What to Do With an Old 401(k)?

Leaving a job raises questions about your employer’s retirement plan: Do I leave my 401(k) with my former employer? How do I roll it over? What if I don’t roll over? Get answers for your retirement savings.

Key Takeaways

Changing jobs or retiring may mean you have to decide what to do with the money in your former employer’s 401(k) or other retirement plan.

From leaving the money in your old 401(k) to rolling it into an IRA or new employer’s plan, some options, like cashing it out, come with drawbacks.

Learn about your options and understand the benefits and risks. Above all, make sure your decision is right for you and your future.

What happens to your 401(k) when you quit or leave a job? Many people leave their money in a former employer's plan simply because they are unaware that they can transfer it elsewhere. They may not know they have other options, such as rolling it over to a new account.

What Can You Do With Your Old 401(k)?

Three of the options for what to do with your old 401(k) can help keep your money invested for your future in a tax-favored account. A fourth option can come with tax penalties and a loss of opportunity. Let’s discuss all four.

Browse by Option for an Old 401(k)s

1. Roll Over Your 401(k) Money to an IRA

Rolling over your 401(k) to an IRA with an investment company of your choice may help you gain more control over how you invest the money. Rollover IRAs, like any IRA, typically offer a wider range of investment choices than employer plans.

After rolling the money over, you can add to the IRA with annual contributions within IRS limits or consolidate other rollovers. However, there are things to consider before combining the money. You can also save using an IRA if you max out contributions in your new 401(k).

Keeping rollover money separate allows you to transfer the funds into another 401(k) or qualified retirement plan later. If you contribute new money to a Rollover IRA, you forfeit that option, and your account will be considered a Traditional IRA.

Keep in mind that there are no current income taxes or penalties for rolling your money into an IRA, although you might pay higher investment fees or account expenses than you would with a workplace plan.

How Do You Roll Over a 401(k) After Leaving a Job

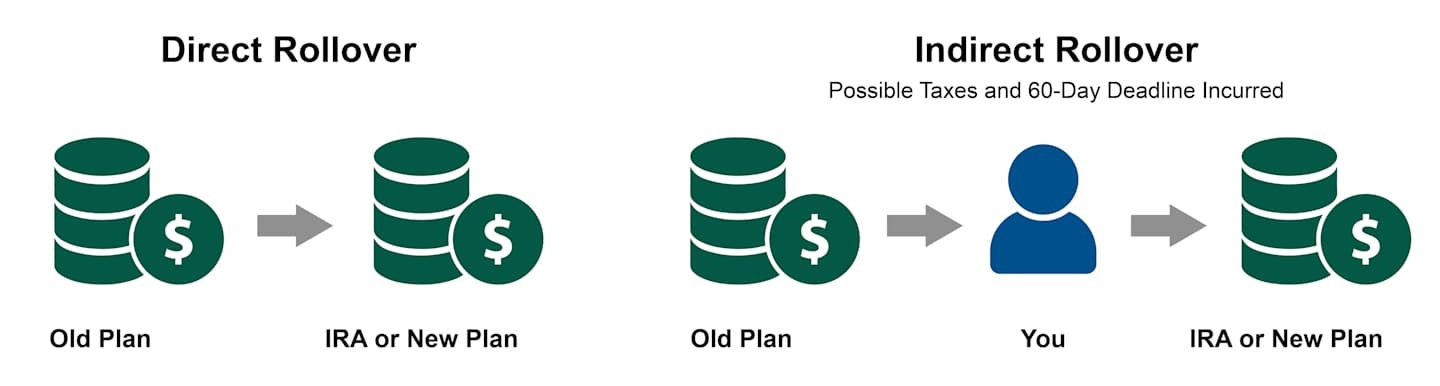

There are different types of rollovers: “direct” and “indirect.” How are they different?

Check with your employer to see if these options are available before you reach retirement age or initiate a rollover. Special rules apply to Roth assets. Talk to a tax advisor before choosing which kind of rollover is best for you.

With a direct rollover, funds in your former employer's retirement plan will transfer directly to the financial firm where you opened a new Rollover IRA.

For an indirect rollover, your old company’s 401(k) plan provider will issue you a check—minus a 20% mandatory withholding payment to the IRS. You must then transfer the money within 60 days. Plus, you are responsible for covering the 20% that was withheld from the distribution. You may face an early withdrawal penalty if you do not deposit the entire amount within 60 days.

Due to the potentially significant tax consequences of indirect rollovers, we recommend consulting with a tax advisor before considering this option.

