Is Your Cash Working Hard Enough?

Cash sitting on the sidelines misses the opportunity (and the risk) of being in the market.

Key Takeaways

Holding cash may feel safe, but it exposes investors to other risks.

Staying out of the market can lead to inflation-related losses or missed opportunities to grow your nest egg.

Investing your money in a diversified strategy may enhance your chances of achieving long-term financial goals.

When the economy seems uncertain, you might be tempted to pull your money out of the market and keep it “on the sidelines.” Doing so can help you avoid potential losses if a downturn occurs.

You wouldn’t be the only person who feels that way. The amount kept in money market funds — a traditional place for parking cash — has soared in recent years. By October 2025, it topped $7.39 trillion.1

That’s a big number, but the percentage of household wealth socked away in money market funds isn’t out of proportion to the historical trend.2

To be fair, there are many good reasons to keep cash. You might need it for an emergency fund, a down payment on a new house or next semester’s tuition.

Beyond circumstances like these, however, keeping too much cash on the sidelines may derail your financial goals. Here’s why.

Factors to Consider When Holding Cash on the Sidelines

Inflation’s Impact on Cash Holdings

Staying out of the market might prevent you from losing money during a sharp downturn. However, it can’t protect you from inflation, especially if you’re keeping these funds out of the market for extended periods.

Because of rising costs, a dollar today can only buy you a fraction of what it could decades ago. A diversified investment strategy may effectively counter inflation by positioning your assets for growth over time when you remain in the market.

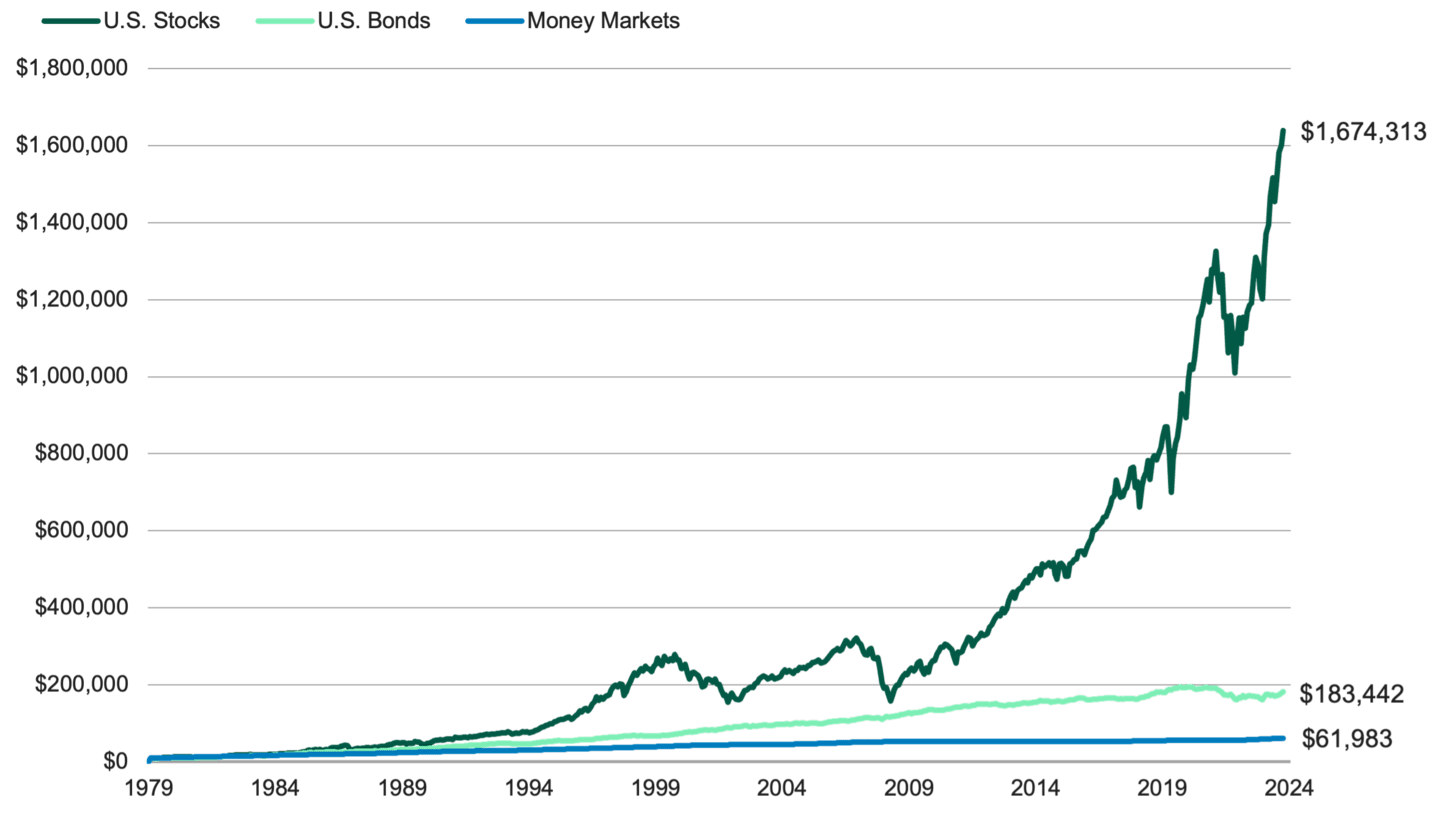

Figure 1 shows how stocks and bonds have historically risen in value, outpacing money market funds.

