Start Investing: A How to Invest Guide

Just starting out, or already investing and feeling like you’re winging it? Let’s cover the basics, how much to invest, what to invest in and strategies to help you reach your goals.

Key Takeaways

Investing can seem confusing, and for some, intimidating. And the financial jargon doesn’t help. Those who are new to it may not know how to start investing.

This 101 investing guide breaks down concepts that can help investors choose their investments and which account types may work best for their goals.

It also covers time-tested strategies and other important considerations that can help investors make decisions and have a better chance of success.

Whether you’re curious about investing, need a refresher course, or want to share a how-to guide with someone who’s just getting started, you’re in the right place. I’ll cover the basics of investing, including: Helping you understand those pesky jargon terms everyone uses (but no one explains), what to consider before choosing investments and where to go from there.

What Is Investing?

Investing involves buying assets—such as mutual funds, exchange-traded funds (ETFs), stocks, or bonds—that have the potential to increase in value and yield returns.

How is investing different from saving? There is a difference between saving versus investing, and people may ask why saving isn’t enough. That question may be based on fear. Investing can feel scary. Saving can feel safer. In my opinion, you want to do both. Let me explain why.

Saving is putting money aside, usually in a lower-risk account, for money you need soon. Investing is putting your money to work so it can potentially grow for your future.

People invest primarily to achieve their long-term financial goals, such as buying a home, funding a child’s education or retiring comfortably. While investing does come with risks, it also offers the opportunity for higher returns than traditional savings accounts. Here are a couple of other reasons why investing is important for long-term goals:

To beat inflation: Over time, inflation decreases the purchasing power of your money (meaning your dollar will buy less than it could before). Investing may help your money grow faster than inflation.

To build wealth: Even smaller, regular investments can grow significantly over the years through compound interest and market growth.

While past performance does not guarantee what will happen in the future, investing, especially in the stock market, has historically paid off for many investors.

10% for 100 Years

The average stock market return for nearly the last century.

Source: NerdWallet, April 2025.¹ Based on the S&P 500(R) Index from 1926 to 2024. Past performance is no guarantee of future results.

