2026 U.S. Equity Outlook

First Quarter

Key Takeaways

Growth Stocks: We see tremendous opportunities in artificial intelligence (AI) and innovation ahead, but the path is likely to be rocky.

Value Stocks: Investor appetite for risk has increased interest in unprofitable and non-revenue stocks, creating an unstable footing in an environment filled with uncertainties.

Growth Stocks

Walking the Tightrope: Navigating Risks and Opportunities in U.S. Markets

The market seems to be focused on three main issues:

Questions about stock valuations.

The sustainability of spending on AI.

The likelihood of more interest rate cuts by the Federal Reserve (Fed).

None of these has a simple, straightforward answer. We expect volatility to continue, but this shouldn’t obscure significant opportunities.

Concentration and Valuation Remain Issues

Valuations on large-cap stock indexes are high compared to historical averages. Growth stocks are similarly expensive relative to value stocks. Market concentration in the top 10 and top 20 companies also remains at remarkably high levels.

The implication is that heavy reliance on a handful of companies increases the risk of poor results or forecasts. And if growth expectations — particularly those related to AI — prove unrealistic, corrections could be sharp.

However, it’s also true that corporate earnings growth has been strong, and forecasts for 2026 are even better. If companies can meet or surpass their 2026 forecasts, that would be a positive sign for valuations and the market.

Will Stimulus Shift the Fed’s 2026 Playbook?

The outlook for monetary policy is complicated. On the one hand, the market has been pricing in additional rate cuts in late 2025 and 2026. On the other hand, we doubt that the Fed will cut as aggressively as the market seems to expect. This is because all the major core inflation measures are rising and remain well above the Fed’s 2% target, according to the latest data.

Note, too, that there’s already positive monetary stimulus in the pipeline because there’s a considerable lag between Fed rate changes and their eventual economic effects. As a result, the Fed’s rate cuts in late 2024 should just now be beginning to take effect.

We expect further stimulus in early 2026 to come from tax refunds under the One Big Beautiful Bill. Our analysis shows that those making between $50,000 and $500,000 will receive refunds ranging from $580 to $4,900. We estimate that approximately 107 million tax returns fall in this range. Will the Fed feel the need to slash rates further with so much stimulus on the way?

AI: Bubble or Breakthrough?

We understand the talk about the AI bubble. Yes, the technology could be the most economically transformative tool ever created. However, massive investment is necessary to turn that potential into reality.

Some companies in the AI ecosystem have experienced strong profit growth. However, others have seen their stocks perform exceptionally well despite the gap between initial AI infrastructure spending and the cash flow generated by that investment.

While the questions are valid, we disagree with the broad conclusions about an AI bubble. Bubbles are usually marked by excess, such as excess capacity and excessive debt, which are two clear examples.

But it should be clear that, so far, the availability of chips and computing power is severely limited. Chip company results indicate that demand for computing power greatly surpasses their capacity to supply it.

We don’t currently see excessive debt financing. The largest spenders on AI are Alphabet, Amazon.com, Meta Platforms and Microsoft. These companies are also among the most profitable worldwide, and their investments are funded by free cash flow.

A third question is, what’s the payoff for these investments? We’d say that all the companies mentioned above report significant bottom-line improvements from using AI. So, the largest AI spenders and most advanced AI users are seeing a contribution to profitability from the technology.

Indeed, the main takeaway from their third-quarter earnings reports is that AI spending is expected to be significantly higher in 2026 than in 2025. So far, we haven’t mentioned anything about sovereign AI. However, NVIDIA CEO Jensen Huang recently attended the U.S./Saudi Investment Forum. Saudi Arabia, the United Arab Emirates, the U.K., the EU? It’s hard to believe, given the bubble narrative, but there’s arguably upside risk in AI spending.

Individual Security Selection Will Be Key in 2026

Of course, we don’t believe that all AI spending or companies are created equal. Investments that are debt-financed and have uncertain use cases are right to be questioned.

We’re continuing to seek more evidence of a return on AI investment by asking pointed questions of corporate management teams. This is a crucial component of our approach. We believe that identifying potential AI winners will come from deep, fundamental research and insight into company financials.

Add it all up, and we’re investing in AI-related stocks that demonstrate strong fundamentals, solid business trends and attractive risk/reward profiles over several years. While we expect some short-term turbulence as the challenges we mentioned are addressed, we believe that AI is a transformative technology. Companies that successfully navigate this environment will likely reap the benefits in the long run.

Value Stocks

No Revenue, No Earnings, No Problem in Today’s Market

In Oklo Inc.’s most recent quarterly report, the word “revenue” doesn’t appear on its statement of operations. The company doesn’t make any money.

Yet, the share price for this maker of small nuclear reactors is up 374% over the last year through November 18.

