Saving vs. Investing: How to Grow Your Portfolio

While saving and investing might be used interchangeably, they’re definitely not the same. Saving money is important, but investing may be the key to growing your money over time.

Key Takeaways

Saving and investing are not the same. One is intended for money you need soon; the other is for long-term goals like retirement.

Low-risk savings may not be enough to overcome inflation or provide growth for your future. Investing can help fill those needs.

Our consultants discuss the importance of both saving and investing, where they fit with your goals and what that looks like.

When thinking about retirement or your future net worth, you may not have a specific number or strategy in mind. You just know you need a lot more money than you have now.

Financial consultants Rachel McLain, Don Thomas and Addison Schubert discuss short-term saving and long-term investment growth and what those might look like for different investors.

Saving and Investing: What’s the Difference?

Saving means putting aside money that you’ll need soon. Bank savings accounts and money markets, for example, are generally used for short-term expenses, not long-term goals. These accounts give you easy access to your money but may have minimal growth prospects and generally cannot outpace inflation.

Investing involves participating in the growth of a company or other entity, where you buy and hold assets for a longer time period to seek an increase in value. Stocks and bonds, individually or within a mutual fund, are commonly used investment vehicles.

Why Saving Won’t Be Enough

Long-term stock and bond investments involve various risks, but looking for safety can come at a cost.

Lower rates. Lower-risk savings vehicles typically don’t have the growth potential of stock and bond investments. While many investors took advantage of the recent higher interest rates, “That era is coming to an end,” says Addison. “Rates on money markets and certificates of deposit are going down, so I’m having conversations with clients about how low rates could be next year.”

Inflation risk. Don says investors should also compare those lower interest rates with the rate of inflation. “If your money can’t keep up with inflation, how will you be able to pay for something in the future?”

Missed opportunities. “I have some clients who are ‘super savers’ who were raised to save instead of invest,” says Rachel. “They might be focusing too much on savings when they could invest some of their excess cash and potentially earn more over time.

“It’s still important to have cash readily available for your emergency fund or short-term goals,” she continues, “But I believe anything outside of that should be invested in something with more growth potential.”

Time in the Market

When the markets hit record highs, many investors worry about investing at the peak, especially if they’re coming off the sidelines and investing their cash.

“In my experience, more time in the market is better than no time in the market,” says Addison. “You could buy at the peak and have a temporary decline, but I think it’s still better to stay invested with a long-term approach and not get too worked up about short-term performance.”