Rollovers: Control Without the Hassle

Rolling over money doesn’t have to be as complicated as it can sound. When choosing a new home for your money, look for:

A streamlined rollover process

Limited paperwork

A dedicated service team

2. Move Your Money to a New Employer’s Plan

You might be able to roll over the money from your old job’s plan to a new one if the new plan allows it. Your new plan could offer many of the same benefits (and drawbacks) as your previous employer’s plan.

Still, you'll be able to see your old 401(k) balance along with any additional savings from your new plan on statements and through online accounts, possibly making it easier to keep track of all your 401(k) savings in one place.

Rollovers to New Employer’s Plans Can Be Direct or Indirect, Too

Like rolling over an old 401(k) to an IRA, a rollover to a new employer’s retirement plan can be direct or indirect. With direct rollovers, if available from your old plan, your money will go directly from your old 401(k) to your new plan without taxes or penalties.

With an indirect rollover, you will receive a check from your old plan provider, minus the 20% required tax withholding. You will have 60 days to deposit to your new employer’s plan. You must make up the 20% withholding amount or potentially face an early withdrawal penalty.

How Do You Transfer an Old Roth 401(k) to a New Employer’s Plan?

If your savings are in a Roth 401(k), which can give you tax-free withdrawals in retirement, you may be able to transfer the funds to an eligible new Roth 401(k) if your new employer offers one and the plan allows it.

Another option is to roll the money over to a Roth IRA. In either case, whether to a Roth 401(k) or Roth IRA, the transfer is not a taxable event. You will also not be required to take a minimum distribution for either a Roth IRA or Roth 401(k) at age 73, a change that took effect for the latter in 2024.

How Do You Roll Over Other Types of Retirement Plans?

While most people think of a 401(k) when they hear 'rollovers,' other plans like 403(b)s and 457(b)s can also be transferred into a new employer’s retirement plan, such as a 401(k), another 457(b), 403(b) or even a SIMPLE IRA, with some restrictions. Specific rules may vary depending on the type of new employer plan, and availability depends on the plan’s provisions.

3. Leave Your 401(k) Money With Your Old Employer

There may be circumstances where leaving your money in your former employer’s plan makes sense. Your money will continue to grow tax-deferred until retirement. You may be eligible to do that if your vested balance in your 401(k) is more than $7,000.

In a retirement plan, vesting means ownership. You will own or “vest” a percentage of your retirement plan account each year. If you are 100% vested, you own 100% of the account.

Is your vested balance below $7,000? Under IRS rules and, depending upon a plan’s provisions, employers are permitted to distribute a former employee’s vested retirement plan balance, even without the employee’s permission.

Even if You Can, Should You Keep Money in an Old Employer’s 401(k)?

Staying in your old 401(k) may seem like the easiest option. But is it the best? In addition to keeping the money tax-deferred, you may not incur the same fees, expenses or penalties you might if you move to a non-retirement account or cash it out. Be sure to reevaluate your old 401(k) to ensure it still aligns with your future and consider the potential risks.

Four Risks of Leaving Money in Your 401(k)

Your Former Employer Has Control

Your former employer's rules will apply to your account, which may include changes to administration, record-keeping, and restrictions on changing investments or withdrawals. Fees could be higher, and investment options could change, which might not suit your needs.

Old Plan May Not Meet New Financial Needs

With a job change or retirement, your financial goals may shift. It's essential to reevaluate your old plan to ensure it aligns with your future goals. If you keep the money in place, you won't be able to make additional contributions as a former employee.

You Might Miss the Big Picture

It's easy to overlook an old retirement plan when creating a current investment strategy. Failing to consider previous assets (such as stocks or bonds) may lead to unnecessary risk with a lack of diversification. When starting a new job's plan, you might struggle to assess your overall asset allocation.

Out of Sight, Out of Mind

Losing track of an old account is a risk, especially if you only monitor it once or twice a year. This can hinder your understanding of your investment performance and might lead to forgetting about your money entirely, as nearly half of workers do, according to one study.1