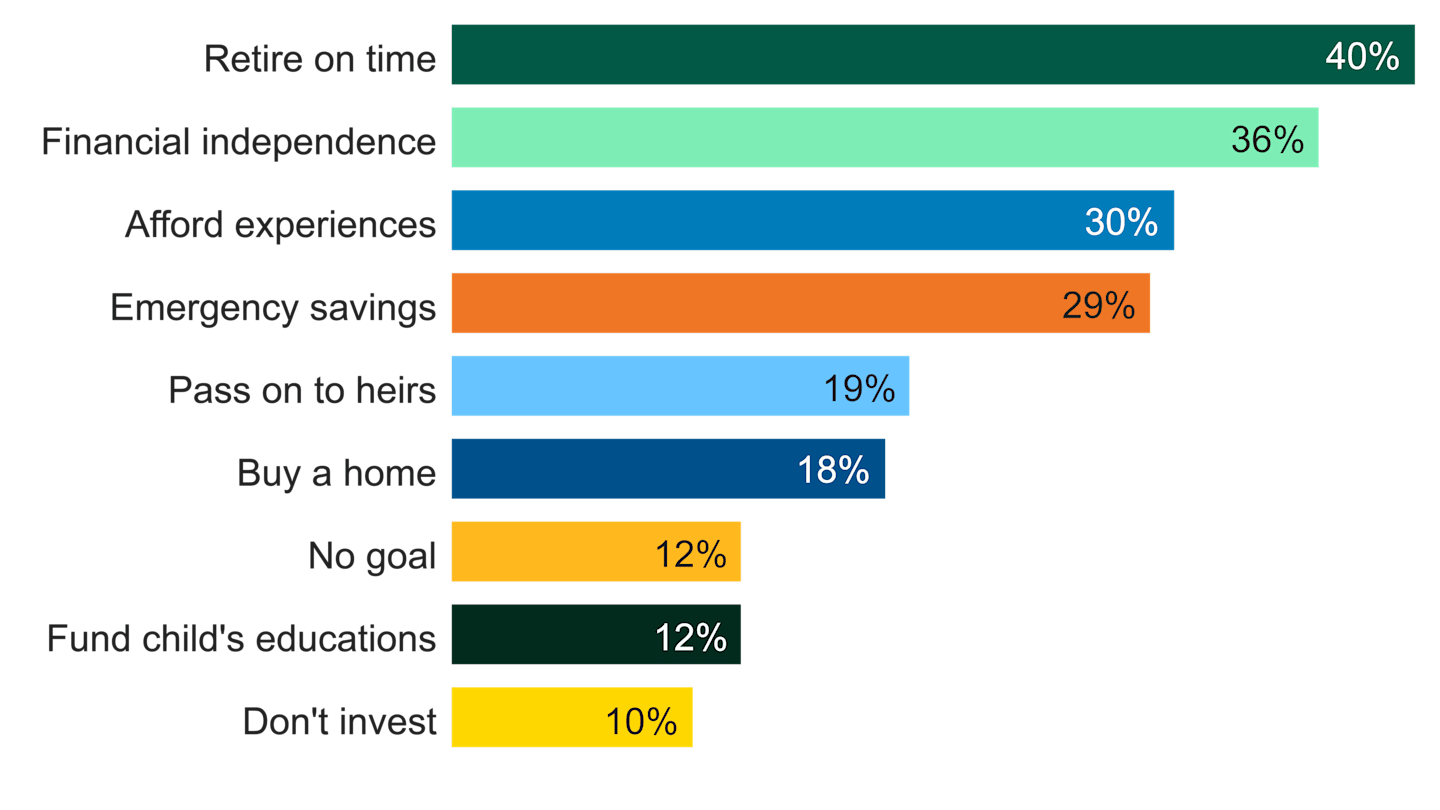

Why Americans Invest

People invest for a lot of reasons. How do your goals stack up to most Americans?

Source: Empower 2025 Survey, February 2025.

5 Concepts Every Investor Should Know

All investors should understand a few foundational concepts. These principles can help you make smarter decisions and avoid common pitfalls as you build your portfolio. They can also help you understand the financial jargon you will hear along the way.

Risk and Reward

Every investment carries some level of risk. Generally, the higher the potential return (the rewards), the higher the risk. For example, stocks can offer higher return potential but are more volatile, while bonds are typically more stable and offer lower return potential.

Compound Interest

Often called the “eighth wonder of the world,” compound interest is when your investment earns interest, and then that interest earns interest. Over time, this snowball effect can significantly grow your wealth—even if you start investing regularly with small amounts. While compounding can lead to exponential growth with positive returns, negative returns can erode your investment.

Diversification and Asset Allocation

Diversification means spreading your money across different types of investments to reduce risk. Instead of putting all your money into one stock fund, you might invest in a mix of stock and bond mutual funds or ETFs. This way, if one investment performs poorly, others may balance it out.

Also note, diversification is different from asset allocation, or how your portfolio is divided across those diversified asset classes (a collection of investments with similar characteristics and market performance.) Understand the difference between asset allocation and asset classes.

Risk Tolerance

Risk tolerance refers to how much investment risk you are comfortable taking. Knowing your risk comfort level can help you pick investments that are well-suited for your financial goals. An important element for your risk comfort level is how much time you have before you’ll need the money.

Time Horizon

Your time horizon is how long you plan to keep your money invested before you need it. Longer time horizons allow you to take on more risk, since you have time to recover from market dips. Shorter time horizons usually call for more conservative investments.

Types of Investments: What Beginners Should Know

When you're just starting out, the world of investing can seem overwhelming. But most investments fall into a few basic categories. Understanding these will help you decide where to put your money based on your goals, risk tolerance and time horizon.