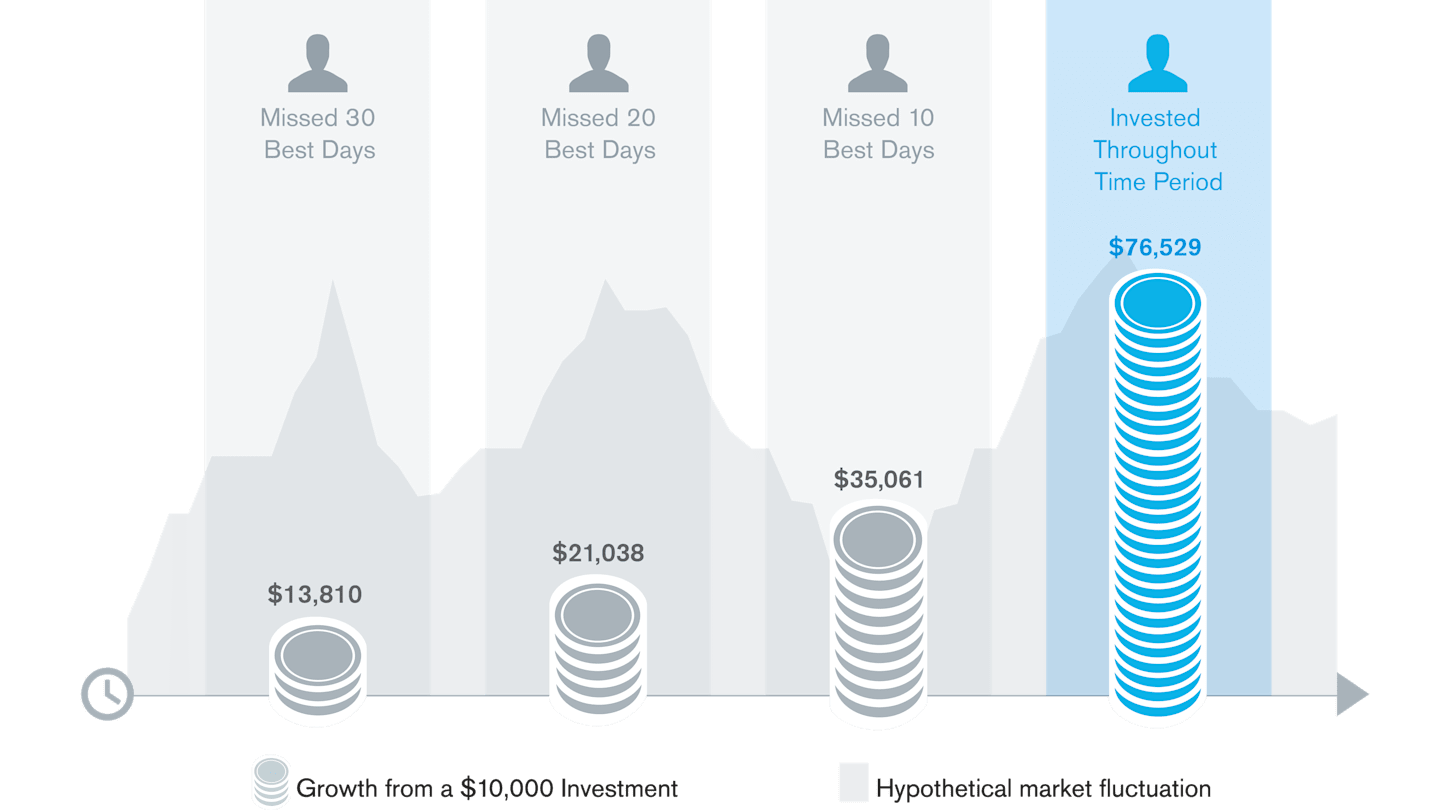

What Happens If You Miss the Market’s Best Days?

Source: FactSet. Growth of $10,000 in the S&P 500, 20-year data as of September 30, 2024. Past performance is no guarantee of future results. This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

