Planning for Income When You're Close to Retirement

Living in retirement will be very different from working toward it. You’ll need a plan to cover expenses and help answer the question of how long your money will last in retirement. Watch our Retirement Income video series and read on for more income planning strategies.

1. Picture It: Know What You Want

Visualize what you want retirement to look like, and then prioritize your life goals. Many people skip this step, but it’s important when you’re planning out how you’ll pay for your future lifestyle. Ask yourself:

When do I want to retire?

Where will I live?

Will I travel?

What kind of legacy do I want to leave?

2. Pay for It: Create Your Budget

Use your current expenses and investments (as expected income) as a starting point to map out a realistic retirement budget.

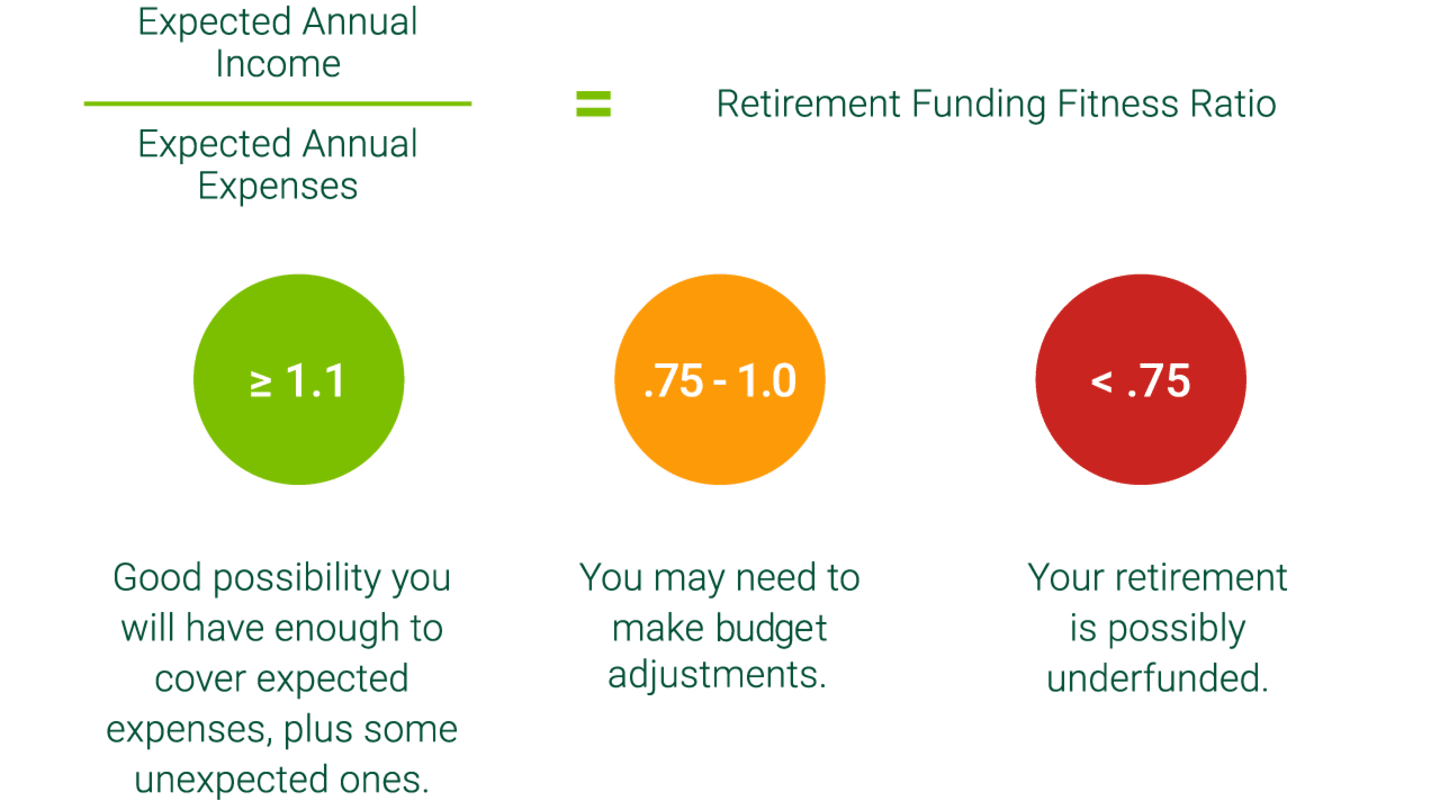

Calculate Your Retirement Fitness Ratio

Source: American Century Investments, 2021.

Did you find any gaps? Now is the time to update your plan. Consider increasing your savings, working longer, adjusting your budget or changing your investments.