Individual Stocks

Stocks represent ownership in a company and can potentially help grow your portfolio. When you buy a stock, you become a shareholder and can benefit from the company’s growth through price increases and dividends. Stocks can offer higher returns but are also more volatile.

Individual Bonds

Bonds are essentially loans you give to governments or corporations. In return, they commit to pay you interest over time and return your principal at maturity. Bonds are generally considered more stable than stocks but offer lower return potential. Because of this, they can play an important role in a portfolio.

Mutual Funds and ETFs

These are collections of stocks, bonds, or other assets bundled together. These bundles make them more diversified than a single stock or bond investment, but not as diversified as if you had a collection of stock and bond funds or ETFs in your portfolio. What’s the difference between them? Compare the mutual funds and ETFs.

Both can be actively managed, meaning an investment professional chooses the investments within the mutual fund or ETF and manages it regularly with the goal of beating its benchmark, which is a standard or index used to measure its performance and risk. Passive mutual funds and ETFs use a strategy that aims to achieve the same return as a particular index, such as the S&P 500®.

Other types of investments include real estate, precious metals (gold and silver, for example), commodities (physical products), and even digital assets (cryptocurrencies). As with any type of investment, these come with their own set of risks and considerations.

How to Get Started Investing

Now that you know some key concepts about investing, you’re ready to get started. Here are three steps you won’t want to pass up. They are just highlights and you can read more details about building your own portfolio.

1. Set a Goal

Your goal should include what you are investing for, how much money you will need, and how long you have to invest. These elements can help you choose the right account to use (retirement, non-retirement, college specific), how much you may need to invest regularly, and which investments may be suitable for your goal.

Not sure how much to invest to reach your goal? Our savings calculator can help.

Choose the Right Account Type

Here’s a quick overview.

Account Type | Purpose |

|---|---|

Single or Joint Account | General goals, i.e., emergency savings or home down payment |

IRAs | Traditional for tax-deferred retirement savings. Roth for tax-free withdrawals in retirement |

401(k) or other employer-sponsored account | Retirement savings at work, sometimes with employer match. |

529s, CESAs, UTMAs | All can be used to save for an education. Compare now. |

2. Determine Your Risk Level

You can figure out how much risk you want to take on your own, with a personal risk assessment, or work with a professional. Things you’ll want to consider are how much money you’re willing to lose if the markets take a dip and how long you have to invest.

3. Choose Your Investments

After defining your goal, timeline and risk level, it’s time to choose which investments may best help you reach your goal. A key is the diversification mentioned earlier, with a mix of investments that may help your portfolio weather market dips better. Here are three ways to choose investments with American Century.

Do-It-Yourself Choose from our wide variety of mutual funds to build a diversified portfolio. Explore Mutual Funds

Go for Convenience Select an already diversified portfolio that’s managed by our professionals. Review Our Portfolios

Get Advice Choose a one-time consult or in-depth planning and advice, with portfolio oversight. Discover Advice Options

Investing Strategies: Follow Examples of Seasoned Investors

Following time-tested strategies may help you have a better chance at reaching your goals. Here are a few to consider.