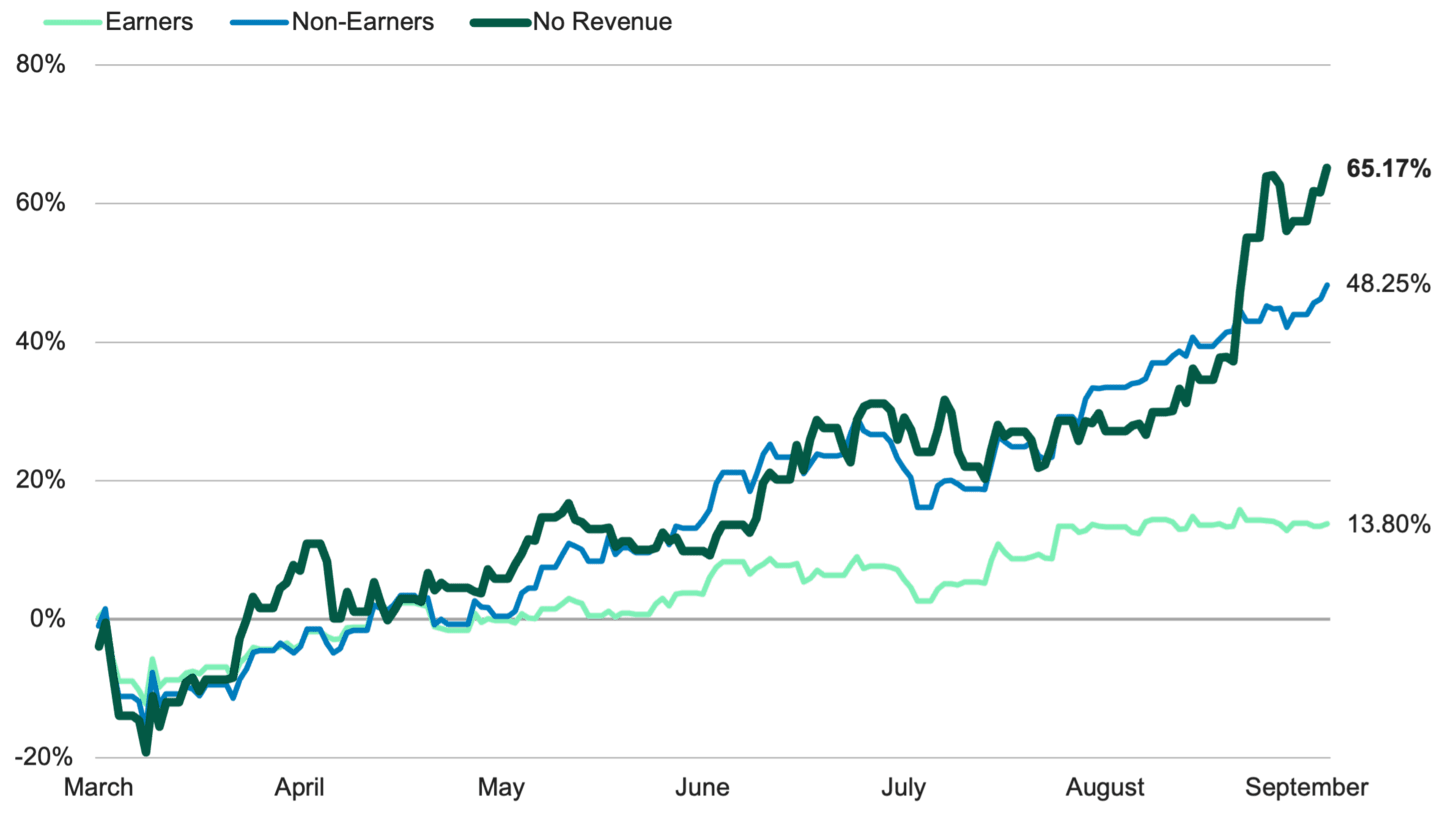

Oklo isn’t an outlier in today’s market environment. As Figure 1 illustrates, companies in the Russell 2000® Value Index that generate no revenue or are unprofitable have outperformed those that make money.

Figure 1 | Companies With No Revenues Have Climbed 65% Since March

Russell 2000® Value Index (Q1-Q3 2025)

Data from 3/31/2025 – 9/30/2025. Source: FactSet. Past performance is no guarantee of future results.

Much of the attention surrounding today’s risk-on environment centers on the performance of the so-called Magnificent Seven mega-cap stocks or investments related to AI.

However, Figure 1 demonstrates how the riskier stocks among smaller companies have surged this year, compared to those of profitable companies with steadier fundamentals.

As value investors who seek to invest in companies with business models we think are durable, today’s risk-on landscape presents a challenge. However, history tells us that while investing in riskier stocks can offer short-term rewards, a downturn can reverse these fortunes, while higher-quality stocks have tended to outperform over time.