3. Plan It: Know the Risks and Select an Income Strategy

It’s time to prepare for the transition from a steady paycheck to retirement income.

New Risks in Retirement

Plan now for key risks your money could face in retirement:

Longevity risk. Consider the likelihood that you could outlive your money.

Inflation risk. Rising prices will impact your long-term purchasing power.

Market risk. Consider the effects of volatility and market declines, especially early in retirement.

Overspending risk. Withdrawing too much too early will affect your long-term plan.

Health care risk. Health care costs could overtake your budget.

Request a call or download our free digital booklet for strategies on overcoming these risks.

Income Strategies

A retirement income strategy can help you decide how to divvy up your savings and convert it into a steady income.

Three popular portfolio strategies are the Interest Only, Total Return and Bucket/Time Segmentation.

INTEREST ONLY

Live off only the interest your investments make and don't touch the principal.

TOTAL RETURN

Create a broadly diversified portfolio that aligns with your risk tolerance.

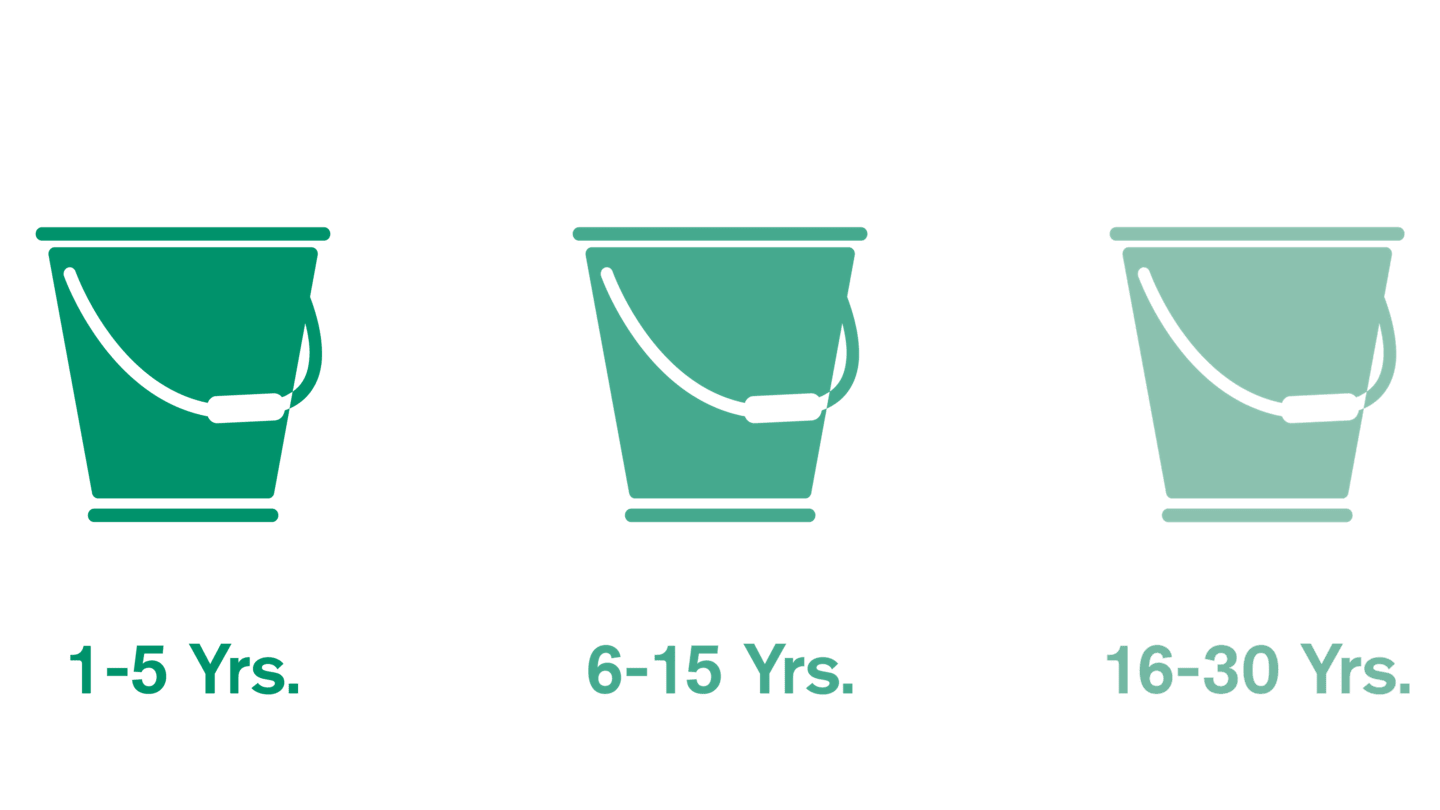

BUCKET / TIME SEGMENTATION

Divide your portfolio into two to six buckets, each with its own goal.

