Fractured Fed Delivers Another Rate Cut to Aid Jobs Market

The growing division within the central bank—and a pending change in Fed leadership—suggest that the future path for interest rates remains unclear.

Key Takeaways

Despite limited government data and unusual division within its ranks, the Fed closed out 2025 with its third consecutive interest rate cut.

The Fed’s near-term path remains unclear amid debate over whether persistent inflation or a cooling labor market poses the bigger risk to the economy.

While we currently expect only one rate cut in 2026, The Fed's easing to date may offer investors opportunities to readjust asset allocation strategies.

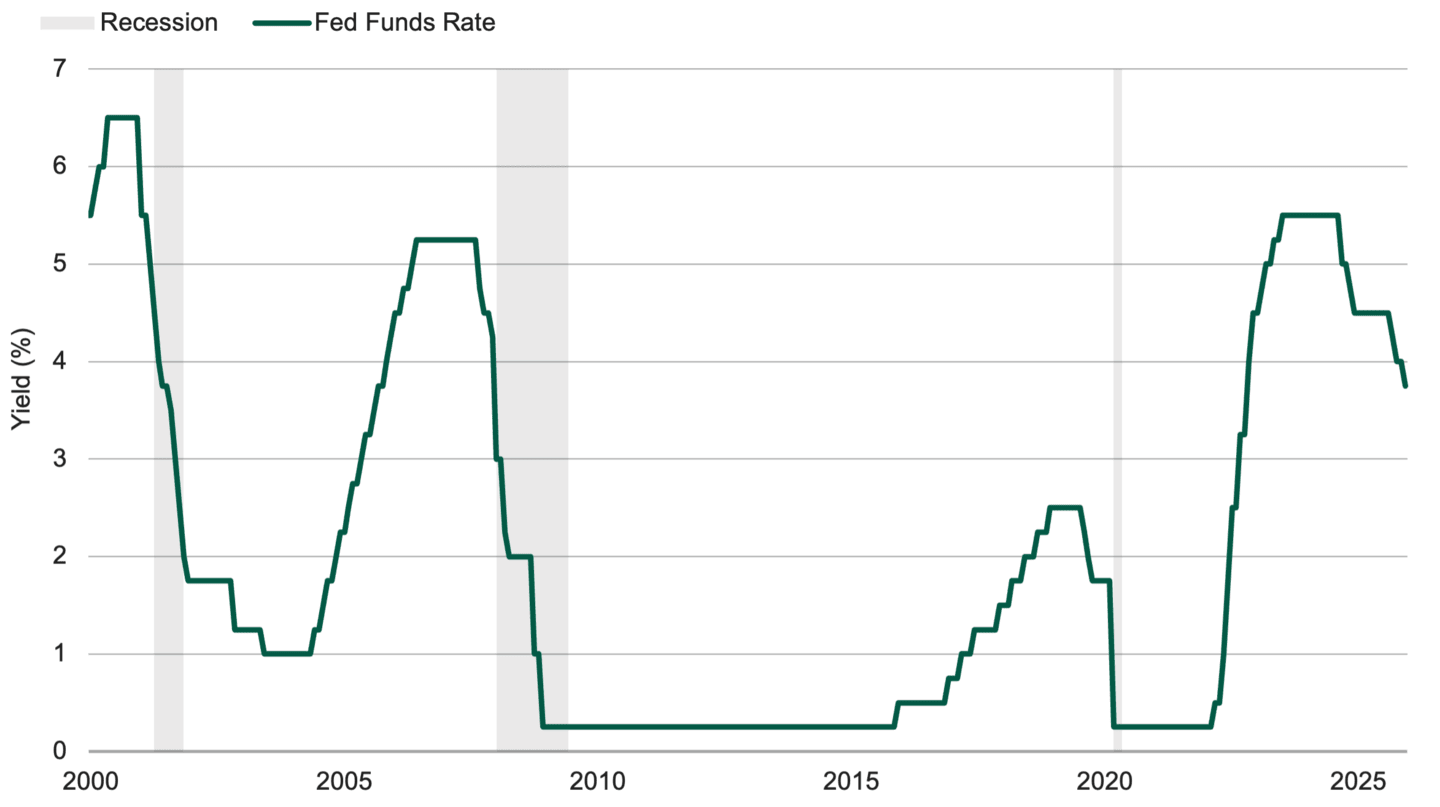

At its final monetary policy meeting of 2025, the Federal Reserve (Fed) cut its target short-term lending rate by another quarter-point. The December 10 decision dropped the U.S. short-term interest rate target to a range of 3.5% to 3.75%, a three-year low. See Figure 1.