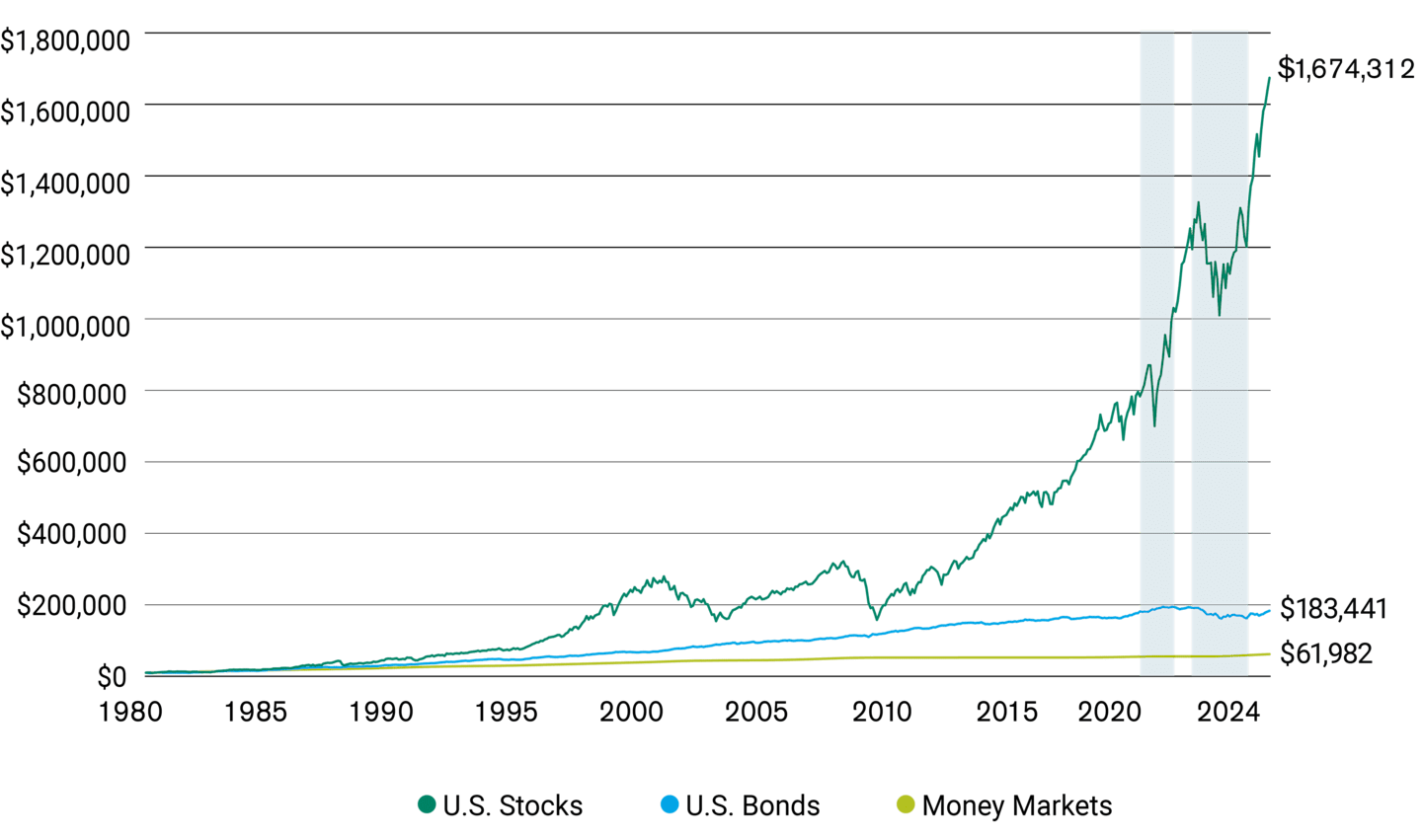

Which Investments Drive Portfolio Growth?

Stocks’ performance potential makes them a key component of a long-term portfolio strategy. Most regular savings or lower-growth options likely won’t be able to match that potential.

“I show this chart and our compounding calculator to clients all the time. Comparing growth possibilities for stocks, bonds and money markets gives them a different perspective,” says Addison.

And even though bonds don’t always have the same potential, they still play a role. “Bonds behave differently than stocks do; they may smooth out portfolio performance so investors may be less likely to make an emotional decision. If you have 100% in stocks and experience a major stock market decline, you might be tempted to sell,” says Don. We believe a bond allocation can help moderate that decline—and lessen anxiety.

Stocks Are Volatile—But Strong Rebounds Have Made It Worthwhile

Source: American Century Investments, Morningstar Direct. Hypothetical value of $10,000 invested at the beginning of 1980 and ending September 30, 2024. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly into an index. Past performance is not guarantee of future results.

U.S. stocks are represented by the S&P 500® Index. U.S. bonds are represented by the Bloomberg U.S. Aggregate Bond Index. T-Bills are represented by the FTSE 3-Month U.S. T Bill Index, which is often used as a benchmark for money market investments.

How Can You Manage Market Highs and Lows? Try Diversification

Remember, you could lose money in the dips. You could make money in the peaks. It’ll likely be a combination of the two, but those ups and downs have historically resulted in a significant upward trend over time.