4. Cash Out Your 401(k) and Pay Taxes and Penalties

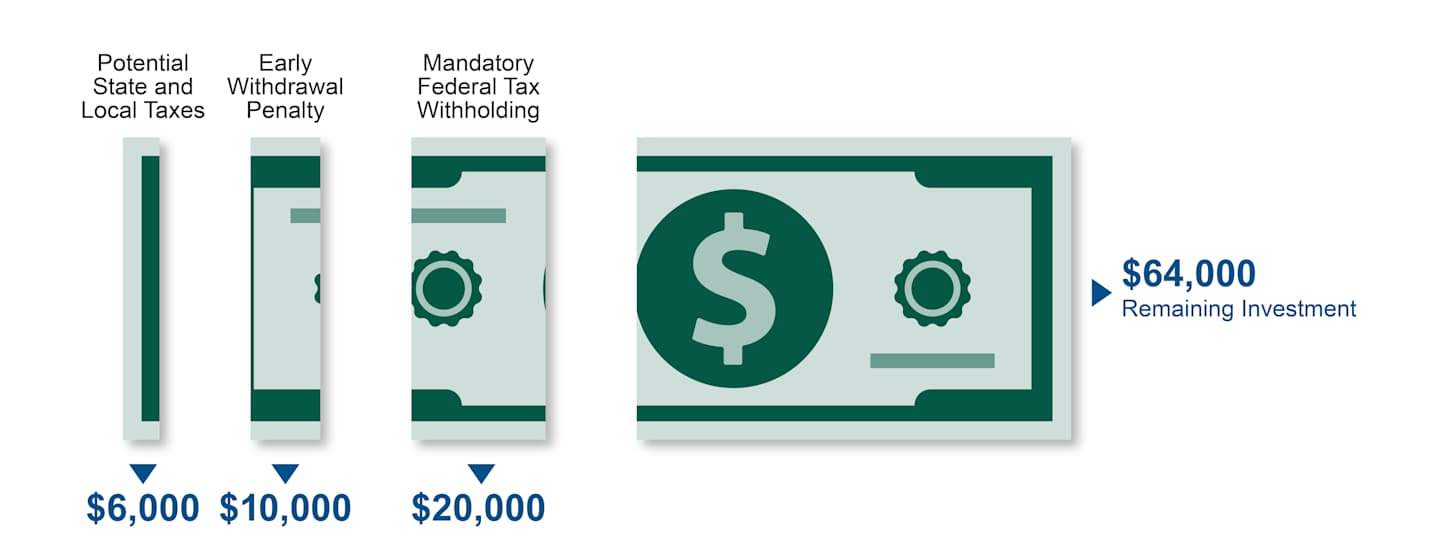

Cashing out your 401(k) or other retirement plan may be a quick way to access your money, but it also comes with a cost in the way of income taxes, state taxes and a 10% federal penalty tax if you are younger than 59 ½. These can drastically reduce the amount you end up with.

Example of a $100,000 Cash Distribution

Taxes are deferred until withdrawal. State and local income taxes may also apply at withdrawal. A 10% penalty will be imposed for early withdrawal. Penalty may apply if you don't meet age requirements.

For example, a cash withdrawal of $100,000 from a 401(k) before age 59½ incurs the following reductions:

$6,000 in potential state and local income taxes, paid when you file your income taxes for the calendar year you took the distribution.

$10,000 as an IRS-imposed 10% early withdrawal penalty, paid when you file your income taxes for the calendar year you took the distribution.

An immediate reduction of $20,000 in mandatory 20% federal tax withholding at the time of the distribution (which is remitted to the IRS as a credit toward your income taxes due on the $100,000 distribution).

Cashing Out Can Lead to Missed Opportunities

In addition to taxes and penalties, cashing out means you sacrifice the potential future growth of your money. For example, the 10% early withdrawal penalty amount of $10,000 invested for 30 years could grow to $57,435.2 Learn more about the pitfalls of cashing out your 401(k) early.

I’ve shared some of the cautions, but it might help if you see it for yourself. Use our 401(k) Cash Out Calculator to see how much you could pay in taxes and penalties, and what you could be missing out on for your future.

How Do You Manage Old 401(k) Accounts?

Leaving a job and starting a new one can be a hectic time, but don’t forget the 401(k) accounts from your old job or jobs. If you have a few old 401(k)s that you haven’t done anything with, you might want to consider consolidating them in one place.

You can do that in an IRA, which may help you keep better track of your retirement savings progress and gain a better understanding of your true retirement portfolio's asset allocation and risk when you see them all together. Additionally, it can help make managing your finances significantly simpler. Who doesn’t want that?

Authors

Financial Consultant

Wondering What’s Best for Your Old 401(k)?

Contact one of our specialists for help determining the best option for your retirement plan money.

’Forgotten’ 401(k) account fees can cost workers in thousands in lost retirement savings, report finds. CNBC.com, June 2025.

This hypothetical situation assumes a $10,000 invested for 30 years with a 6% rate of return. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Source: American Century Investments Future Value of an Investment Calculator. Financial Calculators from Dinkytown.net. January 2026.

This information is for educational purposes only and is not intended as a personalized recommendation or fiduciary advice. There are different options available for your retirement plan investments. You should consider all options before making a decision. Our representatives can help you evaluate all of your distribution options.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.