There are legitimate reasons why a small-cap company might not generate revenue or profit.

In Oklo’s case, it’s developing a nuclear power product. Since Oklo aims to build and sell power from small nuclear reactors, this process is inherently capital-intensive and subject to rigorous regulatory review. Nuclear power also carries political and societal sensitivities.

Given the power demands of AI, Oklo could benefit if its mini-reactors reach the market. However, despite its share performance, the company faces several challenges before it can turn a profit.

Over the past year, even more speculative investments have performed strongly, driven by investors’ increased risk appetite.

Cipher Mining builds data centers for Bitcoin mining. As a result, the company’s share performance — up 118% through November 18 over the past year — is closely linked to cryptocurrency prices. This might appeal to investors seeking quick gains. However, we believe that cryptocurrencies are too volatile and lack clear indicators for why their prices, which have mostly been falling recently, fluctuate.

Instead, we gravitate toward stocks that present less risk. One example is stocks that pay consistent dividends. These companies tend to exhibit strong business fundamentals and are less susceptible to market swings.

Dividends are also a significant source of income, accounting for nearly a third of total returns since 1940. We believe that dividends are particularly significant in today’s expensive stock market, where price returns are likely to be muted going forward.

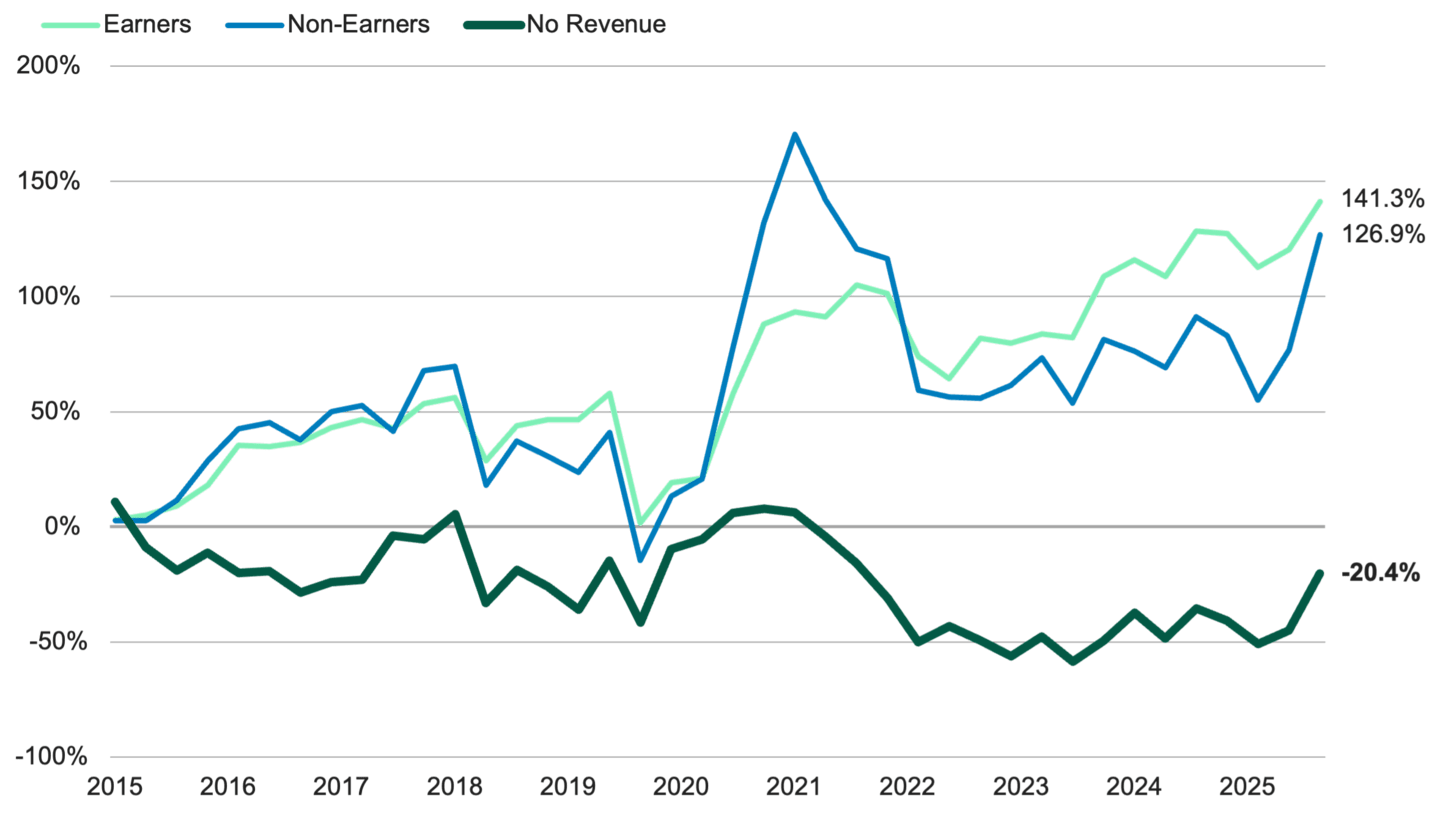

Still, as investors grab up risk assets, dividend stocks have fallen behind. Even so, no-revenue companies in the Russell 2000® Value Index, whose performance has recently soared in the market, don’t, in our view, present suitable long-term strategies. Figure 2 shows that these companies have produced negative returns over the past decade.

