Investment Team

CIO

50+

investment professionals

20+

years average industry experience

10+

years average team collaboration

$36+

billion in assets under management

Source: American Century Investments.

All data as of 12/31/2024.

Teams Dedicated by Sector

Rates & Currencies • Government Securities • Corporate Credit • Securitized Credit • Municipals • Emerging Markets • Cash/Cash Equivalents

Investment Philosophy

Our investment professionals are guided by an understanding of how important returns and income are to investors’ financial security, especially during volatile markets. Drawing on fundamental research augmented by quantitative methodologies, they look to exploit inherent inefficiencies in the bond market to capitalize on opportunities while managing risk.

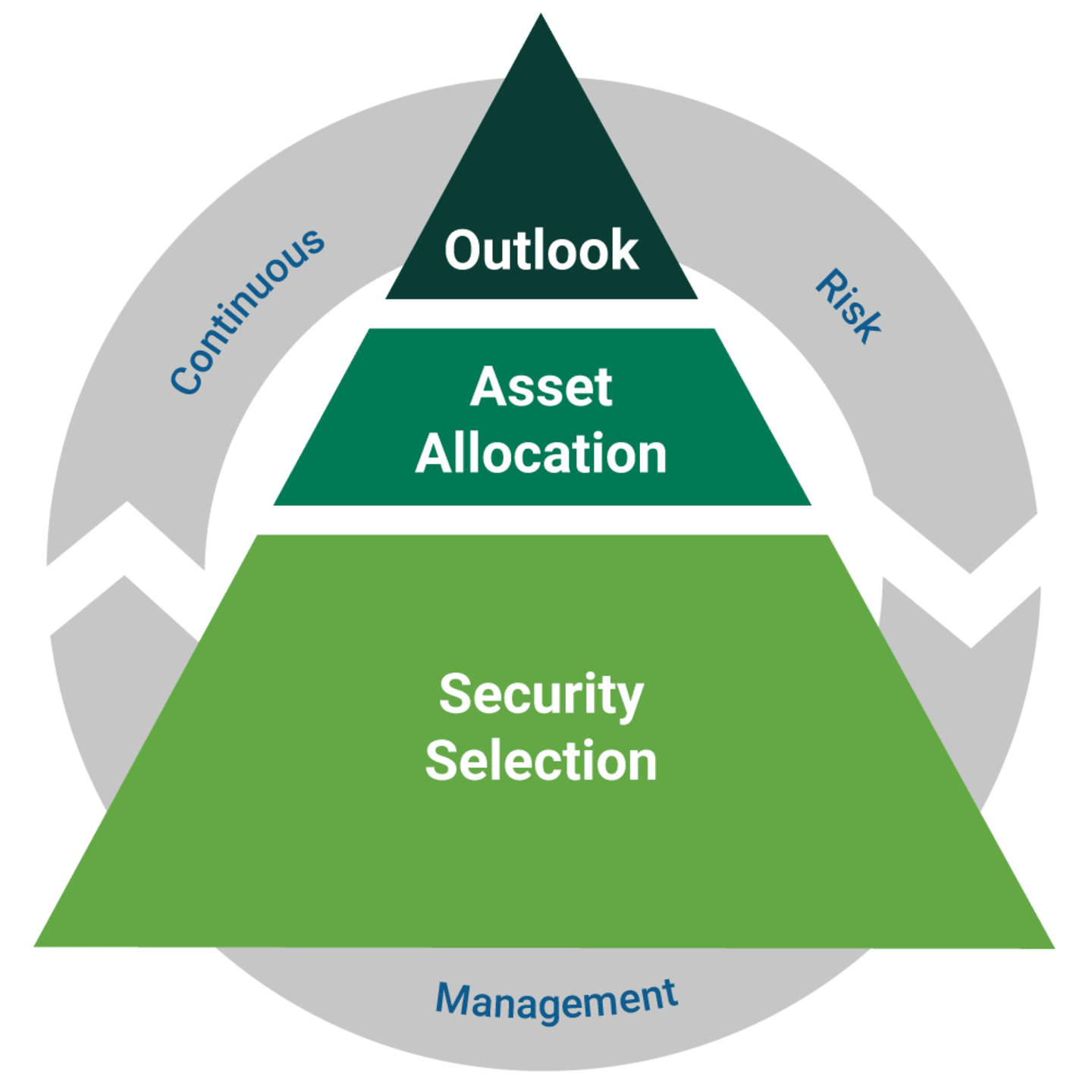

Investment Process

We pursue investment opportunities by following a systematic, repeatable process driven by fundamental research. To enhance our efficiency and ability to spot opportunities and manage risks, our investment team draws on data from our proprietary quantitative models and tools.

Outlook

Macro views on global economic growth, inflation, central bank policies, and interest rates provide context for investment decisions

Asset Allocation

Relative value of potential securities formed using a lens of economic fundamentals and rich/cheap sector analysis

Security Selection

Attractive issues identified by analysts through deep fundamental research, reviewed with portfolio managers and traders to select securities, managing sector exposures and issuer weights

Risk Management

Independent reviews of portfolio holdings to help ensure risk-budget compliance, conducted by a dedicated Risk Management Team, informed by proprietary technology tools

Investment Offerings

U.S. Investment Grade

Multi-Sector Income

Global

Emerging Markets

High Yield

Municipal Securities

Explore More

An Active Mindset for Fixed Income ETFs

Whether you’re looking for income, diversification, downside risk mitigation or tax-managed solutions, our fixed-income portfolios seek to benefit from strong markets while pursuing reduced drawdowns in declining markets.

Strategy in Focus: Short Duration Strategic Income

Seeking attractive income regardless of the interest rate environment.

Municipal Bonds: Building Blocks for Diversified Portfolios

Helping address challenges many investors face today.

Understanding Treasury Inflation Protected Securities (TIPS)

Diving into how TIPS work, with potential solutions to help cope.

Have Questions?

Contact us for more information about our fixed income capabilities.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

The information is not intended as a personalized recommendation or fiduciary advice and should not be relied upon for investment, accounting, legal or tax advice.

Mutual Funds: American Century Investment Services, Inc., Distributor.

Exchange Traded Funds (ETFs): Foreside Fund Services, LLC - Distributor, not affiliated with American Century Investment Services, Inc.