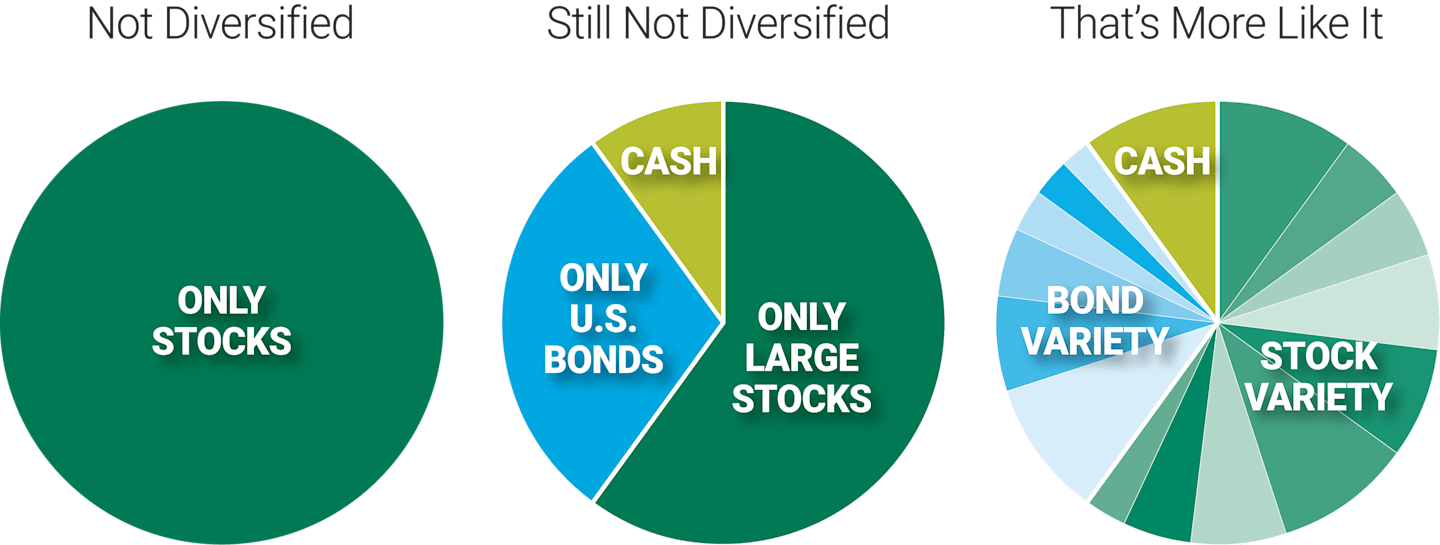

Relying on any single investment may not provide the results you need over the long term. But a diversified portfolio—made up of a variety of investments—may balance out the extremes. Remember, however, it’s not the quantity of investments that determines diversification; it's the overall mix that matters.

What Diversification Is—And Isn’t

Source: American Century Investments. Allocations are hypothetical and are not reflective of an actual investment product. Diversification does not assure a profit nor does it protect against loss of principal.