Figure 2 | Companies With No Revenue Have Historically Underperformed

Russell 2000® Value Index (Last 10 Years)

Data from 9/30/2015 – 9/30/2025. Source: FactSet. Past performance is no guarantee of future results.

The impulse to chase the rapid rise of lower-quality stocks is understandable. However, we believe, and historical data supports, that a focus on higher-quality investments can outperform over time.

Appetite for Change: What’s Next for Packaged Food Stocks?

There’s a lot of talk these days about whether an AI bubble exists, which draws comparisons to the internet bubble of the late 1990s and early 2000s.

A better contemporary comparison — at least for now — to the dotcom crash is how packaged foods stocks have performed. Packaged food stocks in the S&P 500 have trailed the broader index by 43% over the past two years, echoing the same group's underperformance in the two years before the dot-com bubble burst.

In the two years following the dot-com crash, stocks in tech-related subsectors lagged behind the broader index by roughly the same margin that packaged food companies are lagging today (packaged food companies experienced several years of outperformance after the dot-com crash).

The packaged foods industry aligns well with the broader investment thesis for consumer staples: People need to eat, so they will continue to buy food, even if the economy sours.

However, several broad conditions have recently bedeviled food stocks, which have been weighed down by weak volumes. Some consumers are eating healthier, which often means eating less. Other consumers are taking GLP-1s, better known as weight loss drugs, which also cause them to eat less.

Then, there are lower- to middle-income consumers who feel uneasy about the economy or their own finances, leading them to spend less on food or opt for cheaper private label offerings. This trade-down may partly result from food companies maintaining the higher prices they charged during the pandemic for too long.

This all sounds bad for packaged food companies, and for now, it is. Some of these challenges to food stocks could ultimately be fleeting, as they have been in the past. Cocoa prices were a big problem for snack companies a year ago, but have largely normalized this year. It’s not the first time consumer preferences have shifted, and food companies have often innovated to meet these changes.

But food companies have tumbled precipitously. While it’s possible they make up the ground they’ve lost, it’s hard to see that happening in the foreseeable future.

Inflation in Focus

Get market updates, behavioral insights and investment ideas.

A form of securitized debt that represents ownership in pools of mortgage loans and their payments.

A form of securitized debt (defined below), ABS are structured like mortgage-backed securities (MBS, defined below). But instead of mortgage loans or interest in mortgage loans, the underlying assets may include such items as auto loans, home equity loans, student loans, small business loans, and credit card debt. The value of an ABS is affected by changes in the market's perception of the assets backing the security, the creditworthiness of the servicing agent for the loan pool, the originator of the loans, or the financial institution providing any credit enhancement.

Basis points are used in financial literature to express values that are carried out to two decimal places (hundredths of a percentage point), particularly ratios, such as yields, fees, and returns. Basis points describe values that are typically on the right side of the decimal point--one basis point equals one one-hundredth of a percentage point (0.01%). So 25 basis points equals 0.25%, and 50 basis points equals 0.50%. Only when basis points equal or exceed 100 does the value move to the left of the decimal point--100 basis points equals 1.00%, 500 basis points equals 5.00%, etc.

Securities and issuers rated AAA to BBB are considered/perceived “investment-grade”; those rated below BBB are considered/perceived non-investment-grade or more speculative.

Beta is a standard measurement of potential investment risk and return. It shows how volatile a security's or an investment portfolio's returns have been compared with their respective benchmark indices. A benchmark index's beta always equals 1. A security or portfolio with a beta greater than 1 had returns that fluctuated more, both up and down, than those of its benchmark, while a beta of less than 1 indicates less fluctuation than the benchmark.

Represents securities that are taxable, registered with the Securities and Exchange Commission, and U.S. dollar-denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Entity responsible for oversight of a nation’s monetary system, including policies and interest rates.

Volatility indexes are forward-looking measures of the market's expectations of volatility (or how much a stock index's price moves). The CBOE manages and publishes three of the most widely used volatility indexes based on three major stock indexes: The VIX Index tracks the expected 30-day future volatility of the S&P 500 Index, the VXN Index tracks the expected 30-day future volatility of the NASDAQ-100 Index and the VXD Index tracks the expected 30-day future volatility of the Dow Jones Industrial Average Index. VIX, VXN and VXD are the ticker symbols for these three volatility indexes. The VIX in particular is a widely used measure of market risk and is often referred to as the "investor fear gauge."

