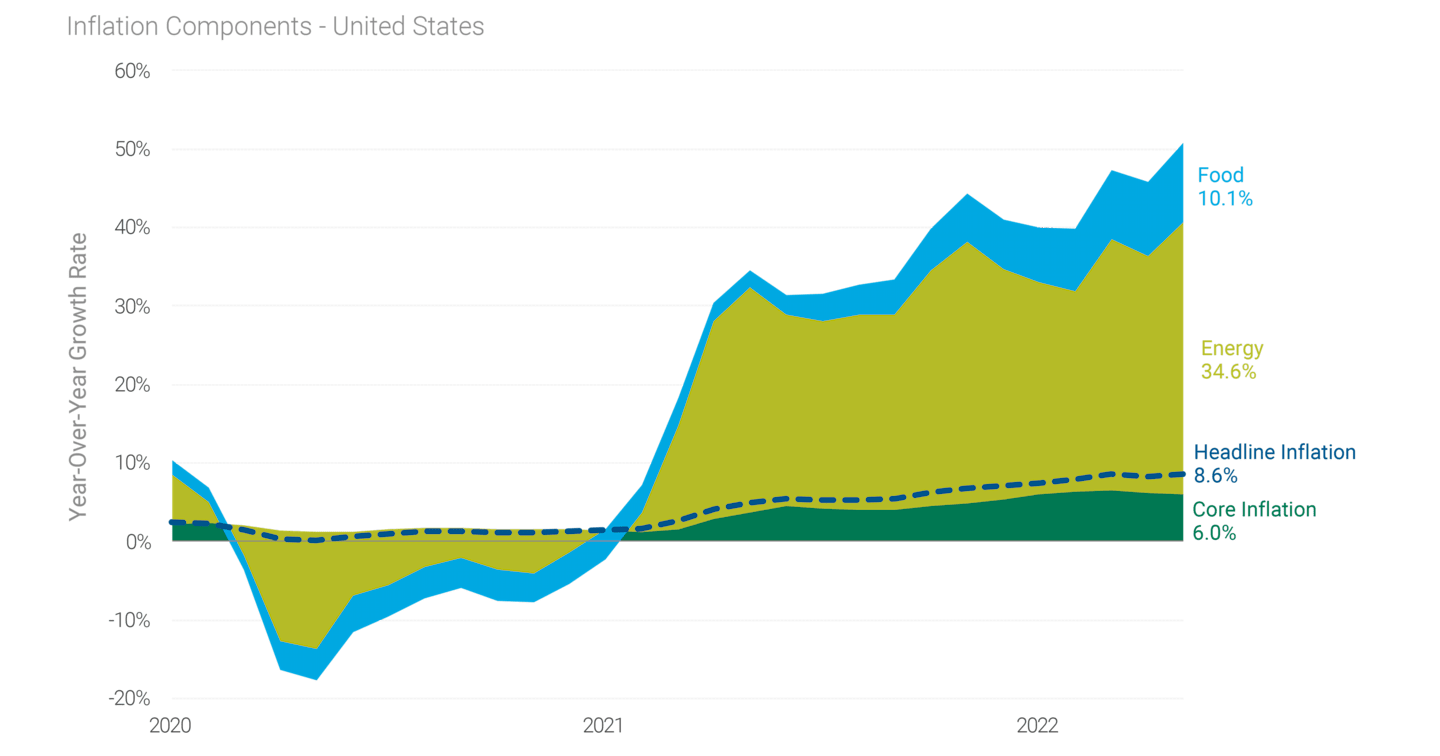

Core inflation has been significantly higher in the U.S. than in Europe. See Figure 1. Higher core data is notable because economists generally consider core inflation data a better predictor of more persistent inflation.

The data indicates that U.S. inflation has been more demand-driven due to the post-pandemic rise in consumer spending and a drawing down of excess savings accumulated during COVID-19 lockdowns.

Wage inflation has also had a significant impact due to the competition for workers. Yet data suggests wage inflation is easing in the U.S., and real wages have started to decline in the face of higher prices.

Figure 1 | Core Inflation Is Significantly Higher in the U.S.

Data from 1/31/2020 – 5/31/2022. Source: FactSet, Bureau of Labor Statistics (BLS). Headline inflation in the U.S. is based on the Consumer Price Index (CPI), the BLS measure of consumer price inflation. Core inflation is the CPI excluding food and energy.