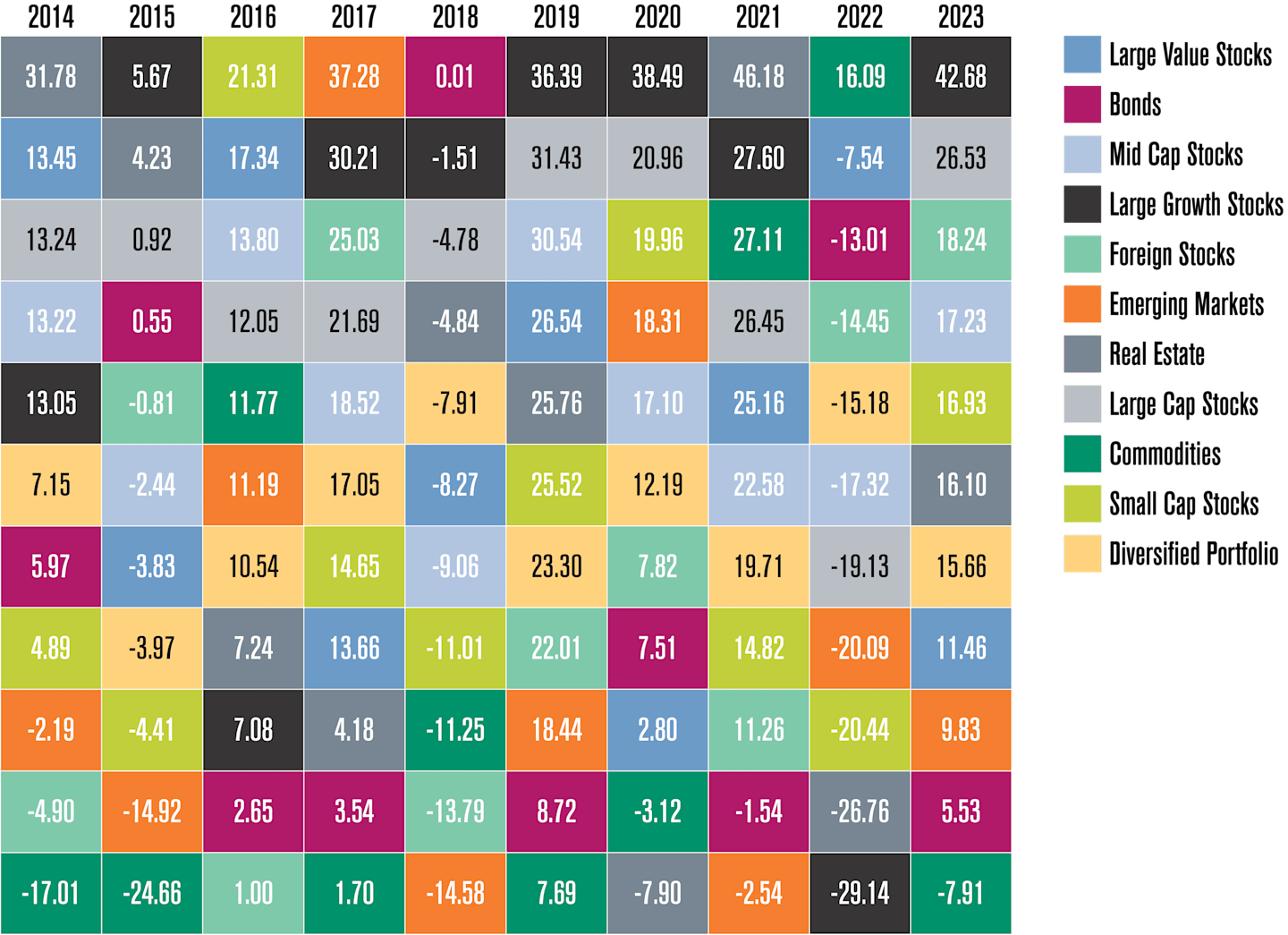

There’s No Pattern to Market Performance

The biggest problem with seeking growth is that it comes with market risk. But there are ways to manage that risk, even if you can’t take it away completely.

“You may choose to invest in a specific stock or single mutual fund that performs pretty well. But it won’t be the best every year. You have to capture the other asset categories,” says Addison.

Let’s look at emerging markets in the orange boxes below. Emerging markets can be used as a growth allocation in a portfolio. In the last decade, this asset class has been a top performer—and a disappointment—depending on the year. While that’s an extreme case, no asset type is consistently at the top from year to year. That’s why having a diverse allocation (and a diversified portfolio, in the yellow boxes) is key to managing risk and smoothing out performance over time.

Diversification Balances Asset Class Performance

Sources: U.S. Bureau of Labor Statistics, Federal Reserve, Bloomberg, Morningstar and Russell Investments: 12/31/2023. The diversified portfolio is a hypothetical example of an equal-weighted portfolio of all other represented asset classes (e.g., 1/10th allocation). Diversification does not assure a profit nor does it protect against loss of principal. Asset classes are represented by the following indexes: Large Cap Stocks = Russell 1000 Index, Large Growth Stocks = Russell 1000 Growth Index, Large Value Stocks = Russell 1000 Value Index, Mid Cap Stocks = Russell Midcap Index, Small Cap Stocks = Russell 2000 Index, Foreign Stocks = MSCI EAFE Index (Europe, Australasia and Far East), Emerging Markets = MSCI Emerging Markets Index, Real Estate = Wilshire U.S. REIT Index, Commodities = Bloomberg Commodity Total Return Index, Bonds = Bloomberg U.S. Aggregate Bond Index.

Balancing the Right Growth Mix

Should every investor’s portfolio look the same? Certainly not. The mix of investments (and the percentages of each kind) should reflect your own personal circumstances: the amount you’ve already saved, your age, your current and future contributions, the amount of time until you’re ready to use your money, your comfort with (or fear of) risk, among other considerations.

