Assess the Risk of Inflation on Your Finances

Inflation Means Your Money Will Buy Less in the Future

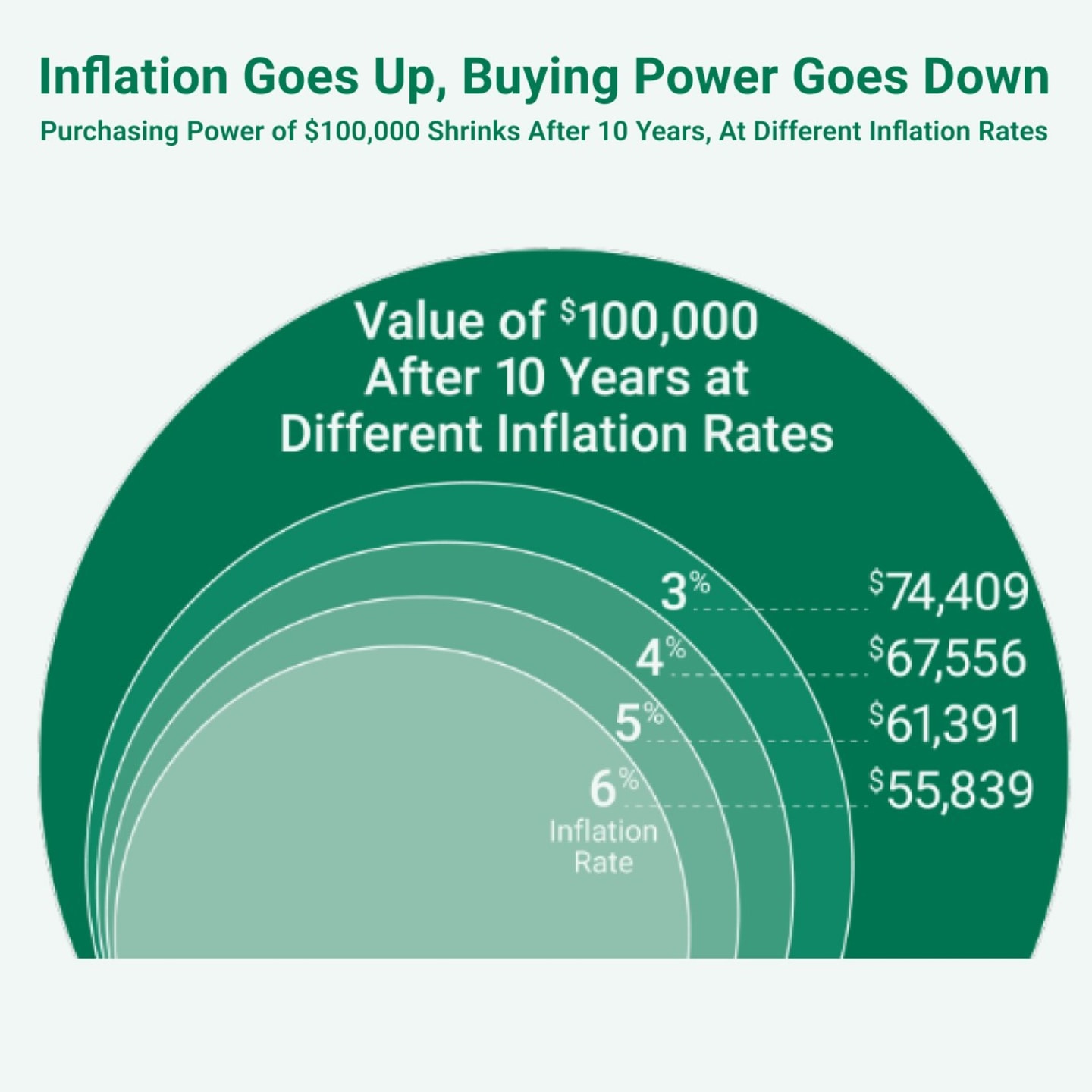

Counting on that $100,000 in savings? The loss of purchasing power from inflation can mean you need to withdraw more money than planned to cover the higher cost of living.

Here's how inflation guarantees your money will buy less in the future.

How Inflation Affects Purchasing Power

Even low inflation gradually eats away at your money. As our inflation calculator shows, at just 3%, a $100,000 investment will lose almost a quarter of its purchasing power over 10 years. At 6%, it could be cut in half.

See how inflation could affect your current portfolio.

How Does Inflation Affect the Markets?

Financial markets hate uncertainty. And uncertainty spikes when inflation is rapidly rising. Specifically, people worry about the Federal Reserve's ability to control inflation without slowing economic growth too much.

