Rates Stay Unchanged as Fed’s Search for Clarity Continues

Policymakers remained cautious amid muted inflation, mixed economic data and tariff uncertainties, but they still expect to cut interest rates this year.

Key Takeaways

Short-term interest rates remained unchanged, but the Fed left rate cuts on the table for later this year.

As policymakers seek better economic clarity, Fed Chair Powell insisted the central bank is well-positioned to quickly respond to changing conditions.

We believe maintaining a diversified portfolio may help weather market and economic uncertainties.

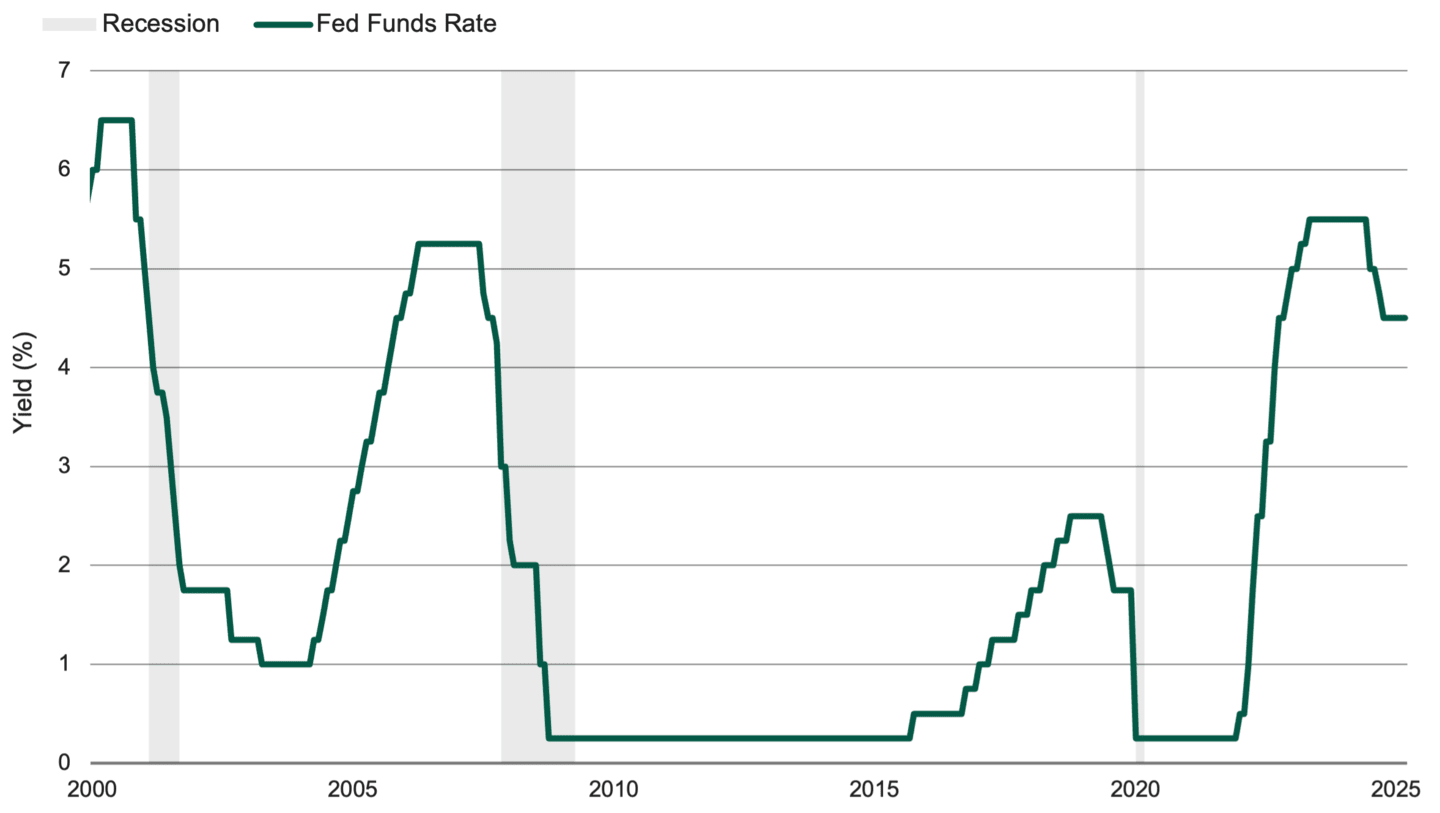

Despite a steady slowdown in the inflation rate, the Federal Reserve (Fed) left the target short-term lending rate unchanged at its fourth straight meeting on June 18. The U.S. short-term rate target held steady in a range of 4.25% to 4.5%, bucking the trend in other developed markets. The rate remains at a 17-year high, as Figure 1 illustrates.

Figure 1 | Fed Keeps Interest Rates at a Multi-Year High

Data from 1/1/2000 – 6/18/2025. Source: FactSet.

Rate Cuts Remain an Option as Growth Forecast Slows

“Uncertainty about the economic outlook has diminished but remains elevated,” Fed Board Chair Jerome Powell said in his post-meeting news conference. He further noted that Fed officials need to “learn more” about trade, fiscal and regulatory policies before making interest rate adjustments. However, most policymakers still expect to cut rates later in the year.

The rate-cut expectations likely stem from two components of the Fed’s latest economic projections. Policymakers now expect gross domestic product (GDP) growth to slow to 1.4% by year-end, down from the Fed’s March forecast of 1.7%. They also project the unemployment rate, which was 4.2% in May, to climb to 4.5% by December.

Meanwhile, Fed officials expect inflation to reignite as the year progresses, largely due to tariff policies. “We expect a meaningful amount of inflation to arrive in the coming months,” Powell said. He also noted that he expects to gather more clarity about tariffs and their effects on consumer prices throughout the summer.

“We will make smarter and better decisions if we wait,” Powell said.

He and his colleagues forecast the annual core personal consumption expenditures (PCE) index, which slowed to 2.5% in April, to climb to 3.1% by year-end. In March, policymakers expected a year-end core inflation rate of 2.8%.