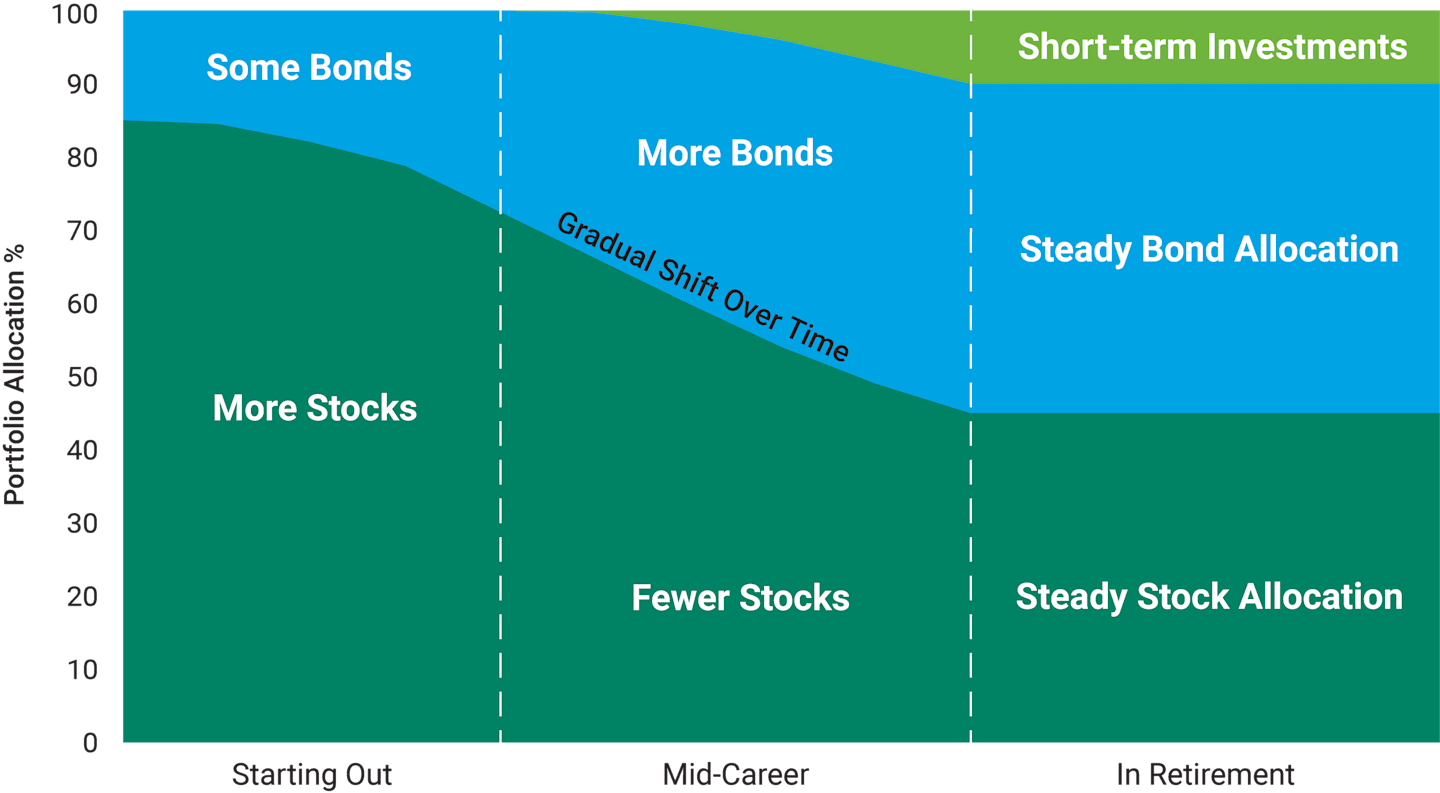

Generally, younger investors should have a higher percentage of stocks than any other type of investment. This mix reflects their need to grow their portfolios from scratch. The risk of shorter-term stock market losses is balanced by the potential for those stocks to rebound and grow over a longer time frame.

“Many clients think they should stay aggressive right up until they retire and then switch to being ultra-conservative,” says Rachel. “In reality, it should be more of a gradual change. If they stay aggressive too long, they run the risk of a recession occurring right before they retire and taking years to gain back what they lost."

She continues, “On the flip side, if they shift their portfolio to ultra-conservative at retirement, they run the risk of running out of money too quickly due to inflation risk.” Some clients will spend 30 years in retirement, and they’ll need their money to continue growing to keep up with increasing expenses as they get older.

Addison agrees. “The past couple of years of higher inflation helped people realize that you can’t be that conservative as you get close to retirement and that they need to have an appropriate percentage in stocks. Over longer time periods, we believe those investments have the potential to protect against inflation more than savings—and even more than bonds will.”

Sample Portfolio Shift Over Time

Source: American Century Investments. Each investor's situation is different. This chart is for general educational purposes only.

Don also points to the differences in retirement portfolios now versus 30 or 40 years ago. “Life expectancies and retirement ages have changed. People tend to spend more years in retirement now, so you need different strategies to make your money last.”

Authors

Financial Consultant

Financial Consultant

Financial Consultant

Ready to Grow? Let’s Talk About Your Saving and Investing Strategy

A financial plan can get you on the right path. Consider a few sessions with one of our Certified Financial Planners to create or revisit your plan.

Diversification does not assure a profit nor does it protect against loss of principal.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

As with all investments, there are risks of fluctuating prices, uncertainty of dividends, rates of return and yields. Current and future holdings are subject to market risk and will fluctuate in value.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

International investing involves special risk considerations, including economic and political conditions, inflation rates and currency fluctuations.

©2025 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.