1. Start Early (or Start Now)

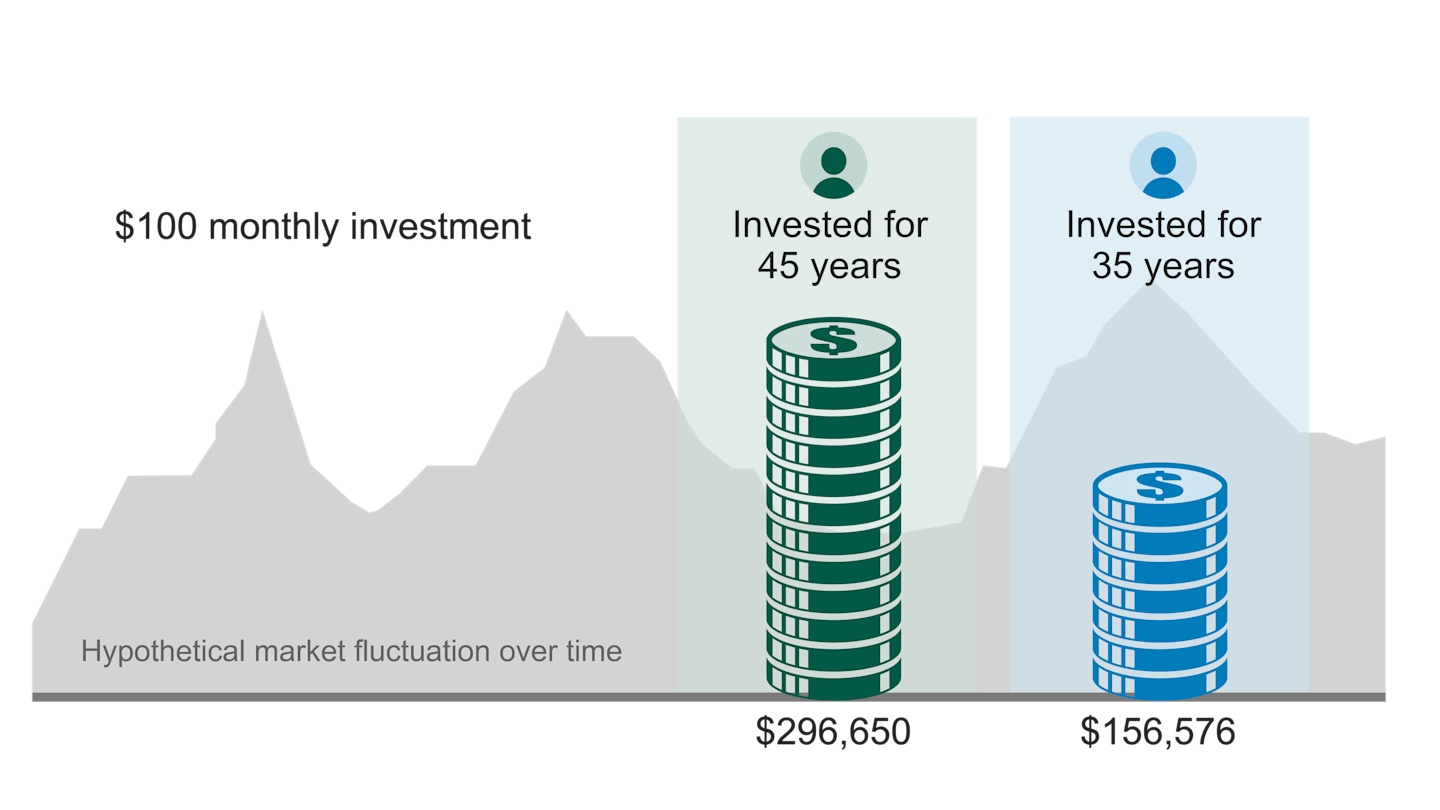

People tend to put off some important decisions in life, including investing. However, seasoned investors have had much success due to time. The difference between starting now and 10 years from now is eye-opening.

What a Difference a Decade Makes

Source: American Century Investments, August 2025.

This hypothetical situation contains assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. It assumes a $2,500 initial investment and $100 a month for 35 and 45 years, with a 6% annual rate of return and reinvestment of interest and dividends. The value of the investment may fluctuate with market conditions, and your redemption may be worth more or less than its original value. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities.

2. Invest Regularly

Investing on a regular basis, such as monthly or quarterly, can help you build up your account balance and possibly take advantage of market swings with a better price because you buy more shares when prices are low and less shares when prices are high."

This strategy, known as dollar-cost averaging can also help take emotions out of “when” to invest and may help you stick to your investing plan better. An easy way to implement this strategy is to automatically invest from your bank account.

3. Forget FOMO

While many of us have a fear of missing out (FOMO) on a hot investment or the ones you hear about on social media, they may not be right for your goals. They also could be tomorrow’s losers. The better option? Stick to your own plan and the investments that fit you.