Inflation in Europe Is Largely Cost-Push

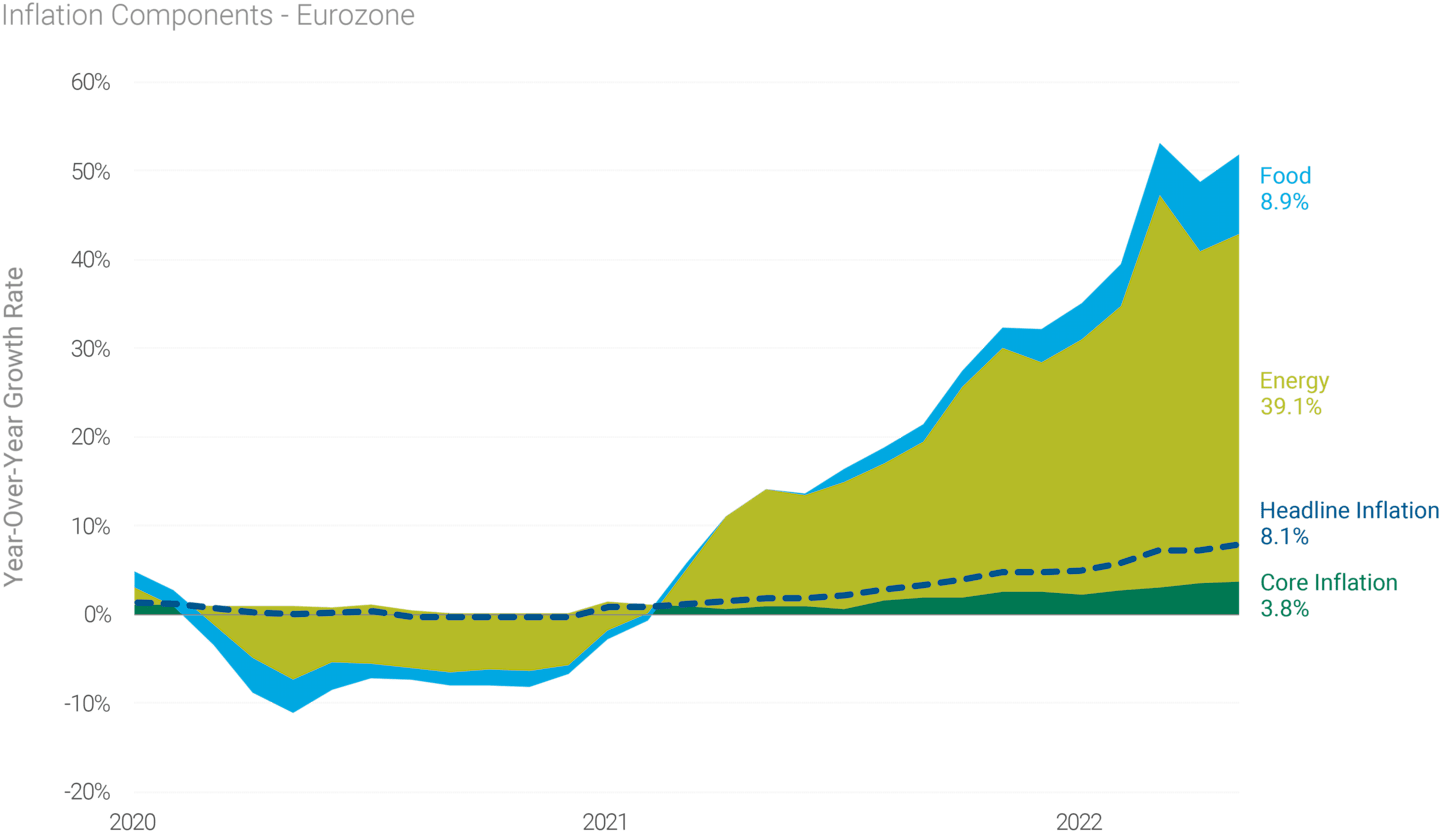

Higher energy costs are a much larger component of inflation numbers in Europe, as shown in Figure 2. Last year’s spike reflected the significant 39.1% year-over-year rise in fuel prices, compared to 34.6% in the U.S. as of May 31, 2022. It’s important to note that energy prices, including natural gas and gasoline, rose from a higher base in Europe.

The war in Ukraine exacerbated already strained supply chains, especially those involving natural gas, commodities and wheat. Even though higher energy costs had an outsized effect on European economies, the impact appears transitory since resolving the war would help alleviate supply shortages and lower prices.

High energy prices have had a comparatively lesser yet meaningful impact on the U.S. Pain at the gas pump, and spikes in travel costs (e.g., airfares, hotel prices) have altered spending patterns.

Figure 2 | High Energy Prices Fueled Inflation in Europe

Data from 1/31/2020 – 5/31/2022. Source: FactSet, Eurostat. Headline inflation in the eurozone is based on the Harmonised Index of Consumer Prices (HICP), the European Central Bank’s measure of consumer price inflation. Core inflation is the HICP excluding food and energy.