Source: American Century Investments. For illustrative purposes only.

4. Position It: Build Your Retirement Portfolio

Your retirement portfolio is just as important as your preretirement portfolio. The goal is to create a portfolio that gives you the best chance of success while managing risk.

Consider these key principles when choosing investments:

Match spending to risk. Consider using lower-risk investments for essentials and using stocks and higher-risk investments for discretionary spending or to address longevity and inflation risk.

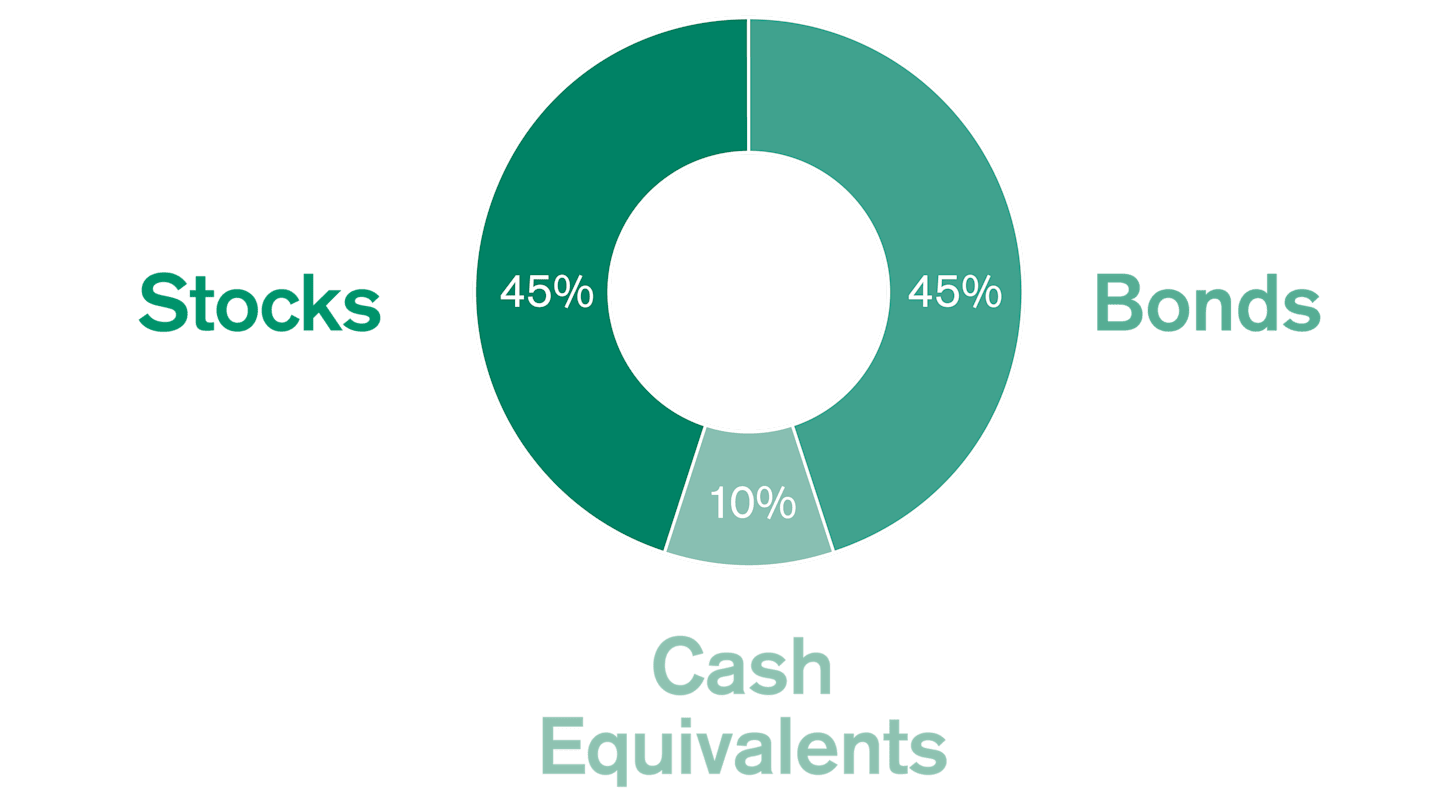

Find balance. Having the appropriate mix of stocks, bonds and cash may improve your odds of retirement success. You can build a portfolio from individual holdings or choose a prediversified option.

Avoid chasing performance. Sticking with your diversified portfolio can help you maintain an appropriate risk level and avoid the temptation of high-flying (and risky) investments.