A form of securitized debt, typically backed by pools of corporate loans and their payments.

MBS that represent ownership in pools of commercial real estate loans used to finance the construction and improvement of income-producing properties, including office buildings, shopping centers, industrial parks, warehouses, hotels, and apartment complexes.

Short-term debt issued by corporations to raise cash and to cover current expenses in anticipation of future revenues.

Commodities are raw materials or primary agricultural products that can be bought or sold on an exchange or market. Examples include grains such as corn, foods such as coffee, and metals such as copper.

CPI is the most commonly used statistic to measure inflation in the U.S. economy. Sometimes referred to as headline CPI, it reflects price changes from the consumer's perspective. It's a U.S. government (Bureau of Labor Statistics) index derived from detailed consumer spending information. Changes in CPI measure price changes in a market basket of consumer goods and services such as gas, food, clothing, and cars. Core CPI excludes food and energy prices, which tend to be volatile.

Debt instruments issued by corporations, as distinct from those issued by governments, government agencies, or municipalities. Corporate securities typically have the following features: 1) they are taxable, 2) they tend to have more credit (default) risk than government or municipal securities, so they tend to have higher yields than comparable-maturity securities in those sectors; and 3) they are traded on major exchanges, with prices published in newspapers.

Correlation measures the relationship between two investments--the higher the correlation, the more likely they are to move in the same direction for a given set of economic or market events. So if two securities are highly correlated, they will move in the same direction the vast majority of the time. Negatively correlated investments do the opposite--as one security rises, the other falls, and vice versa. No correlation means there is no relationship between the movement of two securities--the performance of one security has no bearing on the performance of the other. Correlation is an important concept for portfolio diversification--combining assets with low or negative correlations can improve risk-adjusted performance over time by providing a diversity of payouts under the same financial conditions.

The coupon interest rate is the stated/set interest rate that is assigned to each interest-paying fixed-income security when it is issued. It is used to calculate the security's periodic interest payments to investors; the coupon rate is applied to the security's principal value to generate interest payments.

Credit quality reflects the financial strength of the issuer of a security, and the ability of that issuer to provide timely payment of interest and principal to investors in the issuer's securities. Common measurements of credit quality include the credit ratings provided by credit rating agencies such as Standard & Poor's and Moody's. Credit quality and credit quality perceptions are a key component of the daily market pricing of fixed-income securities, along with maturity, inflation expectations and interest rate levels.

Measurements of credit quality (defined below) provided by credit rating agencies (defined below). Those provided by Standard & Poor's typically are the most widely quoted and distributed, and range from AAA (highest quality; perceived as least likely to default) down to D (in default). Securities and issuers rated AAA to BBB are considered/perceived to be "investment-grade"; those below BBB are considered/perceived to be non-investment-grade or more speculative.

Credit risk is the risk that the inability or perceived inability of the issuers of debt securities to make interest and principal payments will cause the value of those securities to decrease. Changes in the credit ratings of debt securities could have a similar effect.

A debt instrument, including bonds, certificates of deposit or preferred stocks.

Deflation is the opposite of inflation (see Inflation); it describes a decline in prices for goods, assets and services, and is considered a highly undesirable economic outcome by economists and policymakers.

A payment of a company's earnings to stockholders as a distribution of profits.

The return earned by a stock investor, calculated by dividing the amount of annual dividends per share by the current share price of the stock.

Occurs when the investor or fund manager uses techniques attempting to prevent a decrease in the value of the investment.

Duration is an important indicator of potential price volatility and interest rate risk in fixed income investments. It measures the price sensitivity of a fixed income investment to changes in interest rates. The longer the duration, the more a fixed income investment's price will change when interest rates change. Duration also reflects the effect caused by receiving fixed income cash flows sooner instead of later. Fixed income investments structured to potentially pay more to investors earlier (such as high-yield, mortgage, and callable securities) typically have shorter durations than those that return most of their capital at maturity (such as zero-coupon or low-yielding noncallable Treasury securities), assuming that they have similar maturities.

The risk and/or opportunity to a company's market valuation resulting from environmental, social and governance (ESG) factors. Depending on the sector, environmental and social factors include, but are not limited to, 1) climate change, 2) water stress, 3) product safety and quality (supply chain and manufacturing), 4) cybersecurity and data privacy, and 5) human capital management. Regardless of the sector, governance factors include: 1) business (mis)conduct, 2) board composition, independence and entrenchment, 3) accounting practices, 4) ownership structure, and 5) executive pay-for-sustainability performance alignment.

