4 Steps to Planning for Steady Retirement Income

The first step in creating a retirement income plan is to picture how you’d like to spend those years. This way you can understand how much money you’ll need and prioritize what’s most important.

Step 1: Prioritize It

The first step is to picture what you’d like to do in retirement. This way you can understand how much money you’ll need for your retirement income stream and prioritize what’s most important.

Start by asking yourself questions such as:

Logistics – Where will I live? Do I need/want a new car? What’s my retirement date?

Lifestyle – Will I travel, volunteer or get a part-time job?

Legacy – What will I leave to family, friends or philanthropic projects?

Now create a list of goals to determine which things you might add, defer or eliminate depending on your budget. Your list can look something like Our Retirement Goals sample list.

- Stay in our house throughout retirement

- Leave money to the kids/grandkids

- Visit each of our three kids at least once a year

- Help fund the grandkids' education

- Travel to the Grand Canyon and go to Sweden

- His: Volunteer at the hospital

- Hers: Start a consulting business

Step 2: Pay for It

Based on your goals and retirement income needs, create a realistic budget and find out how to revise it for different phases of retirement. You may have dreaded this step and put it off, but your future is worth taking the time to plan.

Start by writing down your current annual budget and increase or decrease specific line items as needed. Some expenses such as taxes, gas, retirement savings and daily lunches may go down when you stop working. Other expenses such as health care, travel and entertainment may go up. Be detailed when preparing your budget so it’s easier to adjust if needed.

You may need 70%-80% of your preretirement salary as annual income in retirement to maintain a similar lifestyle.

If you find your financial plan won’t cover the things you’d like to do in retirement, there are ways to improve your readiness:

Delay retirement and save more.

Reduce future expenses.

Defer Social Security payments to maximize your benefits.

Evaluate how much risk you can take with your investments. More aggressive investments may help you grow your portfolio but also come with more risk.

Start by using our interactive budget checklist to help you create an agenda, then request a call.

Step 3: Plan It

Once your retirement budget is created, it's a good idea to look at the biggest risks you could face. Here are some ideas on how to manage them.

The four common risks retirees confront are:

Retirees are living longer, so you may need your money to last 20, 30 or more years. Otherwise, you may have to cut corners to avoid running out of money at some point. Careful planning may help manage longevity risk.

Help make your money last:

Choose a realistic time frame for how long your retirement money needs to last. If you retire at age 65, plan for 30 to 35 years.

Maintain an adequate amount of stock investments. This can potentially help your savings continue to grow; however, it does come with additional risk.

Pick a sensible withdrawal rate that you can maintain.

Money being worth less over time, known as inflation risk, can have a devastating impact on your retirement. This can be true even when inflation is relatively low.

Help maintain your buying power:

Add inflation-hedging investments to your retirement portfolio.

Maintain enough stock investments so your savings potentially can keep growing.

Maximize Social Security payments*, which automatically adjust for inflation.

As with all investments, there are risks of fluctuating prices, uncertainty of dividends, rates of return and yields. Current and future holdings are subject to market risk and will fluctuate in value.

Market declines, especially early in retirement, can undermine your portfolio.

Diminish volatility's impact:

Balance market highs and lows with a mix of investment types. You want investments that react differently when market conditions change.

Align how much of each kind of investment, known as asset allocation, with how much risk you’re willing to take. It may help you avoid panic in a downturn.

Maintain lower-risk investments to cover your first three to five years of retirement.

