Fed Stays on Course with Second-Straight Rate Cut

As inflation stayed above target, policymakers once again addressed the slowing jobs market with a quarter-point rate reduction.

Key Takeaways

The Fed maintained the easing strategy it relaunched in September, lowering its short-term interest rate target another quarter point.

We still think a December rate cut seems likely, but the Fed’s rate plans appear less certain moving into 2026.

Given the effects of Fed easing on money market and short-term interest rates, investors may want to consider the market’s changing opportunities.

As widely expected, the Federal Reserve (Fed) cut its target short-term lending rate by another quarter point on October 29. This second-straight easing move dropped the U.S. short-term interest rate target to a range of 3.75% to 4%, its lowest level in three years. The Fed also announced it would end its program of shrinking its balance sheet on December 1.

Fed Board Chair Jerome Powell characterized the latest rate cut as a “risk management” exercise in the Fed’s “balanced approach” to monetary policy. He said it was another step toward a neutral policy stance. Powell continued to label the interest rate benchmark as “modestly restrictive.”

The Fed’s rate-cut campaign will likely impact borrowers, savers and investors. Borrowing costs may decline, yields on cash equivalents and shorter-maturity bonds may fall, and “risk-on” investing may take hold. This backdrop — and the market’s expectations for additional rate cuts — underscores the importance of regularly reviewing your financial and investment plans.

Fed’s Response to Rising Unemployment Rates

Powell again cited concerns about the jobs market as the driver of the Fed’s dovish monetary policy. The unemployment rate edged higher in August to a four-year high, and Powell noted the labor market continues to face downside risks. The official September figure from the Bureau of Labor Statistics was delayed amid the partial government shutdown, but unofficial data indicated little change.

However, several high-profile layoff announcements underscored the Fed’s concerns. Target, Meta and Molson Coors are among the companies recently announcing job cuts. Additionally, Amazon is undertaking the largest reduction in its corporate workforce in the company’s history.

Inflation Risks Persist

Meanwhile, the government shutdown didn’t derail the release of the September inflation data, which showed the annualized headline Consumer Price Index (CPI) edged slightly higher. Core CPI (which excludes food and energy prices) slowed slightly, from 3.1% to 3%, lower than expected but still exceeding the Fed’s 2% target.

Powell noted the near-term inflation risks remain skewed to the upside, largely due to tariffs. He still believes the effects will likely be short-lived, and he thinks longer-term inflation expectations are consistent with the Fed’s 2% inflation target. However, he also warned inflationary pressures could prove to be longer lasting, a potential scenario the Fed continues to monitor.

This conflicting dynamic of elevated inflation and a slowing labor market puts the Fed in a conundrum. Cutting rates while inflation remains well above the Fed’s target is a risky strategy that could drive prices even higher. But holding off on rate cuts could put the labor market and the broader economy at risk of weakening.

Will the Fed Continue Cutting Rates?