Together with the national central banks of the European Union member states whose currency is the Euro (€), the European Central Bank (ECB) defines and implements the monetary policy for the Euro area.

The eurozone is sometimes referred to as the euro area and represents the member states that participate in the economic and monetary union (EMU) with the European Union (EU). The eurozone currently consists of: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

The federal funds rate is an overnight interest rate banks charge each other for loans. More specifically, it's the interest rate charged by banks with excess reserves at a Federal Reserve district bank to banks needing overnight loans to meet reserve requirements. It's an interest rate that's mentioned frequently within the context of the Federal Reserve's interest rate policies. The Federal Reserve's Open Market Committee (defined below) sets a target for the federal funds rate (which is a key benchmark for all short-term interest rates, especially in the money markets), which it then supports/strives for with its open market operations (buying or selling government securities).

The Fed is the U.S. central bank, responsible for monetary policies affecting the U.S. financial system and the economy.

A floating rate is associated with payments that fluctuate with an underlying interest rate level, as opposed to paying fixed-rate income.

Investment "fundamentals," in the context of investment analysis, are typically those factors used in determining value that are more economic (growth, interest rates, inflation, employment) and/or financial (income, expenses, assets, credit quality) in nature, as opposed to "technicals," which are based more on market price (into which fundamental factors are considered to have been "priced in"), trend, and volume factors (such as supply and demand), and momentum. Technical factors can often override fundamentals in near-term investor and market behavior, but, in theory, investments with strong fundamental supports should maintain their value and perform relatively well over long time periods.

One of the biggest sectors in the municipal securities (defined below) market. Typically, these bonds are secured by the full faith and credit pledge (defined above) of the issuer and usually supported by the issuer's taxing power (tax revenues provide the means by which most interest payments are made). GO bonds can be issued by states, counties, cities, towns and regional districts to fund a variety of public projects, including construction of and improvements to schools, highways, and water and sewer systems.

The Global Economic Policy Uncertainty Index aims to quantify the level of uncertainty surrounding future economic policies based on news coverage, tax regulations and economic forecasts. The global index is an average of national economic policy uncertainty indices for 20 countries.

A measure of the total economic output in goods and services for an economy.

High-yield bonds are fixed income securities with lower credit quality and lower credit ratings. High-yield securities are those rated below BBB- by Standard & Poor's.

Inflation, sometimes referred to as headline inflation, reflects rising prices for consumer goods and services, or equivalently, a declining value of money. Core inflation excludes food and energy prices, which tend to be volatile. It is the opposite of deflation (see Deflation).

Debt securities that offer returns adjusted for inflation; a feature designed to eliminate the inflation risk.

Published on a monthly basis, the ISM surveys more than 300 manufacturing firms on employment, production, new orders, supplier deliveries, and inventories. A composite diffusion index of national manufacturing conditions is constructed, where readings above (below) 50 percent indicate an expanding (contracting) manufacturing sector.

A debt security with a relatively low risk of default issued and sold by a corporation to investors.

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

This phrase refers to seven stocks that have been high-performing in the technology sector — Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

A form of securitized debt (defined below) that represents ownership in pools of mortgage loans and their payments. Most MBS are structured as "pass-throughs"--the monthly payments of principal and interest on the mortgages in the pool are collected by the financial entity that is servicing the mortgages and are "passed through" monthly to investors. The monthly and principal payments are key differences between MBS and other bonds such as Treasuries, which pay interest every six months and return the whole principal at maturity. Most MBS are issued or guaranteed by the U.S. government, a government-sponsored enterprise (GSE), or by a private lending institution.

A free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States.

The MSCI ACW (All Country World) Investable Market Index (IMI) captures large, mid and small cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 9,139 constituents, the index is comprehensive, covering approximately 99% of the global equity investment opportunity set.

A free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

These are long-term municipal securities (defined below) with maturities of 10 years or longer.

Debt securities typically issued by or on behalf of U.S. state and local governments, their agencies or authorities to raise money for a variety of public purposes, including financing for state and local governments as well as financing for specific projects and public facilities. In addition to their specific set of issuers, the defining characteristic of munis is their tax status. The interest income earned on most munis is exempt from federal income taxes. Interest payments are also generally exempt from state taxes if the bond owner resides within the state that issued the security. The same rule applies to local taxes. Another interesting characteristic of munis: Individuals, rather than institutions, make up the largest investor base. In part because of these characteristics, munis tend to have certain performance attributes, including higher after-tax returns than other fixed income securities of comparable maturity and credit quality and low volatility relative to other fixed-income sectors. The two main types of munis are general obligation bonds (GOs) and revenue bonds. GOs are munis secured by the full faith and credit of the issuer and usually supported by the issuer's taxing power. Revenue bonds are secured by the charges tied to the use of the facilities financed by the bonds.