Despite incomplete data due to the recent government shutdown, the Fed concluded that the labor market presented a bigger economic threat than inflation.

However, not all policymakers were in favor of the easing move. The 9-3 vote for the rate reduction marked the first time in six years that three policymakers dissented. In our view, this divergence hurts the Fed’s credibility regarding the future course of monetary policy.

Figure 1 | Fed’s Short-Term Interest Rate Target Falls to a Three-Year Low

Data from 1/1/2000 – 12/11/2025. Source: FactSet.

Government Shutdown Complicated Fed Decision

The federal government shutdown, which ended in mid-November, left the Fed with limited economic data to consider. For example, a delayed September jobs report showed stronger-than-expected payroll gains in September, job losses in August and a higher unemployment rate in September. Employment reports for October and November, and the inflation data for November, were unavailable ahead of the Fed’s December meeting.

The unemployment rate, which began the year at 4%, stood at 4.4% in September. Notably, the Fed’s post-meeting statement no longer characterized the unemployment rate as “low.” Meanwhile, core inflation in September rose 2.8%, compared with 2.9% in August and the Fed’s 2% target.

Inflation vs. Jobs: The Dual Mandate Debate Continued

This conflicting dynamic of elevated inflation and a slowing labor market continues to fuel debate within the Fed. Cutting rates while inflation remains above-target is a risky strategy that could drive prices even higher. But focusing solely on inflation puts the labor market and the broader economy at risk of weakening.

In his post-meeting press conference, Fed Chair Jerome Powell noted, “our two goals are a bit in tension.” He said it’s unusual for the Fed’s dual mandate to face this ongoing tension, and policymakers must determine where the bigger risk lies. Powell also blamed most of the persistent inflationary pressures on tariffs, the effects of which he expects to subside next year.

Are Interest Rates Back to Neutral?

Powell believes the latest rate cut puts the target lending rate “within a broad range of estimates of its neutral value,” where it neither stimulates nor hinders the economy. Previously, Powell had stated that interest rates remained somewhat restrictive.

Economy Is Likely to Improve in 2026

Along with its rate-cut announcement, the Fed released its final set of economic projections for 2025. Compared with September, policymakers expect growth to improve. They lifted their real gross domestic product (GDP) forecasts from 1.6% to 1.7% for 2025 and from 1.8% to 2.3% for 2026.

The Fed’s unemployment forecasts for 2025 and 2026 remained unchanged at 4.5% and 4.4%, respectively, and its core inflation outlook slowed from 3.1% to 3% in 2025. Next year, policymakers expect core inflation to moderate to 2.5%, slightly lower than their September forecast of 2.6%.

Like the Fed’s forecast, our economic outlook remains generally optimistic. We continue to believe these powerful tailwinds should drive economic growth in 2026:

A capital spending wave benefiting the artificial intelligence (AI) industry along with non-technology-related sectors.

A consumer spending boost supported by federal tax refunds.

The cumulative effects of Fed easing, which should loosen financial conditions and help promote economic growth.

While easier financial conditions should represent a tailwind for economic growth, they could also create headwinds for consumer prices. Against the current backdrop of persistent inflation, resilient growth and slowing employment, the Fed risks “over-easing.” It’s a possibility we’re monitoring, given the potential implications for inflation.

Recent futures market data projected two Fed rate cuts in 2026. We think this number is too high. With the economy likely to reaccelerate as 2026 progresses, we currently expect only one Fed rate cut next year.

It’s also important to note that the inflation and employment data remain key components of the path forward, but they aren’t the only factors. We believe the Fed’s future course also hinges on who becomes the next Fed chair. Powell’s term ends in May, and President Donald Trump appears close to naming his replacement.

Keeping an Eye on Portfolio Diversification

The Fed’s interest rate decisions often drive sharp short-term movements in the financial markets. Following the December 10 announcement, the stock market surged and the bond market rallied. Additionally, as the Fed lowers interest rates, yields on cash equivalents like savings accounts, CDs and other short-term, high-quality vehicles typically follow suit.

For many investors, these dynamics may trigger an asset allocation review. Lower interest rates may have implications for the income and growth potential in various portfolio strategies.

Overall, we believe maintaining a broadly diversified investment portfolio is a sensible strategy throughout economic and Fed cycles. Our experience suggests that investors who maintain their long-term strategies while remaining mindful of emerging opportunities may improve their risk/reward potential. Today, as the Fed lowers rates and the economic outlook remains upbeat, we believe putting cash to work across the financial markets is a prudent policy.

Authors

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, inflation-protected securities with similar durations may experience greater losses than other fixed income securities. Interest payments on inflation-protected debt securities will fluctuate as the principal and/or interest is adjusted for inflation and can be unpredictable.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.