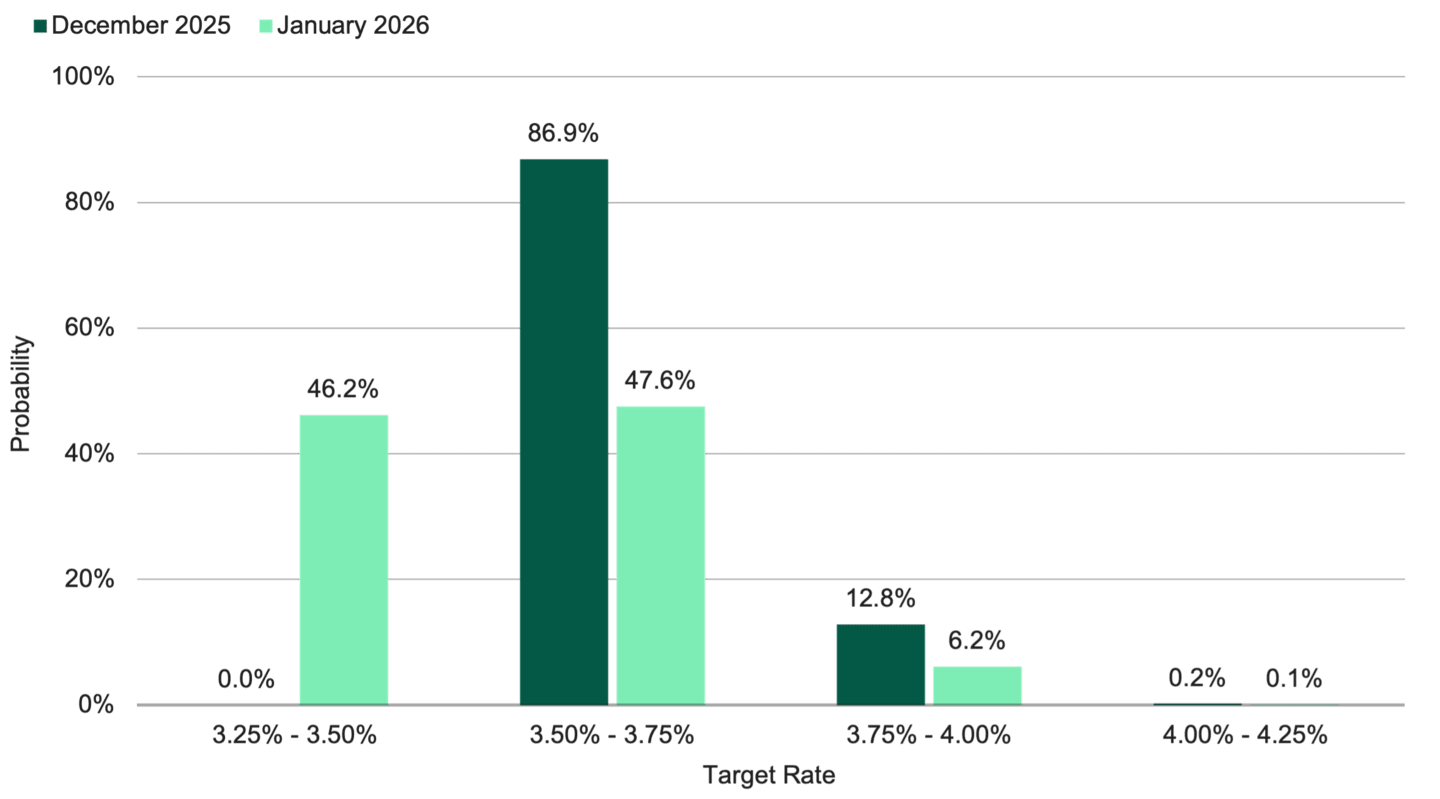

At his post-policy-meeting press conference, Powell rattled the financial markets when he suggested a December rate cut is not a foregone conclusion. Before the October meeting, the market expected a December cut and was nearly split regarding expectations for the Fed’s January meeting, as Figure 1 illustrates.

Figure 1 | Market Expects More Rate Cuts Through January

Data as of 10/28/2025. Source: CME Group.

In our view, the Fed will still likely cut another quarter-point in December. But Fed officials’ interest rate forecasts for 2026 reflect a broad division.

The inflation and employment data remain key components of the path forward, but they aren’t the only factors. We believe the Fed’s future course also hinges on who becomes the next Fed chair. Powell’s term ends in May, and Treasury Secretary Scott Bessent recently said he expects President Donald Trump to name the new chair before year-end.

Economic Tailwinds May Limit Rate Cuts in 2026

Recent futures market data point to three Fed rate cuts in 2026, but we think this estimate is too high. With the economy likely to reaccelerate as 2026 progresses, we currently expect only one Fed rate cut next year.

We expect three powerful tailwinds to support the economy’s resurgence:

A capital spending wave benefiting the artificial intelligence (AI) industry, along with non-technology-related sectors.

A consumer spending boost supported by federal tax refunds totaling approximately $800 billion.

A loosening of financial conditions resulting from Fed easing, which could help promote economic growth.

While easier financial conditions should represent a tailwind for economic growth, they could also create headwinds for consumer prices. Against the current backdrop of persistent inflation, resilient growth and slowing employment, the Fed risks “over-easing.” It’s a possibility we’re monitoring, given the potential implications for inflation.

Lower Rates Highlight Changing Opportunities

As in most easing cycles, Fed rate cuts typically filter through the financial system, affecting borrowers, savers and investors:

Borrowers: Fed easing may lower consumers' interest rates for home, auto and other loans. Of course, there’s neither a direct nor immediate correlation between Fed rate cuts and lower loan rates. However, consumer lending rates tend to track the Fed’s rate changes over time. Additionally, lower interest rates can increase consumers’ buying power, particularly for large purchases, such as a home.

Savers: The Fed’s interest rate decisions directly affect the yields on most short-term, high-quality savings vehicles. So, when the Fed cuts rates, the interest that savers earn on savings, CDs and other cash-equivalent accounts also declines. In our view, this backdrop offers compelling opportunities to reallocate cash into other assets that may deliver higher return potential.

Investors: Many investors view Fed easing as an opportunity to increase risk exposure via select stocks and longer-maturity bonds. A lower rate environment typically encourages spending and reduces borrowing costs, which may boost stock valuations. Falling interest rates also may lift the performance potential of longer-duration bonds, whose prices tend to rise when rates decline.

Why Diversification Matters During Fed Easing

We believe maintaining a broadly diversified investment portfolio is a sensible strategy throughout economic and Federal Reserve cycles. In our experience, investors who maintain their long-term strategies while remaining mindful of emerging opportunities may improve their risk/reward potential.

Today, as the Fed lowers rates and the growth outlook seems bright, we believe it may be prudent to put cash to work across the financial markets.

Authors

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, inflation-protected securities with similar durations may experience greater losses than other fixed income securities. Interest payments on inflation-protected debt securities will fluctuate as the principal and/or interest is adjusted for inflation and can be unpredictable.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.