For most bonds and other fixed-income securities, nominal yield is simply the yield you see listed online or in newspapers. Most nominal fixed-income yields include some extra yield, an "inflation premium," that is typically priced/added into the yields to help offset the effects of inflation (see Inflation). Real yields (see Real yield), such as those for TIPS (see TIPS), don't have the inflation premium. As a result, nominal yields are typically higher than TIPS yields and other real yields.

MBS that represent ownership in pools of commercial real estate loans used to finance the construction and improvement of income-producing properties. Non-agency CMBS are not guaranteed by the U.S. government or a government-sponsored enterprise.

The personal consumption expenditures ("PCE") price deflator—which comes from the Bureau of Economic Analysis' quarterly report on U.S. gross domestic product—is based on a survey of businesses and is intended to capture the price changes in all final goods, no matter the purchaser. Because of its broader scope and certain differences in the methodology used to calculate the PCE price index, the Federal Reserve ("the Fed") holds the PCE deflator as its preferred, consistent measure of inflation over time.

The price of a stock divided by its annual earnings per share. These earnings can be historical (the most recent 12 months) or forward-looking (an estimate of the next 12 months). A P/E ratio allows analysts to compare stocks on the basis of how much an investor is paying (in terms of price) for a dollar of recent or expected earnings. Higher P/E ratios imply that a stock's earnings are valued more highly, usually on the basis of higher expected earnings growth in the future or higher quality of earnings.

Measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

Indicator of the economic health of the manufacturing sector, based on monthly surveys.

Nationally recognized statistical rating organizations assign quality ratings to reflect forward-looking opinions on the creditworthiness of loan issuers.

A form of monetary policy used by central banks to stimulate economic growth. In QE, a central bank (such as the U.S. Federal Reserve) buys domestic government securities to increase the domestic money supply, lower interest rates, and encourage investors to make investments in riskier assets such as stocks and high-yield securities.

Real estate investment trusts (REITs) are securities that trade like stocks and invest in real estate through properties or mortgages.

For most bonds and other fixed-income securities, real yield is simply the yield you see listed online or in newspapers (see Yield) minus the premium (extra yield) added to help counteract the effects of inflation (see Inflation). Most "nominal" fixed-income yields (see Nominal yield) include an "inflation premium" that is typically priced into the yields to help offset the effects of inflation. Real yields, such as those for TIPS, don't have the inflation premium. As a result, TIPS yields and other real yields are typically lower than most nominal yields.

Trades or investments made on the assumption that the world economy will rebound due to reflation (a reversal of deflation due to a government's economic fiscal or monetary policy to stimulate the economy).

One of the biggest sectors in the municipal debt (defined above) market. Unlike a general obligation (GO) bond (defined above), revenue bonds are not backed by a municipal issuer's taxing authority. Instead, interest and principal are secured by the net revenues (tolls, fees, or other charges tied to usage) from the project or facility being financed. Revenue bonds are issued to finance a variety of capital projects, including construction or refurbishment of utility and waste disposal systems, highways, bridges, tunnels, air and seaport facilities, schools and hospitals.

Measures the performance of those Russell 1000 Index companies (the 1,000 largest publicly traded U.S. companies, based on total market capitalization) with higher price-to-book ratios and higher forecasted growth values.

Measures the performance of those Russell 1000 Index companies (the 1,000 largest publicly traded U.S. companies, based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values.

Measures the performance of those Russell 2000 Index companies (the 2,000 smallest of the 3,000 largest publicly traded U.S. companies, based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values.

A style-concentrated index designed to track the performance of stocks that exhibit the strongest growth characteristics by using a style-attractiveness weighting scheme.

The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

The S&P 500 Value Index is a style-concentrated index that measures stocks in the S&P 500 using three factors: the ratios of book value, earnings, and sales to price. It is not an investment product available for purchase.

Provides investors with a benchmark for mid-sized companies. The index covers over 7% of the U.S. equity market, and seeks to remain an accurate measure of mid-sized companies, reflecting the risk and return characteristics of the broader mid-cap universe on an on-going basis.

A capitalization-weighted index consisting of 600 domestic stocks, measures the small company segment of the U.S. market.

Debt resulting from the process of aggregating debt instruments into a pool of similar debts, then issuing new securities backed by the pool (securitizing the debt). Asset-backed and mortgage-backed securities (ABS and MBS, defined further above) and collateralized mortgage obligations (CMOs, defined above) are common forms of securitized debt. The credit quality (defined above) of securitized debt can vary significantly, depending on the underwriting standards of the original debt issuers, the credit quality of the issuers, economic or financial conditions that might affect payments, the existence of credit backing or guarantees, etc.

A security that has a higher priority compared to another in the event of liquidation.