Figure 1 | Stocks, Bonds Have Grown Faster Than Money Market Funds

Data from 12/31/2019 – 9/30/2024. Source: FactSet. Growth of $10,000 in various asset classes. U.S. stocks are represented by the S&P 500® Index. U.S. bonds are represented by the Bloomberg U.S. Aggregate Bond Index. Money markets are represented by the FTSE 3-Month U.S. T-Bill Index. Past performance is no guarantee of future results.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. You cannot invest directly into indexes.

Opportunity Cost of Holding Cash

Investors who don’t consistently stay invested are more likely to miss out when stock prices go up.

Our team conducted an analysis to see how moving in and out of the market could affect returns. Here’s what we found.

If you had put $10,000 into the S&P 500® Index about 25 years ago, it would have grown to $63,767 by this year.

But what if you hadn’t stayed fully invested the entire time? If you had missed just 10 of the market’s best-performing days during those two decades, you would have ended up with less than half of that amount — $29,214.

If you were out of the market for the 30 best days, you’d only have $10,990.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. You cannot invest directly into the S&P 500 Index. Past performance is no guarantee of future results.

This points to another problem: Nobody knows precisely when the stock market’s “best days” will come.

Timing the Market Is Harder Than It Looks

Some investors think they can avoid losses by timing the market. Their strategy involves selling when the market is at or near its peak and then buying when prices have fallen to their lowest point, just before they start to rise again.

It sounds logical, doesn’t it? However, in practice, market timing can be very challenging, and often impossible, to execute successfully.

In a 2022 study, researchers compared the hypothetical performance of market timing to dollar-cost averaging.3 Dollar-cost averaging is a strategy where investors put the same amount of money into the market every month, no matter how stocks are performing.

The only situation where timing clearly outperformed dollar-cost averaging is in cases of “perfect foresight,” where a hypothetical investor could always buy stocks at the market’s exact bottom.

Obviously, humans can’t predict the future — not consistently, at least. Even experienced investors armed with sophisticated models and proven processes can fall victim to surprises that nobody saw coming. A market that seems like it’s hit rock bottom might fall even further.

As the study’s authors put it : “… the perfect foresight method is unattainable by human beings and unintended for any real-world application.”

Behavioral Factors Influence Financial Decisions

Human nature makes market timing tricky, too. It’s all too easy for behavioral biases to throw off your judgment.

Loss aversion: Most people feel the pain of loss more sharply than the potential for gain, even if the odds favor them. This tendency could lead you to limit or avoid investing.

Recency bias: We’re all more likely to remember things that just happened, and this can influence how we respond to events. If stock prices plummet, we focus on that. We forget the historical performance of stocks over extended periods.

Herd mentality: Going along with the crowd seems safer when you’re worried. The pressure can feel even greater if you’re exposed to alarming news reports and social posts 24/7.

Putting Your Cash Back to Work

What’s the best way to bring your cash off the sidelines?

Certainly, you can do it all at once in a lump sum. This puts your money to work right away, but it can cause a lot of worry about getting the timing right. As we mentioned previously, there’s no sure-fire way to get the timing right for entering the market.

Instead, many people reinvest their cash incrementally. They do it over time in fixed amounts at regular intervals, regardless of whether the market is rising or falling. Investing this way removes emotion from the process and creates a dollar-cost averaging effect with the potential to lower your average cost per share.

Another way to get your sideline cash back into the market is to rebalance your portfolio. For example, if your portfolio has become overweight in U.S. stocks, you might consider using your cash to increase your international stock and bond holdings.

It all depends on your risk tolerance and long-term financial goals.

Evaluating the Long-Term Effects of Sideline Cash

You’re more likely to succeed in the long run as an investor when you stick with your long-term plan during periods of volatility. This isn’t always easy; during tough times, it can even feel stomach-churning.

However, the potential for long-term growth makes that discipline worthwhile. We believe the opportunity is much greater for investors who remain in the market.

Authors

Start an Automatic Investment Plan Now

Log in to your account to start investing regularly.

Investment Company Institute, “Release: Money Market Fund Assets,” October 9, 2025.

Federal Reserve Bank of St. Louis – FRED, “Households; Money Market Fund Shares; Asset, Level,” as of January 1, 2024; “Households; Total Financial Assets, Level,” as of January 1, 2024.

Yan He and Junbo Wang, “Does Market Timing Beat Dollar Cost Averaging?” Journal of Finance Issues 20, No. 2, 2022.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

Rebalancing allows you to keep your asset allocation in line with your goals. It does not guarantee investment returns and does not eliminate risk.