Our Partnership Capabilities

Balancing your fiduciary and service demands with client revenue can be a challenge. As you streamline your service model, you can refine your value proposition and serve clients who make the most sense for your business.

American Century Investments offers client solutions to help you diversify your revenue stream, potentially reduce fiduciary exposure, decrease servicing obligations, and free up time and resources for your practice.

Retirement Solutions

Work with our team to make participant servicing more efficient and reduce your fiduciary exposure.

- Rollover services. Assist terminated participants in making a smart choice for their future, and ease plan servicing.

- Plan termination services. Easily implement a rollover feature that’s designed to distribute all plan assets.

Wealth Management

Make your practice more efficient and reduce fiduciary exposure by transitioning small-balance, low-revenue clients.

- Referral program. Leverage our scalable front office to refer clients who may not meet your service model.

Small Business

Round out your retirement capabilities with small business opportunities.

- SIMPLE IRAs and SEP IRAs that feature a digitized setup process.

Client Stages

We provide tailored guidance, advice and investment solutions for every stage of client growth.

Education & Guidance

Approximately 50% of U.S. adults lack financial literacy.¹

Point-in-Time Consultations

Around 60% of households have sought help on 1+ financial tasks in the past 12 months.²

Financial Planning

About 20% of investors actively engage in financial planning.³

Dedicated Advisory Solutions

About 35% of affluent investors rely on dedicated advisors for ongoing planning and advice.⁴

Available Products

Clients can access American Century mutual funds in non-discretionary retirement and non-retirement accounts.

Those needing more in-depth, sophisticated investment solutions can access our Private Client Group advice service.

Why American Century Investments?

At American Century Investments, we are guided by our commitment to do the right thing for clients. This focus on integrity has earned the trust of our clients for more than 65 years.

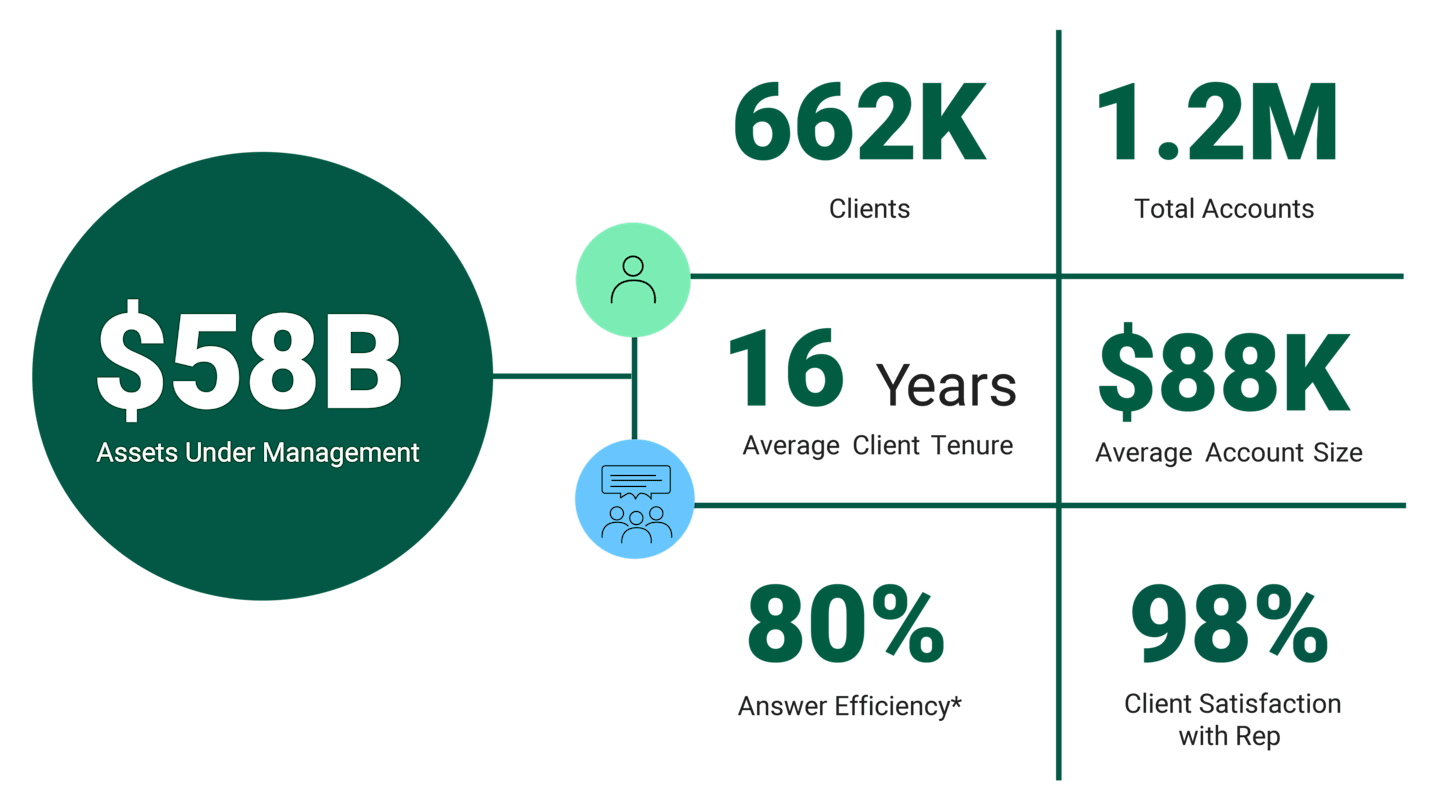

*Percentage of time calls answered within 20 seconds.

Data as of 1/31/2025.

We offer a large, scalable front office with expertise in servicing clients with a wide variety of investment goals. Our Personal Financial Solutions business manages $58 billion for 662,000 clients in over a million accounts.

Making a Difference

We manage money and also seek to make a difference in the world. Every year, 40% of our dividends fund ongoing life-changing medical research—over $2 billion to date.

Learn More

Contact your wholesaler or call us to discuss how we can help you drive efficiency and diversify your revenue.

“Roughly half of Americans are knowledgeable about personal finances.” Pew Research Center. December 9, 2024.

“Pain Points & Actions 2024: Today’s Top Advice Gaps & the Customer Loyalty Connection,” Hearts & Wallets, June 2024.

“Advice & Technology: Opportunities for Hybrid Models, Workplace Resources and Differentiation Among Financial Professionals,” Hearts & Wallets, July 2022.

Hearts & Wallets IQ Database, July 2024.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Private Client Group advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. This service is generally for clients with a minimum $50,000 investment. Call us to determine the level of service that is appropriate for you. The advisory service provides discretionary investment management for a fee. All investing involves risk.

This information is for educational purposes only and is not intended as a recommendation or fiduciary advice. Advisers, plan sponsors, recordkeepers, consultants, and other financial professionals may enter an agreement with American Century as part of this referral platform, and they may receive referral payments from American Century as part of that agreement. Payments may be based on the amount of assets that referred clients invest with American Century, and these payments may continue as long as they remain clients of American Century.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.