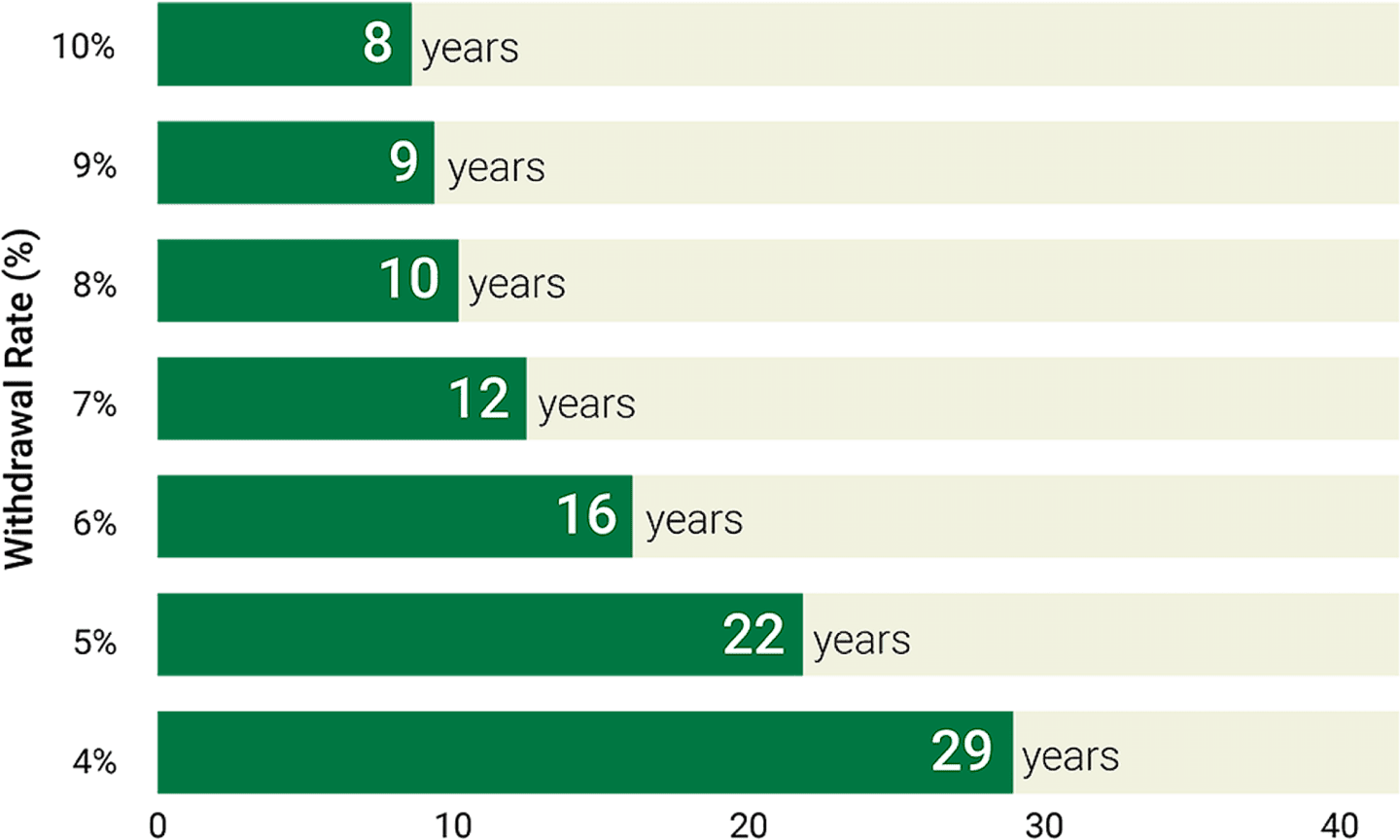

Spending in retirement refers to the withdrawal rate you choose from your savings. Taking too much can deplete your savings too fast.

Lower Withdrawal Rates Could Make Your Money Last Longer

(Hypothetical example)

These hypothetical situations contain assumptions that are intended for illustrative purposes only and are not representative of the performance of any security. There is no assurance similar results can be achieved, and this information should not be relied upon as a specific recommendation to buy or sell securities. Assumes a portfolio with 50% equity, 45% bond, 5% cash allocation over 30 years at a 90% confidence level, with the following average monthly capital market returns: Stocks: 7.90%, 18.90% standard deviation; Bonds: 5.00%, 4.95% standard deviation; Cash: 2.25%, 1.00% standard deviation. The correlation between Stock and Bond returns is 0.2. Inflation rate is assumed to be 2% annually and is included in each of the withdrawal rates depicted above. Correlation measures the relationship between two investments—the higher the correlation, the more likely they are to move in the same direction for a given set of economic or market events. Standard deviation defines how widely returns vary from the average over a period of time. Source: American Century Investments, 2019.

While any of these risks can be significant, market volatility can be especially problematic for recent retirees.

Generally, your savings will be the largest at retirement, before any withdrawals have begun. A market decline early on could have a greater dollar impact.

Withdrawals intensify the impact of market declines because they represent funds that can no longer grow when the market does rebound. You could temporarily reduce your withdrawal rate so more of your investments have a chance to rebound. You may also want to avoid selling stocks. Consider taking any withdrawals from cash equivalent investments, then bonds and lastly stocks—and only if you have to.

Step 4: Withdraw It

Steady retirement income needs a good withdrawal plan. A withdrawal strategy helps you know how much you can take out of your savings and investments each year to cover your needs and wants. It should also outline which funds you’ll withdraw from during retirement and in what order, i.e., retirement accounts, taxable accounts, etc.

Where Should You Withdraw From First?

Most financial professionals will recommend this order because of tax implications and the assumption that your taxes will be lower later in retirement. Start with the least to the most tax-efficient accounts. Of course, what you do depends on your unique situation.

Taxable accounts – Nonretirement accounts

Tax-deferred accounts – Traditional individual retirement accounts (IRAs) and 401(k)s

Tax-exempt accounts – Roth IRAs

You can find many different strategies for withdrawing from your retirement investments. The one you choose should be based on your personal situation, including how well funded you are and your tax situation. Review three general withdrawal strategies.

To learn more, watch our short video series on retirement income.

Receive a complimentary electronic copy of Retirement Income: Shape Your Future to get more ideas on how to plan for retirement.

More Considerations for Your Retirement Plan

Required Distributions

Many retirement accounts require withdrawals, but you can keep that money working for you.

Developing your retirement income plan can get complicated. You don’t need to know the questions to ask, we’ll lead you through it—that’s why we’re here.

Ready to Invest?

We offer fully diversified portfolios, or you can build your own. Want more information? Talk to an investment consultant and get a complimentary, one-on-one, personalized consultation.

Each individual has unique circumstances that should be considered when deciding what is the best age to start taking social security.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Please consult your tax advisor for more detailed information regarding the Roth IRA or for advice regarding your individual situation.

Taxes are deferred until withdrawal if the requirements are met. A 10% penalty may be imposed for withdrawal prior to reaching age 59½.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

IRA investment earnings are not taxed. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½.

Diversification does not assure a profit nor does it protect against loss of principal.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.