If these projections materialize, Fed officials could face a complicated situation. Do they cut rates to aid a slowing economy and weakening labor market, or do they hold interest rates steady to combat rising prices?

Powell Defends Fed’s Wait-and-See Strategy

Despite the lingering threats to growth, inflation and employment, Powell continued to characterize the economy as “solid.” He stressed that the Fed is in no hurry to adjust monetary policy, which he described as “in a good place” and “modestly restrictive.” He also emphasized that the Fed is well-positioned to respond to incoming data and any need for interest rate adjustments.

Will Inflation Eventually Slow Enough for the Fed to Act?

After moderating for four consecutive months, the annual headline Consumer Price Index (CPI) increased slightly from 2.3% in April to 2.4% in May. Core CPI (which excludes food and energy prices) held steady at 2.8% for the third straight month. Meanwhile, consumer inflation expectations eased amid waning fears about tariffs.

We still believe inflation will continue to moderate slowly. Of course, tariffs may create bumps in the road, but we expect them to smooth out over time. We believe concerns about the slowing economy will outweigh temporary pricing pressures, prompting the Fed to resume its rate-cut program later this year.

Uncertainties Put Diversification, Opportunity in Spotlight

We believe broad portfolio diversification is appropriate for all market climates, but it may be particularly prudent during periods of heightened uncertainty and volatility. As we’ve seen recently, staying diversified can help temper near-term swings in asset class performance. What’s more, volatility often leads to market dislocations, which can highlight value and opportunity across asset classes.

Over time, volatility will likely ease as the economy and financial markets adjust to new trade agreements and other aspects of President Donald Trump’s agenda. Until then, staying diversified across high-quality stocks to capture upside potential and high-quality bonds to foster risk management may help manage market fluctuations.

Authors

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, inflation-protected securities with similar durations may experience greater losses than other fixed income securities. Interest payments on inflation-protected debt securities will fluctuate as the principal and/or interest is adjusted for inflation and can be unpredictable.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.