A country's own government-issued debt, priced in its native currency, that can be sold to investors in other countries to raise needed funds. For example, U.S. Treasury debt is U.S. sovereign debt, and would be referred to as sovereign debt when bought by foreign investors. Conversely, debt issued by foreign governments and priced in their currencies would be sovereign debt to U.S. investors.

In fixed income parlance, spreads are simply measured differences or gaps that exist between two interest rates or yields that are being compared with each other. Spreads typically exist and are measured between fixed income securities of the same credit quality (defined above), but different maturities, or of the same maturity, but different credit quality. Changes in spreads typically reflect changes in relative value, with "spread widening" usually indicating relative price depreciation of the securities whose yields are increasing most, and "spread tightening" indicating relative price appreciation of the securities whose yields are declining most (or remaining relatively fixed while other yields are rising to meet them). Value-oriented investors typically seek to buy when spreads are relatively wide and sell after spreads tighten.

In fixed income parlance, these are typically non-Treasury securities that usually trade in the fixed income markets at higher yields than same-maturity U.S. Treasury securities. The yield difference between Treasuries and non-Treasuries is called the "spread" (defined further above), hence the name "spread sectors" for non-Treasuries. These sectors--such as corporate-issued securities and mortgage-backed securities (MBS, defined above)--typically trade at higher yields (spreads) than Treasuries because they usually have relatively lower credit quality (defined above) and more credit/default risk (defined above), and/or they have more prepayment risk (defined above).

Changes in spreads that reflect changes in relative value, with "spread widening" usually indicating relative price depreciation and "spread tightening" indicating relative price appreciation.

Stagflation describes slowing economic growth combined with high inflation.

An unsecured loan or bond that ranks below more senior loans in terms of claims on assets or earnings.

For bonds and other fixed-income securities, total return is a standard performance measurement that incorporates both income (primarily from interest payments) and changes in the prices of the securities (see Price changes from market changes). It is viewed as a more complete measurement of fixed-income performance than yield alone.

TIPS are a special type of U.S. Treasury security designed to address a fundamental, long-standing fixed-income market issue: that the fixed interest payments and principal values at maturity of most fixed-income securities don't adjust for inflation. TIPS interest payments and principal values do. The adjustments include upward or downward changes to both principal and coupon interest based on inflation. TIPS are inflation-indexed; that is, tied to the U.S. government's Consumer Price Index (CPI). At maturity, TIPS are guaranteed by the U.S. government to return at least their initial $1,000 principal value, or that principal value adjusted for inflation, whichever amount is greater. In addition, as their principal values are adjusted for inflation, their interest payments also adjust.

A treasury note is a debt security issued by the U.S. government with a fixed interest rate and maturity ranging from one to 10 years.

The yield (defined below) of a Treasury security (most often refers to U.S. Treasury securities issued by the U.S. government).

Debt securities issued by the U.S. Treasury and backed by the direct "full faith and credit" pledge of the U.S. government. Treasury securities include bills (maturing in one year or less), notes (maturing in two to 10 years) and bonds (maturing in more than 10 years). They are generally considered among the highest quality and most liquid securities in the world.

A quantitative estimate of a company or asset’s value.

See Chicago Board of Trade (CBOE) Volatility Indexes.

For bonds and other fixed-income securities, yield is a rate of return on those securities. There are several types of yields and yield calculations. "Yield to maturity" is a common calculation for fixed-income securities, which takes into account total annual interest payments, the purchase price, the redemption value, and the amount of time remaining until maturity.

A line graph showing the yields of fixed income securities from a single sector (such as Treasuries or municipals), but from a range of different maturities (typically three months to 30 years), at a single point in time (often at month-, quarter- or year-end). Maturities are plotted on the x-axis of the graph, and yields are plotted on the y-axis. The resulting line is a key bond market benchmark and a leading economic indicator.

A "spread," in fixed income parlance, is simply a difference. Yield spreads measure yield differences, typically between debt securities with high credit ratings (which typically have lower yields) and those with lower ratings (which typically have higher yields). Yield spreads can also be measured between debt securities with different maturities (shorter-maturity securities typically have lower yields and longer-maturity securities typically have higher yields).

©2026 Standard & Poor's Financial Services LLC. The S&P 500® Index is composed of 500 selected common stocks most of which are listed on the New York Stock Exchange. It is not an investment product available for purchase.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. Opinions and estimates offered constitute our judgment and, along with other portfolio data, are subject to change without notice.

International investing involves special risks, such as political instability and currency fluctuations. Investing in emerging markets may accentuate these risks.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Historically, small- and/or mid-cap stocks have been more volatile than the stock of larger, more-established companies. Smaller companies may have limited resources, product lines and markets, and their securities may trade less frequently and in more limited volumes than the securities of larger companies.

Diversification does not assure a profit nor does it protect against loss of principal.

Generally, as interest rates rise, bond prices fall. The opposite is true when interest rates decline.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.