How Did We Get Here? Different Pandemic Responses Created Fork in the Inflation Road

Governments and central banks worldwide aggressively addressed the pandemic in 2020 with support for their economies. They implemented fiscal and monetary stimulus measures to encourage demand and preserve jobs. Differences in the number and frequency of these moves critically affected the subsequent inflationary response in each country.

Stimulus Checks Atop Quantitative Easing Spurred Higher U.S. Inflation

The U.S. government supplemented quantitative easing (QE) with more than $5 trillion in direct stimulus payments, according to the Congressional Budget Office.1 This massive response supported the economy and helped bring about the sharp V-shaped recovery in spring 2020. However, the size and frequency of stimulus payments increased the national debt and heightened inflationary pressures.

The U.S. response also helped fuel the “great resignation” and its upward pressure on wages as millions of workers left their jobs or declined to return when their employers rehired. The subsequent competition for qualified workers in all industries contributed to wage inflation, which was initially greater than in Europe.

Europe’s More Measured Response Was Less Inflationary

While the European Central Bank (ECB) and individual European governments initiated similar support mechanisms, inflation in Europe was initially less severe than in the U.S. for two reasons:

Interest rates across Europe hovered near, or even below, zero, so the ECB and Bank of England (BoE) had little room to move.

The magnitude of the stimulus was much smaller than in the U.S., both in absolute and relative per capita terms. Subsequently, recovery was slower, and inflationary pressure was lower.

A Look Ahead: How Might the Different Inflation Scenarios Resolve?

Both central banks are attempting to achieve a soft landing as prices continue to climb (though at a decelerating rate). Where prices go from here in the U.S. and Europe depends on how well the central banks manage the give-and-take between slowing demand and supporting growth.

The Fed Maintains Vigilance

An aggressive Federal Reserve (Fed) has moved decisively while leaving the door open for more hikes this year and next. These efforts reduced core U.S. inflation to 3% year over year in June, down from above 9% in June 2022, according to the U.S. Department of Labor, but it’s uncertain when it may subside further.2

The data reflects higher consumer prices, though shelter — a sizable portion of U.S. inflation — appears to be decelerating as rents and housing costs moderate. U.S. housing is feeling the effects of higher mortgage rates, and supply is improving as rates rise.

Overall, evidence suggests that core inflation in the U.S. is easing. Initial jobless claims also softened in July 2023, suggesting upward pressures on wage inflation may be easing, though we note news of additional layoffs, especially in financial services and technology.

The Fed’s June pause was cheered by markets and investors alike. Investors hope that moderating inflation and a softening labor market can persuade the Fed to keep slowing or even stopping its succession of rate hikes.

Europe Remains Hawkish

Even though the ECB and BoE were less aggressive in their initial responses, they are now moving to the Fed’s hardline approach. The ECB raised rates at its recent meeting and is telegraphing further hikes.

European inflation is moderating but at a slow rate of decline. Core inflation logged in at 5.3% year over year in June, down from 6.1% in May.3

Despite recent moderation, U.S. and European inflation remains north of their central banks’ target rate of 2%.

How Does the Tale of Two Inflations End for Investors?

While inflation in the U.S. and Europe has moderated, the two countries remain on divergent paths. The Fed’s more aggressive response from the beginning has meant that recovery and subsequent inflation occurred sooner in the U.S. As expected, inflation began to peak sooner in the U.S. than it did in Europe.

The U.S.’s lower reliance on energy imports (compared to Europe’s dependence on natural gas from Russia, for example) should also lower relative inflationary pressures as the Northern Hemisphere heads into colder autumn and winter weather.

Fortunately for Europe, a milder-than-usual 2022-2023 winter lessened the effects of energy uncertainty for the continent in late 2022 and into early 2023. Policymakers would undoubtedly welcome another mild winter. The IMF estimates that nearly half of current European inflation results from higher import costs (including energy) being passed on to consumers, plus increased labor expenses.

Any clear resolution of the energy uncertainty could lead to a rapid deceleration in European inflation data, which could quickly improve the environment for investors. Higher core inflation in the U.S. could be more concerning because of its potential to linger relative to the more transitory, wage-driven tightness. An over-aggressive Fed could choke off growth and trigger a recession in the U.S. But if the central bank isn’t bold enough, it might struggle to effectively manage inflation, potentially leading to more economic damage.

Authors

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

Alicia Parlapiano, Deborah B. Solomon, Madeleine Ngo, and Stacy Cowley, “Where $5 Trillion in Pandemic Stimulus Money Went,” New York Times, March 11, 2022.

Gwynn Guilford and Nick Timiraos, “Inflation Eased to 3% in June, Slowest Pace in More Than Two Years,” Wall Street Journal, July 12, 2023.

Liz Alderman, “Eurozone Inflation Slides to Lowest in More Than a Year,” New York Times, June 1, 2023.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments' portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

International investing involves special risks, such as political instability and currency fluctuations.