4. Stay Invested

When the markets get rocky, it can be tempting to stop investing or to move your money to a perceived safer option, such as a cash equivalent like a money market. However, in doing so, you could miss out on some of the market's best days and the money you could have had if you’d stuck with your plan.

Another way to say this is not to “time” the markets, which means trying to get in and out at the right time. Few people are successful at market timing, and time in the market is a much better strategy. Even the most well-known investor, Warren Buffett, said marketing timing doesn’t work and isn’t necessary for success.

It is tempting to react impulsively to short-term market swings, but history shows that those who remain steadfast in their investment strategy are often rewarded.²

5. Ask for Help

Investing can feel complicated, especially if you don’t have a lot of experience (yet). It never hurts to ask for help from a professional. While advisors do have fees, they may not be as much as you think. Here we offer one-time consultations with a certified financial planner, or more in-depth planning and advice if your needs warrant that. Learn more about our advice options.

What Else to Think About Before and After You Start Investing

So far, I’ve covered some of the fundamentals of investing, but I also want you to think about other important elements so you can make the best decisions as you start and throughout your investing life cycle. Here goes:

1. Fees Matter

While many investors look at past performance and ratings to see if they want to invest in a particular product, another thing that can affect your returns is how much they cost.

Active investments, which are managed by investment professionals who aim to beat whatever index they use as a benchmark, generally have higher fees than passive funds. Passive funds are designed to mimic an index. The published returns you see should account for the fees.

2. Volatility Happens

Even if you understand that markets move up and down, watching your investments fall may be scary. We believe it’s important to resist the urge to pull all your money out of the market.

Historically, investors who stay invested during a downturn see bigger returns than those who move to the sidelines (to perceived safer investments or stop investing altogether) during volatility. That was shown again in the first half of 2025 when markets fell in the first and second quarters, then reached record highs by the end of the quarter.

12.1% Loss vs. 6.2% Gain

The loss investors would have experienced if they missed the five best days in the first half of 2025 versus gains for the same period had they stayed invested.³

Source: American Century Investments, based on Morningstar Direct data of the S&P 500® Index from January 1, 2025 to June 30, 2025

3. Debt and Investing

If you are investing and carrying high-interest consumer debt, you may want to think about which should be the priority. Keep this in mind: Paying down debt also yields a return in the form of the interest you’re saving over time. For example, if you’re paying on a credit card with 20% interest, the amount of money you could save by paying off the card first may be more beneficial than paying it off slowly and investing in the market. One caveat in my opinion: If your employer offers a retirement plan with a match, don’t miss out on that. Invest enough to get the match while you’re paying off high-interest cards.

Put Time on Your Side: Start Investing

The best time to start investing is now to position yourself for potential growth opportunities. If you need help getting started, we’d love to help with guidance about your options or advice and planning if you need more.

Authors

Financial Consultant

Ready to Start Investing for Your Goals?

You can contact us for more information or go for it now.

What Is the Average Stock Market Return? Nerdwallet.com, July 2025.

Warran Buffett Has It Right: Time in the Market Trumps Market Timing, Forbes.com, September 2024.

Source: American Century Investments, Morningstar Direct, August 2025.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns.

American Century's advisory services are provided by American Century Investments Private Client Group, Inc., a registered investment advisor. These advisory services provide discretionary investment management for a fee. The amount of the fee and how it is charged depend on the advisory service you select. American Century’s financial consultants do not receive a portion or a range of the advisory fee paid. Contact us to learn more about the different advisory services. All investing involves the risk of losing money.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.

Diversification does not assure a profit nor does it protect against loss of principal.

Dollar cost averaging does not ensure a profit or protect against a loss in declining markets. This investment strategy involves continuous investment in securities, regardless of fluctuating price levels. An investor should consider his or her financial ability to continue purchases in periods of low or fluctuating price levels.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

©2026 Morningstar, Inc. All Rights Reserved. Certain information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.