When uncertainty is high, the markets see large price swings. And these swings—also known as volatility—can play into our emotions and decision-making.

Make Better Decisions by Avoiding Behavioral Biases

How Inflation Affects Our Emotions—and Investing

Are you your own worst enemy? Our perceptions and biases can lurk under the surface—preventing us from taking the right actions.

But there are steps you can take to make better decisions for your financial situation.

Take Action

Look to Inflation-Hedging Investments

It’s a tricky balance. If you invest too aggressively on a short time horizon, you risk losing money that you’ll need for the future. But if you invest too conservatively, your money may not grow enough. Finding the right balance is key to staying ahead of inflation.

What's Your Goal?

The risk of inflation eating away a portfolio’s purchasing power is well documented. That’s why considering investments that help you keep pace with rising costs is a vital part of financial planning.

Explore the role inflation-protected securities can play in portfolios. Also look at diversifying duration and keep quality in mind when it comes to choosing an investment.

Why TIPS Strategies May Help

Treasury Inflation-Protected Securities (TIPS) are securities issued by the U.S. Treasury Department. They feature principal values and interest income linked directly to the Consumer Price Index (CPI), which is commonly used to measure inflation.

When CPI changes, TIPS’ principal value also adjusts up or down. That means when unexpected inflation shocks occur, TIPS adjust to help absorb them.

TIPS have a fixed coupon interest rate. If the principal value rises in response to a CPI increase, the income dollar amount also rises by the fixed percentage amount, allowing investors to keep pace with inflation. TIPS also have a fixed maturity rate and are backed by the full faith and credit of the U.S. government.

TIPS investments tend to be highly correlated with inflation over the long term.

Why Diversifying Duration May Help

Duration measures a bond’s price sensitivity to changes in interest rates. Interest rates and bond prices move in opposite directions, so the shorter the duration, the less a bond’s price will swing when rates go up or down.

When interest rates are rising, shortening duration may make sense. Conversely, as rates come down, lengthening duration might be more beneficial.

Changes in the economy and market dynamics can happen quickly, which in turn can cause interest rates to fluctuate. In addition, the Federal Reserve uses its federal funds rate to help tamp down surging inflation.

By diversifying duration, a portfolio may have a smoother pattern of performance.

Why a Focus on Quality Matters

Higher-quality investment choices, whether in fixed income or equities, have the potential for less volatility, particularly during times of economic and market uncertainty.

Lower-quality bonds tend to experience more volatility in response to changes in economic and market conditions.

Investments to Consider

When rising inflation is a concern, having investments with an income component can help offer some peace of mind. Choosing interest- or dividend-paying investments is one way to achieve this income-generating goal. (Keep in mind that these investments can—and do—lose value at times.)

Investments to Consider

*Effective February 14, 2023, Strategic Income Fund was renamed Multisector Income Fund.

Growing a portfolio at a rate ahead of inflation is a goal for many investors. As with any growth-oriented investment approach, diversification, appropriateness for your time horizon and including equity investments can all help. Another idea worth consideration is adding dividend-paying investments.

Why Diversification Can Help

Diversification, spreading your money over multiple asset classes that respond differently to market changes, may have a smoother pattern of performance over time. The key is to choose a mix of investments with a low correlation to each other—meaning they don’t all move in the same direction at the same time.

Why Investing Appropriately for Your Time Horizon Can Help

Knowing when you’ll need to withdraw money from your investment portfolio can help you invest with risk in mind. For instance, the longer you have to invest, the more you may consider investments with higher-reward/higher-risk potential because you have time to recover from market drops. Generally, the closer you are to your goals, the less risk you’ll want to take.

Why Investing in Quality-Oriented Equity Investments Can Help

Investing in equities offers the opportunity to outearn inflation, while focusing on quality helps to manage risk.

Investments to Consider

Ready To Act or Not Sure of Your Next Steps?

Request a call or call your financial professional.

General Disclosures

There is no guarantee that the investment objectives will be met.

Diversification does not assure a profit nor does it protect against loss of principal.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

Fixed Income Disclosures

Investments in fixed income securities are subject to the risks associated with debt securities including credit, price and interest rate risk.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

The lower rated securities in which the fund invests are subject to greater credit risk, default risk and liquidity risk.

Credit risk is the risk that an obligation won't be paid and a loss will result. Generally, a lower credit rating indicates a greater risk of non-payment. Liquidity risk is the risk that the fund will have difficulty selling its debt securities.

Exchange Traded Funds (ETFs): Foreside Fund Services, LLC - Distributor, not affiliated with American Century Investment Services, Inc.

Mutual Funds: American Century Investment Services, Inc., Distributor.