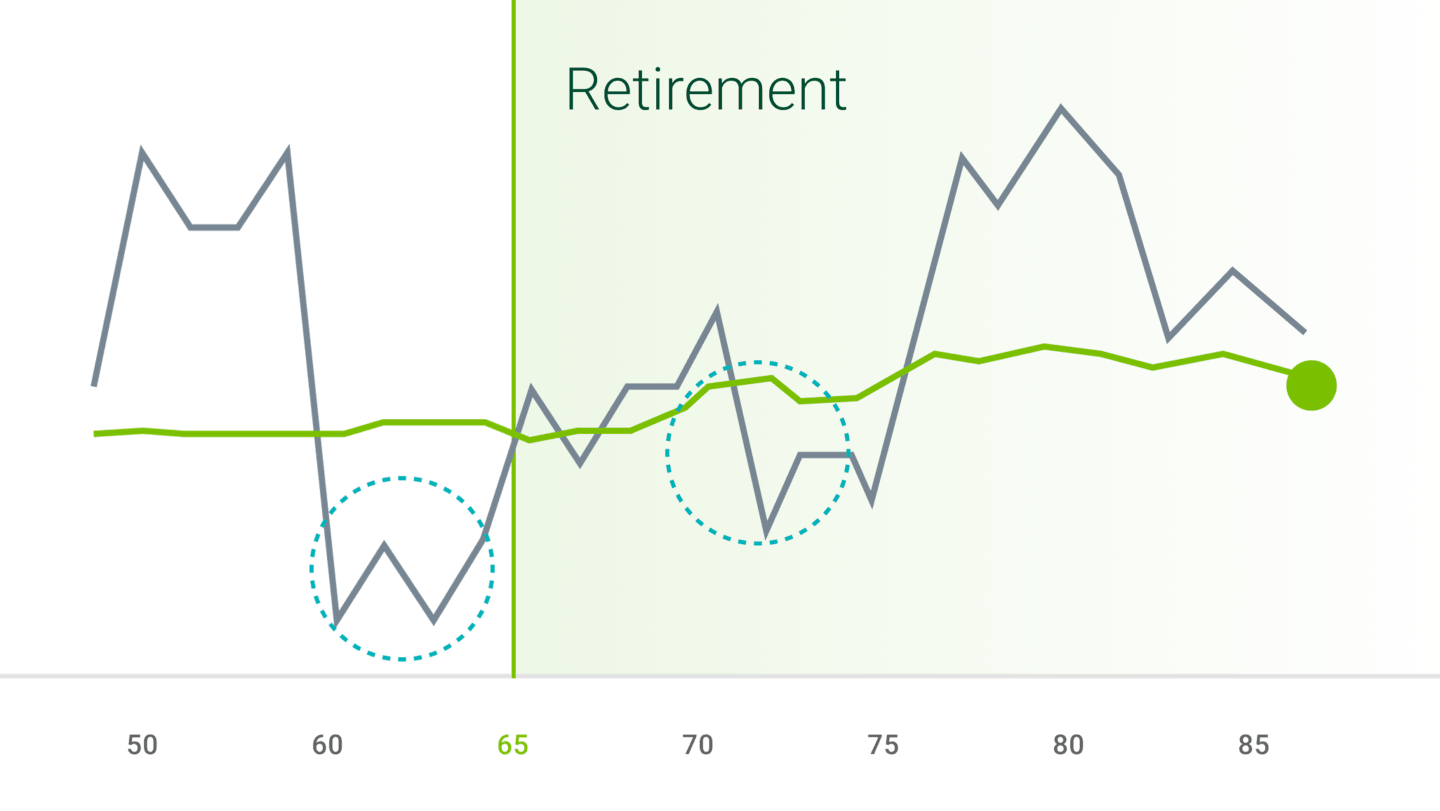

Diversification may help lower risk if volatility occurs right before or after you retire.

Source: American Century Investments. For illustrative purposes only.

Receive a complimentary electronic copy of Retirement Income: Shape Your Future to get more ideas on how to plan for retirement.

You Don’t Have to Plan Alone

Our investment consultants are available to help guide you through retirement planning. We also offer fully diversified portfolios that can help you invest for your retirement.

Educational charts and imagery in videos are for illustrative purposes only and do not represent a personal recommendation.

Investment return and principal value of security investments will fluctuate. The value at the time of redemption may be more or less than the original cost. Past performance is no guarantee of future results.

Diversification does not assure a profit nor does it protect against loss of principal.

You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Generally, as interest rates rise, the value of the bonds held in the fund will decline. The opposite is true when interest rates decline.